Insurance

P&C Danger, Knowledge and Underwriting: The Crush That’s Driving Higher Know-how

Choose your stress. In case your group needed to have a ache level, would you fairly have…

- Increased than regular common declare prices attributable to inflation and provide chain challenges?

- Rising expense construction attributable to rising expertise and core working system prices?

- Larger danger and underwriting losses as a direct results of unpredictable climate?

- Lack of information insights to enhance A. B. or C.?

Sadly for right this moment’s P&C insurers, the enterprise local weather has been chosen for them.

E. The entire Above

P&C insurers are in an awfully tight spot. Title a stress and it’s taking place proper now to them. It could be short-term. It is probably not as unhealthy because it has ever been. However, it’s difficult sufficient that insurers should take steps to alleviate their pains and pressures and create alternatives.

In response to A.M. Greatest’s Q1-2023 report, the P&C mixed ratio worsened by 6.1 share factors to 102.0 in Q123 (when in comparison with the prior 12 months’s quarter.)[i] In 2022, The US property-casualty insurance coverage market skilled a $26.5 billion internet underwriting loss, a decline of $21.5 billion from the prior 12 months’s underwriting loss, based on A.M. Greatest.

Whereas environmental climate and pure disasters equivalent to wildfires, hurricanes, or different catastrophic occasions, are prime of thoughts, there’s a rising set of recent dangers together with societal and technological. And most not too long ago we’ve as soon as once more seen the affect of monetary danger with the current failure of Silicon Valley Financial institution and the continuing fallout. As famous in an article in Insurance coverage Journal, the failure was an absence of efficient danger administration.

All of those developments point out P&C insurers should rethink danger administration methods from merchandise and pricing to claims and prevention. As an alternative of taking part in protection, insurers should go on offense. However that requires a distinct operational and expertise technique and strategy.

At a current Majesco and Capgemini roundtable, business specialists mentioned the altering danger setting and which adjustments insurers could make to show E. The entire Above into Not one of the Above. You possibly can learn extra about this in our standpoint report, The Altering World of Danger: Insurers and Brokers on the Heart of Danger. In right this moment’s weblog, we glance particularly at pressures that may be mitigated by improved applied sciences.

A correct evaluation of danger contains…

Prior to now, we could have checked out a particular coverage danger for solutions to loss likelihood and profitability. Immediately’s danger requires a wider lens, together with:

- How a coverage danger impacts the general portfolio danger (and portfolio profitability).

- What different layers of danger needs to be thought of together with environmental, societal, and technological dangers?

- How can loss management be used to evaluate each danger cost-effectively to handle the portfolio, reinsurance wants, and assist clients mitigate danger?

- How does personalised knowledge shift underwriting and danger?

- How do insurers higher perceive new dangers?

Digital Automobiles (EVs) make a great case examine for a broad strategy to understanding danger.

- As EV utilization grows, we are actually seeing the affect on claims attributable to accidents. We now have a number of incidents involving EV fires. Responders don’t essentially know methods to put these fires out. There have been cases of automotive doorways being “too digital” to open. When batteries are punctured, new dangers seem.

- Restore prices of EVs are costly. One instance is Rivian R1T pickup truck, which was rear-ended by a Lexus in February 2023 at a stoplight in Columbus, Ohio. The harm was initially deemed comparatively minor, and the opposite driver’s insurer supplied him $1,600. The precise value to repair the bumper at a enterprise licensed to restore Rivian automobiles — one in all simply three in Ohio — was $42,000, roughly half the truck’s promoting worth[DG1] .

- Due to the complexities of EVs, many are totaled as a result of substitute of the battery is troublesome or not possible to do, growing the chance and value.

- Legal responsibility isn’t simple to kind out, particularly when the “driver” is probably not driving. Wouldn’t it be the proprietor? The auto producer? For insurers, it turns into making an attempt to resolve a Rubik’s dice of understanding all the chances and dimensions of danger.

Residence and Enterprise sensible property programs have some related points, solely in some cases, new applied sciences could also be offering new protections.

- The sensible dwelling has the flexibility to maintain observe of dangers inside water provide, drainage, safety, and electrical programs.

- As sensible dwelling/sensible enterprise networks develop more and more tied to electrical programs, some programs could also be discovered to be outdated and overly-taxed — dangerous to policyholders and insurers.

- Are insurers ready to seize and assess the proper varieties of information that can defend policyholders, forestall fires, water harm, and theft, and in addition cut back claims?

- Are insurers actively utilizing AI and knowledge personalization to speak shortly about coming dangers, equivalent to hail, fires, and storms?

The excellent news is that for essentially the most half, change and danger are accelerating change with insurers to adapt extra shortly operationally. It is likely to be fearful in tempo, however definitely not within the alternative and outcomes that create new worth and advantages clients can anticipate:

- Larger protection — extra individuals and extra companies could discover themselves coated by extra related or newer choices and fewer steps to utilization, together with embedded protection, lowering the insurance coverage protection hole.

- Larger predictive safety — insurance coverage could enhance underwriting profitability, cut back its prices and clients’ prices by a dramatic uptick in loss management data-driven danger assessments for underwriting that additionally gives perception and suggestions for danger avoidance or mitigation by proactive options.

- Larger effectivity and effectiveness — insurers are proper now grappling with operational challenges together with expertise shortages and tech debt that can give them the “excuse” to revamp their working fashions and introduce higher options and ecosystems to enhance operational outcomes.

- Larger resiliency — a rapidly-growing set of dangers is prone to spark off two ancillary developments: new product improvement and higher danger data and response.

Mitigated danger is an improved expertise

Buyer expectations are yet one more very important stress level for insurers. These expectations are linked to the entire different pressures (e.g. — prevention improves buyer satisfaction AND earnings) however they deserve their very own consideration. Clients live totally different existence and exhibit much more sturdy digital proficiency. They demand totally different experiences, they usually have totally different expectations about worth. In response to a current AM Greatest innovation evaluation report, “the rise of digital platforms and ecosystems will make relationships with clients much more necessary.”

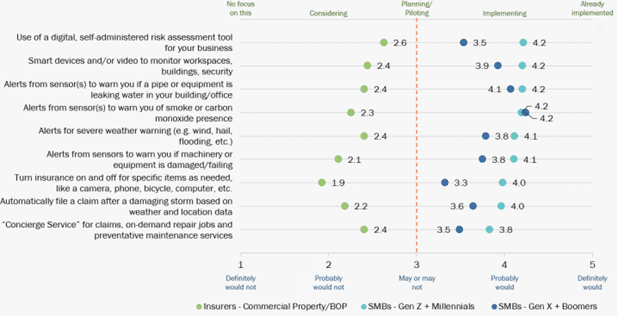

These altering expectations and wishes are making a disconnect between what they need and what insurers supply. The disconnect contains buyer altering priorities and merchandise wanted, demand for danger mitigation and avoidance, personalised pricing and score primarily based on their particular danger profile and a necessity for value-added providers that stretch buyer worth and loyalty as seen in Determine 1.

Determine 1

The gaps between buyer expectations and what insurers are providing are practically twofold for each generational teams of SMBs and related for shoppers, primarily based on Majesco analysis! Clients need and anticipate extra. To satisfy the elevated expectations, we have to determine priorities that can bridge the hole for insurers equivalent to digitalization, knowledge, and danger resilience — new methods of coping with each the brand new buyer and the brand new dangers we’re seeing in right this moment’s period.

Clients need personalised underwriting primarily based on their particular knowledge or steady evaluation of danger. The standard danger fashions or once-per-year, conventional strategy doesn’t work for the brand new dangers which are offered. Knowledge and analytics and the way it impacts our danger perspective on a micro stage are extra consumable in methods that don’t pressure our expertise and our underwriting groups.

For this reason there’s elevated curiosity in usage-based or telematics-based insurance coverage. In right this moment’s macroeconomic setting, clients are attempting to handle their prices, together with insurance coverage premiums, therefore the elevated demand for telematics-based insurance coverage.

An amazing instance of the worth is within the current earnings name from Progressive Insurance coverage Group and a view from Mike Zaremski, Sr. P&C insurance coverage fairness analysis analyst, and MD at BMO Capital Markets:

“Progressive is constructing upon its materials first-mover aggressive telematics benefit by providing a brand new crash-detection/security service to its clients. We estimate PGR’s aggressive benefit in telematics can also be structural in that buyer adoption charges of telematics-based insurance policies through D-2-C distribution are multiples increased than through a dealer, that means PGR is constructing upon its aggressive benefit vs. its common peer every day (be aware, most of its friends distribute through insurance coverage brokers).”

Worth-added providers contribute to danger resilience

We live in a world that has growing danger. Insurance coverage can not be about simply underwriting after which ready for the declare to occur, however insurance coverage additionally should assist keep away from or decrease the chance, creating higher buyer worth.

Whereas most insurers are targeted on how they will higher assess danger, many extra are increasing to additionally deal with the prevention of losses and creating danger resilience for purchasers. The adage of “management what you possibly can management” is now entrance and heart for insurers as they have a look at new danger administration methods as a vital part of their underwriting and customer support technique.

Main insurers are leveraging expertise equivalent to IoT gadgets, sensible watches, loss management assessments, and value-added providers to not solely assess and monitor danger however to proactively reply to it with mitigation providers and actions. From concierge providers to monitoring water hazards and the security of workers, to serving to to stay wholesome existence, main insurers are shifting to danger resilience methods that not solely drive higher enterprise outcomes but additionally produce nice buyer loyalty.

This creates danger resilience.

New applied sciences, paired with knowledge & analytics

One of many essential areas for insurers to fulfill the altering world of danger is with expertise and knowledge and analytics. They need to create a brand new basis that permits operational optimization and innovation by the substitute of legacy programs, adoption of recent applied sciences, and embracing the strategic function of information and analytics.

Know-how is the essential basis to adapt, innovate and ship at pace to execute on technique and market shifts. The rising significance and adoption of platform applied sciences, APIs, microservices, digital capabilities, new/non-traditional knowledge sources, and superior analytics capabilities – together with generative AI — are actually essential to progress, profitability, buyer engagement, channel attain, and workforce change.

From the entrance workplace to the again workplace, SaaS platforms are reshaping the enterprise focus from coverage to buyer, from course of to expertise, from static to dynamic pricing, from point-in-time underwriting to steady underwriting, from a historic view of information to predictive and prescriptive knowledge, from conventional merchandise to new, modern merchandise, and a lot extra. Insurers’ potential to create an interconnected tech basis will ship each progress and buyer relationship alternatives.

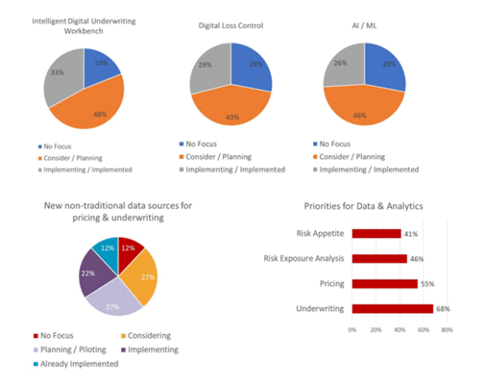

Superior analytics capabilities are poised to be a game-changer for insurance coverage. When new and real-time knowledge, superior analytics, AI and machine studying, and generative AI are successfully embedded into the operation and core programs, insurers can have a major operational affect throughout the whole insurance coverage worth chain. Knowledge is turning into extra available and cheaper, turning into a commodity that permits it to unfold throughout the whole worth chain. And superior analytics with AI, ML, and NLP are rising as highly effective instruments to boost underwriting, determine and forestall danger, and drive extra efficiencies, main to raised profitability and loss ratios.

Knowledge overload and diminishing pace to insights

The swelling quantity of information is creating issue for underwriters to handle and use it successfully. The market is seeing large knowledge will increase in IoT gadget knowledge, telematics knowledge, and risk-specific knowledge.

Underwriters and actuaries can not validate and devise their understandings shortly sufficient, resulting in the need of automated strategies needing to be utilized to the information to attract perception to create higher and expedited enterprise choices. With using extra correct knowledge, insurers can leverage predictive modeling to offer personalized protection and higher pricing. However it’s greater than anybody coverage. The mixture of clever underwriting, loss management and superior analytics like AI/ML are more and more essential to assess the precise danger, but additionally its affect by way of danger urge for food and danger publicity evaluation for the portfolio as seen in Determine 2.

Determine 2

Because the competitors tightens within the business, each a part of the insurance coverage group should be dedicated to using next-generation expertise and knowledge and analytics to face out from their opponents and to fulfill buyer expectations.

These caught on legacy core programs are boxed in and are restricted of their potential. Shifting their enterprise to next-gen cloud platforms is essential, not only for single strains of enterprise, however for the whole enterprise to realize actual optimization and value discount. Extra importantly, it frees up sources to fund tomorrow’s enterprise.

Tomorrow’s enterprise should be digital, enabling the flexibility to quickly introduce new merchandise that seize new market segments, meet new dangers, buyer wants and expectations, and new distribution channels. It should embed insurance coverage into different services to make it simpler to grasp and buy.

For insurers, enterprise processes in the end should be considered otherwise than in earlier instances. It’s about being aggressive in prevention and giving your underwriters (and different staff members) the instruments they should obtain the most effective outcomes. A renewed core and upgraded expertise will play a considerable function and assist insurers obtain a complicated loss management technique. Inside that expertise platform, insurers should additionally not be afraid to make the most of cloud capabilities that may assist enhance knowledge utilization and quicken the time that underwriters can produce protection choices.

Know-how is the essential basis for coping with the present and future pressures of a high-pressure P&C setting. It should assist insurers to adapt, innovate, and ship at pace to execute on technique and market shifts. The rising significance and adoption of platform applied sciences, APIs, microservices, digital capabilities, new/non-traditional knowledge sources, and superior analytics capabilities are actually important to progress, profitability, buyer engagement, channel attain, and workforce change.

For a deeper have a look at how rising ecosystem participation and efficient management are concerned in the identical risk-mitigation equation, remember to obtain the Majesco/Capgemini standpoint report, The Altering World of Danger: Insurers and Brokers on the Heart of Danger.

Immediately’s weblog is co-authored by Denise Garth, Chief Technique Officer at Majesco, and Kelly Reisling, Senior Director, Capgemini

[i] Willard, Jack, US P&C business sees $8.2bn internet underwriting loss in Q1: AM Greatest, June 16, 2023

[DG1]https://www.nytimes.com/2023/07/03/enterprise/car-repairs-electric-vehicles.html#:~:textual content=Datapercent20frompercent20Mitchellpercent20showspercent20that,requirepercent20workpercent20bypercent20specialistpercent20mechanics.

The put up P&C Danger, Knowledge and Underwriting: The Crush That’s Driving Higher Know-how appeared first on Majesco.

Related Posts

- The Crush That's Driving Higher Know-how

Printed onAugust 4, 2023 Decide your stress. In case your group needed to have a…

- AXA faucets Verisk for well being danger underwriting options in Egypt

Verisk’s well being danger score device will probably be marketed by AXA in Egypt as…

- Oral healthcare knowledge powers 4 new indicators for all times insurance coverage underwriting

Dental knowledge drives highly effective indicators for Alzheimer’s/dementia, periodontal illness, sleep apnea, and COVID-19 …