What You Must Know

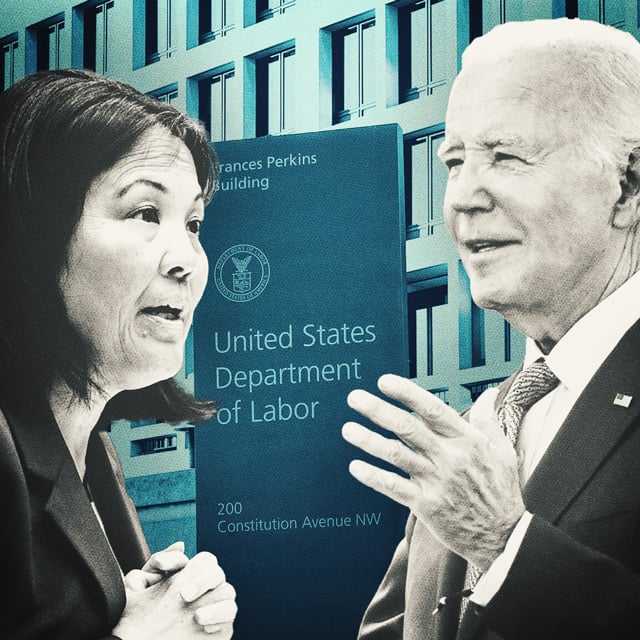

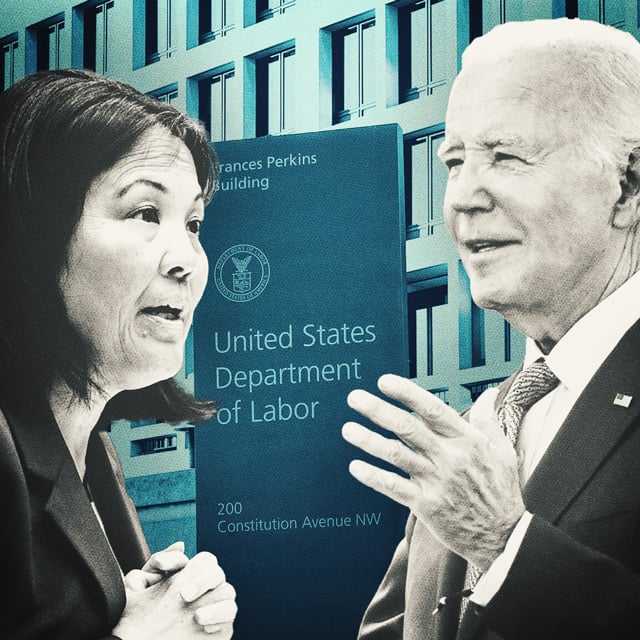

- DOL desires suggestions on titles that will convey the provide of individualized suggestions to retirement buyers.

The Labor Division is requesting feedback on learn how to probably regulate advisor-like titles — similar to monetary advisor, monetary planner and wealth supervisor — beneath its new fiduciary rule.

The preamble to the proposed rule says the division desires suggestions on titles that “could convey the provide of individualized suggestions and are relied upon by the retirement investor,” Duane Thompson, senior coverage analyst at Broadridge Fi360 Options, mentioned on a current webcast held by Broadridge.

By requesting such suggestions, Labor, in accordance with Thompson, could “add one thing within the remaining rule that in the event you use these advisor-like titles, that will convey to a possible retirement buyers that you just’re appearing able of belief and confidence.”

Preamble Language

The preamble to the DOL’s present fiduciary rule proposal states on pages 42 and 43 that Labor “intends to look at the methods funding recommendation suppliers market themselves and describe their companies.”

For instance, the premable continues, “some stakeholders have beforehand expressed concern that funding recommendation suppliers that undertake titles similar to monetary advisor, monetary planner, and wealth supervisor, are holding themselves out as appearing in positions of belief and confidence whereas concurrently disclaiming standing as an ERISA fiduciary.”

Within the Division’s view, “an funding recommendation supplier’s use of such titles routinely includes holding themselves out as making funding suggestions that shall be primarily based on the actual wants or particular person circumstances of the retirement investor and could also be relied upon as a foundation for funding choices which are within the retirement investor’s finest curiosity,” the premable states.

Labor can be requesting touch upon whether or not “different sorts of conduct, communication, illustration, and phrases of engagement of funding recommendation suppliers ought to benefit related therapy.”

The premable to Labor’s Retirement Safety Rule additionally factors out that “along with missing rudimentary monetary information, many retirement buyers don’t perceive the roles of various gamers within the funding trade and what these gamers are obligated to do.”

With this language, Labor’s “concern is that, whereas totally different titles could have which means within the monetary companies sector, these titles are indistinguishable to foremost road buyers and the buyers could imagine that they’ll place belief within the suggestions due to the titles,” ERISA legal professional Fred Reish of Faegre Drinker informed ThinkAdvisor Monday in an e-mail.