What You Have to Know

- Medicare Benefit plans assign every enrollee a well being rating.

- A federal deficit-fighting group was saying earlier than that the chance scoring has been too aggressive and is driving up prices.

- Now, the group says, new research present the enrollees are more healthy than different Medicare enrollees.

A debate about how sick or wholesome typical Medicare Benefit plan enrollees actually are might have an effect on how a lot funding strain issuers face in Congress for the remainder of the 12 months.

The Committee for a Accountable Federal Funds — a gaggle that tries to slender the hole between how a lot income the federal government raises and the way a lot it spends — stated in a new evaluation that two current research present that the Medicare Benefit program enjoys favorable number of higher dangers, and that typical Medicare Benefit enrollees are a lot more healthy than typical enrollees who follow “Authentic Medicare,” with or with out Medicare complement insurance coverage.

The hole is so extensive that, beneath present guidelines, the federal government and enrollees might pay the plans about $810 billion to $1.56 trillion an excessive amount of from now by means of 2033, in contrast with earlier committee overpayment estimates of $230 billion to $412 billion. The sooner estimates have been based mostly solely on details about the enrollees’ typical well being “threat scores,” or well being downside “coding depth.”

The committee predicted that eliminating all overpayments based mostly each on enrollee well being coding depth and favorable choice might save the Medicare Half A hospitalization plan belief fund $400 billion to $770 billion over 10 years.

What It Means

Medicare Benefit plan issuers, their commerce teams and their joyful plan enrollees might must work arduous to defend the plans towards members of Congress trying to find simple methods to cut back the federal price range deficit or methods to offset the price of new federal packages.

The Federal Deficit

The U.S. federal authorities misplaced $1.4 trillion in 2022 on $4.6 trillion in income. It expects so as to add $14 trillion in debt over the following decade.

Medicare Economics

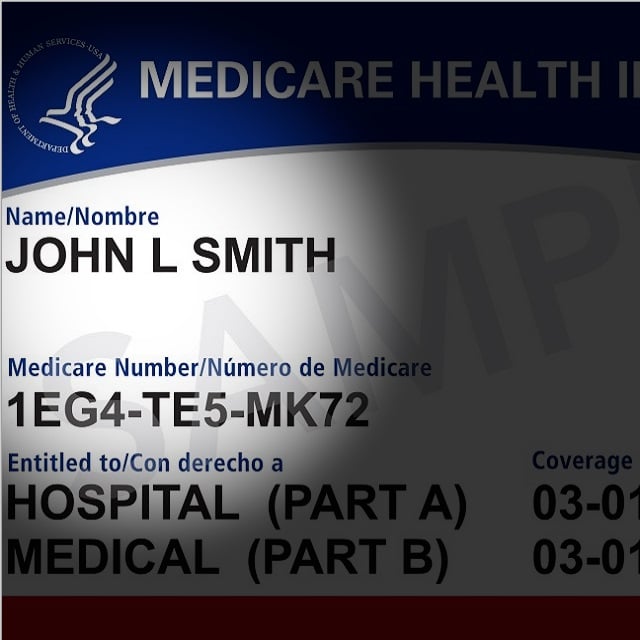

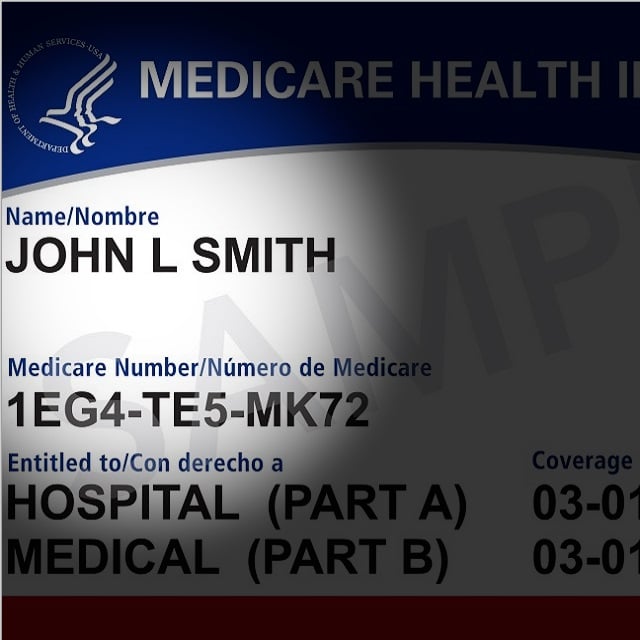

Medicare is a program that gives well being protection for 65 million folks.

About 35 million folks get their protection from the Medicare Half A hospitalization plan and the Medicare Half B outpatient and doctor companies plan, that are administered by nonprofit and for-profit well being plan directors.

One other 30 million enrollees get their protection straight from non-public plan issuers. The issuers get a mix of money from Medicare and premiums from enrollees.

In 2022, the federal government collected $353 billion in payroll taxes and $4.6 billion in enrollees premiums for the Medicare Half A program and $468 billion in premium income for the Half B program. It paid $403 billion to Medicare Benefit plan issuers.