Life Insurance

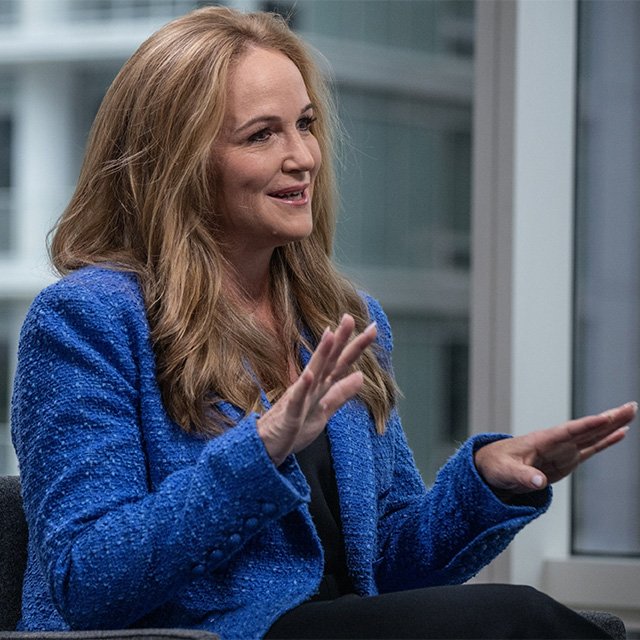

Largest U.S. Pension’s Funding Boss Pushed Sports activities Offers Earlier than Calling It Quits

Calpers explored a take care of the Nationwide Basketball Affiliation’s Sacramento Kings, with proprietor Vivek Ranadivé visiting the pension fund’s workplace as a part of the conversations, individuals acquainted with the matter mentioned.

The talks, which haven’t beforehand been reported, didn’t result in a deal. Calpers declined to remark, and representatives for Ranadivé didn’t reply to requests for remark.

‘Toys for Billionaires’

Non-public fairness corporations have emerged as main financiers {of professional} sports activities groups, however given the extra dangers, it stays an uncommon funding technique for pension funds chargeable for the retirement nest eggs of hundreds of thousands of individuals.

Sports activities groups are “toys for billionaires” and a poor match for a public pension fund, mentioned Matt Cole, who left Calpers in 2022 after 16 years and now heads Try Asset Administration, the agency co-founded by Vivek Ramaswamy.

“They’re an underfunded pension and so they hold doing the identical factor; there’s want for change,” Cole mentioned. However in case you allocate cash to a group, “you’re hoping there’s a billionaire down the road that will provide you with an excellent exit,” he mentioned. “It was probably the most baffling methods that I’ve heard.”

Advocates for Musicco say she was making an attempt to proper a pension portfolio that has lengthy been among the many nation’s worst performers.

“While you’ve received 22-year veterans in these positions, who’ve persistently underperformed and below delivered and so they get the carpet pulled out and moved round, there’s going to be pushback,” mentioned Terry Brennand, director of income, budgets, and pensions at SEIU, California’s largest union, which intently displays Calpers’ insurance policies.

Calpers additionally pushed to speculate $1 billion with funding corporations TPG Inc. and GCM Grosvenor to again up-and-coming buyout corporations. Some funding staffers thought this did the alternative of what Musicco was preaching when it comes to making an attempt to chop out the middlemen, an individual acquainted with the matter mentioned.

Calpers did make some headway in doing non-public fairness offers in ways in which decreased charges throughout Musicco’s tenure. Its workers accomplished $3.9 billion in non-public fairness co-investments, persevering with their earlier efforts. The pension fund additionally made a $300 million dedication to the enterprise capital agency Thrive Capital to assist Calpers scale its venture-focused investments.

And Musicco was additionally constructing off momentum by workers to do extra financing performs. Earlier than she joined, Calpers was within the remaining stretch of sealing a $750 million dedication to Ressler’s Ares to finance sports activities, media and leisure companies.

Nonetheless, as Musicco wrapped up her first 12 months on the job, some longtime staff expressed unease to one another in regards to the selections of the newly arrived boss, who often crisscrossed the continent.

Her fixed journey not solely put a pressure on Musicco, in accordance with an individual near her, but in addition on senior workers, who had been anticipating a clearer blueprint on how the fund would meet its funding objectives after an 18-month management hole.

Her predecessor, Ben Meng, resigned in August 2020 amid a evaluate into whether or not his private investments violated the pension fund’s guidelines. No proof of wrongdoing has surfaced, and he disclosed the holdings. Meng declined to remark.

Courtside Seats

A flashpoint for some workers disgruntled with Musicco was a photograph that started circulating across the Calpers workplace and appeared on the weblog Bare Capitalism. The image confirmed Musicco and her son on the Nationwide Basketball Affiliation playoff on April 15 between the Golden State Warriors and the Sacramento Kings.

She was pictured subsequent to Joe Lacob, the proprietor of the Golden State Warriors. Lacob didn’t reply to a request for remark. Myers mentioned Musicco wasn’t acquainted with him earlier than the sport.

She additionally sat within the neighborhood of Ranadivé, the proprietor of the group Calpers explored investing in, two individuals acquainted with the matter mentioned.

Some workers mentioned the scene exhibiting the guardian of civil servants’ retirement financial savings sitting in dear courtside seats, close to a possible investing counterparty, risked blurring private {and professional} strains.

She paid for her personal season tickets, Calpers mentioned.

“Like many individuals, she has a private love of sports activities,” Myers mentioned. “She and her son embraced their new residence group.”

Keith Brainard, analysis director on the Nationwide Affiliation of State Retirement Directors, likened the job of public-pension investing to working in a “fishbowl” due to the excessive diploma of transparency required for every little thing from conferences to worker compensation.

“The extent of data and expertise and experience turns into elevated and the expectations and visibility and the stress additionally will increase,” he mentioned in an interview.

Musicco attributed her resolution to go away to the broader problem of juggling work and residential life.

“I’ve spent my total profession making the required trade-offs between my private {and professional} life,” she mentioned in a press release Friday. “However these days, these trade-offs have come at too excessive of a value.”

(Picture: Bloomberg)

Copyright 2023 Bloomberg. All rights reserved. This materials is probably not revealed, broadcast, rewritten, or redistributed.

Related Posts

- Overcoming sports activities nervousness in teenagers

Again to high school means a number of modifications for teenagers, teenagers, and households, with…

- Girls’s U Sports activities cross nation mid-season energy rankings

We at the moment are two weeks into the 2023 U Sports activities cross-country season,…

- When Sports activities and Politics Combine

Whereas Stonewall was the birthplace of homosexual liberation, the motion for homosexual civic equality had…