Insurance

Property insurance coverage’s secret sauce for profitability: information & analytics

Printed on

Do you could have a favourite sauce? Certainly one of mine is a candy chili sauce that I exploit on salmon, cucumber salad, and different recipes. Most everybody has a favourite sauce or a dip, with just a few hundred varieties to select from. It’s possible you’ll like a selected marinara, tzatziki, or tahini. It’s possible you’ll fancy a chutney, wasabi, soy, or sriracha. Whether or not you want béchamel, béarnaise, or barbecue, there’s undoubtedly some type of sauce that you just periodically simply crave.

The unusual factor about sauces, although, is that they’re meals, however they aren’t a meal. They aren’t soup. They aren’t interesting on their very own. They’re merely meant to be “meals help.” They complement and improve. Sauces aren’t the factor. They get added to the factor to make it higher. Every part tastes a bit higher with the correct of sauce.

It’s the similar with information. Information isn’t the factor. It’s essential and may make or break your insurance coverage operation. However information is a key supporting participant, an integral a part of the merchandise, providers, and experiences it enhances.

Information is the lifeblood of insurance coverage and the important thing to unlocking the ability and potential in a lot of what insurers do. Information is the important thing to underwriting established merchandise correctly. It’s the important thing to creating new merchandise based mostly on new markets and newly accessible information sources. It’s the important thing to profitable the revenue sport. It’s the important thing to establish fraud. There may be virtually nowhere in insurance coverage that received’t enhance if you know the way to use information in the proper method. In insurance coverage, the whole lot goes higher with information.

The issue is that many insurers are having bother getting the sauce out of the kitchen. They’ve a few of the proper components. They’ve some inspiration. They’ve just a few recipes of their field. However, they’re stymied on tips on how to make one thing magnificent out of the bits and items that appear like they may go nicely collectively.

It was, with information, the time it took to determine it out didn’t matter a lot. Insurers may take their time, create their fashions, and run some numbers. Insurers may spend years and years turning information into growth, however that’s not doable in the present day. Property insurers, particularly, are in a spot the place they MUST get their information and analytics working for them rapidly, or it received’t be working in any respect.

The true reply within the information sport is to determine the place the info could also be utilized, the place it is going to have probably the most influence, and do the most effective. Majesco, in actual fact, has already achieved this evaluation many occasions over and is utilizing these insights in our options for the business. Now we have discovered, time and time once more, that the alternatives for insurers are discovered within the gaps between what is predicted by clients and what’s presently in vogue for insurers. When insurers catch as much as clients, they fill the gaps, and on this case, that implies that insurers might be utilizing information and analytics in a approach in that can positively influence each their clients and their inner operations. In the event you’d like to know these gaps in larger element, you need to learn Majesco’s latest survey report, Bridging the Buyer Expectation Hole: Property Insurance coverage.

Why rush the info and analytics recipe?

The state of the property insurance coverage enterprise is more and more difficult. It wants a change of operations and expertise that makes use of information intelligently to stay viable and worthwhile. 2022’s pure disasters had a huge effect on the business. However 2023 is worse. In keeping with the latest NOAA report, the US skilled 23 separate billion-dollar climate and local weather disasters within the first 8 months of 2023 – the most important quantity since information started and already surpassing the earlier report of twenty-two occasions in 2020. And this was earlier than the latest hurricanes and with 4 months to go in 2023.

The rising variety of excessive climate occasions and pure disasters has had a considerable impact on individuals and companies. With rising property costs, supplies, and restore prices, many insureds lack adequate insurance coverage protection, leading to a spot and elevated monetary threat.

The influence of that is that property disaster reinsurance charges are rising. The January 2023 renewals mirrored 20-year highs, persevering with a trajectory that started in catastrophe-exposed property versus non-catastrophe uncovered property, resulting in broad worth variations. Demand for protection has grown as pure disasters proceed to influence clients and insurers alike. However different components akin to inflation, provide chain challenges, dramatic property worth will increase, and monetary market losses are driving the business additional into a tough market. This development is solidified by the American Property and Casualty Insurance coverage Affiliation noting in a 2023 report, that the mixture of historic excessive inflation and the rising frequency of pure catastrophes has created the toughest market in a era for property insurance coverage.[1] We will seemingly count on excessive charges once more for 2024 renewals given what has occurred this yr.

What’s the answer?

Insurance coverage losses are leading to greater premiums for patrons, greater premiums for reinsurance for insurers, and a refocus on the underwriting self-discipline, new merchandise, and value-added providers that concentrate on threat resiliency with prevention and mitigation.[2]

So, the place can any insurer discover alternative within the mild of an surroundings that begs for adaptation and innovation?

Properly, there’s information. Industrial property buildings, for instance, are more and more turning into “sensible” and delivering huge quantities of information via real-time related gadgets built-in with Constructing Administration Techniques (BMS) that can be utilized to observe, predict, and stop loss. Along with defending the constructing surroundings from dangers akin to water leaks, fireplace, or equipment put on, sensors can assess exterior dangers akin to climate, to supply a 360-degree view of threat in real-time.

And there’s loss management – both with adjusters or utilizing digital capabilities like video and self-surveys to seize photos, information, and different details about properties – each industrial and private after which assess that information for threat.

Each of those are a possibility, and due to the proliferation of sensor and sensible applied sciences, digital loss management capabilities like Majesco Loss Management, to not point out the brand new applied sciences akin to ChatGPT and actionable AI, there are numerous extra alternatives similar to it.

The adage of “management what you may management” is now entrance and heart for insurers as they take a look at new threat administration methods as an important element of their buyer technique and their property strains of enterprise. Insurers should more and more focus their time and sources on how they will higher assess threat for a broader set of properties and stop losses to enhance underwriting profitability and buyer experiences. The answer will contain information, superior analytics, and different instruments that harness information’s energy, however the answer will solely be viable for insurers who’re keen to catch up, proper now. Information will stretch insurers and their capabilities, however it is going to stretch them in the proper path, making ready them for a way more environment friendly and worthwhile future.

Information & Analytics for Property Pricing and Underwriting

P&C underwriting is on the coronary heart of the insurance coverage enterprise. From evaluating particular person dangers and the exposures in a whole portfolio to assessing the chance, threat urge for food, and in the end profitability, underwriting is more and more essential within the face of quickly altering threat components. On the core of underwriting is information.

Insurance coverage has at all times been a data-driven enterprise, however entry to new information sources for properties and the usage of AI/ML is redefining and revolutionizing the business. Threat administration, underwriting, and loss management all contain gathering and utilizing information wanted for AI/ML fashions to precisely assess and establish threat, and handle and cut back dangers.

Majesco has the business’s most in depth repository of property loss management survey information, encompassing over 2 billion observational information factors from 16+ million meticulously accomplished property surveys performed by educated threat engineers within the discipline. These surveys, rigorously quality-assured, embody a staggering 200+ million tagged images, offering the best basis for harnessing the potential of AI/ML. Now we have used this information to develop our Property Intelligence AI/ML mannequin to assist assess particular property information utilizing this repository of information. Utilizing this information and our mannequin, insurers can personalize the pricing and underwriting for the shopper’s particular threat.

Industrial Property SMB – Insurer Gaps in Information Use and Curiosity

Bear in mind when insurance coverage’s excuse for not utilizing information was that clients didn’t need to quit their key bits of related information, even when it meant that it might save them cash? Who might need guessed that the problem has flipped and that now it might be that insurers may lose enterprise as a result of clients are keen to share the info and insurers aren’t able to make a buyer’s information work for them.

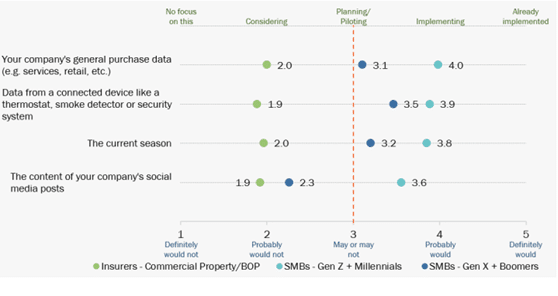

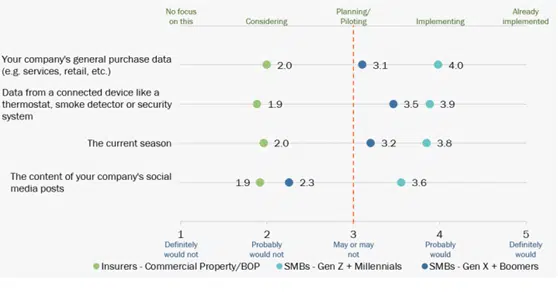

In keeping with Majesco surveys, the outdated excuse evaporated within the industrial market. Overwhelmingly, SMBs are keen to share information with insurers to cost and underwrite their industrial property insurance coverage at practically double the speed that insurers are presently utilizing this information, as mirrored in Determine 1. Curiously, each generational teams agree, aside from social media content material, the place the older era aligns with insurers.

Determine 1: Buyer-Insurer gaps in new information sources and applied sciences for industrial property insurance coverage pricing and underwriting

The expansion of IoT gadgets and sensors all through houses and companies is accelerating. Along with sensors (temperature, water, infrared, sound, and so on.), we’re witnessing super progress in video surveillance (with cell capabilities), significantly given the rise in crime resulting from societal threat.

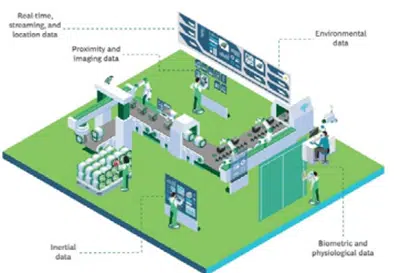

In keeping with a BCG article, in 2020 there have been 30 billion related gadgets on this planet, which is predicted to extend by over 30%, to 41 billion gadgets by 2024.[3] Immediately’s IoT gadgets embedded in gear and infrastructure for industrial companies produce over 14 zettabytes of information, with numerical or visible info on individuals, issues, and environmental components, as mirrored in Determine 2. The breadth of this information gives the chance to make use of it in real-time, slightly than depend on historic information for threat evaluation and underwriting, whereas additionally offering new information that offers extra perception into the chance.

Determine 2: Forms of information generated by industrial IoT gadgets

In actual fact, companies are profiting from IoT-based applied sciences to streamline processes, improve effectivity and security, and supply safety. It’s estimated that almost 34% of North American and European companies use IoT gadgets, with one other 12% planning to combine IoT throughout the subsequent yr.[4]

Insurers’ skill to create buyer worth from the IoT will rely on their willingness to dive in and begin experimenting with IoT expertise and information in the present day. Leaders are doing this and can outpace those that observe, placing them susceptible to maintaining their clients. Insurers that want to stay viable, should catch up of their use of information within the industrial market.

Private Property Client – Insurer Gaps in Information Use and Curiosity

Just like SMBs, customers are overwhelmingly fascinated about utilizing their information for pricing and underwriting of their property insurance coverage as mirrored in Determine 3. In actual fact, they’re as much as 2 occasions extra than insurers, reflecting a big buyer expectation hole.

Determine 3: Buyer-Insurer gaps in new information sources and applied sciences for private property insurance coverage pricing and underwriting

In keeping with CoreLogic’s Residential Price Handbook, practically 64% of householders don’t have sufficient insurance coverage protection and are underinsured by a median of 27%.[5]

This isn’t stunning, given the rise in property values. In November 2021, it was reported that the median worth of single-family present houses rose in 99% of the 183 markets tracked by the Nationwide Affiliation of Realtors within the third quarter, with double-digit worth will increase seen in 78% of the markets.[6]During the last couple of years, costs have risen from 15% to over 30% on common, with some markets even greater. Think about doing a digital loss management survey through self-survey or video in your complete ebook of enterprise to raised assess every property threat, but in addition to raised assess reinsurance wants. Majesco has clients who’re doing simply that with nice success.

Including gasoline to the change, it’s anticipated that sensible residence gadgets will proceed to be a significant space for IoT, with over 800 million sensible residence gadgets shipped in 2020 and predicted to exceed 1.4 billion by 2025. It’s estimated that 41.9% of US households owned a wise residence system in 2021, which can rise to just about 50% by 2025. The result’s the variety of sensible residence gadgets bought will exceed 1.94 billion by 2023.[7]

This progress in adoption gives insurers a big alternative to satisfy buyer expectations by capturing and utilizing the info for customized threat assessments and underwriting. With the elevated valuations and the expansion of the adoption of sensible residence gadgets, clients are more and more fascinated about customized pricing and underwriting based mostly on their very own location and property particulars. Insurers should start to handle this want and expectation to amass and retain clients. Buyer loyalty is in jeopardy as soon as customized pricing takes over the market. Solely insurers which are assembly expectations can count on to hold on to and broaden their enterprise and portfolio of shoppers.

However greater than that, solely insurers who really perceive their enterprise, utilizing information as their information, will know which enterprise they need and which they don’t need. The information-smart insurer will profit from the data-vetted portfolio.

Majesco is, proper now, serving to insurers to transition their operations to catch up within the information sport. These firms are making ready to make the most of market-leading information and analytic applied sciences for P&C insurance coverage. They’re making higher selections utilizing information and analytics and are proving how the whole lot within the insurance coverage operation goes higher with information. Majesco’s Clever Core for P&C, Loss Management, and Property Intelligence is at the vanguard of what main insurance coverage operations want now, and within the very close to future.

“The necessity for fast product innovation, environment friendly operations, and strong digital capabilities is driving the necessity for core methods wealthy with APIs and accessible information. Majesco gives a P&C Coverage answer with an open structure and self-service configuration instruments that allow insurance coverage carriers to deploy the capabilities wanted to achieve this new period of insurance coverage. Majesco’s sizable buyer base and continued momentum available in the market qualifies them as a Dominant Supplier within the P&C core methods house.” — Martina Conlon, Head of Property and Casualty Insurance coverage at Datos Insights.

Do you perceive what it means to have an Clever Core and superior information and analytics working your corporation? Try Majesco’s newest webinar, The Daybreak of Clever Core Insurance coverage Software program, for a peek at how information and AI/ML, working collectively, will rewrite the foundations of P&C insurance coverage.

[1] Sams, Jim, “APCIA Says Property Insurance coverage Market ‘Hardest in a Technology’,” Claims Journal, March 28, 2023, https://www.claimsjournal.com/information/nationwide/2023/03/28/316110.htm

[2] “Information + Statistics: Householders and renters insurance coverage,” Insurance coverage Info Institute, https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

[3] Taglioni, Giambattista, et al., “The Energy of the Web of Issues in Industrial Insurance coverage,” BCG, October 4, 2021, https://www.bcg.com/publications/2021/commercial-insurance-should-start-testing-the-power-of-the-internet-of-things

[4] Vailshery, Lionel Sujay, Web of Issues (IoT) within the U.S. – statistics & info, Statista, October 27, 2022, https://www.statista.com/subjects/5236/internet-of-things-iot-in-the-us/

[5] “Report: How Many US Houses Are Underinsured?” Kin, April 12, 2021, https://www.kin.com/weblog/underinsurance-report/

[6] “Residence Costs Spiked In Almost All Metro Areas In 3Q 2021,” Nationwide Mortgage Skilled, November 12, 2021, https://nationalmortgageprofessional.com/information/home-prices-spiked-nearly-all-metro-areas-3q-2021

[7] Cook dinner, Sam, “60+ IoT statistics and info.” Comparitech, December 13, 2022, https://www.comparitech.com/internet-providers/iot-statistics/

Related Posts

- Amwins launches information and analytics portfolio

Amwins launches information and analytics portfolio | Insurance coverage Enterprise America Insurance coverage Information Amwins…

- Insurance coverage Information: Cultivating a sustainable future | Insurance coverage Weblog

As Earth Day approaches, the world is reminded of our shared environmental, social, and governance…

- Insurance coverage Information: Workforce wellness and inclusion | Insurance coverage Weblog

I'm delighted that my colleague Tony Steadman joined me to debate the most recent trade…