Insurance

Rental enterprise insurance coverage: a complete information

Rental enterprise insurance coverage is a broad kind of protection for the objects you lease out. However which insurance policies do you want? Try this text to study extra

If you happen to personal a rental enterprise, then you know the way any loss or harm to the objects you lease out can impression your operations. To maintain your corporation operating easily when such incidents happen, you want a selected type of cowl known as rental enterprise insurance coverage.

However how does the sort of protection work? Insurance coverage Enterprise solutions this query and extra on this information. This text can provide you an thought about which insurance policies go well with your corporation and the way a lot that you must spend on each. Learn on and learn how rental enterprise insurance coverage can defend your corporation’ belongings and investments.

Rental enterprise insurance coverage is a broad kind of protection encompassing totally different insurance policies designed to guard – because the identify suggests – your rental enterprise. This type of insurance coverage works barely otherwise relying on the objects a enterprise rents out. However typically, it gives safety in opposition to the next:

- Loss or harm your shopper causes that they refuse to pay out

- Loss or harm occurring whereas the objects are being transported or saved in your premises

- Loss or harm your shopper suffers as a result of the objects are in poor situation

Rental enterprise insurance coverage additionally is available in totally different names relying on the character of the enterprise. It is usually known as tools rental insurance coverage for companies that lease out instruments and tools. These embody leisure gear, get together provides, development equipment, and audio and video recording tools.

Industrial fleets may also take out automobile rental insurance coverage. Property homeowners, in the meantime, want property rental insurance coverage, extra popularly often known as landlord insurance coverage.

Rental companies can entry a spread of insurance policies, with every offering various ranges of safety. Listed below are among the most important coverages to maintain your corporation protected:

1. Common legal responsibility insurance coverage

What you are promoting wants safety in conditions the place the objects you lease out or your day-to-day operations trigger loss or harm to your purchasers. That is the place common legal responsibility insurance coverage comes into play.

Additionally known as rental legal responsibility protection, it is likely one of the hottest types of rental enterprise insurance coverage due to the extent of safety it affords. The sort of coverage covers your corporation from lawsuits claiming bodily harm, property harm, or monetary losses ensuing out of your day by day operations.

Rental legal responsibility insurance coverage pays out the authorized and settlement prices you incur due to these claims. Some insurance policies additionally cowl medical bills for shopper accidents attributable to the objects you lease out or these sustained inside your corporation premises. That is no matter who’s at fault or whether or not your corporation has been sued.

You should purchase common legal responsibility insurance coverage as a standalone product or bundled with business property insurance coverage in a enterprise proprietor’s coverage (BOP). It’s not a authorized requirement on your rental enterprise to function, however given the advantages, it might be value contemplating.

Premiums for common legal responsibility insurance coverage fluctuate relying on a spread of things. If you wish to know how a lot common legal responsibility insurance coverage prices for various companies, our complete information can provide you an correct estimate.

2. Gear insurance coverage

Gear insurance coverage is designed to cowl the prices to restore and change instruments and tools that you just use for your corporation if these are misplaced, broken, or vandalized. These embody objects that you just lease out like:

- Sports activities tools and leisure gear

- Occasion and occasions provides

- Building instruments and tools

- TV and movie manufacturing tools

Gear insurance coverage additionally gives protection for harm attributable to your purchasers or weather-related incidents similar to storms, flooding, and hail. Some insurance policies even pay out for cleanup bills ensuing from a lined occasion.

Gear protection is a type of inland marine insurance coverage, which covers items transported over land. It’s possible you’ll select to take out the sort of coverage as an alternative, however keep in mind that this solely covers your rental tools whereas it’s being transported.

If you would like a extra in depth coverage that covers objects your purchasers use onsite or these in storage, it’s best to buy instruments and tools insurance coverage. You’ll be able to study extra about the sort of protection in our complete information to tools insurance coverage.

3. Industrial property insurance coverage

If your corporation operates from a bodily area similar to an workplace or constructing, one other vital kind of rental enterprise insurance coverage to have is business property protection. This coverage helps reduce the monetary impression of the harm to your bodily belongings attributable to man-made and pure calamities. It protects:

- The property or constructing your rental enterprise operates in

- Gear and objects that your corporation makes use of and rents out

- Stock of things that your corporation shops inside the property

Industrial property insurance coverage minimizes the disruption of unexpected disasters to your day by day operations by compensating you for the losses and damages. Some insurance policies additionally pay out part of misplaced revenue if the harm prevents your corporation from conducting its standard operations.

Many insurance policies, nevertheless, don’t present cowl for belongings with a novel set of dangers or these which are arduous to worth. These embody:

- Enterprise information

- Digital information

- Cash

- Securities

- Accounts

- Payments

- Paved surfaces like walkways and roads

Industrial property insurance coverage is just not necessary. Nonetheless, it’s usually required in business leasing preparations and mortgage purposes.

Industrial property protection is usually bundled with common legal responsibility insurance coverage in a enterprise proprietor’s coverage, nevertheless it can be bought as a separate coverage.

4. Employees’ compensation insurance coverage

Employees’ compensation insurance coverage is required for companies with a sure variety of staff in nearly all US states. It protects your rental enterprise from the monetary legal responsibility of getting to shoulder bills ensuing from work-related accidents and sicknesses.

Employees’ compensation covers the price of medical care and a portion of the misplaced revenue of staff who get sick or injured whereas doing their jobs. Insurance policies additionally pay out incapacity advantages for staff that suffer momentary or everlasting incapacity and loss of life advantages to the household of a deceased workers.

Since staff’ compensation insurance coverage is obligatory, getting caught with out one can have critical authorized and monetary ramifications. Penalties fluctuate by state.

In Florida, for example, in case your rental enterprise is discovered to be working with out protection, you’ll be issued a stop-work order. This requires you to close down operations till you should buy insurance coverage and pay a fantastic. The penalty is the same as twice the quantity the employer would have paid in annual premiums for the interval they had been with out protection. You’ll find out extra about staff’ compensation guidelines in Florida on this information.

5. Extra legal responsibility insurance coverage

Extra legal responsibility insurance coverage is an efficient complement to your legal responsibility insurance coverage protection. It protects your rental enterprise from catastrophic claims and losses that exceed your protection limits. That is particularly helpful in the event you’re a small enterprise proprietor and wish to cut back the chance of a catastrophe or lawsuit inflicting your organization to go bankrupt.

Extra legal responsibility protection can also be known as business umbrella legal responsibility insurance coverage. Though not necessary, some companies make it a situation for leasing preparations or shopper contracts.

Listed below are the opposite varieties of rental enterprise insurance coverage insurance policies fitted to extra specialised operations:

Industrial fleet insurance coverage

If you happen to function a automobile rental firm with a number of automobiles and drivers, you might be required to take out business fleet insurance coverage. It gives the identical safety as non-public auto insurance coverage, however primarily covers business automobiles and firm automobiles.

Due to heightened dangers related to business-use automobiles, business fleet insurance coverage premiums typically price greater in comparison with these for private automobile insurance policies.

Rental property insurance coverage

Rental property insurance coverage, generally known as landlord insurance coverage, capabilities identical to an ordinary owners’ insurance coverage coverage with a number of key variations:

- Landlord insurance coverage gives protection to properties rented out to tenants, to not owner-occupied properties, which owners’ insurance policies cowl.

- Rental property insurance coverage has greater legal responsibility limits as homeowners face extra dangers than those that occupy their very own properties.

- Landlord insurance coverage pays out for misplaced revenue, which owners’ insurance coverage doesn’t.

Opposite to widespread perception, rental property insurance coverage doesn’t cowl the tenants’ belongings. These are protected underneath a special type of coverage known as renters’ insurance coverage. If you happen to lease out your property, it’s best to require your tenants to take out this type of protection. This manner, their possessions will likely be lined in case of loss or harm. It additionally prevents the monetary ramifications from bouncing again to you.

Enterprise proprietor’s coverage

Enterprise proprietor’s coverage (BOP) is a type of small enterprise insurance coverage that mixes common legal responsibility insurance coverage and business property protection. Some insurance policies additionally embody enterprise interruption insurance coverage. This coverage compensates you for the losses your rental enterprise suffers as a result of disruption of your operations.

BOPs, nevertheless, can solely be accessed by companies with fewer than 100 staff and beneath $1 million in income. Startups and small enterprises have distinctive wants that require sure varieties of safety. Discover out which insurance policies suit your wants on this complete information to small enterprise insurance coverage.

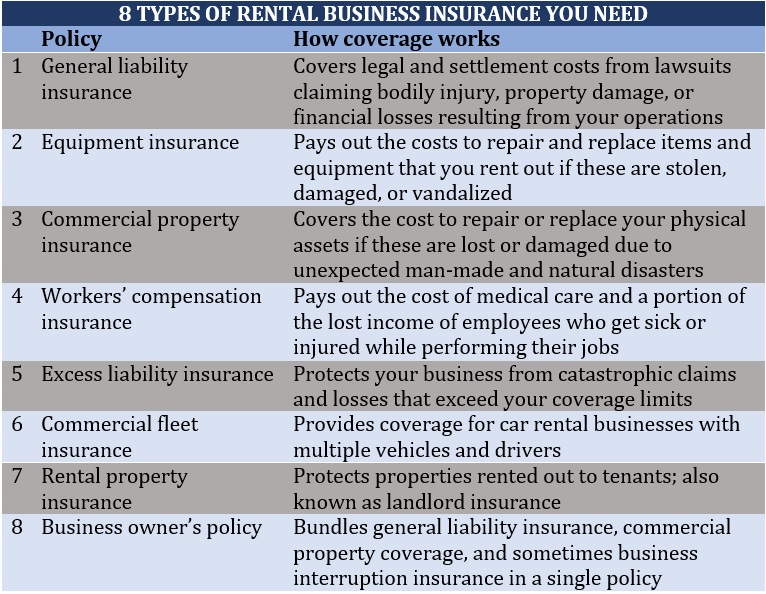

Right here’s a abstract of the varieties of rental enterprise insurance coverage insurance policies you should buy:

How a lot does rental enterprise insurance coverage price?

Right here’s a breakdown of how a lot common premiums price for the various kinds of rental enterprise insurance coverage. The information comes from the varied worth comparability and insurer web sites Insurance coverage Enterprise checked out.

Rental enterprise insurance coverage price – breakdown by coverage

|

HOW MUCH DOES RENTAL BUSINESS INSURANCE COST?

|

||

|---|---|---|

|

Sort of coverage

|

Common month-to-month premiums

|

Common annual premiums

|

|

Common legal responsibility insurance coverage

|

$40 to $55

|

$480 to $660

|

|

Gear insurance coverage

($10,000 protection restrict)

|

$15 to $38

|

$175 to $450

|

|

Industrial property insurance coverage

|

$65 to $70

|

$780 to $840

|

|

Employees’ compensation insurance coverage

(Small enterprise with 3 to five workers)

|

$30 to $60

|

$360 to $720

|

|

Extra legal responsibility insurance coverage

($1 million umbrella protection)

|

$60 to $75

|

$720 to $900

|

|

Industrial fleet insurance coverage

|

About $150

|

About $1,800

|

|

Rental property insurance coverage

|

$65 to $70

|

$780 to $840

|

|

Enterprise proprietor’s coverage

(Common legal responsibility + business property)

|

$55 to $65

|

$660 to $780

|

If you have already got current insurance policies and observed that your premiums are considerably decrease or greater than these figures, it’s as a result of these are simply estimates. There are a selection of things that may drive up or push down your rental enterprise insurance coverage prices, together with:

- The kind of tools or property you lease out

- The variety of years you’ve been in enterprise

- What you are promoting’ claims historical past

- Your annual income

- Your coverage’s protection limits

Totally different enterprise entities require various kinds of protection. If you happen to’re working a restricted legal responsibility firm, you’ll be able to study extra in regards to the totally different insurance policies that may defend your corporation on this information to legal responsibility insurance coverage for LLC.

Rental companies function in a extremely aggressive market. The important thing to protecting your corporation operating easily is having correct protection. With the myriad of rental enterprise insurance coverage insurance policies out there, it may be difficult to seek out the suitable insurance coverage on your wants. That’s why it’s essential that you just perceive the distinctive dangers that your corporation faces. An skilled insurance coverage agent or dealer may also make it easier to make an knowledgeable determination on the varieties of protection to take.

Enterprise insurance coverage is available in many kinds, catering to totally different enterprises. Rental enterprise insurance coverage is only one of them. You’ll be able to study extra about how enterprise insurance coverage works on this complete information.

Do you assume rental enterprise insurance coverage is a worthwhile funding? Can your corporation survive with out it? Share your ideas within the feedback part beneath.

Sustain with the newest information and occasions

Be a part of our mailing record, it’s free!

Related Posts

- Insurance coverage Information: Workforce wellness and inclusion | Insurance coverage Weblog

I'm delighted that my colleague Tony Steadman joined me to debate the most recent trade…

- Insurance coverage Information: Cultivating a sustainable future | Insurance coverage Weblog

As Earth Day approaches, the world is reminded of our shared environmental, social, and governance…

- Insurance coverage Information: Growing threat, inflation, and regulation | Insurance coverage Weblog

As adjustments in threat and macroeconomics—particularly inflation—proceed to affect insurance coverage business dynamics, regulators stay…