Health Insurance

Navigating Georgia Small Enterprise Well being Insurance coverage

Working a small enterprise in Georgia is an endeavor crammed with ardour, dedication, and a dedication to development. Amidst your give attention to delivering distinctive services or products, it is essential to prioritize the well-being of your workers. Providing complete medical health insurance is a robust method to exhibit your dedication to your crew’s well being whereas fostering a constructive office setting.

On this complete information, we’ll delve into the significance of medical health insurance for Georgia small companies, discover accessible choices, and supply insights that will help you make knowledgeable choices that profit each your workers and your online business.

The Significance of Well being Insurance coverage for Georgia Small Companies

Georgia’s small companies play an important position in driving the state’s economic system, and they’re typically the spine of native communities. Offering medical health insurance is not nearly assembly authorized necessities; it is about nurturing a wholesome workforce and a thriving enterprise. Keep in mind, as a small companies you are not truly required to supply medical health insurance to your workers, nevertheless it’s clearly an effective way to spice up morale and productiveness in addition to recruitment and retention.

This is why medical health insurance issues for small companies in Georgia:

1. Worker Nicely-Being and Satisfaction

Providing medical health insurance demonstrates your dedication to your workers’ well being and well-being. It enhances job satisfaction and loyalty, lowering turnover and the prices related to hiring and coaching new workers.

2. Attraction of Prime Expertise

In a aggressive job market, a complete advantages package deal, together with medical health insurance, can appeal to expert people to your small enterprise, serving to you construct a proficient and devoted crew.

3. Concentrate on Core Enterprise Actions

When your workers have entry to high quality healthcare, they will give attention to their roles with out worrying about medical bills, resulting in elevated productiveness and engagement.

4. Optimistic Office Tradition

Offering medical health insurance fosters a constructive office tradition the place workers really feel valued, supported, and a part of a crew that cares about their well being and well-being.

Selecting Well being Insurance coverage for Your Georgia Small Enterprise

Prioritizing medical health insurance to your small enterprise in Georgia is an funding within the well being, well-being, and general job satisfaction of your workers. By providing complete protection, you are fostering a constructive office tradition that values your crew’s well being and happiness. As you discover medical health insurance choices, contemplate the distinctive wants of your workers and goal to supply plans that align with their well-being. By safeguarding your workers’ well being, you are contributing to the success and development of your small enterprise in Georgia, creating a robust basis for a thriving and motivated workforce.

As a small enterprise proprietor in Georgia, you might have a number of choices for offering medical health insurance for small enterprise workers. This is a better take a look at the important thing concerns:

1. Small Group Well being Plans

These plans are designed particularly for teams of workers inside small companies. They provide a spread of protection choices, together with well being, dental, and imaginative and prescient. You may need to consider the premium prices, deductibles, co-payments, and different out-of-pocket bills related to every plan. They’re very one-size-fits-all and topic to cost hikes every year.

2. Well being Reimbursement Preparations

Small companies in Georgia can reimburse workers for particular person medical health insurance tax-free by new fashions of well being reimbursement preparations. Since this does not require medical underwriting, there is no such thing as a threat to bear. You select your funds and keep it up. Your workers get to decide on which plan is greatest for his or her distinctive wants and all of those choices. For 2024, this implies they’d store on Georgia’s new state change known as Georgia Entry (vs Healthcare.gov). All of those prime quality medical health insurance plans will cowl Important Well being Advantages and are ACA-compliant.

3. SHOP Market

The Small Enterprise Well being Choices Program (SHOP) Market, accessible by HealthCare.gov, permits small companies to check and buy medical health insurance plans that swimsuit their wants and funds.

→ For bonus factors, learn our Information to Small Enterprise Well being Insurance coverage.

Advantages of Offering Well being Insurance coverage for Georgia Small Companies

Providing medical health insurance brings a large number of advantages to your small enterprise:

1. Worker Retention and Satisfaction

Aggressive medical health insurance enhances worker satisfaction and loyalty, lowering turnover and fostering a steady workforce.

2. Improved Worker Well being

Entry to healthcare results in improved general well being, leading to elevated productiveness, lowered absenteeism, and better morale.

3. Attraction of Expert Expertise:

Complete medical health insurance can appeal to expert people who prioritize their well being and search engaging advantages.

4. Optimistic Firm Picture

Offering medical health insurance demonstrates your dedication to your workers’ well-being and portrays your online business as a accountable and caring employer.

Well being Reimbursement Preparations in Georgia: The Straightforward, Reasonably priced Choice

And now for our favourite topic: Well being Reimbursement Preparations. As we talked about above, these outlined contribution instruments enable Georgia enterprise house owners to reimburse their workers for medical health insurance tax-free.

The result’s value management, predictable budgets, and hands-off administration for small enterprise house owners and adaptability, personalization and selection for workers.

What’s an HRA?

A well being reimbursement association is a tax-advantaged advantages answer that permits employers to reimburse their workers for certified well being prices or particular person insurance coverage premiums.

Conventional group medical health insurance plans are complicated, overpriced, and inflexible. To not point out, it is difficult to search out the fitting plan that matches your whole worker’s well being care wants. For a lot of small employers, a Well being Reimbursement Association (HRA) is a wonderful various to group plans.

Benefits of HRAs for Georgia Small Companies

- Worker Alternative. Staff get to decide on a person insurance coverage plan that meets their wants. They might even be reimbursed for out-of-pocket well being care bills.

- No Pre-Funding Accounts. No extra upfront prices. With an HRA, the employer units the allowance, and reimbursement funds aren’t made till certified claims are authorised.

- Mounted Greenback Quantities. No annual premium raises on group insurance coverage.

- No Participation Necessities. If workers determine to not use the profit, it would not affect the HRA plan.

- Tax Benefits. Staff get reimbursements tax-free. Employers can deduct the reimbursements from taxes. Plus, there is no such thing as a payroll tax on the quantity.

Why is Georgia well-positioned to reap the benefits of HRAs?

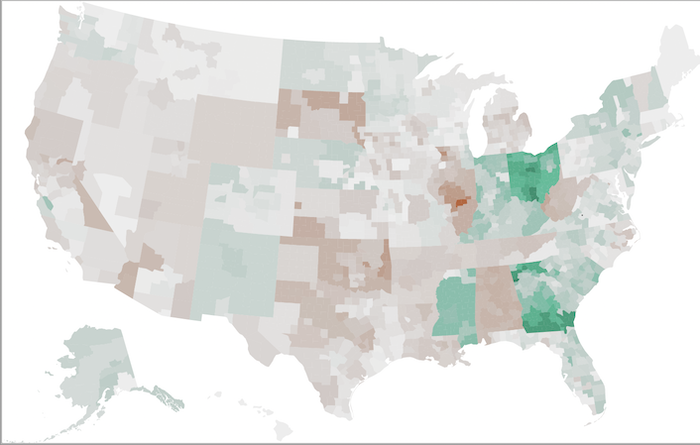

Georgia’s particular person medical health insurance panorama is very aggressive, which implies that there are ample reasonably priced choices for workers to select from. The truth is, in lots of counties in Georgia, particular person medical health insurance charges are significantly cheaper than their small group counterparts.

See all that vivid inexperienced? That implies that in these counties, particular person charges are cheaper. Why not reap the benefits of that?

Which means your advantages {dollars} will stretch additional with an HRA.

If you wish to see what particular person charges are in your particular county, use our Market Snapshot Device. It is going to let you know what medical health insurance corporations your workers can select from, the community sorts accessible (like HMO vs PPO), and what common premium prices can be. This is an instance for Fulton County. So many nice decisions!

Sound attention-grabbing? We thought so. Join with one among our consultants. We would like to stroll you thru how our platform works.

Related Posts

- Assessment your enterprise life insurance coverage coverage yearly

Life insurance coverage could be a precious a part of your enterprise plans. We…

- First Insurance coverage & Danger Administration commences enterprise in US

A tailor-made danger administration dashboard based on business or classification is made accessible for insureds,…

- Delos secures funds to develop householders' insurance coverage enterprise

Delos’s platform gathers and evaluates publicity and focus knowledge to find out the precise wildfire…