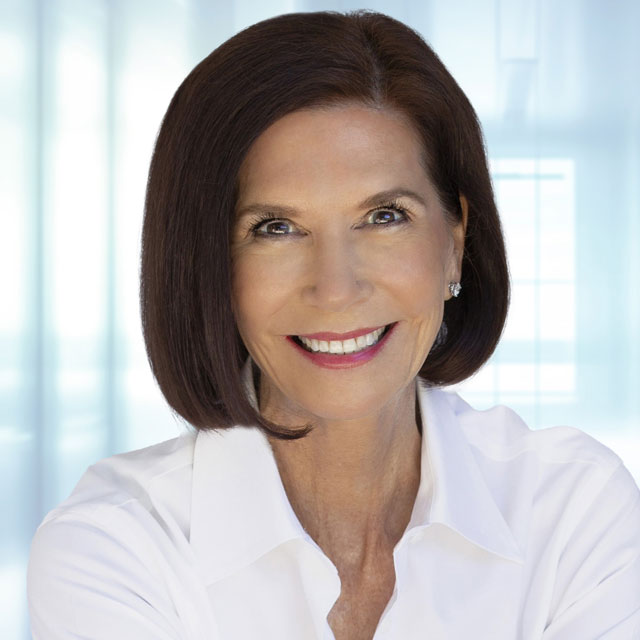

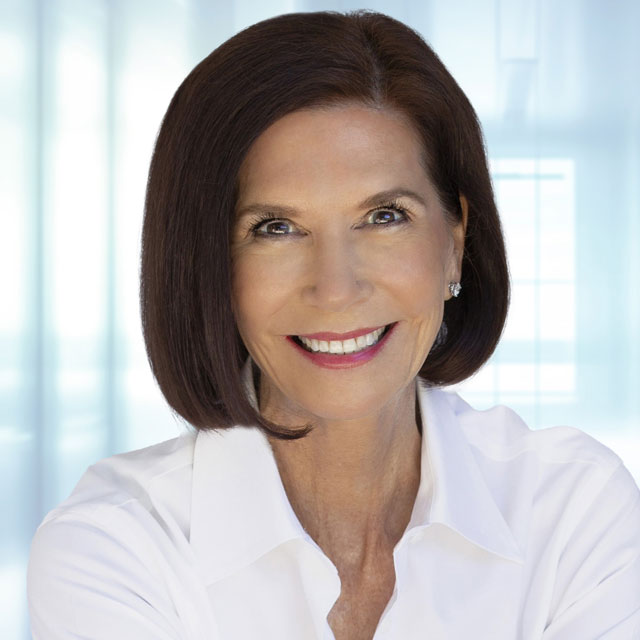

Step one in defending shoppers that present indicators of cognitive decline is straightforward, argues Barbara Archer, managing director and companion of Hightower Wealth Advisors in St. Louis.

“If we see one thing, we have to say one thing,” she says in an interview with ThinkAdvisor.

Particularly, this implies talking with the shopper after which to a trusted contact if the shopper has one.

When advisors spot a pink flag, in addition they want to guard themselves. This entails taking the above steps plus contacting their agency’s compliance division and the state wherein they’re based mostly to find out acceptable guidelines, says Archer.

Ought to a shopper with diminishing cognitive capability or different psychological well being points begin to deal with belongings in another way from a longtime method, “the shopper’s household or their counsel could query the advisor. If there’s a problem, there may be legal responsibility,” Archer factors out.

Some behavioral modifications don’t essentially sign cognitive decline, she notes. They could be short-term modifications ensuing from a brand new remedy or an an infection.

Archer, who heads a apply with two companions and 5 different advisors, supported by six associates — with belongings below administration of greater than $1 billion — based Archer Wealth Administration in 1983 and joined Hightower in 2016, merging her apply with Carol Rogers, a longtime advisor and buddy who retired in 2022.

Archer focuses on homeowners of intently held companies, prime company executives and professionals, like physicians and attorneys.

Within the latest interview with Archer, who was talking from Memphis, Tennessee, the place she was holding a shopper assembly, discusses her course of for serving shoppers with lowering psychological capability and particulars shield shoppers — aged or younger — from scammers.

“There’s no age restriction on being phished,” Archer says. “It could actually occur to anybody.”

Listed below are highlights of our interview:

THINKADVISOR: What ought to monetary advisors do in the event that they observe cognitive decline in a shopper?

BARBARA ARCHER: If we see one thing, we have to say one thing.

If we all know how the shopper usually acts and hastily one thing begins altering, we have now to step in as an goal observer.

It’s a tough dialog to have. Nevertheless it’s crucial for advisors who care for his or her shoppers to deal with the difficulty completely.

If the shopper has kids, we could discover one thing earlier than they do. Or generally the household is in denial. We inform them, “Right here’s what we observed.”

Then we’ll counsel that the kids go to Mother or Dad to see in the event that they observe something completely different.

How can advisors shield themselves and shoppers ought to a shopper grow to be confused or mentally incapacitated?

First, throughout our common planning conferences, we at all times overview the shopper’s authorized paperwork that must be in place: energy of legal professional, designated particular person who would possibly make monetary choices when the shopper now not can, a medical directive, residing will that states their medical preferences if they will’t talk.

Additionally, we be sure that the shopper has their will and trusts in place, particularly for distributing belongings after they die, and that the right beneficiary designations are on their retirement plans and life insurance coverage.

Do you do anything to guard shoppers?

We provide the choice to provide us the title of a trusted contact. That’s virtually at all times going to be the partner and, then, it’s the kids. In the event that they don’t have kids, it will likely be one among their highest mates.

We are able to counsel to the trusted contact to achieve out to authorized and medical counsel.

By connecting with the trusted contact, we’ve happy our obligation because the monetary fiduciary.

Is the trusted contact choice meant only for older shoppers?

No. The shopper could be 30 years previous. They might fall and bump their head and get confused and overlook issues. There are many methods individuals can have points.

What has to happen so that you can talk with the trusted contact?

We name to allow them to know we observed one thing that isn’t proper within the shopper’s world.

If we have now a relationship with two or three of the generations in a household, there’s extra of a consolation system to assist the shopper which may be teetering on that psychological [cliff] in comparison with what we usually see.

We additionally supply household conferences, the place we deliver within the kids or grandchildren. The shopper can share the technique of how their belongings will transfer sooner or later.

Some are very snug sharing the numbers, too.

How do advisors shield themselves when a shopper exhibits indicators of cognitive decline?

Notify the trusted contact of any pink flags. Have common conferences and keep conscious of any modifications throughout them.

Sustaining detailed notes on all interactions may help shield in opposition to potential disputes.

Contact compliance. Attain out to the state the advisor is in or search for contacts on the North American Securities Directors Affiliation for his or her state contact as a way to perceive necessities.