Insurance Law

Who’re the main innovators in good car harm evaluation for the insurance coverage business?

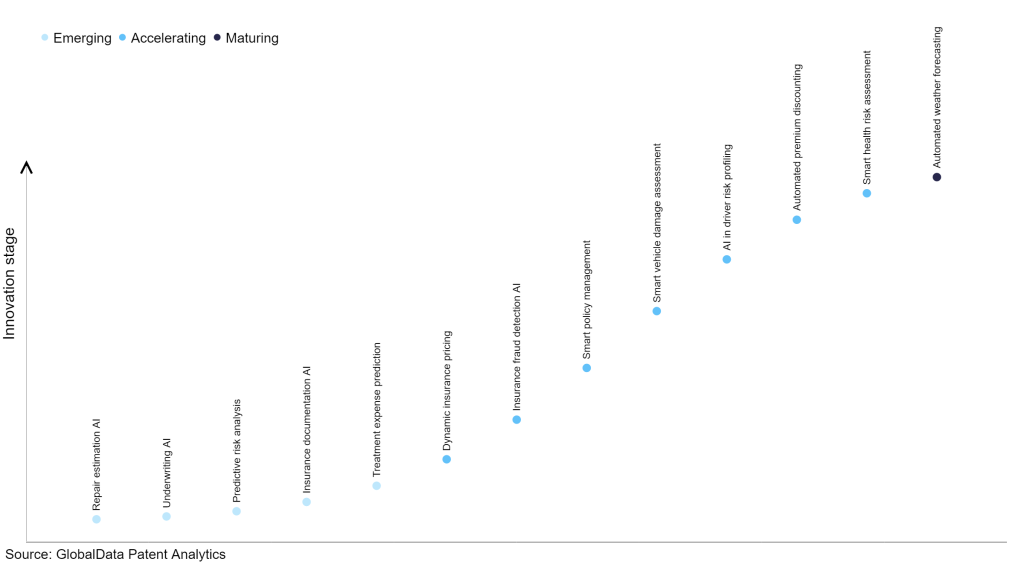

Nevertheless, not all improvements are equal and nor do they observe a continuing upward development. As an alternative, their evolution takes the type of an S-shaped curve that displays their typical lifecycle from early emergence to accelerating adoption, earlier than lastly stabilizing and reaching maturity.

Figuring out the place a selected innovation is on this journey, particularly these which are within the rising and accelerating phases, is important for understanding their present stage of adoption and the seemingly future trajectory and influence they may have.

20+ improvements will form the insurance coverage business

In accordance with GlobalData’s Know-how Foresights, which plots the S-curve for the insurance coverage business utilizing innovation depth fashions constructed on over 70,000 patents, there are 20+ innovation areas that may form the way forward for the business.

Inside the rising innovation stage, underwriting AI, predictive danger evaluation, and insurance coverage documentation AI are disruptive applied sciences which are within the early phases of utility and needs to be tracked carefully. Insurance coverage fraud detection AI, good coverage administration, and good car harm evaluation are a number of the accelerating innovation areas, the place adoption has been steadily growing. Amongst maturing innovation areas is automated climate forecasting, which is now properly established within the business.

Innovation S-curve for synthetic intelligence within the insurance coverage business

Sensible car harm evaluation is a key innovation space in synthetic intelligence

Sensible car harm evaluation refers to using superior AI applied sciences corresponding to picture processing, laptop imaginative and prescient, and machine studying to robotically assess and estimate the restore value of broken autos. By analyzing photos of the broken car, each exterior and inner harm may be detected and inferred by insurers, permitting for a extra correct estimation of restore prices. This know-how goals to streamline and automate the method of car harm claims, thereby decreasing guide effort and bettering the effectivity of insurers.

GlobalData’s evaluation additionally uncovers the businesses on the forefront of every innovation space and assesses the potential attain and influence of their patenting exercise throughout totally different functions and geographies. In accordance with GlobalData, there are 150+ firms, spanning know-how distributors, established insurance coverage firms, and up-and-coming start-ups engaged within the growth and utility of good car harm evaluation.

Key gamers in good car harm evaluation – a disruptive innovation within the insurance coverage business

‘Software range’ measures the variety of functions recognized for every patent. It broadly splits firms into both ‘area of interest’ or ‘diversified’ innovators.

‘Geographic attain’ refers back to the variety of international locations every patent is registered in. It displays the breadth of geographic utility meant, starting from ‘world’ to ‘native’.

Patent volumes associated to good car harm evaluation

Supply: GlobalData Patent Analytics

State Farm Mutual Vehicle Insurance coverage is without doubt one of the main patent filers in good car harm evaluation. The corporate filed patents associated to machine studying and deep studying picture processing strategies for robotically estimating the harm stage, restore time, and restore value for autos concerned in an accident. Cox Enterprises, Alibaba Group, and Ping An Insurance coverage (Group) are a number of the different key patent filers within the good car harm evaluation area.

By way of utility range, Theator held the highest place, whereas Curiteva and Clearlake Capital stood in second and third positions, respectively. By way of geographic attain, Alphabet leads the pack, adopted by Pictometry Worldwide and Clearlake Capital.

To additional perceive the important thing themes and applied sciences disrupting the insurance coverage business, entry GlobalData’s newest thematic analysis report on Synthetic Intelligence (AI) in Insurance coverage.

From

The gold customary of enterprise intelligence.

Mixing knowledgeable data with cutting-edge know-how, GlobalData’s unrivalled proprietary knowledge will allow you to decode what’s occurring in your market. You may make higher knowledgeable choices and achieve a future-proof benefit over your opponents.

GlobalData, the main supplier of business intelligence, supplied the underlying knowledge, analysis, and evaluation used to supply this text.

GlobalData’s Patent Analytics tracks patent filings and grants from official places of work around the globe. Textual evaluation and official patent classifications are used to group patents into key thematic areas and hyperlink them to particular firms the world over’s largest industries.

Related Posts

- Inszone Insurance coverage buys Speck Insurance coverage and Monetary Companies

Earlier this month, Inszone Insurance coverage acquired a New Mexico-based insurance coverage company. Credit score:…

- Life insurance coverage laboratory collaboration examine: $4 billion tobacco misrepresentation price to the life insurance coverage business

Initially printed July 21, 2022Authored by: Doug Ingle, FALU, FLMI, Doug Ingle Underwriting Analysis LLC…

- Insurance coverage Enterprise secures quite a few business awards

Insurance coverage Enterprise secures quite a few business awards | Insurance coverage Enterprise America Insurance…