Insurance

The world’s most useful insurance coverage model revealed

Model values of essentially the most priceless insurance coverage corporations present a blended bag of outcomes. Learn the way the highest insurers fare amid the present financial local weather

Regardless of experiencing a dip in model worth, the world’s 5 most useful insurance coverage manufacturers retain their locations on Model Finance’s newest Insurance coverage 100 rankings. The model valuation consultancy’s annual report lists the world’s most useful insurance coverage corporations based mostly on “the worth of earnings particularly associated to model fame.”

On this article, Insurance coverage Enterprise delves deeper into the insurance coverage manufacturers that made it to the newest rankings’ high 10. If you wish to understand how the current financial local weather has impacted the efficiency of the {industry}’s largest manufacturers, then this piece may give you an concept. Learn on and be taught extra about essentially the most priceless insurance coverage corporations when it comes to model fame.

The desk beneath lists the ten most useful insurance coverage manufacturers based mostly on the newest version of Model Finance’s Insurance coverage 100 report.

Prime 10 most useful insurance coverage corporations based mostly on model worth

|

Rank

|

Insurer

|

Headquarters

|

Model worth

|

Earlier rating

|

|

1

|

Ping An

|

China

|

$32.2 billion

|

1

|

|

2

|

|

Germany

|

$21.0 billion

|

2

|

|

3

|

China Life

|

China

|

$17.1 billion

|

3

|

|

4

|

|

France

|

$15.9 billion

|

4

|

|

5

|

CPIC

|

China

|

$15.2 billion

|

5

|

|

6

|

AIA

|

Hong Kong

|

$15.0 billion

|

7

|

|

7

|

|

United States

|

$14.1 billion

|

6

|

|

8

|

Progressive

|

United States

|

$11.8 billion

|

8

|

|

9

|

PICC

|

China

|

$11.7 billion

|

13

|

|

10

|

|

United States

|

$11.6 billion

|

11

|

The model valuation consultancy’s newest rankings present that half of the highest 10 checklist contains China-based insurance coverage corporations, together with one from Hong Kong. Three of those corporations have secured their locations within the high 5. The US has three representatives whereas Germany and France have one every. Let’s dig deeper into the numbers.

1. Ping An

Present model worth: $32.2 billion

Earlier model worth: $42.9 billion

Proportion change: -25%

Ping An retains the title of the world’s most useful insurance coverage model, regardless of a 25% drop in model worth. The corporate has secured the highest spot for the seventh straight 12 months.

In keeping with the report, Ping An has confronted difficult working circumstances up to now two years as China’s financial development has taken successful, primarily because of the pandemic. The scenario has resulted in diminished family consumption, adversely affecting Ping An’s premiums.

Ping An is China’s largest basic insurer, serving greater than 220 million shoppers and 611 million on-line customers worldwide. The Shenzhen-headquartered agency has a sturdy life and well being, and property and casualty insurance coverage portfolio. It additionally invests closely in expertise to assist streamline its companies.

2. Allianz

Present model worth: $21.0 billion

Earlier model worth: $23.1 billion

Proportion change: -9%

German insurance coverage model Allianz has been persistently within the high three on the checklist of most useful insurance coverage corporations, putting second up to now two years. After seeing a 14% rise in 2022, the agency’s model worth went down by 9% this 12 months.

The Munich-based insurance coverage big affords property and casualty, life and well being, credit score, and industrial insurance coverage via its a number of manufacturers and subsidiaries. These embody:

- Allianz International Company & Specialty (AGCS): A world insurer specializing in enterprise insurance coverage and huge company and specialty dangers.

- Euler Hermes: A credit score insurance coverage firm offering shoppers with bonding, ensures, and collections companies for managing business-to-business (B2B) commerce receivables.

Allianz additionally affords asset administration companies. It has a worldwide attain spanning greater than 70 nations and caters to over 126 million clients.

3. China Life

Present model worth: $17.1 billion

Earlier model worth: $22.9 billion

Proportion change: -25%

China Life suffered an enormous dip in model worth, with the pandemic hampering Chinese language insurance coverage corporations’ potential to conduct offline transactions. The scenario has led to a big decline in premium income for a lot of insurers working within the nation.

The Beijing-based agency is among the many largest suppliers of accident, well being, and life insurance coverage in China. It additionally affords annuity companies. The corporate’s operations are backed by 746,000 particular person brokers, 41,000 direct gross sales representatives, and 23,000 account managers within the bancassurance channel.

China Life has round 317 million annuity contracts and long-term life and medical health insurance insurance policies in power.

4. AXA

Present model worth: $15.9 billion

Earlier model worth: $17.2 billion

Proportion change: -8%

Even with its model worth reducing, French insurance coverage model AXA retains the fourth spot on the checklist. The corporate has been persistently within the higher half of the rankings, reaching its highest place at second in 2015 and 2016.

The Paris-headquartered world insurance coverage and asset administration companies supplier serves round 93 million clients in additional than 50 nations and territories. A community of 145,000 workers and distributors assist the corporate’s operations.

AXA operates 4 divisions:

- Asset administration and banking

- Well being

- Life and financial savings

- Property and casualty

The insurance coverage big has workplaces in North America, Western Europe, the Center East, and the Asia-Pacific area.

5. CPIC

Present model worth: $15.2 billion

Earlier model worth: $15.8 billion

Proportion change: -4%

China Pacific Insurance coverage (Group) Co. Ltd, also referred to as CPIC, skilled a slight dip in model worth, however has remained within the higher half of this 12 months’s checklist of essentially the most priceless insurance coverage corporations. Similar to most Chinese language manufacturers within the rankings, CPIC’s decline is primarily brought on by the COVID-19 outbreak.

The Shanghai-based agency is considered one of China’s largest insurance coverage holding corporations. It operates three companies: property and casualty insurance coverage, life insurance coverage, and asset administration and investments. The corporate’s insurance coverage merchandise are distributed via its community of home and international subsidiaries. A 107,000-strong workforce is a part of its operations.

CPIC is the primary insurance coverage group to be listed concurrently on the Shanghai, London, and Hong Kong Inventory Exchanges.

6. AIA

Present model worth: $15.0 billion

Earlier model worth: $13.0 billion

Proportion change: 16%

AIA registered one of many highest will increase in model worth on the checklist, climbing a notch within the rankings. The Hong Kong-domiciled insurance coverage big reached its highest place at fourth place in 2017 and 2019.

AIA is the biggest pan-Asian life insurance coverage group, offering monetary companies and insurance coverage merchandise in 18 markets throughout the Asia-Pacific area. Its insurance coverage portfolio contains life, well being, accident safety, medical, and retirement insurance coverage.

The corporate additionally affords worker advantages and pension companies to companies. These insurance policies cowl workers’ well being, earnings safety, and retirement wants.

7. GEICO

Present model worth: $14.1 billion

Earlier model worth: $13.1 billion

Proportion change: 8%

GEICO’s 8% rise in model worth wasn’t sufficient to maintain it in sixth place, slipping a notch from final 12 months. Nonetheless, the Berkshire Hathaway subsidiary is essentially the most priceless insurance coverage firm in America in the case of model fame.

GEICO is among the many high names within the nation in the case of auto protection, rating amongst the biggest automotive insurance coverage corporations within the US. The Maryland-headquartered insurer can be one of many nation’s hottest automotive insurance coverage manufacturers, due to its sturdy choices and above-industry-average buyer satisfaction scores.

One other issue that has contributed to its model worth is, in fact, Gecko. GEICO’s lovable mascot continues to be among the many most recognizable points of the insurer’s commercials.

For a brief overview on how model worth influences buying choices, watch this video:

8. Progressive

Present model worth: $11.8 billion

Earlier model worth: $11.2 billion

Proportion change: 6%

Progressive retains the quantity eight spot in essentially the most priceless insurance coverage model rankings, with its model worth rising 6% from final 12 months. The Ohio-based insurer can be the biggest insurance coverage firm within the US based mostly on market cap for the non-life phase.

The corporate affords a spread of private and industrial insurance policies, in addition to monetary companies. Its insurance coverage merchandise will be accessed immediately or via its nationwide community of 38,000 impartial brokers.

Progressive additionally has considered one of the most well-liked insurance coverage mascots in its arsenal, serving to the model obtain a wider attain. Performed by actress and comic Stephanie Courtney, the energetic and pleasant Flo has appeared in additional than 100 of the corporate’s commercials. The character is equally well-liked on social media, boasting an enormous Twitter following and greater than 5 million Fb likes.

9. PICC

Present model worth: $11.7 billion

Earlier model worth: $9.6 billion

Proportion change: 22%

The Folks’s Insurance coverage Firm (Group) of China, extra popularly often called PICC, barges into the highest 10, registering the sharpest rise in model worth. The corporate is the one exception to the struggling Chinese language manufacturers within the rankings.

In keeping with Model Finance’s report, PICC has been capable of keep its market dominance due to its authorities background and substantial underwriting capability. This gave the agency a powerful aggressive benefit in conducting companies with giant companies and state-owned enterprises.

The Beijing-based insurance coverage group owns greater than 10 subsidiaries, together with its property and casualty, and life and medical health insurance companies. It has partnerships with over 10,000 establishments spanning city and rural areas throughout China.

10. Chubb

Present model worth: $11.6 billion

Earlier model worth: $10.8 billion

Proportion change: 8%

Chubb climbed one notch to assert the final spot on this 12 months’s checklist of essentially the most priceless insurance coverage corporations by model. The worldwide insurer’s portfolio spans quite a lot of insurance coverage merchandise, from industrial insurance policies to private traces protection. The New Jersey-based firm operates in additional than 50 nations and territories and employs over 31,000 employees globally.

Chubb depends on a community of retail and wholesale brokers, impartial and captive brokers, in addition to banks, direct advertising, and different channels to distribute its merchandise. It additionally offers a spread of instruments, coaching, and sources to its accomplice brokerages to assist them succeed of their jobs.

Methodology for rating the world’s most useful insurance coverage corporations

Model Finance defines model worth as “the current worth of earnings particularly associated to model fame,” including that corporations personal and management these earnings by proudly owning trademark rights.

To calculate an insurance coverage firm’s model valuation, the UK-based consultancy agency applies a technique it calls “royalty reduction.” By way of this method, the agency determines the worth an organization is prepared to pay to license its model as if it doesn’t personal it. The method includes estimating the longer term income attributable to a model and calculating a royalty fee that will likely be charged for utilizing the model.

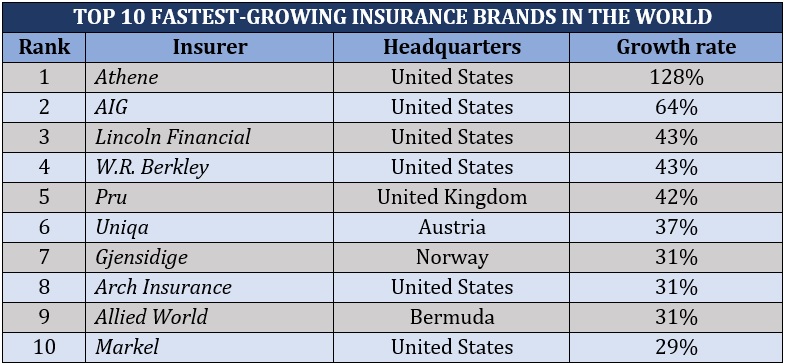

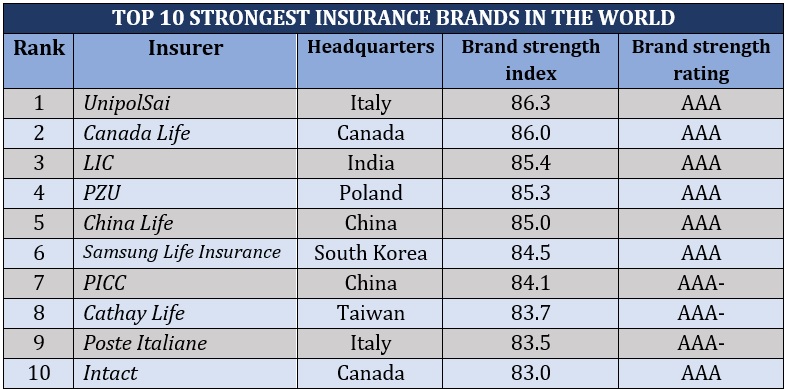

Aside from essentially the most priceless insurance coverage manufacturers, Model Finance ranks the world’s fastest-growing insurance coverage manufacturers. It additionally has a listing of the strongest insurance coverage manufacturers, which replicate their monetary stability. These corporations are listed within the tables beneath.

Most dear insurance coverage corporations – fastest-growing insurance coverage manufacturers

Most dear insurance coverage corporations – strongest insurance coverage manufacturers

Insurance coverage Enterprise additionally carried out analysis on which manufacturers come to thoughts when People store for a coverage. You’ll find the whole checklist in our rankings of the highest insurance coverage manufacturers within the US.

Have you ever skilled working with the world’s most useful insurance coverage corporations? How was it? We’d love so that you can share your story beneath.

Sustain with the newest information and occasions

Be a part of our mailing checklist, it’s free!

Related Posts

- Insurance coverage Model Promoting Versus Insurance coverage Firm Therapy | Property Insurance coverage Protection Regulation Weblog

Sarah Parker wrote me, forwarding a fast studying weblog, Liberty Mutual to Refund $7.7 Million in…

- Inszone Insurance coverage buys Speck Insurance coverage and Monetary Companies

Earlier this month, Inszone Insurance coverage acquired a New Mexico-based insurance coverage company. Credit score:…

- ALKEME acquires Paul Kinan Insurance coverage, Wiggans Farha Insurance coverage

Paul Kinan Insurance coverage Group focuses on providing companies, households and people with property and…