Health

Why Biden’s Funding Increase Is A Large Political Wager

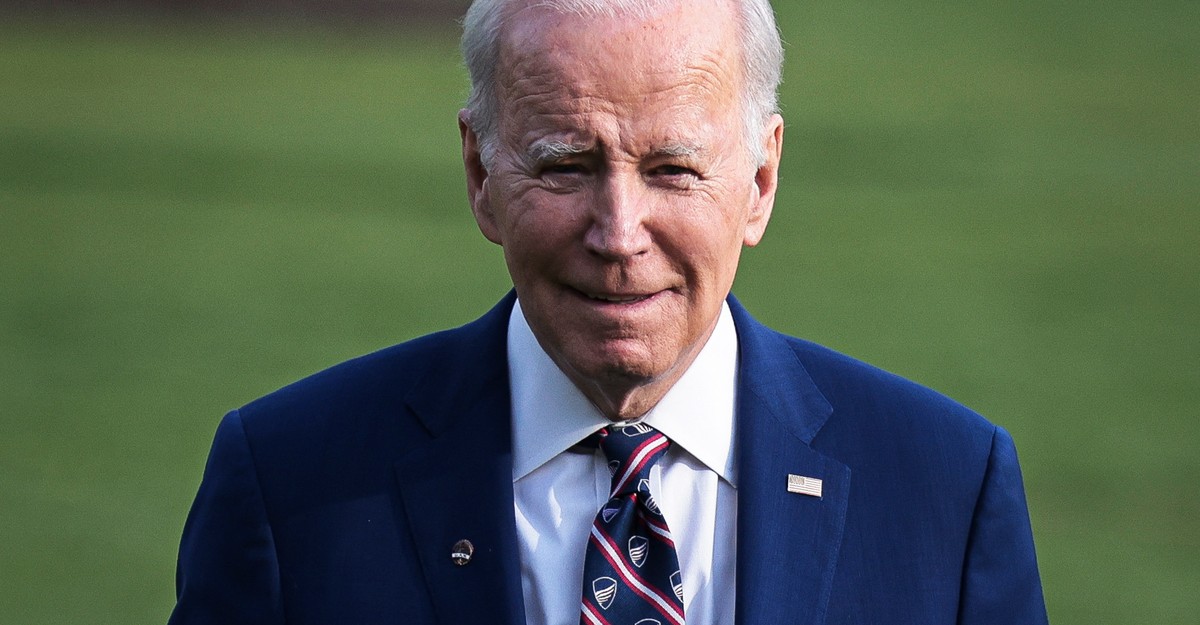

When President Joe Biden visits South Carolina to tout a brand new solar-energy-manufacturing facility as we speak, he’ll underscore a placing sample: Among the greatest winners from his financial agenda have been Republican-leaning locations whose political leaders have persistently opposed his initiatives.

Centered on a trio of payments Biden signed in his first two years, the president’s financial program has triggered what might change into probably the most concentrated burst of private and non-private funding for the reason that Sixties. The dual payments Biden signed in 2022 to advertise extra home manufacturing of unpolluted vitality and semiconductors have already helped generate about $500 billion in non-public funding in new factories and enlargement of present crops, in accordance with the administration’s tally. Concurrently, the federal authorities is spending billions extra repairing roads, bridges, and different services via some 32,000 initiatives already funded by the bipartisan infrastructure invoice accepted in 2021. Corporations are spending twice as a lot on developing new manufacturing services as they had been as not too long ago as two years in the past, a latest Treasury Division evaluation discovered.

“We had excessive expectations, and we’re assembly or exceeding these expectations, notably on these investments serving as a catalyst for private-sector funding,” White Home Chief of Employees Jeff Zients advised me in an interview.

Learn: Biden’s Blue-Collar Wager

This surge of funding might rumble via the financial system for years. The reverberations might embrace reviving home manufacturing, opening new services in depressed communities which have suffered plant closings and disinvestment for the reason that Nineteen Seventies, and doubtlessly growing the nation’s productiveness, a key ingredient of sustained development.

“That knowledge suggests we’re within the midst of a giant construct as a rustic,” says Joseph Parilla, the director of utilized analysis on the Brookings Metro suppose tank. “We’re in an important financial second, notably for lots of those areas which were ready for this kind of non-public funding, and desperately want it.”

However the political impression of this funding for Biden and different Democrats stays far more unsure. Polls recommend that for many Individuals, the continued ache of inflation, even because it moderates, overshadows the excellent news of recent manufacturing facility openings. And analyses by Brookings Metro and different teams have discovered that this non-public funding is flowing disproportionately into locations that didn’t vote for Biden in 2020 and stay extremely unlikely to vote for him once more in 2024. Most of the communities benefiting most are represented by congressional Republicans who initially voted towards the brand new federal incentives encouraging these investments, and extra not too long ago even voted to repeal a few of them.

Biden has introduced the crimson tint of the funding patterns as some extent of satisfaction, proof that he’s delivering on his promise, after the polarization of Donald Trump’s presidency, to manipulate within the curiosity of all Individuals. “I promised to be a president for all Individuals, whether or not or not they voted for me or whether or not or not they voted for these legal guidelines,” Biden stated final week when saying a $42 billion plan beneath the infrastructure invoice to increase high-speed web to all communities by 2030. “These investments will assist all Individuals. We’re not going to depart anybody behind.”

Many Democrats see that as an vital financial dedication and a strong political argument. However parts of the social gathering are grumbling that the administration is just not exhibiting sufficient concern as firms steer a lot of the funding triggered by the brand new federal incentives towards Republican-leaning states and counties.

That concern is rooted partly within the perception that voters in these locations are unlikely to credit score Biden for selling new factories and services or to punish Republicans who’ve opposed the incentives that made them potential. A fair bigger complication could also be the truth that many of those new jobs are transferring into states the place staff have traditionally obtained decrease wages and advantages than within the extra closely unionized blue states. “They’re sending the cash to the states with the bottom employee protections, decrease employee requirements,” Michael Podhorzer, the previous longtime political director of the AFL-CIO, advised me. “It’s placing strain on blue-state employers to decrease their requirements to be aggressive.”

The magnitude of the Biden growth in funding could possibly be historic. Three payments are contributing to the upsurge. One is the Inflation Discount Act, which offers sweeping subsidies for the home manufacture and deployment of clean-energy merchandise equivalent to electrical autos. The second is the CHIPS and Science Act, which allocates billions of {dollars} to encourage the home manufacturing of semiconductors, now produced largely overseas. The third is the bipartisan infrastructure invoice, which funds not solely conventional infrastructure initiatives equivalent to roads and bridges but additionally new wants just like the broadband program and a nationwide community of electric-vehicle chargers. Biden hopes to turbocharge the impact of those payments with different insurance policies pushing firms to purchase American within the supplies they use in all of those initiatives.

“What appears to be rising is a clearly American industrial technique,” says Ellen Hughes-Cromwick, a senior fellow in local weather and vitality at Third Manner, a centrist Democratic group. “That is about transferring forward in markets the place we will be tremendous aggressive.”

In a tough calculation, the administration has forecast that these three payments will generate about $3.5 trillion in funding over the following decade. Public spending, both instantly on infrastructure initiatives or via the tax and grant incentives for semiconductors and clean-energy initiatives, will account for less than about two-fifths of that whole, with funding from non-public firms offering the remainder. If these payments encourage that a lot new private and non-private funding, it might characterize a considerable enhance—as a lot as 7 % yearly—within the stage of funding the financial system now produces (about $5 trillion yearly).

The torrent of spending from firms that these payments are anticipated to unlock is essential as a result of it refutes the normal conservative criticism that public investments merely discourage non-public investments, Jared Bernstein, the brand new chair of the Council of Financial Advisers, advised me. “The concept public funding crowds out non-public investments seems to be ‘bass-ackwards,’ and that is a crucial perception of Bidenomics,” Bernstein stated.

There’s no assure that the payments will generate as a lot web new funding because the administration hopes. Jason Furman, who served as chair of the Council of Financial Advisers for President Barack Obama, advised me that if the surge of funding contributes to “overheating” the financial system, that will immediate the Federal Reserve Board to boost rates of interest, which would scale back the extent of funding elsewhere. “If you happen to get extra in these areas, you will get much less in different areas, and you’ll’t simply consider these as additive,” stated Furman, now an economics professor at Harvard.

Bernstein doesn’t fully reject that risk, however he advised me that extra funding will simply as doubtless broaden the financial system’s capability to provide extra output with out inflation. “These are investments within the provide facet; they’re methods to present your self a bit of extra room to develop,” Bernstein stated. “In case you are really standing up a home business that wasn’t there earlier than, that’s new capability, and, in the long term, that reduces inflationary pressures.”

Whether or not or not the Biden agenda generates all of the funding the administration now initiatives, it doubtless will characterize the federal authorities’s most bold effort for the reason that peak of the Chilly Struggle to improve the nation’s bodily infrastructure and nurture technologically superior strategic industries. Financial-development consultants equivalent to Parilla say that the closest fashionable parallel to Biden’s funding agenda often is the intertwined federal initiatives from the mid-Nineteen Fifties to the late ’60s to construct the interstate freeway system, invigorate larger training and scientific analysis after the shock of the Soviet Union’s Sputnik-satellite launch, improve our nuclear-weapons capabilities, after which win the area race to land on the moon. These efforts accelerated the event of an array of recent applied sciences, from semiconductors to computer systems to the web, that present the inspiration of the Twenty first-century digital financial system.

Biden has indicated that he’s anticipating related long-term financial advantages from his agenda, whose direct public spending in inflation-adjusted {dollars} is bigger than the funds Washington spent mixed on the interstate freeway system and the Apollo moon-landing program. Some Democrats see Biden’s interlocking insurance policies to extend private and non-private funding because the social gathering’s most totally fleshed-out different to the GOP’s argument, for the reason that Ronald Reagan period, that decrease taxes and fewer regulation are the keys to development.

However the distribution of this new funding has difficult that political calculus. Parilla and a senior analysis analyst at Brookings Metro, Glencora Haskins, calculated that half the private-sector investments the White Home has cataloged have gone to counties that voted for Trump—way over the 28 % of the nation’s whole financial output that these locations generate. Regionally, the largest winner from the brand new funding has been the Republican-leaning South, attracting greater than two-fifths of the brand new {dollars}, significantly greater than its share of the whole GDP (a couple of third). The Midwest (a couple of fifth) and West (a couple of fourth) have every attracted a share of recent funding that roughly matches its portion of the GDP, whereas the large loser has been the staunchly Democratic Northeast, which is drawing solely about an eighth of the brand new spending.

Some key swing states are among the many greatest beneficiaries. Arizona, Georgia, and Michigan—every of which flipped from Trump in 2016 to Biden in 2020—rank within the high six states receiving probably the most investments, in accordance with unpublished knowledge supplied by Brookings Metro to The Atlantic.

However 9 of the 15 states receiving probably the most non-public funding backed Trump in 2020—together with Texas, Ohio, Idaho, Kentucky, Tennessee, Indiana, Utah, North Carolina and South Carolina. And of these 9, North Carolina is the one one which Biden realistically can hope to contest in 2024. In the meantime, a number of blue-leaning however nonetheless aggressive states that Biden doubtless should maintain to win subsequent 12 months have attracted a lot much less funding, together with Wisconsin (twenty fourth), Pennsylvania (twenty sixth), Minnesota (thirty fourth), and New Hampshire (forty fourth).

Administration officers are adamant that they don’t seem to be attempting to channel the funding in any manner. “The president ran as being president for the American individuals, for communities all throughout the nation, and that’s what he’s doing,” Zients advised me. “This implementation is just not a political train.” As a substitute, Zients stated, “the cash is flowing into all communities” the place there may be both, in his phrases, a “want” to improve infrastructure or an “alternative” to find manufacturing services.

Hughes-Cromwick appropriately notes that if Biden in any manner stated, “‘This cash must go to blue states,’ the response” from Republicans “can be fierce.” However critics are additionally right that the administration’s hands-off strategy to the funding circulation might threaten its broader financial and political targets.

Joel Dodge: My Hometown Is Getting a $100 Billion Dose of Bidenomics

The administration hopes “that in crimson and purple states, staff will credit score Biden and Democrats for the brand new funding and jobs, which is able to make Democrats aggressive within the area,” Podhorzer, the previous AFL-CIO political director, advised me. “That’s simply not going to be the case. Historical past tells us that if any politicians are credited, it’s more likely they are going to be native ones.” Georgia’s Republican governor, Brian Kemp, final week demonstrated the issue when he denounced Biden’s program and credited native efforts on the opening of an electric-vehicle-battery plant within the state that has obtained tax breaks beneath the Inflation Discount Act.

The problem isn’t just who will get political credit score for the brand new jobs. To attain its full impression, Biden’s funding agenda will want sturdy help over time from a congressional majority prepared to defend its central provisions. The early proof means that funding in crimson locations is just not serving to this trigger: Regardless that four-fifths of all of the clean-energy investments introduced have gone to districts held by Republicans within the Home of Representatives, each certainly one of them voted this spring to repeal the Inflation Discount Act incentives which have inspired these investments.

The White Home, in a truth sheet for Biden’s go to to South Carolina, pointedly famous that Republican Consultant Joe Wilson (who famously yelled “You lie” at Obama throughout one of many president’s State of the Union speeches) was amongst those that voted to repeal the incentives, though they helped finance the enlargement of photo voltaic manufacturing in his district that Biden visited to have fun as we speak. Zients stated that Biden plans to aggressively “name out” Republicans who aren’t simply “exhibiting up on the ribbon cuttings for a invoice they didn’t help, [but] are actively attempting to take that cash away from their communities.”

The largest problem within the red-state-investment tilt could also be whether or not it impedes Biden’s overarching purpose of making extra well-paying jobs for staff and not using a faculty diploma. As Podhorzer identified, common wages in lots of industries, together with manufacturing, are a lot decrease in crimson states than in blue.

Virtually all of the initiatives funded beneath the infrastructure invoice require contractors to pay larger “prevailing wages,” in order that laws has proved immensely well-liked with unions representing development staff. However the UAW union has repeatedly complained that the auto firms receiving huge federal subsidies beneath the Inflation Discount Act are looking for to scale back wages and advantages by producing EV batteries and different elements in new services that aren’t topic to the union’s nationwide contract. “Why is Joe Biden’s administration facilitating this company greed with taxpayer cash?” UAW President Shawn Fain complained in a press release late final month after the Vitality Division accepted a $9.2 billion mortgage to Ford to assemble three new EV-battery crops in Kentucky and Tennessee.

Compounding the union’s concern is that, because the EV share of the general market grows, the auto firms will inevitably scale back employment on the unionized crops now producing the batteries for internal-combustion autos as they gear up manufacturing at their EV-battery crops. Given the areas of most of these EV crops, that change can even doubtless shift jobs from Rust Belt states that Democrats should win, like Michigan, to states equivalent to Kentucky, Tennessee, and South Carolina, the place their prospects are dim. “If I’m a Democratic Get together adviser, why are we giving $9 billion to interchange 7,500 Rust Belt jobs with half-the-wage Kentucky and Tennessee jobs?” one UAW supply, who requested for anonymity whereas discussing union technique, advised me. “What’s the political calculus there?”

Biden misplaced his strongest software to advertise unionization within the EV transition when Senator Joe Manchin insisted on the removing of a provision within the inflation-reduction invoice that will have given shoppers a considerable tax break for buying electrical autos constructed with union labor.

However critics within the social gathering consider that the administration ought to be extra aggressive about difficult firms to supply good wages with the instruments they nonetheless have, such because the situations they’ll connect to the kind of mortgage Ford obtained. “We positively don’t wish to be stimulating a race-to-the-bottom dynamic that will probably be undermining our personal targets of making certain respectable livelihoods for staff,” Isabel Estevez, the deputy director of commercial coverage and commerce on the Roosevelt Institute, a liberal suppose tank, advised me.

Biden has recognized with unions extra overtly than any Democratic president in a long time, so he’ll doubtless search some approach to soothe the discontent on the UAW. However he most likely gained’t veer from his bigger course of celebrating how a lot of the brand new funding is flowing into red-leaning blue-collar locations, even when a lot of these are communities he’s unlikely to win or in states he can’t severely contest.

As a result of Bidenomics goals to revive “investments in locations which have lengthy been left behind, then it’s inevitable” that a few of that funding will profit distressed communities which have turned away from Democrats and embraced Trump, Bernstein advised me. For Biden, aides say, that’s not a bug in his plan, however a profit. “President Biden usually says, ‘Whether or not you voted for me or not, I will probably be your president,’” Bernstein stated. “Now he can stand on the podium and maintain up the graphics that present that it’s true.”

Related Posts

- Mosaic will increase political threat capability to $30m

Mosaic has taken initiatives to replicate its dedication to supply sustainable finance to initiatives that…

- Brazenly lands $100m Sequence D funding

Brazenly presents house owner’s insurance coverage by way of unbiased brokers within the US. Credit…

- Fintech Agency CAIS Launches Different Funding Platform

CAIS, a fintech agency, has launched its new software program as a service platform, CAIS Options, which…