Insurance

What is trade credit insurance?

Trade credit insurance is an essential form of the danger management tool. Find out how this type of coverage protects your business from potential losses.

Accounts receivables comprise round 40% of an organization’s belongings, in keeping with the most recent analysis from Allianz Commerce, one of many world’s largest commerce credit score insurance coverage suppliers. Information additionally exhibits, nevertheless, that one in 10 of those unpaid invoices ultimately turns into delinquent, highlighting the necessity for correct protection.

That is the place commerce credit score insurance coverage comes into play. This type of danger administration device is designed to guard companies towards unhealthy money owed.

On this article, Insurance coverage Enterprise digs deeper into the sort of safety. We referred to trade specialists to elucidate how the coverage works and what advantages companies can get by acquiring protection.

In case you’re trying to find methods to guard your organization’s money movement, then commerce credit score insurance coverage may assist. Study extra about this important sort of enterprise insurance coverage on this information.

Commerce credit score insurance coverage is a sort of enterprise coverage that protects your organization’s accounts receivables towards losses from unpaid industrial debt. If a buyer fails to pay because of chapter, insolvency, or different points, the coverage reimburses a share of the excellent debt. Protection can also kick in if the cost is extraordinarily delayed.

You possibly can take out protection for each home and worldwide purchasers, typically with customizable options and advantages to match what you are promoting’ wants.

Relying on the insurer, commerce credit score insurance coverage can be known as accounts receivable insurance coverage, debtor insurance coverage, or export credit score insurance coverage.

Commerce credit score insurance coverage protects sellers towards patrons who’re unable to pay. The coverage insures towards purchasers which have declared chapter, insolvency, or the same authorized standing. It additionally covers the policyholder if prospects are allowed to delay funds below a chapter safety association.

Insurance policies reimburse a majority of the commerce debt, in keeping with the Worldwide Credit score Insurance coverage & Surety Affiliation (ICISA), the sector’s commerce physique.

“If a purchaser doesn’t pay, the commerce credit score insurance coverage coverage can pay out a share of the excellent debt,” ICISA explains. “This share normally ranges from 75% to 95% of the bill quantity however could also be increased or decrease relying on the kind of cowl that was bought.

“Commerce credit score insurance coverage insurance policies are versatile and permit the policyholder to cowl your entire portfolio or simply the important thing accounts towards company insolvency, chapter, and unhealthy money owed.”

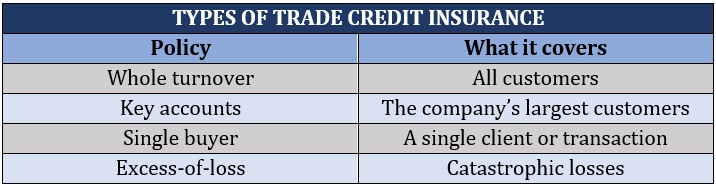

ICISA lists a number of methods a commerce insurance coverage coverage might be structured:

-

- Entire turnover protection: This protects towards losses from unpaid commerce debt from all prospects. Companies can set if protection applies to home or worldwide gross sales solely, or each.

-

- Key accounts protection: This covers an organization’s greatest purchasers whose non-payment poses the best danger to its operations.

-

- Single purchaser protection: Additionally referred to as transactional protection, this insures all gross sales to a specific buyer or a single transaction with a consumer.

-

- Extra-of-loss protection: This covers catastrophic or distinctive losses of a enterprise’ largest patrons that exceed the conventional ranges of unhealthy debt. The coverage comes with an insurance coverage deductible.

Right here’s a abstract of the various kinds of commerce credit score insurance coverage insurance policies.

What you are promoting faces dangers and challenges which are completely different from these of different companies. That’s why there’s no single coverage that may cater to each want. Discover out which kinds of enterprise insurance coverage insurance policies are important to your operations on this information.

Commerce credit score insurance coverage typically supplies protection for 2 kinds of dangers:

-

- Industrial dangers: Insurance policies cowl situations the place purchasers are unable to pay excellent money owed because of monetary causes. These embody declared chapter or insolvency, and protracted default.

-

- Political dangers: Occasions exterior your prospects’ management can also be lined, together with political upheavals like warfare and terrorism, and pure disasters corresponding to hurricanes and earthquakes. If a consumer is affected by its nation’s guidelines or financial situation proscribing the switch of cash, protection could kick in as effectively.

At the beginning of the coverage, the commerce credit score insurance coverage supplier evaluates the creditworthiness and monetary stability of a enterprise’ insurable purchasers based mostly on these dangers. The insurer then assigns an appropriate protection restrict. That is the utmost quantity the insurance coverage firm will reimburse if a buyer fails to pay.

Relying on the insurance coverage supplier, they could hold monitoring your purchasers’ monetary standing to make sure their creditworthiness. You can too request extra protection for a specific buyer or new purchaser if the necessity arises, though that is topic to your insurer’s approval.

Some insurers notify policyholders if a sure consumer is experiencing monetary issue. They could additionally work with you to create a plan to mitigate potential losses.

The chance being transferred should join on to an underlying commerce transaction to be lined by a commerce credit score insurance coverage coverage. If no direct commerce hyperlink exists, excellent money owed can’t be lined.

Allianz Commerce additionally reminds firms that they can not rely solely on their insurance policies to reduce the chance of potential losses because of unhealthy commerce debt.

“Credit score insurance coverage isn’t an alternative choice to prudent, considerate credit score administration,” the insurer explains. “Sound credit score administration practices must be the muse of any credit score insurance coverage coverage and partnership. Credit score insurance coverage goes past indemnification and doesn’t change an organization’s credit score practices, however somewhat dietary supplements and enhances the job of a credit score skilled.”

Small companies are notably susceptible to unhealthy commerce debt. However there are different insurance policies that may defend small enterprise homeowners financially. Our information to small enterprise insurance coverage provides you a rundown of those insurance policies.

Annual premiums in your commerce credit score insurance coverage coverage typically value between a tenth and 1 / 4 of a cent for each greenback of your complete gross sales for the 12 months. Which means that if you happen to make $2 million in gross sales, you may anticipate to pay round $2,000 to $5,000 in yearly premiums.

However other than gross sales, there are a number of variables that come into play when figuring out how a lot it is advisable pay for protection, together with:

-

- The kind of coverage (entire turnover, key accounts, or single purchaser)

-

- Degree of danger lined for every transaction

-

- Your buying and selling historical past, together with the unhealthy money owed you’ve incurred

-

- Your purchasers’ creditworthiness

-

- Credit score phrases together with your prospects

-

- The trade you’re in

-

- The nation the place your purchasers are based mostly

Discover out extra about how insurers decide you charges on this complete information to insurance coverage premiums.

Companies have a tendency to show to commerce credit score insurance coverage once they have already got a credit score downside or foresee publicity. However that’s typically too late for insurers to tackle the chance, in keeping with Yue Ma, vice-president and senior underwriter for political danger and sovereign credit score at Sovereign Danger Insurance coverage Ltd.

“Commerce credit score insurance coverage might help firms apply long term danger administration methods,” he explains. “We’d advise corporations to think about commerce credit score insurance coverage when enterprise is nice, in order that when an issue does strike, they don’t discover themselves making an attempt to get protection for an uninsurable danger.”

The principle different to commerce credit score insurance coverage is self-insurance, a follow notably common within the US the place commerce credit score insurance coverage take-up is decrease than 5%. Companies that select to self-insure can put a reserve on their steadiness sheet to cowl any unhealthy debt which will incur over a monetary 12 months.

Nonetheless, in keeping with James Daly, CEO of Americas area at Allianz Commerce (previously Euler Hermes), self-insurance is “not probably the most capital environment friendly resolution.”

“Somewhat than have capital in your steadiness sheet doing nothing however ready for unhealthy debt, why not buy commerce credit score insurance coverage after which make investments that extra capital into progress or new merchandise?”

Daly believes that the shift within the distribution of insurance coverage in the direction of digitalization and know-how platforms presents enormous alternatives within the commerce credit score insurance coverage house.

“Immediately, if you wish to purchase a commerce credit score insurance coverage coverage, we’ll discuss to you round all of the enterprise you’re doing on open credit score,” he says. “We’ll check out the purchasers you’re supplying to and we’ll underwrite these patrons.

“Then, in the course of the 12 months, if any of these patrons go bust or don’t pay, then we’ll make the cost. We take a look at the entire turnover of an organization and we underwrite the whole thing.”

Daly provides that the rise of on-line platforms facilitates monitoring and cost processing.

“What we’re seeing via digital platforms is that folks can go surfing and may promote a single bill. Within the new fintech world, individuals are going to have the ability to go on to a platform and add their accounting data.

“The platforms can see the invoices which are excellent and may make a proposal to purchase these excellent invoices. What the client can then do is make the selection to insure that single bill. As soon as that bill is insured, it’s mainly a assure that the bill shall be paid.”

The worldwide commerce credit score insurance coverage market was valued at $9.2 billion within the final monetary 12 months, in keeping with the numbers obtained by knowledge analytics firm World Market Insights (GMI). The agency expects the sector to turn out to be a $23.9 billion trade within the subsequent decade for a compounded annual progress price (CAGR) of 10.2%.

Progress shall be primarily pushed by enlargement of worldwide commerce actions, the emergence of recent markets, and rising consciousness about the advantages of commerce credit score insurance coverage.

Europe stays the most important market, accounting for greater than a 3rd of the whole. Massive firms, in the meantime, comprise round a tenth of the general market.

Commerce credit score insurance coverage could be a very important aspect of what you are promoting protection. If you wish to discover out what kinds of insurance policies might help what you are promoting run easily, you may try our complete information to enterprise insurance coverage.

Do you suppose commerce credit score insurance coverage is price having? What are the professionals and cons of getting protection? Share your ideas under.

Associated Tales

Be part of our mailing checklist, it’s free!

[the_ad id=”28200″]

Related Posts

- Provide Chain Finance and Commerce Credit score Insurance coverage in Highlight

As struggling firms proceed to search for liquidity amid the COVID-19 pandemic, many have turned…

- Resilience conjures up optimism within the insurance coverage trade | Insurance coverage Weblog

Regardless of persevering with market volatility and uncertainty, we're essentially optimistic about the way forward…

- An Unprecedented Transfer: The Insurance coverage Trade Speaks Positively About Public Insurance coverage Adjusters | Property Insurance coverage Protection Legislation Weblog

Mark in your calendar: October 24, 2023, at 2:45 pm CST. That is when the…