Life Insurance

Tremendous Bowl 2024 Highlights NFL’s Growing old Billionaire Drawback

What You Have to Know

- The NFL was answerable for 93 of the 100 most-watched TV broadcasts final yr, and introduced in practically $20 billion in income.

- Progress has created succession-planning challenges — and will power the doorways open for buyers pushed by monetary imperatives.

- Bringing in institutional homeowners and personal fairness buyers might assist groups elevate capital and provides minority companions a approach to money out.

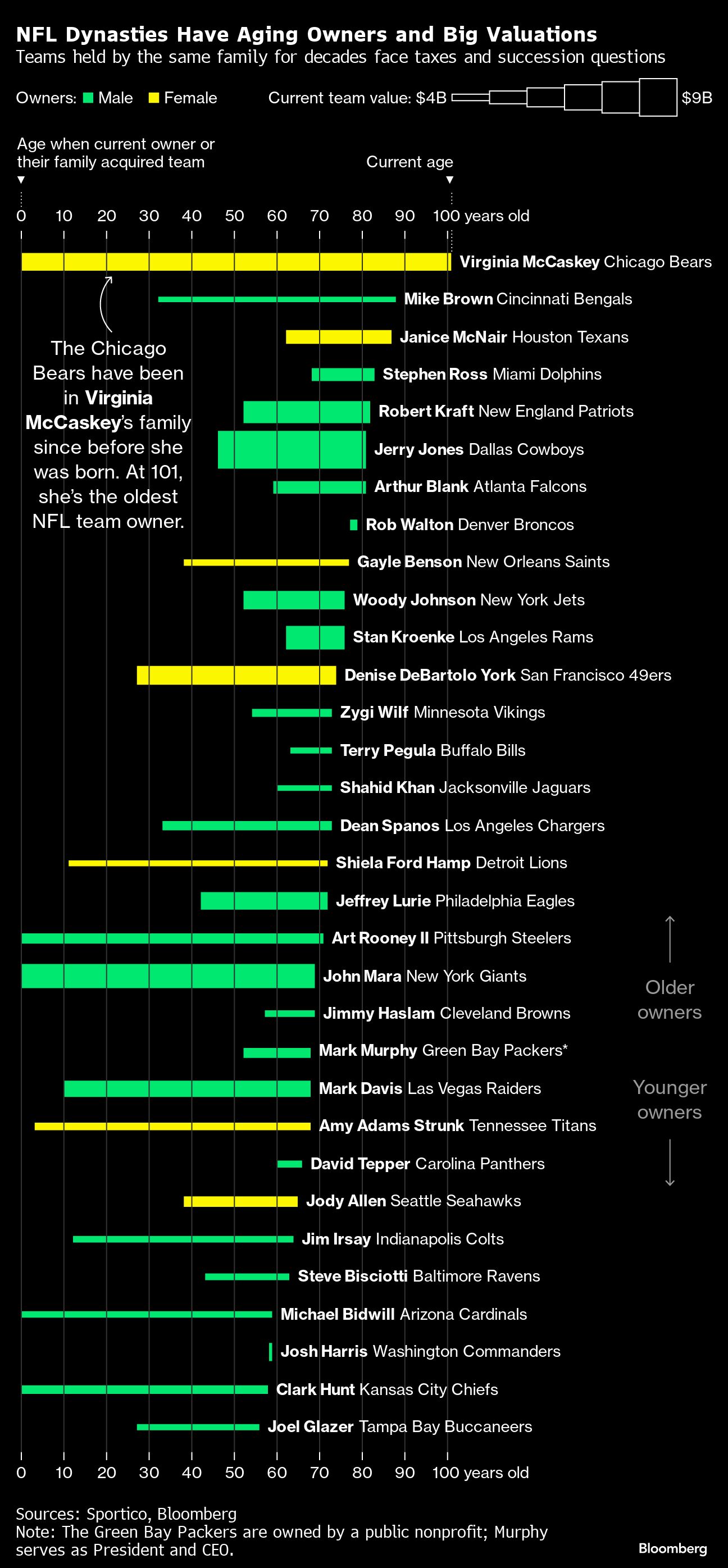

When she was 9 years previous, Virginia McCaskey attended the first NFL playoff recreation, at Chicago Stadium in December 1932. The Chicago Bears, coached by her father, George “Papa Bear” Halas – the group’s founder and proprietor — beat the Spartans of Portsmouth, Ohio, by a rating of 9-0 to grow to be the then 12-year-old league’s champions.

Moved indoors due to a blizzard, the sport, a precursor to the annual championship now referred to as the Tremendous Bowl, was performed in entrance of about 11,000 individuals on a 60-yard discipline utilizing dust and manure left over from a touring circus.

One punt hit the stadium’s organist. Two years later, a radio station proprietor paid $7,952.08 (about $180,000 in at this time’s {dollars}) to purchase the Spartans and transfer them to Detroit, the place they now play because the Lions.

Now, the 101-year-old McCaskey owns the Bears. Earlier than his demise in 1983, her dad got here up with a plan to go the group to McCaskey, his solely residing baby, with out saddling her with a heavy tax burden.

Halas divided the 49.35% of the Bears he owned into equal shares for his 13 grandchildren utilizing a set of trusts. Voting energy over these shares went to McCaskey, who already owned shut to twenty% of the group. McCaskey has since raised 11 kids, with 21 grandchildren, 35 great-grandchildren and 4 great-great-grandchildren.

The Bears are a part of a towering U.S. media colossus. The Nationwide Soccer League was answerable for 93 of the 100 most-watched TV broadcasts final yr, and introduced in practically $20 billion in income.

McCaskey’s group alone is value $6 billion, in accordance with the newest estimates by sports-business media outlet Sportico, and throughout the league common franchise valuations rose 69% between 2020 and 2023.

That progress has helped make NFL group homeowners wealthy. However it has additionally created succession-planning challenges in a league that venerates household and custom — and will power the doorways open for buyers pushed by monetary imperatives.

Time for Non-public Fairness?

In September, the NFL shaped a particular committee of 5 homeowners to contemplate ending a block on private-equity funds. Different prime sports activities leagues have already lowered the gates for such buyers, however the nation’s hottest one has remained a holdout.

Clark Hunt, an element proprietor and chairman of the Kansas Metropolis Chiefs — who will face the San Francisco 49ers in Tremendous Bowl LVIII in Las Vegas on Sunday — stated in an interview that the league has been watching as different sports activities dip their toes into personal fairness.

“I do assume it’s an avenue that may be useful from a capital standpoint,” stated Hunt, who can be chairman of the NFL’s finance committee, a member of the panel wanting into the private-equity guidelines and a son of Chiefs founder Lamar Hunt.

Clearing a path for personal fairness is more likely to end in a collection of offers briefly order, with six to eight groups doubtlessly promoting minority stakes inside a yr, in accordance with an govt for one NFL group who declined to be recognized as a result of they aren’t approved to talk publicly on the matter.

Approval of the personal fairness plan is predicted to return on the league’s annual assembly subsequent month, in accordance with individuals aware of the method.

The NFL declined to remark for this text.

A Historical past of Household Companies

For many of its greater than 100-year historical past, the NFL has operated as a intently knit collective of household companies — and has taken steps to attempt to hold it that approach. Beneath Commissioner Roger Goodell, who has held his submit since 2006, the NFL has repeatedly adjusted its guidelines to make it simpler to go groups throughout generations, as common group values climbed to round $5 billion.

“He appreciates the continuity, the historical past, the pores and skin within the recreation that the household ownerships present,” stated Marc Ganis, president of the consulting agency Sportscorp Ltd. and confidant to many NFL homeowners. “You’re making choices for a for much longer horizon for those who’re considering of a group staying within the household together with your kids.”

But the NFL’s prosperity has made sustaining such cohesion a costlier and extra sophisticated proposition, as an growing old cohort of householders goals to maintain their households in management and keep away from exposing heirs to a whole lot of hundreds of thousands in tax liabilities.

Pressured to Promote

“In our expertise, sports activities group homeowners hardly ever if ever promote their groups until they’re compelled to for exterior causes — which is occurring with just a few NFL franchises in the mean time,” stated Andrew Kline, a former St. Louis Rams offensive lineman and now funding banker at Park Lane.

The U.S. taxes inherited belongings after a person exemption of $13.6 million at a fee of 40%, with a further 40% levy on belongings handed to grandchildren. The exemption is predicted to be minimize practically in half in 2026, when modifications handed in 2017 below President Donald Trump are scheduled to lapse.

The common age of the league’s 32 principal homeowners is 72. Seven are 80 or older. Eight groups are nonetheless owned by their founding households. Beneath NFL guidelines, these households should maintain no less than 30% of a franchise, led by a single controlling proprietor. For lots of the league’s oldest households, whose wealth is generally tied up of their groups, a big tax invoice might go away them with little selection however to promote.

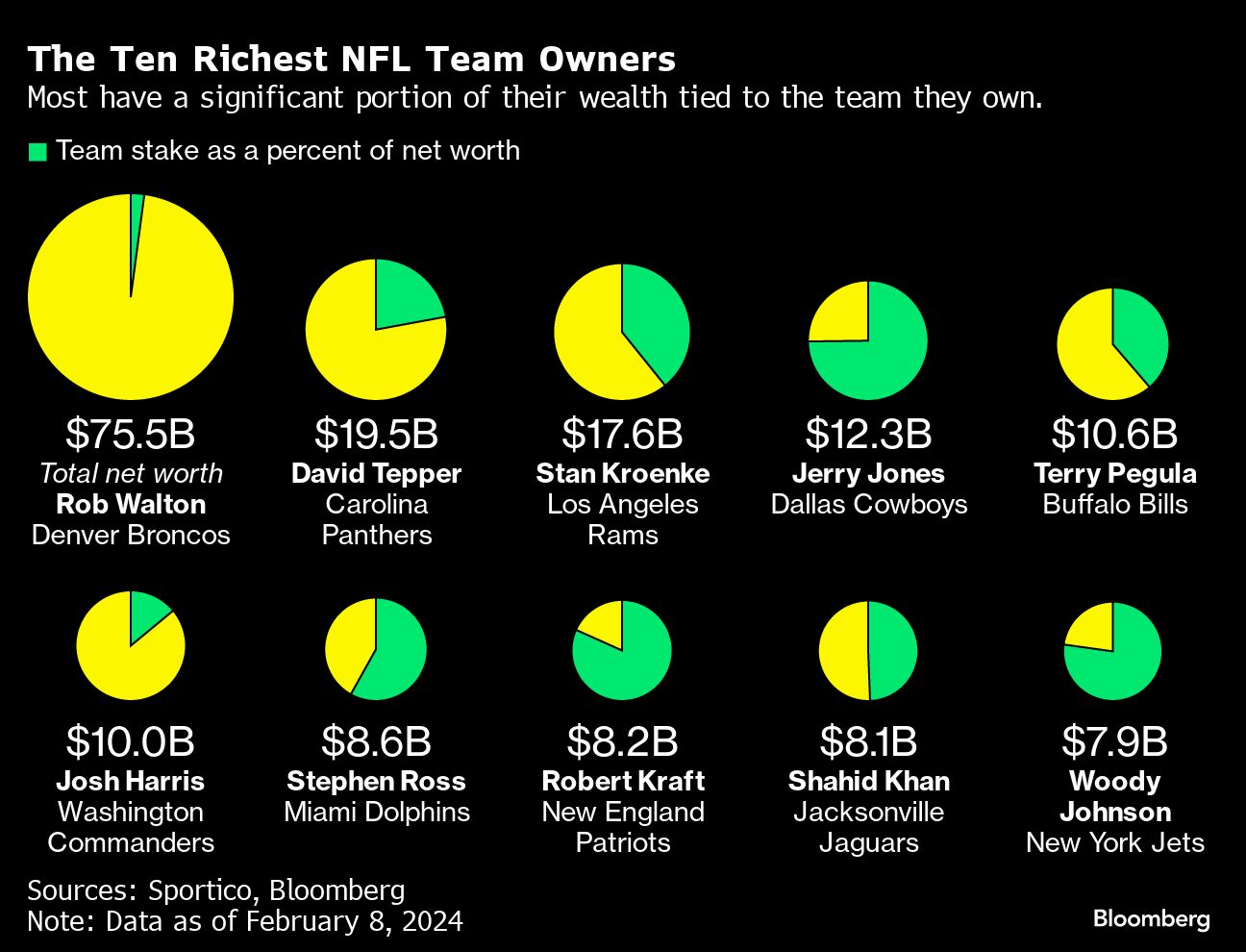

“When groups have been value $300 million, that was one factor,” stated Ganis. “When they’re value $7 or $8 billion, that could be a unique story.”

Over the previous decade, the NFL has accredited 4 record-breaking franchise gross sales. In 2014, fracking billionaire Terry Pegula and his spouse, Kim, purchased the Buffalo Payments from the property of founding proprietor Ralph Wilson for a then-record $1.4 billion. That deal was adopted 4 years later by the sale of the Carolina Panthers to hedge fund billionaire David Tepper for $2.3 billion.

Walmart Inc. inheritor Rob Walton led a bunch that in 2022 purchased the Denver Broncos for $4.65 billion after its controlling Bowlen household couldn’t agree on a succession plan. And final yr, personal fairness billionaire Josh Harris led a bunch of greater than 15 companions who paid over $6 billion for the Washington Commanders.

In the meantime, different buyers have expressed curiosity in taking a smaller slice of a group. Clearlake Capital co-founders Behdad Eghbali and Jose Feliciano have been stated final yr to be weighing a bid for a stake within the Los Angeles Chargers.

Points with New Cash

Some longstanding homeowners have been unnerved by the inflow of recent cash.

“There’s previous homeowners who need to keep and are very involved with franchise values getting uncontrolled,” stated Frank Hawkins, a former NFL govt who runs a consulting agency, “and others who’re very inquisitive about maximizing their worth.”

Different prime U.S. leagues have handled surging franchise values, which have put shopping for even a part of a group out of attain for all however the ultra-rich, by letting in institutional buyers.

Specialised personal fairness companies have arrange funds to purchase passive stakes in franchises within the Nationwide Basketball Affiliation, Main League Baseball and the Nationwide Hockey League.

For the NFL, permitting in such automobiles would assist groups elevate capital and provides minority companions a approach to money out.

“To present an instance the price of constructing and renovating stadiums continues to rise at a really quick fee,” stated Hunt, the Chiefs proprietor, “and being able to entry exterior capital to assist facilitate tasks like that might be useful.”

Permitting extra exterior buyers would shift the character of the league. Historically, restricted companions have been mates of possession, former gamers, native celebrities and others who see the funding as greater than an alternate asset class for his or her portfolio.

Non-public fairness buyers would add to the strain to push revenues increased — and for groups to vary palms at ever-higher costs.

https://feeds.feedblitz.com/-/869505446/0/thinkadvisor/

Related Posts

- Our Tremendous Bowl + 12 + Issues.

(Vest, shirt, pants, footwear) The joy for my marathon hit me like a wave yesterday.…

- Enroll in a 2024 well being plan

Open Enrollment for 2024 well being care protection began November 1, 2023, and ends January…

- 15 Hottest Housing Markets for 2024

Begin Slideshow Many of the markets in Realtor.com’s 2024 high U.S. housing markets forecast, launched…