Insurance Law

Who’re the main innovators in underwriting AI for the insurance coverage trade?

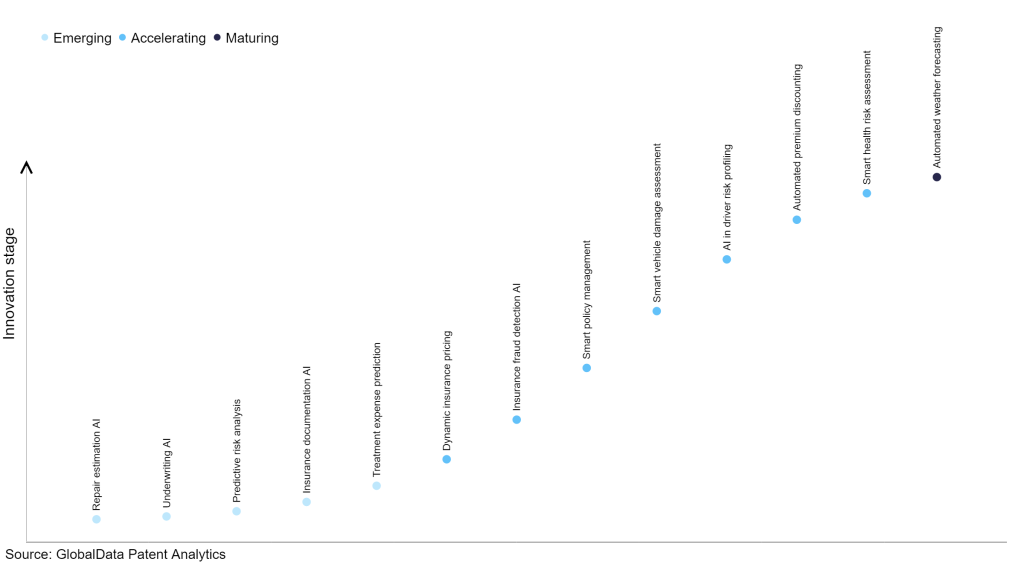

Nevertheless, not all improvements are equal and nor do they comply with a continuing upward pattern. As a substitute, their evolution takes the type of an S-shaped curve that displays their typical lifecycle from early emergence to accelerating adoption, earlier than lastly stabilizing and reaching maturity.

Figuring out the place a specific innovation is on this journey, particularly these which are within the rising and accelerating phases, is crucial for understanding their present degree of adoption and the probably future trajectory and affect they’ll have.

20+ improvements will form the insurance coverage trade

In line with GlobalData’s Know-how Foresights, which plots the S-curve for the insurance coverage trade utilizing innovation depth fashions constructed on over 70,000 patents, there are 20+ innovation areas that can form the way forward for the trade.

Throughout the rising innovation stage, underwriting AI, predictive danger evaluation, and insurance coverage documentation AI are disruptive applied sciences which are within the early phases of software and needs to be tracked carefully. Insurance coverage fraud detection AI, sensible coverage administration, and sensible car harm evaluation are among the accelerating innovation areas, the place adoption has been steadily rising. Amongst maturing innovation areas is automated climate forecasting, which is now effectively established within the trade.

Innovation S-curve for synthetic intelligence within the insurance coverage trade

Underwriting AI is a key innovation space in synthetic intelligence

Underwriting AI refers to using synthetic intelligence and knowledge processing methods by insurers to facilitate and ease the underwriting course of. It entails analyzing and modeling knowledge to evaluate dangers, decide insurance coverage premiums, and make knowledgeable selections relating to coverage approvals or rejections. By leveraging superior algorithms and machine studying, underwriting AI enhances accuracy, effectivity, and automation within the underwriting course of.

GlobalData’s evaluation additionally uncovers the businesses on the forefront of every innovation space and assesses the potential attain and affect of their patenting exercise throughout totally different functions and geographies. In line with GlobalData, there are 330+ corporations, spanning expertise distributors, established insurance coverage corporations, and up-and-coming start-ups engaged within the improvement and software of underwriting AI.

Key gamers in underwriting AI – a disruptive innovation within the insurance coverage trade

‘Utility range’ measures the variety of functions recognized for every patent. It broadly splits corporations into both ‘area of interest’ or ‘diversified’ innovators.

‘Geographic attain’ refers back to the variety of nations every patent is registered in. It displays the breadth of geographic software supposed, starting from ‘world’ to ‘native’.

Patent volumes associated to underwriting AI

Supply: GlobalData Patent Analytics

Ping An Insurance coverage (Group) is without doubt one of the main patent filers in underwriting AI. It has been on the forefront in using superior applied sciences resembling AI, cloud, and massive knowledge to drive operational efficiencies, enhance underwriting and claims administration procedures, and decrease safety dangers. Ping An OneConnect is an AI-powered service platform for insurance coverage corporations to entry and analyze massive quantities of knowledge from a number of sources rapidly and precisely, and optimize danger management in underwriting and declare settlement.

State Farm Mutual Car Insurance coverage, Alibaba Group, and Taikang Insurance coverage Group are among the different main innovators in underwriting AI.

When it comes to software range, Theator held the highest place, whereas INRIX and Wholesome io stood in second and third positions, respectively. By the use of geographic attain, Expanse Bioinformatics leads the pack, adopted by Tractable and INRIX.

To additional perceive the important thing themes and applied sciences disrupting the insurance coverage trade, entry GlobalData’s newest thematic analysis report on Synthetic Intelligence (AI) in Insurance coverage.

From

The gold normal of enterprise intelligence.

Mixing professional data with cutting-edge expertise, GlobalData’s unrivalled proprietary knowledge will allow you to decode what’s occurring in your market. You can also make higher knowledgeable selections and achieve a future-proof benefit over your rivals.

GlobalData, the main supplier of trade intelligence, supplied the underlying knowledge, analysis, and evaluation used to supply this text.

GlobalData’s Patent Analytics tracks patent filings and grants from official places of work world wide. Textual evaluation and official patent classifications are used to group patents into key thematic areas and hyperlink them to particular corporations the world over’s largest industries.

Related Posts

- Insurance coverage Information: How AI is enabling the longer term workforce | Insurance coverage Weblog

The insurance coverage business continues to deal with an getting old workforce and with the…

- Who're the main innovators in good coverage administration for the insurance coverage trade?

Nonetheless, not all improvements are equal and nor do they observe a relentless upward pattern.…

- Resilience conjures up optimism within the insurance coverage trade | Insurance coverage Weblog

Regardless of persevering with market volatility and uncertainty, we're essentially optimistic about the way forward…