Insurance

Tips on how to handle the pressing insurance coverage workforce hole with expertise | Insurance coverage Weblog

The insurance coverage business is experiencing a rising expertise scarcity. Whereas this problem has been anticipated, a lot of the dialogue on options is commonly generalized to the whole workforce. However not each job will probably be impacted in the identical method. As insurers develop, some capabilities will want extra assist, whereas others will probably be higher primed to make use of cognitive expertise, like AI, RPA and extra. This implies some jobs will probably be changed by expertise, different jobs will probably be enhanced by expertise and different jobs would require extra people (an space the place folks can shift to, if their job is changed).

The very fact is that insurance coverage operations are altering, and individuals are the middle of that change. The query isn’t, “How can we handle this workforce hole?” The query is, “How will claims, underwriting and gross sales be impacted by this workforce hole, and the way can we leverage expertise to handle every one to enhance our operations holistically?” That’s what I’ll be exploring right here.

Urgency wanted to handle the rising workforce hole in insurance coverage

In June 2021, the US Chamber of Commerce launched the The America Works Report with alarming statistics:

- Lower than 25% of the insurance coverage business is beneath 35 years previous.

- Within the final 10 years, insurance coverage professionals aged 55 and older elevated by 74%.

- The Bureau of Labor Statistics estimates that over the following 15 years, 50% of the present insurance coverage workforce will retire.

- There will probably be greater than 400,000 open positions unfilled over the following decade.

These statistics paint a startling image—and one which requires an pressing response. However an growing older workforce isn’t the one concern:

- Insurance coverage firms are additionally making an attempt to develop, that means they both want a bigger workforce or the flexibility to scale with the present measurement workforce.

- Many occasions, there’s a expertise mismatch the place the present insurance coverage workforce lack the talents wanted to function in an automatic and information centric atmosphere.

- Whereas insurance coverage firms don’t all the time want a whole bunch of elite tech engineers, they do want their justifiable share of foundational and complimentary technical specialists, particularly because the deal with AI/ML and the cloud continues to extend. This could create expertise competitors with huge tech firms that provide greater salaries, extra perks and extra progressive work.

Tackling the workforce hole holistically

Realistically, the business will be unable to exchange 400,000 open positions one-to-one. And even when it did, the quantity of information loss with 50% of the workforce retiring is gigantic. That is the place cognitive expertise is available in as a part of the answer.

It’s essential to emphasise that expertise is barely half of the workforce hole resolution. Whereas extra administrative, redundant duties may be automated, different capabilities may have extra folks (like sales-related areas, which I’ll discover intimately later).

Insurers must do two contradictory issues on the similar time: Have a look at their workforce individually and holistically. Choice makers must know the influence of the workforce hole and the supporting applied sciences for every particular person job operate. However since jobs don’t function in silos (at the least, they shouldn’t), insurers additionally must have a holistic understanding of how modifications will influence the best way totally different capabilities work together with and assist one another. In the end, there is no such thing as a one-size-fits-all resolution. However there are essential insights for all insurers to contemplate.

Cognitive expertise is altering the insurance coverage workforce

Cognitive expertise will influence totally different jobs in several methods. Some jobs will probably be changed by automation; others will probably be augmented by expertise; and different jobs might want to develop the human workforce in tandem with expertise.

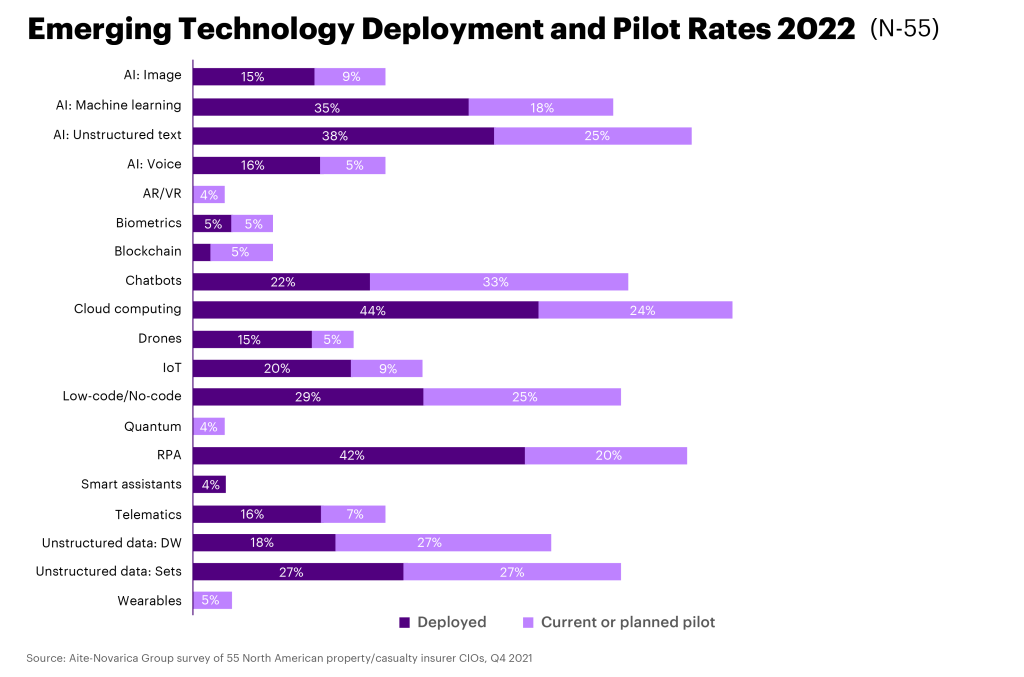

Earlier than leaping into particular job capabilities, it’s essential to know the varieties of expertise which are turning into increasingly more ubiquitous. The next desk highlights the expertise P&C insurers are specializing in in 2022.

Clearly, AI, information and RPA are main areas of focus. Chatbots are additionally getting used extra typically to enhance customer support, whereas cloud and information stay key areas for operational efficiencies and insights. Every of those applied sciences will influence jobs in several methods. Let’s discover.

The importance of partnerships

A fast word on the significance of partnerships: You’ll discover all through the examples under that nearly each considered one of them is completed through a partnership. With tech expertise turning into more durable to seek out, partnerships will probably be a key technique to bridge the expertise hole and implement advanced expertise at scale—and shortly.

The future of claims: Replace and augment

To deal with the workforce hole in claims, expertise will probably be used to each substitute and increase workers, although the size of this influence will probably be totally different between private and business traces.

Private:

Private claims is essentially the most vulnerable to automation, particularly for easy claims. A small car parking zone automobile accident is an ideal instance of a simple kind of declare that AI can deal with—with human spot-checking, after all.

Actual-life tech instance: Hippo just lately partnered with Claimatic and 5 Sigma to make use of automation to course of householders’ claims quicker and handle them end-to-end. From a buyer perspective, this provides a single level of contact, quicker response occasions and simpler claims monitoring. From an operations perspective, this automation reduces back-end friction and ensures accuracy by figuring out the severity of a declare and flagging when a loss is recognized.

Worker influence: There’ll possible be an worker scale-down of the claims workforce as automation manages extra of the claims course of. On the similar time, remaining workers will probably be augmented with expertise to assist them to handle claims quicker and extra precisely. Wanting on the Hippo instance, a part of its new automation expertise is to match claimants with adjusters—a sometimes handbook, time-consuming course of. This augments the claims workforce in order that they will keep away from most of these administrative duties and deal with what issues: the shopper.

Industrial:

Like private traces, business claims departments will probably be each changed and augmented by cognitive expertise, however at a special price. Industrial claims are sometimes extra advanced, so there will probably be extra augmentation versus substitute, in comparison with private traces.

Actual-life tech instance: Protecting insurance coverage partnered with Roots Automation to scale its trucking and business auto insurance coverage claims. In solely 4 months, Protecting launched two “digital co-workers” known as Roxy (for sending letters to claimants) and Rex (for indexing claims paperwork). Each bots have been in a position to full 95% of duties with out human intervention.

Worker influence: Most claims workers working in business traces will probably be augmented by cognitive expertise. The Protecting insurance coverage instance reveals how bots may be leveraged to handle essentially the most time-consuming duties, like indexing paperwork. This frees up workers to deal with extra essential duties or deal with extra claims. That is particularly essential for the underserved small-to-medium enterprise (SME) market. By streamlining business claims as a lot as attainable, the SME market may look extra engaging to insurers.

The way forward for underwriting: Increase

Underwriting encompasses each danger evaluation and product growth. This may proceed to be a key space for insurers to stay trendy and aggressive, so headcount will possible not be reduce. Nonetheless, individuals are retiring. Insurers should ask themselves: Can we substitute retiring staff or use expertise to scale up our present workforce? With the present expertise hole, that latter is extra reasonable. This implies underwriting is transferring right into a world of semi-automation, each for private and business traces. And meaning re/upskilling.

Actual-life tech instance (private): Product growth is a big a part of underwriting, and a whole lot of insurers are leveraging cognitive expertise to make the appropriate merchandise on the proper time. Arbol partnered with RealTimeRental to supply real-time parametric climate safety for trip leases utilizing AI, analytics and third-party information. AXA Life & Well being Reinsurance Options makes use of a white-labeled model of Verisk’s Well being Threat Score Device they’ve branded because the Clever Medical Acceptance Device (IMPACT) to automate components of the medical health insurance underwriting course of to allow higher protection for purchasers with pre-existing situations.

Actual-life tech instance (business): On the business aspect, danger is the core theme for cognitive expertise. Allianz SE partnered with Cytora to faucet into AI-based danger processing for its business traces enterprise, permitting underwriters to deal with value-adding duties. One other instance is insurtech Neptune Flood, which developed an AI-based ranking and quoting platform for automated danger evaluation. With this expertise, Neptune noticed 400% progress and is now the most important personal flood MGU within the US.

Worker influence: Know-how is already altering underwriting, particularly from a product growth and danger evaluation standpoint. Reskilling the workforce will probably be important. Know-how, particularly the flexibility to ingest third-party information leveraging the drive of the cloud, could make product growth quick and nimble. Staff might want to really feel comfy trusting new information sources and AI to drive innovation. Taking a look at danger evaluation, a human perspective will all the time be essential. However underwriters may be knowledgeable and supported by AI and different cognitive expertise to enhance accuracy and make higher choices. Staff will have to be reskilled to modernize their method and make the most of the large-scale evaluation supplied by AI and different applied sciences.

The way forward for gross sales: Increase and develop

It’s not stunning that gross sales and its related capabilities, like advertising and marketing, might want to scale with digital tech. Gross sales must get extra progressive as competitors grows and prospects demand a seamless expertise. New areas, akin to embedded insurance coverage, will leverage expertise and technique in a method the business has by no means carried out earlier than. To assist this fast shift and progress, gross sales capabilities might want to increase whereas additionally being augmented with expertise.

Actual-life tech instance (private): Direct Auto & Life Insurance coverage selected Advertising Evolution’s buyer journey monitoring resolution. This persona-based advertising and marketing measurement and optimization platform will present insights into the touchpoints prospects have interaction with alongside their path to buy. These insights will assist Direct Auto & Life Insurance coverage to raised perceive its prospects, ship a personalised expertise and critically—how you can hyperlink habits to gross sales.

Actual-life tech instance (business): Nationwide expanded its relationship with Amazon Internet Companies to innovate and deploy progressive merchandise whereas additionally they streamlined inner operations. From a gross sales business perspective, this partnership helped Nationwide construct a Small Enterprise Advisory platform that makes use of machine studying to tailor customized insurance coverage coverage suggestions to small enterprise prospects in minutes.

Worker influence: Gross sales, advertising and marketing and buyer engagement are important for progress. Staff in these areas will probably be augmented with expertise, whereas groups increase headcount. To stay aggressive, insurers might want to innovate and construct a enterprise growth ecosystem. Know-how by itself gained’t do that. Like underwriting, cognitive expertise will provide the instruments for artistic salespeople to innovate—and the shopper insights to make data-driven choices and promote progress.

Roadmap to the long run: A cross-functional perspective

As I discussed earlier than, job capabilities don’t function in silos. So, this breakdown will get extra difficult after we have a look at how every operate interacts with one another. For instance: Claims and underwriting are intertwined. Modernizing claims to raised leverage the information utilized in underwriting and vice versa is extra essential than ever. Breaking down these silos will drive an enterprise degree change in behaviors and collaboration.

That’s why insurance coverage firms must take a cross-functional perspective when figuring out how expertise will change their workforce. And this shouldn’t be a theoretical technique.

Tips on how to use tech to shut the insurance coverage workforce hole

Insurers ought to put collectively a concrete workforce roadmap. The roadmap needs to be modular, outlining which areas will want new hires versus reskilling. It ought to contemplate the interplay between capabilities and the way altering one will influence the opposite. It must also point out the place folks may be moved round to capitalize in your present workforce and the data and expertise that they’ve.

One other key aspect of evolving your workforce is early inclusion. Staff deserve transparency in the case of how their jobs will change. Early involvement will assist workers really feel like they’re part of that change—and decrease substitute fears. As a result of all of the roadmaps on this planet gained’t assist if workers really feel threatened and reject change. Insurance coverage firms can keep away from this by being supportive, sincere and by listening.

Whereas a roadmap and transparency are essential from an worker perspective, the expertise aspect is its personal area. This weblog appeared on the product and repair aspect of the insurance coverage workforce, however implementing cognitive applied sciences requires a gifted, motivated IT workforce. Insurers might want to marry a tech roadmap that aligns with its workforce imaginative and prescient utilizing agile methodologies to permit for flexibility and pivots, if wanted. Critically, executives want to have the ability to talk this holistic imaginative and prescient throughout the group—together with tech companions.

The insurance coverage business has a troublesome highway forward in the case of expertise. A long time’ price of information is about to be misplaced to excessive retirements, and youthful generations aren’t banging down the door to work in insurance coverage. Carriers might want to get artistic utilizing a mixture of expertise and a reskilled human workforce to shut this hole and drive future progress. The time for this transition is now, or else you danger falling behind. Simply do not forget that workers are folks—deal with them with respect and compassion, and they’re going to rise to your expectations. As we are saying at Accenture: Innovation occurs the place expertise meets human ingenuity. The insurance coverage business will want each to reach the long run.

Remodeling claims and underwriting with AI: AI has emerged because the important differentiator within the insurance coverage business when utilized in tandem with people.

Get the most recent insurance coverage business insights, information, and analysis delivered straight to your inbox.

Disclaimer: This content material is supplied for basic info functions and isn’t supposed for use instead of session with our skilled advisors.

Disclaimer: This doc refers to marks owned by third events. All such third-party marks are the property of their respective house owners. No sponsorship, endorsement or approval of this content material by the house owners of such marks is meant, expressed or implied.

Related Posts

- Insurance coverage Information: Workforce wellness and inclusion | Insurance coverage Weblog

I'm delighted that my colleague Tony Steadman joined me to debate the most recent trade…

- Pie Insurance coverage bolsters management workforce

Pie Insurance coverage has boosted management with Carla Woodard as vp of claims, Jaime Gilliam-Swartz…

- Insurance coverage Information: How AI is enabling the longer term workforce | Insurance coverage Weblog

The insurance coverage business continues to deal with an getting old workforce and with the…