Health Care

The Story of Rising Inequality Turned Out to Be Unsuitable

During the Nice Recession, public discourse in regards to the economic system underwent one thing of a Nice Disappointment.

For a lot of the nation’s historical past, most People assumed that the longer term would carry them or their descendants better affluence. Regardless of periodic financial crises, the general story gave the impression to be one in all progress for each stratum of the inhabitants. These expectations had been largely borne out: The usual of residing loved by working-class People for a lot of the mid-Twentieth century, for instance, was far superior to that loved by prosperous People a era or two earlier.

However after the 2008 monetary disaster, these assumptions had been upended by a interval of intense financial struggling coupled with a newfound curiosity amongst economists within the subject of inequality. Predictions of financial decline took over the dialog. America, a rustic lengthy recognized for its inveterate optimism, got here to dread the longer term—through which it now appeared that most individuals would have much less and fewer.

Adam Ozimek: The easy mistake that nearly triggered a recession

Three arguments supplied the mental basis for the Nice Disappointment. The primary, influentially superior by the MIT economist David Autor, was that the wages of most People had been stagnating for the primary time in residing reminiscence. Though the revenue of common People had roughly doubled as soon as each era for a lot of the earlier century, wage development for a lot of the inhabitants started to flatline within the Nineteen Eighties. By 2010, it regarded as if poorer People confronted a future through which they might now not anticipate any actual enchancment of their way of life.

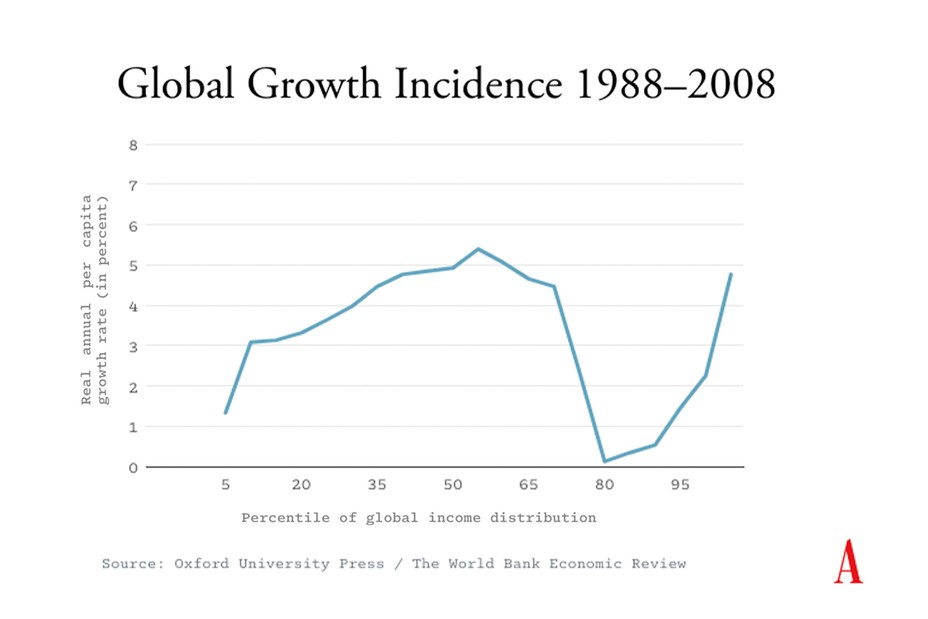

The second argument needed to do with globalization’s affect on the worldwide distribution of revenue. In a graph that got here to be generally known as the “elephant curve,” the Serbian American economist Branko Milanović argued that the world’s poorest folks had been experiencing solely minor revenue development; that the center percentiles had been benefiting mightily from globalization; that these within the upper-middle phase—which included many industrial employees and folks within the service trade in wealthy international locations, together with America—had seen their incomes stagnate; and that the very richest had been making out like bandits. Globalization, it appeared, was a blended blessing, and a distinctly regarding one for the underside half of wage earners in industrialized economies corresponding to the USA.

The ultimate, and most sweeping, argument was in regards to the nature and causes of inequality. Whilst a lot of the inhabitants was simply holding its personal in prosperity, the wealth and revenue of the richest People had been rising quickly. In his 2013 shock finest vendor, Capital within the Twenty-First Century, the French economist Thomas Piketty proposed that this development was prone to proceed. Arguing that the returns on capital had lengthy outstripped these of labor, Piketty appeared to counsel that solely a calamitous occasion corresponding to a significant conflict—or a radical political transformation, which didn’t look like on the horizon—may assist tame the development towards ever-greater inequality.

The Nice Disappointment continues to form the best way many People take into consideration the present and future state of the economic system. However because the pandemic and the rise of inflation have altered the world economic system, the mental foundation for the thesis has begun to wobble. The explanations for financial pessimism have began to look much less convincing than they as soon as had been. Is it time to revise the core tenets of the Nice Disappointment?

One of the most distinguished labor economists within the U.S., Autor has over the previous decade supplied a lot of the proof concerning the stagnation of American employees’ incomes, particularly for these with no school diploma.

The U.S. economic system, Autor wrote in a extremely influential paper in 2010, is bifurcating. Whilst demand for high-skilled employees rose, demand for “middle-wage, middle-skill white-collar and blue-collar jobs” was contracting. America’s economic system, which had as soon as supplied loads of middle-class jobs, was splitting right into a extremely prosperous skilled stratum and a big the rest that was turning into extra immiserated. The general final result, in keeping with Autor, was “falling actual earnings for noncollege employees” and “a pointy rise within the inequality of wages.”

Autor’s previous work on the falling wages of a significant phase of the American workforce makes it all of the extra notable that he now sounds much more optimistic. As a result of corporations had been desperately looking for employees on the tail-end of the pandemic, Autor argues in a working paper printed earlier this 12 months, low-wage employees discovered themselves in a a lot better bargaining place. There was a exceptional reversal in financial fortunes.

“Disproportionate wage development on the backside of the distribution diminished the faculty wage premium and reversed the rise in mixture wage inequality since 1980 by roughly one quarter,” Autor writes. The massive winners of current financial developments are exactly these teams that had been not noted in previous many years: “The rise in wages was significantly robust amongst employees below 40 years of age and with no school diploma.”

Even after accounting for inflation, Autor reveals, the underside quarter of American employees has seen a major increase in revenue for the primary time in years. The scholar who beforehand wrote in regards to the “polarization” within the U.S. workforce now concludes that the American economic system is experiencing an “sudden compression.” In different phrases, the wealth hole is narrowing with stunning velocity.

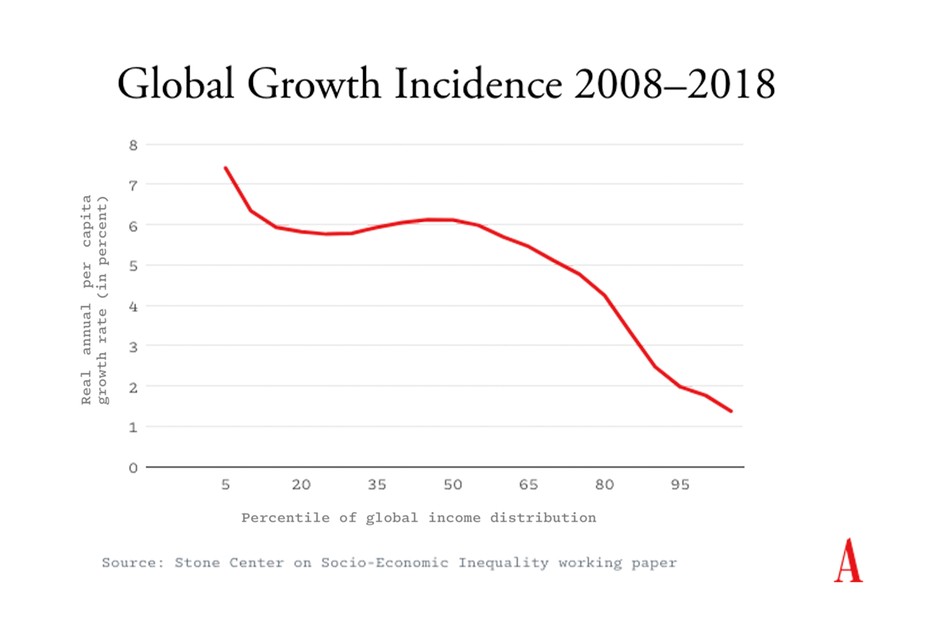

Autor just isn’t the one main economist who is asking into doubt the underpinnings of the Nice Disappointment. In line with Milanović, his “elephant curve” proved so influential partially as a result of it confirmed fears many individuals had in regards to the results of globalization. His well-known graph was, he now admits, an “empirical affirmation of what many thought.” He’s now not so certain about that piece of typical knowledge.

Just a few years in the past, Milanović got down to replace the unique elephant curve, which was based mostly on information from 1988 to 2008. The outcome got here as a shock—a optimistic one. As soon as Milanović included information for an additional decade, to 2018, the curve modified form. As a substitute of the attribute “rise, fall, rise once more” that had given the curve its viral title, its steadily falling gradient now appeared to color a simple and rather more optimistic image. Over the 4 many years he now surveyed, the incomes of the poorest folks on this planet rose very quick, these of individuals towards the center of the distribution pretty quick, and people of the richest relatively sluggishly. International financial circumstances had been enhancing for almost everybody, and, opposite to traditional knowledge, it was essentially the most needy, not essentially the most prosperous, who had been reaping the best rewards.

In a current article for Overseas Affairs, Milanović goes even additional. “We’re often instructed,” he writes, that “we dwell in an age of inequality.” However whenever you have a look at the latest international information, that seems to be false: In truth, “the world is rising extra equal than it has been for over 100 years.”

To this present day, Piketty stays the patron saint of the Nice Disappointment. No thinker is invoked extra typically to justify the speculation. However even Piketty’s pessimistic analysis, made a decade in the past, has come to look a lot much less dire.

Partly, it’s because Piketty’s work has are available for criticism from different economists. In line with one influential line of argument, Piketty mistook why returns on capital had been increased than returns to labor in lots of industrialized international locations within the many years after World Battle II. Absent concerted strain to forestall this, Piketty had argued, the character of capitalism would at all times favor billionaires and big companies over odd employees. However in keeping with Matthew Rognlie, an economist at Northwestern College, Piketty’s rationalization for why inequality elevated throughout that interval was based mostly on a misinterpretation of the info.

The outsize returns on capital in the course of the latter half of the Twentieth century, Rognlie argues, had been primarily as a result of enormous development in home costs in metropolitan facilities corresponding to Paris and New York. If returns on capital had been bigger than returns to labor over this era, the explanation was not a basic financial development however particular political elements, corresponding to restrictive constructing codes. As well as, the primary beneficiaries weren’t the billionaires and large companies on which Piketty targeted; relatively, they had been the sorts of upper-middle-class professionals who personal the majority of housing inventory in main cities.

Economists proceed to debate whether or not such criticisms hit the mark. However at the same time as Piketty defended his work, he himself began to strike a extra optimistic be aware in regards to the long-term construction of the economic system. In his 2022 e-book, A Transient Historical past of Equality, he talks in regards to the rise of inequality as an anomaly. “A minimum of for the reason that finish of the eighteenth century there was a historic motion in the direction of equality,” he writes. “The world of the 2020s, irrespective of how unjust it could appear, is extra egalitarian than that of 1950 or that of 1900, which had been themselves in lots of respects extra egalitarian than these of 1850 or 1780.”

Like Autor and Milanović, Piketty appears to have concluded that the thesis of the Nice Disappointment was, in key respects, improper.

It can be untimely to place worries about stagnating incomes or rising inequality to relaxation. The three former prophets of doom all emphasize the position that social and political elements play in shaping financial outcomes. Consequently, they see current wage development for poorer People as induced partially by the expansionary financial insurance policies that each Donald Trump and Joe Biden pursued in response to the pandemic.

Equally, the massive beneficial properties that a number of the poorest folks on this planet have made in current many years derive partially from their governments’ efforts to make use of industrial coverage to form the affect of globalization on their international locations. Whether or not, as Piketty has argued, the returns on capital will in the long term outstrip the returns to labor is determined by political choices about taxation and redistribution, in regards to the power of commerce unions and the principles governing labor markets.

Oren Cass: The labor-shortage fantasy

Latest excellent news about our financial prospects shouldn’t lead us to conclusions that might shortly develop into overexuberant. However we also needs to keep away from perpetuating an instinctive pessimism that appears much less and fewer warranted. Though pessimism could appear sensible or shrewd, cynicism about our collective capability to construct a greater world solely makes it tougher to win help for the type of financial insurance policies we have to create that future.

Progressives typically appear to imagine that they’ll mobilize folks by making the longer term look scary. However when voters really feel threatened, it’s often unscrupulous reactionaries who make unrealistic guarantees and scapegoat outsiders who profit. Wage stagnation and rising inequality are nonetheless actual risks about which we should stay vigilant—however the truth that a greater financial future has come to look a great deal extra achievable must be trigger for full-throated celebration.

Related Posts

- 8 High Tax-Saving Suggestions for Rising Markets

Begin Slideshow If there was one theme that dominated discussions about sensible portfolio administration in…

- 8 Prime Tax-Saving Suggestions for Rising Markets

Begin Slideshow If there was one theme that dominated discussions about sensible portfolio administration in…

- 2022 ExamOne Awards: Staff RISING UP

2022 Award Winners Lifetime Achievement Award: Betsy Sears Industrial Participant of the Yr: Brian Lanzrath…