Insurance

What if an employer can’t accommodate work restrictions?

In case your employer is unable to accommodate work restrictions following a job-related harm, there are specific steps you’ll be able to take. Discover out what these are

Many work-related accidents end in minor accidents, permitting staff to return to their common jobs rapidly, typically even with out lacking time. However there are additionally unlucky situations the place a employee sustains a extra severe harm that requires an extended time to completely heal.

Staff’ compensation legal guidelines require employers to make affordable lodging for such staff if they’re declared match sufficient to return to work so long as they comply with sure restrictions. However what if an employer can’t accommodate work restrictions?

Insurance coverage Enterprise sheds gentle on this subject and extra on this article. You probably have been injured on the job and are questioning how one can return to work earlier than utterly recovering, this piece can provide you an image of what to anticipate. Learn on and be taught extra in regards to the steps you’ll be able to take in case your employer can’t accommodate work restrictions.

As soon as your physician declares which you could return to work however with sure restrictions, your employer should solely assign duties that meet these limitations. This will likely entail decreasing your time or modifying sure duties or offering the required tools that will help you get the work carried out.

Communication is vital throughout these situations. You need to be capable to present your employer the medical restrictions your physician has imposed and talk about how these restrictions may be met.

Your employer, nevertheless, is just not required to make lodging if these would show too expensive or troublesome to offer based mostly on the corporate’s measurement, monetary sources, and nature of enterprise.

In case your employer says that it can’t accommodate your work restrictions, then they can’t require you to return to work. You’re additionally eligible for incapacity payouts underneath your employer’s staff compensation insurance coverage, in addition to different comparable advantages. These embody Social Safety Incapacity Insurance coverage (SSDI) and Supplemental Safety Revenue (SSI).

Your employer can’t drive you to do duties which might be past your work restrictions. If you’ll want to refuse a piece project as a result of it fails to fulfill your restrictions, then you have to clarify this clearly to your employer, ideally in writing. An skilled staff’ compensation lawyer will help you with the documentation.

As well as, your employer is legally prohibited from retaliating or threatening motion in opposition to you for refusing a piece project. Nevertheless, you additionally can’t refuse an project simply because it’s not the sort of work that you really want even when it meets your medical restrictions. Doing so can terminate your staff’ compensation advantages.

Work restrictions, typically known as medical restrictions, are particular limits to the duties you are able to do in case you return to work whereas recovering from a job-related harm. Medical doctors impose these sorts of restrictions to stop an worker from reinjuring themselves or aggravating their accidents.

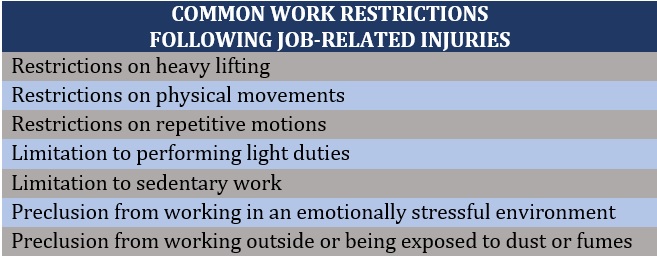

Some frequent work restrictions that medical doctors set embody:

- Heavy lifting restrictions: These are particular limits on how a lot weight you’ll be able to carry.

- Bodily motion restrictions: Medical doctors can set limits on the kinds of actions you’ll be able to carry out to stop you from worsening your harm. These can embody avoiding reaching over your head or turning your physique in sure instructions.

- Restrictions on repetitive motions: Medical doctors may also put restrictions on sure actions that prompted your harm or might make it worse. This will embody decreasing the time you spend on doing repetitive duties.

- Limitation to performing gentle duties: Your harm may additionally restrict you to work assignments that aren’t bodily demanding. These embody desk jobs and different administrative duties.

Medical doctors may also prohibit you from working in an emotionally demanding surroundings or the place you may be uncovered to sure parts resembling mud and fumes. They’ll likewise set a restrict on the size of your shift.

The desk under sums up the frequent work restrictions that medical doctors set to stop accidents from worsening.

Except your physician clears you, it’s best not to return to work even in case you really feel nicely sufficient. Returning too early might have an effect on your restoration and trigger you to reinjure your self. Your physician may additionally impose work restrictions that you simply and your employer should comply with that will help you absolutely recuperate.

Returning to work in opposition to your physician’s recommendation isn’t a good move as this could affect the employees’ compensation advantages you obtain, particularly if you find yourself aggravating your harm. Equally, your employer can’t drive you to return to work till you might be medically cleared to take action.

Whereas recovering from harm, it’s essential so that you can have open communication along with your employer. Make sure you replace your employer about your restoration and what your physician says about your attainable return.

Staying in contact along with your employer exhibits your real curiosity in returning to your job and helps your employer put together for once you’re cleared to return. In case your physician imposes work restrictions, you have to inform your employer about these, to allow them to work out methods on make affordable lodging.

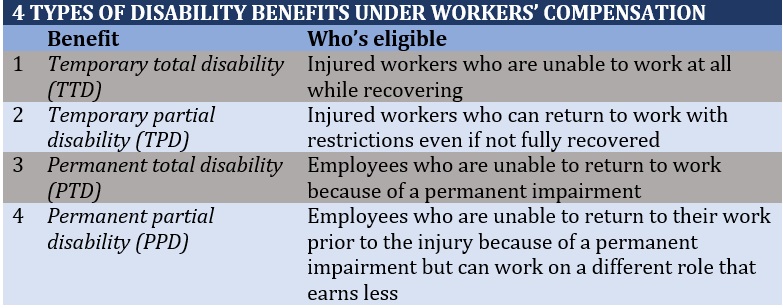

In case your work-related harm prevents you from doing all your job, chances are you’ll be eligible for incapacity advantages underneath your employer’s staff compensation insurance coverage plan. These advantages fall into 4 classes, with every offering a special degree of economic safety. These are:

1. Short-term whole incapacity (TTD) advantages

TTD funds are designed to compensate for misplaced wages if you are recovering from a work-related sickness or harm. You’re eligible for the sort of profit in case you’re unable to work in any respect whereas recovering.

State legal guidelines range on the profit quantity, however TTD funds are normally equal to two-thirds of your revenue and usually are not tax-deductible. You need to obtain your first fee inside 14 days after your employer has been knowledgeable of two issues:

- That you’ve suffered a work-related harm

- That your physician has declared that you’re quickly disabled

Your claims administrator ought to ship the TTD profit, together with a proof of the fee calculation.

You’re additionally not eligible to obtain any advantages to your first three days off work until your harm lasts greater than two weeks or requires hospitalization.

2. Short-term partial incapacity (TPD) advantages

Short-term partial incapacity advantages work the identical method as TTD payouts, however you may also obtain TPD funds in case you can return to work with sure restrictions. These embody limitations on the variety of hours you’ll be able to work and the kinds of duties you are able to do.

TPD funds are equal to two-thirds of your misplaced wages. Misplaced wages are calculated by subtracting the quantity you’re incomes by working part-time out of your common weekly wage. TPD advantages are topic to your most non permanent incapacity (TD) charge.

Each TTD and TPD advantages finish when you meet one of many following standards:

- You’ve got returned to work

- Your physician declares which you could return to work

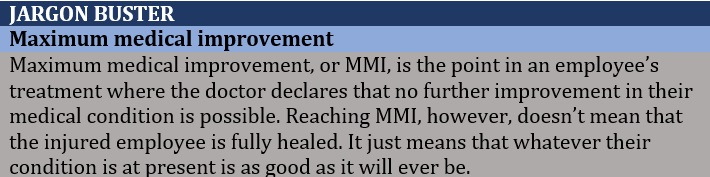

- Your physician says you may have reached “most medical enchancment”

- You’ve got acquired greater than 104 compensable weeks of funds for a single incapacity inside two years from when the TD funds started

- You or the insurer disputes the treating physician’s analysis, and a certified medical evaluator (QME) assesses you and finds any of the above

As soon as your TD funds finish, your claims administrator is required to ship you a letter explaining the explanations.

3. Everlasting whole incapacity (PTD) advantages

You could qualify for PTD advantages if a work-related harm prevents you from returning to your job previous to the harm after you may have reached MMI.

4. Everlasting partial incapacity (PPD) advantages

If you’re unable to work in the identical position earlier than the harm due to some everlasting impairment however can work in a special position that earns much less, chances are you’ll be eligible for PPD advantages.

Each PTD and PPD funds are set by the regulation and are based mostly on three components:

- Your wages on the time of the harm

- The date once you have been injured

- Your incapacity ranking

Incapacity scores estimate how a lot your harm impacts your potential to work. A 100% ranking signifies whole incapacity, whereas figures under 100% signify partial incapacity. The scores are based mostly on a number of components, together with:

- A QME’s medical evaluation

- The date of harm

- Your age

- Your occupation

- How a lot of your incapacity is brought on by your job

- Your lowered future incomes capability

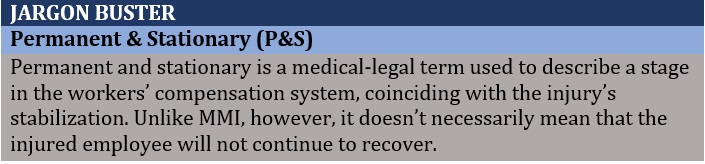

You can begin receiving everlasting incapacity (PD) funds as quickly as your physician or a QME finds indicators of any everlasting incapacity. You probably have been receiving TD advantages, the PD payouts have to be despatched inside 14 days after your final non permanent incapacity examine. In any other case, funds have to be despatched inside two weeks after your physician declares your harm to be “everlasting and stationary.” After the preliminary fee, PD checks are despatched out each 14 days.

Right here’s a abstract of the 4 kinds of incapacity advantages injured staff can qualify for underneath staff’ compensation insurance coverage.

Staff’ compensation insurance coverage is a type of enterprise insurance coverage that covers the price of medical care and a portion of misplaced revenue of staff who get sick or injured whereas doing their jobs. It additionally protects companies from the monetary legal responsibility of getting to pay for bills arising from work-related sicknesses and accidents out of pocket.

Nearly all states require companies to take out staff’ compensation insurance coverage. The charges and degree of safety range, relying on the place and during which business the enterprise operates.

- The corporate’s annual payroll

- Job classifications, which replicate the riskiness of the work staff do

- Expertise modification charges, which observe previous staff’ compensation claims

The state additionally decides who handles and sells staff’ compensation insurance coverage insurance policies. These could also be state-run companies, non-public insurance coverage firms, or the state itself.

What in case you get injured at work and your employer can’t accommodate your work restrictions? How would you take care of it? Tell us within the feedback part under.

Associated Tales

Sustain with the newest information and occasions

Be a part of our mailing listing, it’s free!

Related Posts

- Can employer-based medical insurance finance protection of gene therapies? – Healthcare Economist

In keeping with a latest paper by Doshi et al. (2023), the reply is ‘sure‘!…

- How Life Insurance coverage Payouts Work [2023]

What You Ought to Know Upon the insured’s demise, a life insurance coverage payout is…

- How Life Insurance coverage Payouts Work [2023]

What You Ought to Know Upon the insured’s loss of life, a life insurance coverage…