Health Insurance

Navigating Well being Insurance coverage for Small Companies in Minnesota

Working a small enterprise in Minnesota comes with its personal set of challenges and alternatives. As a small enterprise proprietor, one of many key concerns is offering medical health insurance in your staff. Providing complete medical health insurance not solely attracts and retains proficient staff but in addition demonstrates your dedication to their well-being. On this information, we’ll discover the choices and concerns for medical health insurance for small companies in Minnesota, serving to you make knowledgeable choices that profit each your staff and your small business.

Advantages of Offering Minnesota Small Enterprise Well being Insurance coverage

Providing Minnesota small enterprise medical health insurance to your staff brings quite a few advantages in your small enterprise. This is just a few of our favorites.

1. Worker Attraction and Retention

Greater than half of small companies aren’t providing well being advantages, and they’re dropping expertise in consequence. In right now’s aggressive job market, proficient professionals are searching for greater than only a paycheck. They wish to work for firms that prioritize their well-being and provide advantages that transcend the fundamentals. By offering complete medical health insurance, you might be sending a transparent message to potential staff that you simply worth their well being and are dedicated to their long-term success. This may give you a aggressive edge on the subject of attracting and retaining high expertise in your trade.

2. Improved Worker Effectively-Being

Entry to high quality healthcare results in improved total well being and well-being in your staff, leading to elevated productiveness and job satisfaction. When staff have entry to common medical check-ups, preventive care, and well timed remedy, they’re extra prone to keep wholesome and handle any well being considerations early on. This not solely reduces the chance of great sicknesses but in addition helps staff handle persistent circumstances successfully. Consequently, they’ll carry out their job duties extra effectively and with higher focus, resulting in elevated productiveness.

3. Constructive Work Surroundings

Offering medical health insurance demonstrates that you simply care about your staff’ well being and fosters a optimistic office tradition. When staff know that their employer values their well-being and is invested of their well being, it creates a way of belief and loyalty. This, in flip, results in a extra optimistic work surroundings the place staff really feel supported and motivated to carry out at their finest.

4. Tax Benefits

Small companies might qualify for tax credit when providing medical health insurance to staff, serving to offset the prices. This is usually a important benefit for small companies in Minnesota, because it permits them to supply complete medical health insurance with out incurring extreme bills. One choice that small companies can take into account is using Well being Reimbursement Preparations (HRAs). With HRAs, reimbursements for worker medical health insurance bills usually are not topic to payroll tax, employer tax, or revenue tax.

5. Enterprise Status

Providing medical health insurance enhances your small business’s status as a accountable and caring employer locally. Not solely does it reveal your dedication to your staff’ well-being, but it surely additionally showcases your dedication to supporting the area people. By offering complete medical health insurance, you aren’t solely investing within the success of your small business, however you might be additionally contributing to the general well being and prosperity of your staff and their households. By prioritizing the well being and well-being of your staff, you might be investing within the long-term success and progress of your small enterprise in Minnesota.

Well being Insurance coverage Panorama for Small Companies in Minnesota

Minnesota presents numerous medical health insurance choices for small companies, together with the next:

1. Small Group Well being Plans

Small companies can buy small group well being plans from insurance coverage carriers. These plans are designed particularly for teams of staff and provide a variety of protection choices. These could be costly, one-size-fits-all, and topic to excessive renewals.

2. Well being Insurance coverage Market (MNsure)

MNsure is Minnesota’s medical health insurance market, the place small companies can discover and buy medical health insurance plans that meet Reasonably priced Care Act (ACA) necessities.

3. SHOP Market

The Small Enterprise Well being Choices Program (SHOP) Market is a part of Healthcare.gov that enables small companies to check and buy medical health insurance plans for his or her staff.

4. Well being Reimbursement Preparations

As an alternative of coping with one of many above choices, enterprise house owners can merely reimburse staff for particular person well being plans bought at Healthcare.gov or the State Alternate. It is tax-free, hands-off and reasonably priced. Workers acquired customized well being plans that work finest for his or her distinctive wants.

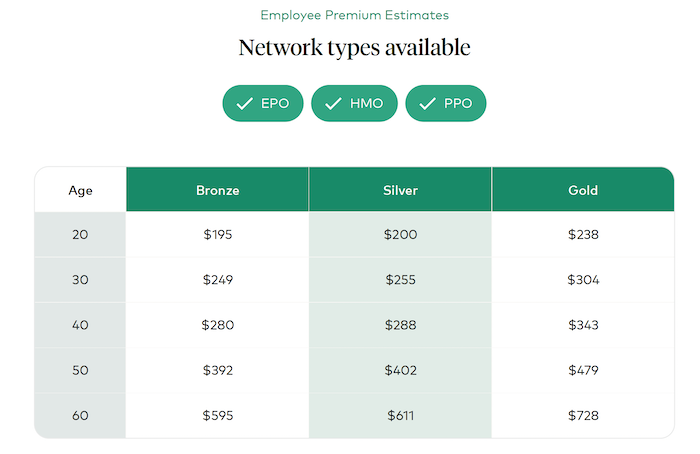

Listed below are just a few benefits at a look:

Issues When Selecting Well being Insurance coverage for Your Small Enterprise

Choosing the suitable medical health insurance plan in your small enterprise in Minnesota requires cautious analysis. Listed below are key concerns to remember:

1. Plan Choices:

- Consider the various kinds of medical health insurance plans accessible, akin to Well being Upkeep Group (HMO), Most well-liked Supplier Group (PPO), and Excessive Deductible Well being Plans (HDHP).

2. Community Protection:

- Test if the plans embrace a community of healthcare suppliers and hospitals which might be handy in your staff.

3. Price Sharing:

- Think about the premium prices, deductibles, co-payments, and coinsurance that your staff and your small business will likely be accountable for.

4. Important Well being Advantages:

- Evaluation the important well being advantages coated by the plans, guaranteeing they meet the ACA necessities and supply the mandatory protection in your staff.

5. Worker Enter:

- Search enter out of your staff to know their medical health insurance wants and preferences. This can assist you select a plan that aligns with their necessities.

HRAs, the higher choice for Minnesota Small Enterprise Advantages

Minnesota enterprise house owners ought to check out HRAs for just a few causes. For starters, price management and taking good care of your staff. Secondly, Minnesota has an unimaginable particular person medical health insurance market with modern carriers, plans with perks, and many choices. Listed below are just a few questions we hear usually.

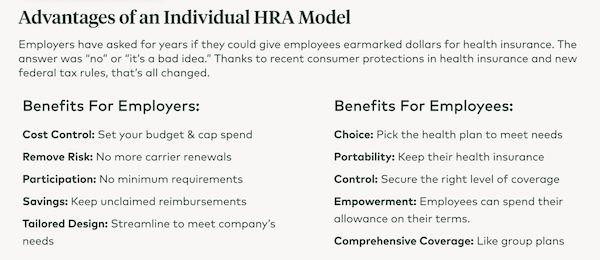

What can my staff purchase?

Minnesota boasts one of the aggressive particular person medical health insurance markets within the nation. For that motive, the state was one of many earliest adopters for these new fashions of HRAs.

Supply: Take Command’s Market Snapshot Device

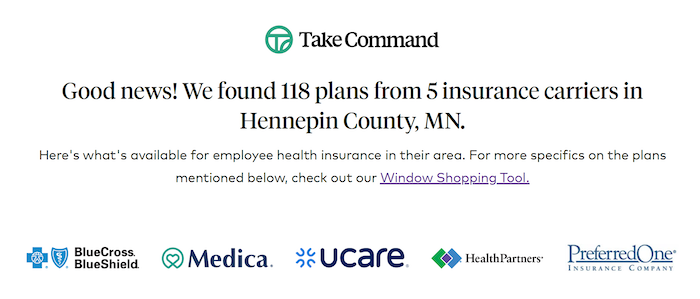

Are they high quality well being plans?

Minnesota small enterprise staff usually are not restricted to HMOs. There are EPOs, HMOs and PPOs relying on the extent of protection they want. And bear in mind, all of those plans are prime quality medical health insurance that meet the requirements required by the Reasonably priced Care Act, together with masking preexisting circumstances and ten important well being advantages.

Supply: Take Command’s Market Snapshot Device

Supply: Take Command’s Market Snapshot Device

Get extra out of your advantages price range with HRAs

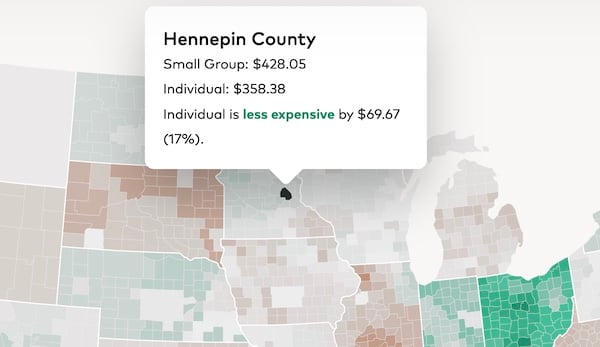

This is an instance of Hennepin County. Whereas $69 may not sound like a ton of financial savings, simply keep in mind that is per thirty days and per worker.

Particular person charges are 14% cheaper than group in Minnesota’s three largest counties.

Supply: HRA Warmth Map

Able to get began?

Reimbursing your staff tax-free via a Well being Reimbursement Association) has by no means been simpler. Design and launch your QSEHRA plan in minutes with our HRA administration platform.

-

Handle advantages for an hour or much less per thirty days

-

Provide medical health insurance in your price range & save on taxes

-

Enhance recruitment and retention in tight hiring market

Related Posts

- Inszone Insurance coverage buys Speck Insurance coverage and Monetary Companies

Earlier this month, Inszone Insurance coverage acquired a New Mexico-based insurance coverage company. Credit score:…

- Nice Japanese to purchase two Malaysian insurance coverage companies

GELM will purchase a 100% stake in AmMetLife Insurance coverage and GETB will purchase 100%…

- Three quarters of insurance coverage companies have suffered CMS breach

Three quarters of insurance coverage and reinsurance companies have suffered a knowledge breach by means…