A rich Senate Republican known as Wednesday for tightening the principles taxpayers use when figuring out whether or not revenue needs to be topic to the three.8% web funding revenue tax.

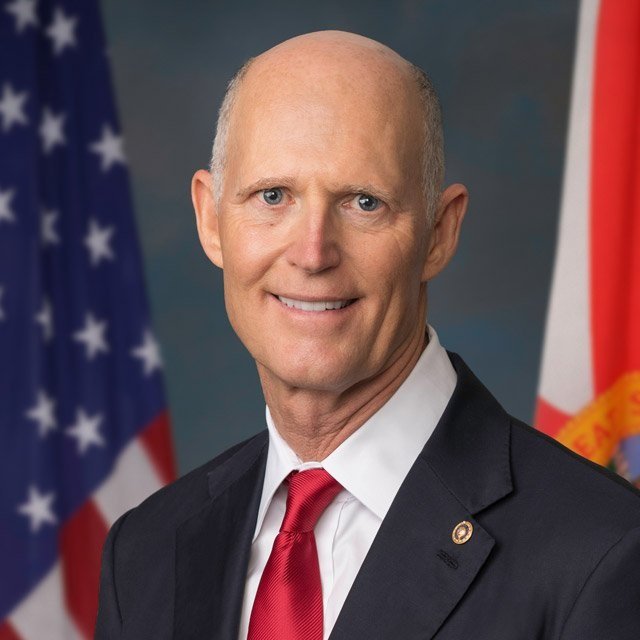

Sen. Rick Scott, R-Fla., talked concerning the NIIT, or Medicare tax, throughout a listening to the Senate Price range Committee held to debate concepts for elevating income for the Medicare program and growing its solvency.

Sen. Sheldon Whitehouse, D-R.I., the chairman of the committee, is making an attempt to spherical up help for S. 1174, a invoice that may enhance the online funding revenue tax price to five% for some high-income taxpayers, and broaden the bottom of that tax, by making use of the tax to earnings from lively S firms and the earnings of lively restricted companions.

Scott identified throughout the listening to that President Joe Biden and his spouse, Jill Biden, took some revenue from books and speeches out of their web funding revenue tax calculations by classifying the revenue as “S company” revenue, or revenue earned by an organization organized below subchapter S in chapter 1 of the Inner Income Code.

“That’s clearly one thing that must be mounted,” Scott mentioned. “As a result of it’s clearly unfair that individuals are doing that.”

What it means: Democrats and independents who caucus with them maintain 50 seats within the Senate and use votes from Vice President Kamala Harris to interrupt ties.

Republicans have 50 seats within the Senate.

If Scott is open to the thought of increasing the attain of the online funding revenue tax, that might enhance the percentages that lawmakers making an attempt to chop the federal finances deficit or fund new applications will counsel utilizing web funding revenue tax scope growth as a “pay for.”

Medicare solvency: Whitehouse held the listening to due to issues that the belief fund supporting the Medicare Half A hospitalization program will run dry in 2031.

If the belief fund empties, Congress takes no motion, and this system and the economic system carry out as authorities forecasters anticipate, Medicare would generate about sufficient income from present payroll tax income and premium funds to pay 89% of the anticipated claims.

Whitehouse mentioned that, as of early Wednesday, the federal authorities was nearing a potential shutdown as a result of “Home Republicans are as soon as once more making an attempt to make the tax system even much less honest, to present extra freebies to Huge Enterprise and billionaires.”

“Republicans over there wish to preserve the large exemption for inheritances to rich heirs,” Whitehouse added, referring to efforts to increase a provision within the Tax Cuts and Jobs Act of 2017 that doubled the property tax exemption. The availability was momentary and is about to expire in 2026.

Sen. Charles Grassley, R-Iowa, the highest-ranking Republican on the committee, rejected the concept Republicans are hostile to Medicare.

“All of us acknowledge that Medicare in addition to Social Safety are very a lot part of the social material of America,” Grassley mentioned. “They might be authorities applications, however additionally they work together with the non-public sector retirement and well being advantages as effectively, so it’s not one thing that simply authorities does.”

The web funding revenue tax: Tax guidelines let taxpayers classify sure sorts of revenue as wages and a few as enterprise revenue. That flexibility impacts all Medicare and Social Safety payroll tax payments.

When the Reasonably priced Care Act of 2010 added the online funding revenue tax, the pliability additionally affected the tax base for the NIIT.