Insurance

Software insurance coverage: every part you might want to know

In case your instruments and gear are important to maintain your enterprise working, then you may profit from instrument insurance coverage. Learn the way this coverage works

If your enterprise depends closely in your instruments and gear to get the job completed, then any loss or harm to those objects can show expensive. That’s why having the proper instrument insurance coverage is necessary in maintaining your operations working easily.

On this article, Insurance coverage Enterprise explains every part you might want to learn about any such protection. We’ll focus on how instrument insurance coverage works, what it covers, and the various factors you might want to think about earlier than taking out a coverage. Learn on and learn how instrument insurance coverage can defend your enterprise.

Software insurance coverage is a kind of coverage that pays out the restore and alternative prices if the instruments and gear that you simply use for your enterprise are stolen, broken, or vandalized. Additionally it is generally known as contractor’s instruments and gear insurance coverage or gear floater protection.

Instruments and gear protection is a type of inland marine insurance coverage, which covers items transported on land. Which means for the objects to be coated, you have to have the ability to transfer them from one place to a different.

Software insurance coverage sometimes covers gear value as much as $10,000, with these valued at greater than $5,000 requiring scheduling.

Most insurance policies cowl solely objects lower than 5 years previous, though some present precise worth protection for older instruments and gear.

Sure insurance policies additionally include provisions that compensate you for misplaced revenue and prices incurred as a result of challenge delay if these are attributable to a coated incident.

Instruments and gear insurance coverage shouldn’t be necessary, though companies might require you to have protection in place earlier than agreeing to work with you to guard their investments. You should purchase instrument insurance coverage as a standalone coverage or as a rider to your industrial property insurance coverage or enterprise proprietor’s coverage, which bundles property protection with normal legal responsibility insurance coverage.

At first look, instrument insurance coverage looks like a simple type of protection. Nevertheless, there are specific facets of this coverage that you might want to perceive that will help you get the proper protection for your enterprise. Listed below are a few of them:

Scheduled vs unscheduled objects

Whenever you buy a instrument insurance coverage coverage, you’ll be requested to supply an inventory of two teams of things. These are:

- Unscheduled objects: These are instruments and gear value lower than $5,000. They don’t should be individually listed in your coverage, however you have to to supply an combination worth for these things.

- Scheduled objects: These are high-value objects value greater than $5,000 which must be individually laid out in your coverage. Having extra scheduled objects listed additionally means you’ll be paying increased premiums.

Per-item vs per-occurrence restrict

Most insurance policies include a $10,000 coverage protection restrict. That is the utmost quantity your insurer pays for the yr. Software insurance coverage additionally has these kinds of protection limits:

- Per-item restrict: Normally pegged between $500 and $1,000, this is applicable to unscheduled objects in your coverage.

- Per-occurrence restrict: That is the utmost quantity your insurer pays for a single incident or “incidence” and covers each scheduled and unscheduled objects.

Precise worth vs alternative value

You should purchase contractor’s instruments and gear insurance coverage on an precise money worth or alternative value foundation.

Precise money worth instrument insurance coverage insurance policies pay for the truthful market worth of the merchandise on the time of the loss. This implies protection is the same as the value of the merchandise when it was bought minus depreciation.

Alternative worth insurance policies, however, pay out an quantity equal to how a lot it could take to interchange the misplaced or broken merchandise with a brand new one.

Precise money worth insurance policies are inexpensive than alternative worth plans. But when your enterprise owns a number of high-value instruments and gear which have skilled important depreciation up to now few years, it might be value paying the additional value.

Coinsurance

Most instruments and gear insurance policies include a coinsurance clause. This requires you to hold protection equal to a sure proportion of the whole worth of the objects you need coated. That is to make sure that you will have enough protection within the occasion you make a declare.

Coinsurance charges fluctuate relying on the insurer, however most insurance policies require you to insure your gear for 80% of its worth for it to be coated for its full worth. When you fail to take action, your insurer might impose a coinsurance penalty that places you on the hook for a portion of the fee. Some insurance coverage firms may waive the clause in case you take out protection on an precise money worth foundation.

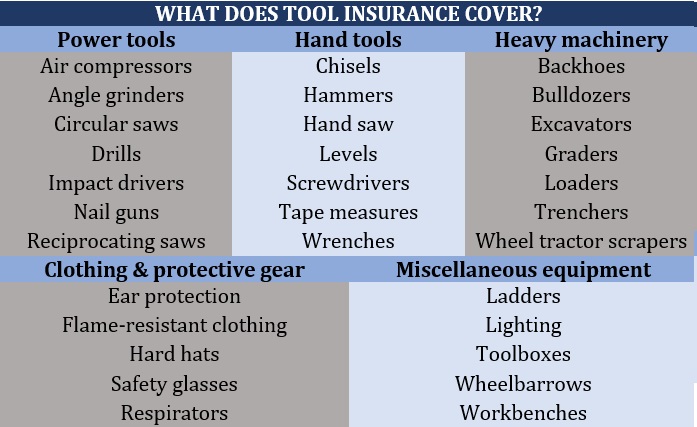

Software insurance coverage offers protection for a variety of instruments and gear that you simply use for your enterprise if the objects meet these three standards:

- They’re movable.

- They’re lower than 5 years previous.

- They’re value lower than $10,000.

The desk beneath lists the totally different objects sometimes coated by contractor’s instruments and gear insurance coverage.

Software insurance coverage is commonly written on an all-risks foundation. This implies it might cowl occasions not particularly listed in your coverage. A number of the incidents that the majority insurance policies cowl embody:

- Theft

- Hearth

- Flooding

- Unintended harm

- Vandalism

Some insurance policies present protection for the instruments and gear that you simply lease or lease. There are additionally insurance policies that pay out for misplaced revenue and extra prices incurred due to challenge delays.

Software insurance coverage, nonetheless, doesn’t cowl all incidents that trigger harm to your instruments and gear. Some exclusions are:

- Regular put on and tear

- Intentional loss

- Mechanical breakdown

- Stationary gear

Due to some related components and overlapping coverages, instrument insurance coverage is typically confused with different sorts of insurance policies. Instruments and gear protection is commonly mistaken for inland marine insurance coverage and gear breakdown insurance coverage.

Listed below are the important thing variations between these types of protection.

Instruments and gear insurance coverage vs inland marine insurance coverage

Inland marine insurance coverage is a broad type of protection designed to guard items whereas they’re being transported on land. It’s an offshoot of marine insurance coverage, which covers items being transported by ship.

Most inland marine insurance policies finish protection as soon as the objects have reached their vacation spot. That is the important thing distinction between such insurance policies and instruments and gear insurance coverage. Software insurance coverage constantly offers protection for objects as they’re transported between, used on, and stored at totally different job websites.

Instruments and gear insurance coverage vs gear breakdown insurance coverage

Contractor’s instruments and gear insurance coverage primarily works the identical approach as gear breakdown insurance coverage. Each present protection if sure gear is misplaced or broken as a result of a coated occasion. Each can be included in a enterprise proprietor’s coverage. The distinction lies in what the insurance policies cowl.

Software insurance coverage covers movable objects as they’re transported and used on totally different job websites. Tools breakdown insurance coverage, however, offers protection for stationary gear equivalent to boilers, laptop programs, turbines, HVAC programs, and different infrastructure-related equipment.

If you wish to delve deeper into the inclusions and exclusions beneath contractor’s instruments and gear insurance coverage, you may try our full information to what gear insurance coverage covers.

For insurance policies with a protection restrict of $10,000, instrument insurance coverage premiums sometimes vary between $175 and $450 per yr or about $15 to $38 month-to-month. These figures are primarily based on the varied insurer web sites Insurance coverage Enterprise checked out.

However as a result of every enterprise comes with various wants and publicity, the quantity you pay could also be considerably decrease or increased than the figures above. Listed below are a number of the components which have a serious influence on premium costs for instruments and gear insurance coverage:

- How a lot your instruments and gear are value

- How previous your instruments and gear are

- The way you retailer and preserve your instruments and gear

- The place your enterprise operates

- Your small business’ claims historical past

- The coverage’s protection limits

Any enterprise that depends on their instruments and gear to maintain their operations working can profit from instrument insurance coverage. This type of protection allows companies to renew work rapidly if a necessary instrument or gear is misplaced or broken. The desk beneath lists some sorts of companies that may profit from taking out a instruments and gear coverage.

The important thing to discovering the proper instrument insurance coverage insurance policies for your enterprise is to grasp its distinctive wants and circumstances. Listed below are a number of the components that you might want to think about when trying to find the instruments and gear protection that matches your enterprise.

- Degree of protection: Insurance coverage firms permit you to decide between precise money worth or alternative worth protection. Whereas the previous value much less, it might not present the extent of protection that you simply want, particularly if your enterprise operates high-value gear that has depreciated considerably up to now few years.

- Coverage restrict: The utmost restrict of your coverage ought to cowl the whole worth of your instruments and gear. Coinsurance charges apply, so make sure to make an correct evaluation of the worth of this stuff.

- Premiums: In each kind of insurance coverage coverage, all the time keep in mind that cheaper doesn’t essentially imply higher. A inexpensive coverage could also be good to your funds at first. However it might probably value you extra in the long term, particularly in case your plan doesn’t pay out an quantity enough to restore or substitute important gear.

- Deductible: A better deductible additionally means decrease premiums as a result of your insurer is taking up much less danger. However make sure to carry an quantity that you could afford to shell out if an surprising incident happens.

- Insurance coverage supplier: It helps to learn insurer evaluations to see how effectively an organization handles claims. You may also examine an insurer’s monetary rankings, which signifies their potential to pay claims, by way of the web sites of assorted rankings businesses and business associations.

A instruments and gear insurance coverage coverage may be quoted and issued on the identical day you probably have the next info prepared:

- An correct estimate of the worth of all instruments and gear value $5,000

- The make, mannequin, yr, serial quantity, and buy value of scheduled objects

Given the kind of protection it presents, instrument insurance coverage offers a comparatively cheap means of economic safety for companies and professionals closely reliant on their instruments to get their jobs completed.

Other than masking restore and alternative bills of instruments important for working your operations, some insurance policies compensate your enterprise for misplaced revenue and extra prices incurred due to the delay attributable to misplaced or broken gear.

Instruments and gear insurance coverage include protection limits, which hardly ever covers high-value, specialised objects. For the few insurance policies that present such protection, they won’t insure the total quantity, or they might include costly premiums. What makes instrument insurance coverage a worthwhile funding? If it offers satisfactory protection for the instruments and gear that hold your enterprise working.

Among the many industries that may profit from instruments and gear insurance coverage are the development and engineering sectors. Getting protection is simply one of many steps that firms have to take to maintain their companies protected.

Such insurance policies should even be paired with sound danger administration methods. You possibly can obtain this by frequently visiting and bookmarking our Building & Engineering Insurance coverage Information part, the place you could find breaking information and the newest business updates.

Is your enterprise eager on taking out instrument insurance coverage? We’d like to see why or why not within the feedback part beneath.

Sustain with the newest information and occasions

Be a part of our mailing record, it’s free!

Related Posts

- Inszone Insurance coverage buys Speck Insurance coverage and Monetary Companies

Earlier this month, Inszone Insurance coverage acquired a New Mexico-based insurance coverage company. Credit score:…

- ALKEME acquires Paul Kinan Insurance coverage, Wiggans Farha Insurance coverage

Paul Kinan Insurance coverage Group focuses on providing companies, households and people with property and…

- Evertree Insurance coverage Providers acquires Prosper Insurance coverage

The deal additionally permits Evertree to offer progressive insurance coverage options. Credit score: PanuShot/ shutterstock.com.…