Insurance

What’s the New “Normal Gear” for L&AH Insurers?

Printed on

In August and September, auto producers historically start promoting the following yr’s fashions. The observe began in 1936 when Franklin Delano Roosevelt requested auto producers to regulate their annual manufacturing unit retooling schedule to maintain auto employees working throughout the vacation seasons. It was meant as an financial stimulus.

In most mannequin years, you don’t see many modifications. We see the automotive tweaks with just a few angles and some new kinds — massive modifications are few and much between. Inside touchscreens are getting bigger. Good system choices are rising. Knowledge gathering can be rising.

For vehicles, the massive change in 2024 will probably be that many extra fashions will probably be electrical or hybrid, with some very well-known nameplates starting to supply electrical variations. Volkswagen is quickly to come back out with a brand new electrical Vanagon within the US. A Corvette hybrid is on the horizon, utilizing electrical energy for quicker acceleration. Cadillac is including to its EV lineup with the Celestiq. Whereas electrical autos aren’t anticipated to take over the market very quickly, it’s clear that many automobile producers are shifting gears.

It’s a brand new mannequin yr for insurance coverage, too. Insurers are within the midst of an incredible shift that may require not solely retooling methods however mindsets as nicely. It’s a needed reconfiguring for insurers that want to retain and develop market share.

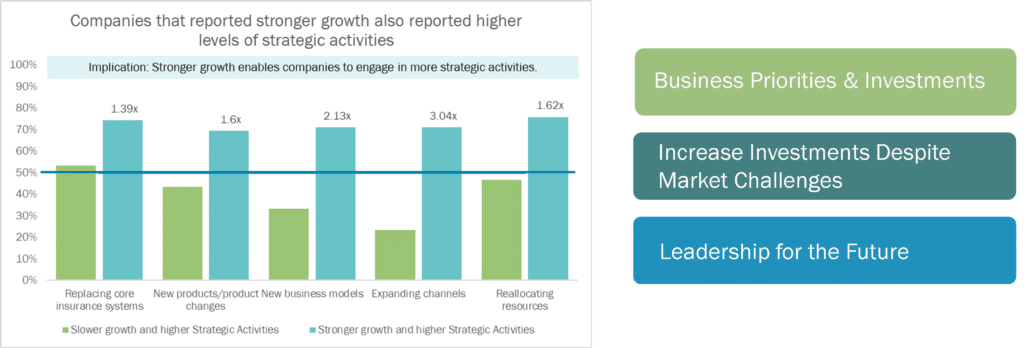

Majesco’s Strategic Priorities analysis discovered that as insurers thought of and launched into a enterprise transformation and centered on key strategic areas comparable to core alternative, new product growth, exploring progressive enterprise fashions, reimagining enterprise processes, and diversifying distribution channels, they skilled increased development, as illustrated in Determine 1 beneath.

Determine 1: Alignment between development and strategic actions

Equally essential is the reallocation of sources, making certain the continuation of present enterprise operations whereas investing sooner or later. This strategy underscores the importance of setting priorities, making strategic investments, and exhibiting sturdy management.

In a current Majesco/Capgemini L&AH Roundtable dialogue, L&AH enterprise leaders shared their views on this transformation. They outlined the steps their firms are taking to create the operational and cultural atmosphere wanted to maintain tempo and lead the trade. You’ll be able to learn the total Majesco/Capgemini report by downloading, Don’t Pull Again…Put the Pedal to the Steel for L&AH Transformation. You’ll discover a few of these insurer insights within the quotes beneath.

Normal Gear #1: An funding technique for retooling and development

Prioritizing operational and distribution investments as a technique for development might appear to be a no brainer. The truth is that it’s robust to do.Many insurers are grappling with the query of whether or not they can undertake the enterprise transformation and funding alone. It entails vital capital investments in an already capital-intensive enterprise. Thus, it prompts the consideration of potential alternatives that align with a dedication to funding and a possibility to set a unique trajectory. Essentially, insurers should obtain operational effectivity at scale, which will be completed via acquisitions, natural development, and efficient utilization of investments.

“Once I envision our firm ten years from now, I anticipate a big transformation in our tradition and operations. With a steady inflow of latest associates, we’re dedicated to alter, evolution, and elevated agility. Over the following 5 to 10 years, many workers, who might have been extra resistant to alter, will retire. We’ve exerted further effort to convey them alongside on this journey.”

Roundtable Participant

As firms embark on these substantial investments, it’s essential to query whether or not they’re defensive or offensive. Are they making these investments to outlive or to realize scalability? The success of those investments depends on attaining operational effectivity and attaining development throughout all enterprise traces. Due to this fact, development turns into crucial.

Are insurers rising and subsequently making investments or are they making investments to facilitate development? These features warrant cautious consideration in setting enterprise priorities – for each the present and future enterprise.

Normal Gear #2: Preparations that may permit for alliances, partnerships, mergers, and acquisitions.

A quick-changing insurance coverage trade can be grappling with the challenges and alternatives that is likely to be discovered via mergers and acquisitions. On the one hand, a merger would possibly assist a standard insurer set up a route for change and modernization. Alternatively, an insurer would possibly achieve the higher hand in partnerships and mergers by establishing a know-how framework that’s so aggressive as to be unassailable. The proper preparations will place insurers to be discerning, swift, and enticing as they strategy new relationships of any form.

Roundtable contributors mentioned the likelihood that the market will witness intriguing partnerships and M&A actions that transcend personal fairness companies buying annuity firms solely for his or her capital. As a substitute, we may even see companies searching for alliances with firms which might be already making substantial investments, recognizing that becoming a member of forces can collectively foster development and serve the very best pursuits of policyholders. It will convey a contemporary strategy to technique, priorities, and funding within the enterprise that’s critically wanted.

These preparations would require actual innovation as a result of main insurers have to show that they:

- Perceive the hyperlink between utilizing cutting-edge applied sciences, like generative AI and machine studying, and reaching new markets.

- Grasp the timing crucial — that insurers are within the midst of a vital shift in how they do enterprise that have to be met with new enterprise fashions.

- Pursue options and companions that align with their concentrate on clients and stakeholders.

Normal Gear #3: A renewed have a look at what creates differentiation in insurance coverage.

One other essential facet that deserves consideration is the position of individuals, tradition, and management on this course of. Managing these modifications will be extraordinarily difficult, and maybe way more complicated than its technical features. Many organizations are grappling with change when their long-standing mindset was to construct merchandise that final for many years with out change. Shifting this mentality is essential for achievement with as we speak’s altering market and buyer wants.

“Certainly, I strongly consider that change administration surrounding the implementation of latest technical platforms requires extra effort than the know-how itself. It’s important to convey individuals alongside on the journey, making certain that they share a transparent imaginative and prescient and perceive the strategic aims. It’s important to acknowledge that people have various ranges of consolation with change and that not everybody will embrace it enthusiastically. Contemplating the generational variety inside our group, we now have workers with vital tenure who might not view change as a optimistic factor or readily embrace it. Millennials, then again, is likely to be relieved to depart behind the period of inexperienced screens. Getting Gen Xers or child boomers on board might pose extra challenges. Therefore, we can’t overlook the human facet of transformation. The individuals facet is of utmost significance.”

Roundtable Participant

Up to now, insurers believed that the key sauce lay in how they dealt with coverage issuance and repair. They thought that customizing the software program or constructing their methods, preserved their distinctive strengths. That form of uniqueness is now a burden that’s holding insurers again from progressing. The intensive customization made it expensive and difficult to improve the software program or transfer to the cloud. They can’t rapidly take improvements from upgrades.

Does management perceive the total scope of alternative out there to insurers proper now? Does the enterprise acknowledge it is going to have extra “uniqueness” because it good points capabilities that aren’t custom-built?

The roundtable agreed that insurers should rethink their technique and embrace the strategy of taking as a lot as attainable out of the field. Not solely will this strategy speed up velocity to implementation, however it is going to lower general complete value of possession and allow faster velocity to market upgrades, new merchandise, and extra. The flexibility to simply improve when new releases can be found is essential to maintain the corporate at the forefront by profiting from the R&D in software program and fast shift in applied sciences – like Cloud, AI/ML, and now, generative AI.

“You made an important level about differentiation being attributed to our individuals and our merchandise. I absolutely agree with that. The problem we’ve set for ourselves is to depend on out-of-the-box options for 95% or extra of our wants. In any other case, we might simply be ingesting the identical wine from a elaborate new bottle. Change administration is essential right here. We have to be prepared to alter, leveraging know-how with out intensive customization. This permits us to keep away from the prices related to customization and concentrate on deploying our individuals to serve our clients, whereas letting our merchandise shine on their very own. It’s about cultivating a mindset inside the group that embraces change and is prepared to let go of previous practices. Our most important focus needs to be on serving our clients and delivering worth. All the pieces can change, and that’s okay.”

Roundtable Participant

Normal Gear #4: Subsequent-gen know-how, from point-of-purchase to clever core.

Insurers should speed up their digital enterprise transformation as a result of know-how and new working fashions present a basis to adapt, innovate, and ship at velocity as markets shift. This insurance coverage mannequin yr is inaugurating ground-breaking potentialities to insurers which might be open to swapping out their “engines” with extra economical, quick, and AI-powered options.

The rising significance and adoption of platform applied sciences, Cloud, APIs, new/non-traditional information sources, and superior analytics capabilities are actually essential to development, profitability, buyer engagement, new merchandise, channel attain, and workforce modifications.

Proper now, selections are being made that may decide which firms will emerge as winners within the subsequent three to 5 years. These winners will probably be wanted as companions and employers as a consequence of their capacity to realize scalability, agility, and their pivotal position in leveraging know-how. These leaders will probably be ready for the following main disruption, leaping ahead from the competitors.

L&AH firms are actually in a position to make strides that weren’t attainable even twelve months in the past, because of the launch of Majesco’s L&AH Clever Core, Majesco International IQX Gross sales & Underwriting Workbench, Digital Enroll360 for L&AH, and ClaimVantage Connect360 for L&AH. Majesco options kind the benchmark for a way Particular person, Group, and Voluntary enterprise will probably be accomplished now and into the longer term.

As we speak’s leaders are nimble, inventive — and daring. As they sort out the robust problems with legacy debt and an elevated want for organized information and analytics, forward-looking L&AH insurers will probably be fixing supplemental points that had been silently driving down profitability whereas they steadily climb the ladder of development.

Daring strikes that embrace the longer term are defining the following technology of leaders within the insurance coverage trade. Every firm must rethink the way it prioritizes and allocates sources – individuals and capital. Will you retain issues comparatively the identical, allocate the identical quantity to every enterprise unit to maintain it operational, and concentrate on some enhancements for enterprise processes and merchandise? Or will you reallocate a few of these sources to make daring modifications for the longer term?

As we speak’s weblog is co-authored by Denise Garth, Chief Technique Officer at Majesco, and Samantha Chow, International Head, Insurance coverage, Annuities, and Advantages Chief, Capgemini Monetary Companies

Related Posts

- Reliance Normal Insurance coverage will get $24.36m capital infusion

The capital infusion was carried out subsequent to acquiring approval from the lenders of Reliance…

- What does the metaverse imply for insurers? | Insurance coverage Weblog

The metaverse is an idea making headlines throughout the globe, with its utility being imagined…

- Australia normal insurance coverage to hit $83.9bn by 2027

That is based on GlobalData which additionally said that the final insurance coverage trade in…