Insurance

Insurance coverage methods to fulfill altering calls for

Printed on

It’s the top of the day. In the event you aren’t working into the night, there may be dinner to make. There could also be one thing it’s essential to do with children. You may care for private procuring. Chances are you’ll deal with your self to some tv, hearken to music, or learn a e-book.

Let’s say you activate the TV and also you click on on Netflix. There’s a sequence that you simply’ve been looking ahead to the previous few months. You’ve gotten been patiently limiting your self to an episode per week, however tonight you “binge” on the previous few episodes. The season is over. It was nice. What do you must stay up for the subsequent time you watch TV?

What you don’t stay up for is painstakingly looking for one thing else to observe. That takes an excessive amount of time. You shortly choose what Netflix recommends and also you skim the brief synopsis. Netflix has made it straightforward by saving you time, making it handy, and supplying you with a rudimentary understanding in a matter of seconds. Oh…and it could actually do that as a result of it is aware of you and the earlier exhibits you appeared to love. Netflix exhibits are nearly secondary to their service as a result of you might be on the heart of each interplay.

How do firms use know-how to assist them lead?

Enterprise leaders grasp the key sauce of resilience and progress. It’s a drive to please the shopper that prioritizes the fitting know-how selections. They ask:

“What’s going to it take to create buyer experiences which can be straightforward, considerate, and intuitive?”

“How can we construct an organization that operates with agility, flexibility, and data-driven selections?”

It isn’t straightforward to do, however it’s easyto perceive. In the present day’s progress for insurers begins with choosing the strategic priorities that may make a distinction, then executing these priorities. In Majesco’s newest thought-leadership report, Sport-Altering Strategic Priorities Redefining Market Leaders, Majesco shares useful survey information from insurance coverage executives concerning their firm’s priorities for 2023. We then weigh insurer priorities in opposition to each particular person and SMB buyer opinions.

The end result? A transparent understanding of how insurers can transfer from a Follower or Laggard place right into a Chief place after which preserve it. In at the moment’s weblog, I take a look at how Majesco’s newest surveys level to operational transformations that produce customer-centric worth.

How ought to insurers reply to the rising threat local weather?

In an ideal world, insurance coverage wouldn’t be wanted. It’s the threat on this planet that makes insurance coverage useful and essential to folks and companies.

As 2023 unfolds, we face a set of dangers that seem new however are acquainted to those that skilled them within the early Eighties. It’s the return of older dangers – inflation and cost-of-living crises in addition to new dangers with commerce wars, provide chain challenges, rising medical bills, elevated prices in supplies, combat for expertise, vital employee retirements, widespread social unrest, and growing crime – which a lot of at the moment’s insurance coverage enterprise leaders have skilled.

The influence of those dangers could possibly be diminishing profitability and progress, in addition to channel and buyer loyalty – creating potential headwinds to insurer digital enterprise transformation methods and plans. As a result of occasions like these might be problematic and precarious for the longer term, it’s extra necessary than ever to rethink your method and switch the headwind right into a tailwind. The previous proverb, “Necessity is the mom of invention” features new relevance.

Insurers should speed up their digital enterprise transformation as a result of know-how and new working fashions present a basis to adapt, optimize operations, innovate and ship at pace as markets shift, buyer wants and expectations shift, and alter continues its relentless path ahead. The rising significance and adoption of platform applied sciences, Cloud, APIs, microservices, digital capabilities, new/non-traditional information sources, and superior analytics capabilities at the moment are essential to progress, profitability, buyer engagement, channel attain, and workforce modifications.

That’s the key to managing threat. Danger is actual. Danger is difficult. Danger, nevertheless, is our trade, our experience, and our worth. It’s as much as insurers to beat the chance studying curve by studying learn how to cowl, stop and shield whereas on the identical time anticipating buyer preferences and wishes.

Majesco’s newest shopper and SMB analysis has recognized rising curiosity and demand for brand new merchandise, value-added companies, channels, personalization, and digital expectations. The yr 2023 is poised to ship some game-changing situations that may influence insurance coverage.

In the present day’s query is, “Can we afford to disregard the enterprise and know-how traits which can be re-imagining the worth proposition for insurance coverage and the longer term enterprise mannequin?” The reply is not any…as a result of pausing or holding again now will solely create a widening aggressive hole, putting insurers’ companies in danger and putting them properly behind leaders who’re “placing the pedal to the metallic.”

Good strikes, and nice alternatives to show customer-centricity.

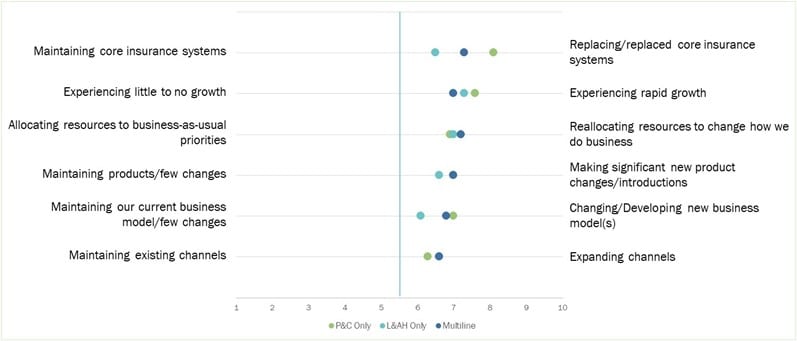

Within the final two years, we’re seeing the resurgence of changing core legacy programs, reallocating sources to strategic areas, improvement of recent merchandise, and the rise of recent enterprise fashions. (See Fig. 1) What’s driving this resurgence? How are they influencing sustainable, worthwhile progress?

Determine 1: State of the corporate final yr, by firm kind

Insurers should proceed to construct on this momentum and give attention to each operational and modern methods and priorities, with a customer-centric focus. And there may be some motion on this route as indicated in Determine 2. Nonetheless, what can also be apparent is that P&C-only insurers are outpacing L&AH-only insurers. This displays the fact that P&C insurers are and have been forward of the transformation and innovation curve the final 5-10 years, however it additionally exposes the rising stress on L&AH insurers to maintain tempo with clients and distributors who’re experiencing first had the worth of digital transformation and count on it from each insurer, no matter strains of enterprise.

Additional emphasizing this, our analysis with insurance coverage clients – customers and SMBs suggests insurers should shift and ratchet up their focus from an operational transformation of changing legacy core programs to subsequent gen Cloud options to generate higher worth and advantages by proactively anticipating buyer, channel, and companion wants and expectations.

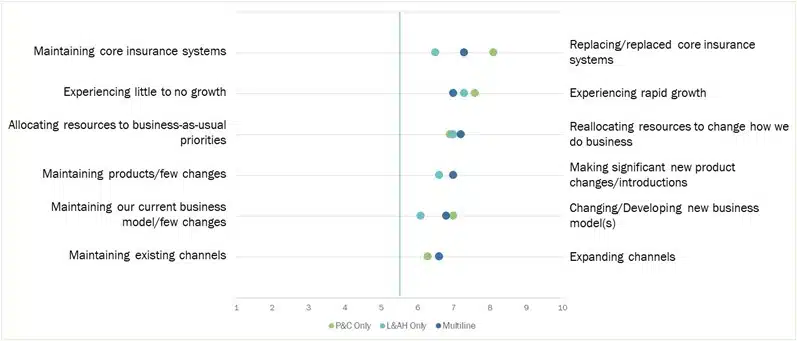

Determine 2: Traits within the state of the corporate scores since 2015-16

Insurers can leverage their new basis to create aggressive differentiation, market management, and worthwhile progress. Expertise enablement, cloud, ecosystems, information accessibility, AI, dangers, merchandise, and buyer sentiment are pushing insurance coverage out of custom and into innovation sooner than some could like.

However this push will give clients a greater expertise by reducing the time it is going to take to know and buy services in addition to service them.

Hyperlinks between transformation, customer-centricity and progress

Leaders, Followers, Laggards

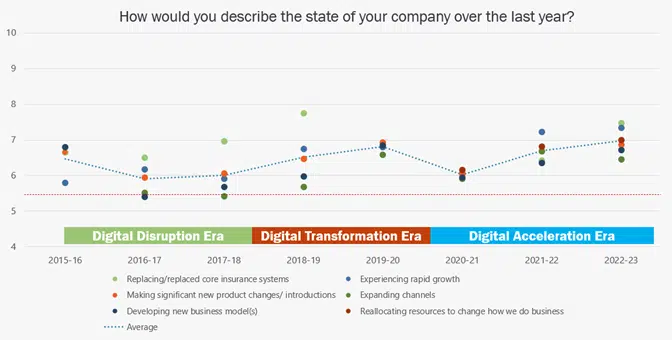

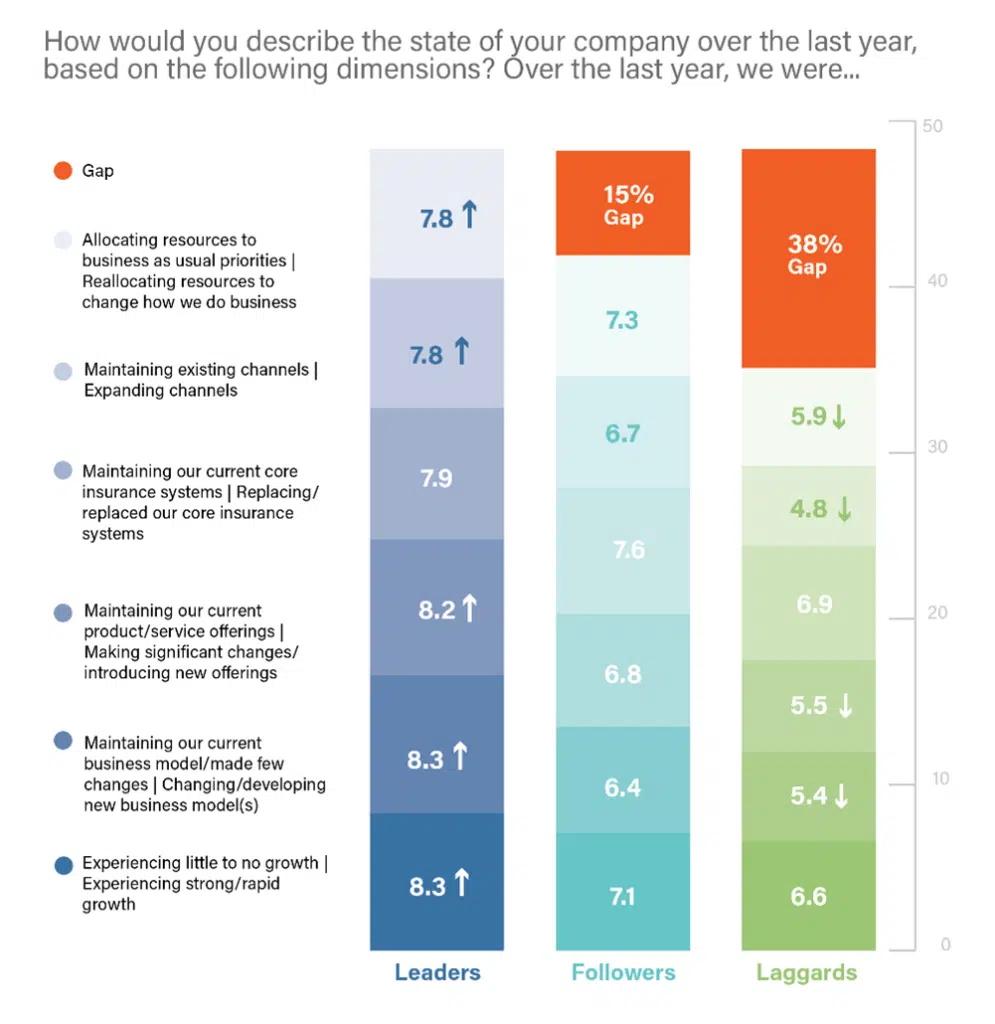

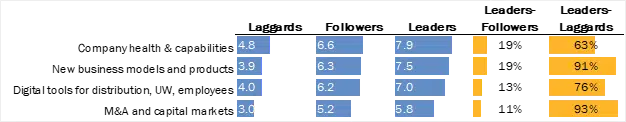

Annually, Majesco asks insurers to put themselves on a transformational scale (1-10) throughout six strategic priorities. After we stack the responses (See Fig. 3), it highlights the gaps between Leaders, Followers and Laggards. It additionally makes it straightforward to identify clear hyperlinks between them and a spotlight to remodel in methods that may positively influence clients.

As in earlier years, Leaders proceed to outpace Followers and Laggards as they describe the state of their enterprise for the final yr. Sadly, as in comparison with final yr, the gaps elevated barely between Leaders and Followers from 13% to fifteen% and extra profoundly between Leaders and Laggards from 20% to 38%.

The numerous hole enhance for Laggards is because of a decline in altering/growing new enterprise fashions, new product choices, increasing channels and reallocating sources – suggesting they’re persevering with enterprise as is, quite than adapting to new market realities which is able to influence progress. Laggards should rethink their methods and priorities after which execute on them to make sure future relevance. Leaders received’t cease increasing channels and growing new choices to proceed their give attention to progress and meet the quickly altering buyer calls for and expectations.

Determine 3: State of the corporate final yr, by Leaders, Followers, and Laggards

Initiatives align with value-based enhancements

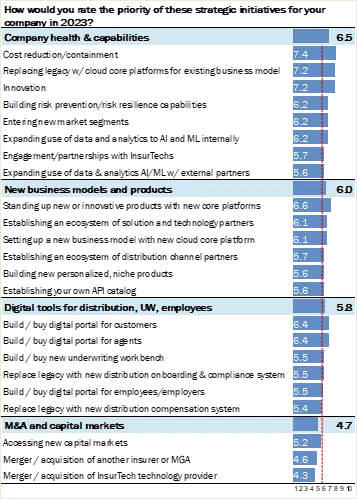

4 thematic teams emerged based mostly on the 20 initiatives assessed within the survey, together with:

Ranking the very best common precedence total is Firm Well being & Capabilities, pushed by the three highest-rated initiatives total: price discount/containment (7.4); changing legacy w/cloud core platforms for current enterprise mannequin (7.2); and Innovation (7.2). (See Fig. 4) This displays a steadiness between optimizing and innovating the enterprise to fulfill the know-how and buyer demographic traits. Rethinking how insurance coverage operates is extra necessary than ever.

New Enterprise Fashions and Merchandise (6.0) and Digital Instruments (5.8) present very wholesome curiosity. Standing up new or modern merchandise on a brand new core resolution (6.6) and digital portals for purchasers (6.4) and brokers (6.4) mirror the necessity to meet new dangers and buyer wants and expectations as a precedence for progress.

Determine 4: 2023 Strategic initiative priorities

Leaders prioritize initiatives that make a distinction

Unsurprisingly, Leaders have the very best common priorities for all of the initiative teams. Laggards are considerably behind of their consideration of those priorities, with gaps starting from 63% to 93% mirrored in Determine 5. What actually stands out are the gaps in new enterprise fashions and merchandise (91%) and digital instruments (76%), two essential areas that handle two key shifts – dangers and buyer expectations – placing Laggards at an growing drawback in staying related.

Determine 5: Strategic initiative priorities of Leaders, Followers, and Laggards

Applied sciences to enhance customer-facing capabilities

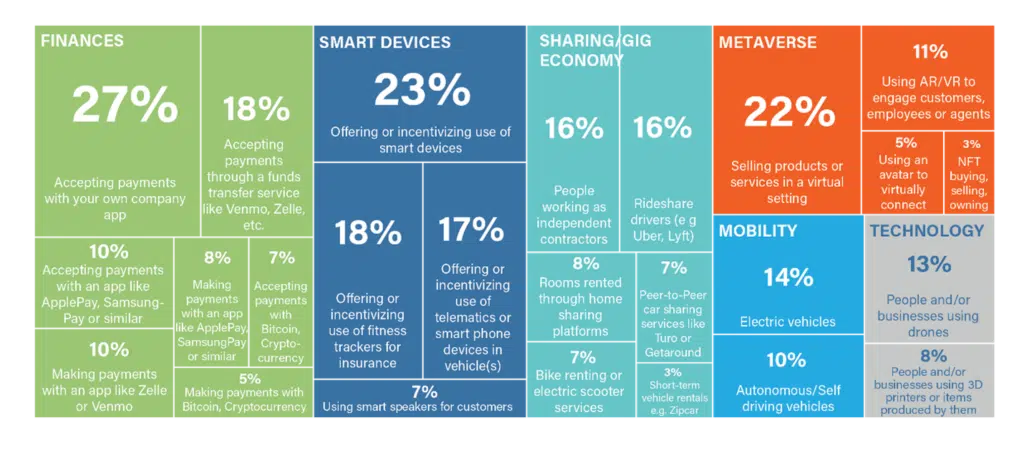

As a result of enterprise fashions and new applied sciences are so intertwined, we needed to look extra carefully at curiosity in particular applied sciences. Which applied sciences do insurers appear to suppose are essentially the most essential?

Utilizing a listing of 25 know-how and enterprise traits, we requested insurers which ones they had been incorporating into their merchandise and enterprise capabilities. Surprisingly, insurers exhibit low exercise in most of those areas. Solely three are being addressed with over a 20% focus, together with accepting funds with your individual firm app (27%, within the Funds group), providing or incentivizing the usage of sensible gadgets (23%, within the Sensible Gadgets group), and promoting services or products in a digital setting (22% within the Metaverse group) as seen in Determine 6.

Determine 6: Applied sciences and traits being integrated into insurers’ services

These low responses place insurers considerably out of sync with their clients (customers and SMBs by generational group) on many of those traits and applied sciences, notably given different companies have embraced these applied sciences driving up buyer expectations.

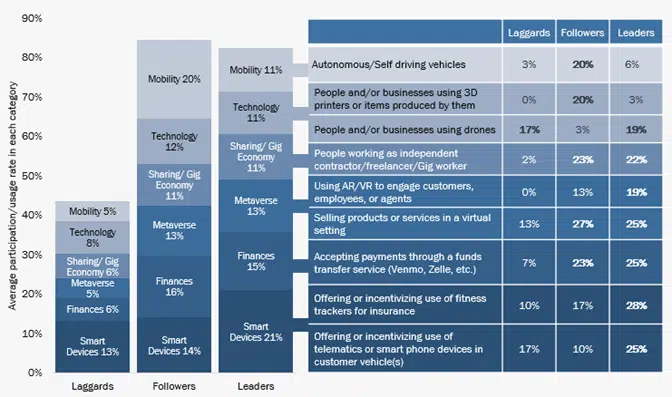

Wanting on the element behind tech priorities, nevertheless, yields some attention-grabbing information. General, Followers and Leaders are neck and neck throughout all of the classes mixed, with a slight edge given to Followers. Nonetheless, the hole with Laggards is giant, placing them at a major drawback to each.

Whereas Followers and Leaders are total related, there are some key variations. Followers have a powerful lead over Leaders in Mobility (20% vs. 11%) whereas Leaders have a powerful lead with Sensible Gadgets (21% vs 14%), The sensible gadgets pattern is pushed by two gadgets, health trackers (28% vs. 17%) and telematics/smartphone gadgets in automobiles (25% vs. 10%). With Mobility, that is pushed by autonomous/self-driving automobiles (20% vs. 6%). Leaders and Followers are demonstrating management within the IoT, and Telematics applied sciences utilized in automobiles or sensible gadgets to supply new merchandise, customized scores, and enhanced companies.

Each Leaders and Followers have substantial leads over Laggards in all of the teams apart from Sensible Gadgets, the place Laggards are only one% other than Followers in use. Determine 7 exhibits the class averages for every group in addition to callouts for the largest gaps.

Determine 7: Key know-how and traits gaps between Leaders, Followers, and Laggards

Strategic Priorities information in focus

One of the simplest ways to know this information is to contemplate all of it by the eyes of the shopper. For instance, folks working as unbiased contractors/freelancers or Gig staff are these almost certainly to want fast, straightforward, custom-made insurance coverage options that ‘make selections’ for them. Leaders and Followers are way more possible to concentrate to the applied sciences that they will implement to supply insurance coverage and companies “on the go.”

Promoting services in a digital setting may appear outlandish however suppose again to Netflix for a second. What might be simpler than deciding on a brand new “product” whilst you’re within the midst of utilizing a service that you simply get pleasure from? Netflix claims that 80% of viewing might be tied to its suggestion engine. Is the thought of a Metaverse channel providing any totally different? In the present day’s buyer is utilizing tomorrow’s channels forward of the trade’s arrival. Retaining tempo would require future priorities to cowl future procuring, future buy strategies, and future threat mitigation.

What ties all of it collectively is the know-how behind the scenes. A brand new method to core programs that Majesco is main the trade on its clever core within the cloud, will give your organization a greater place to compete whereas it provides the enterprise a cost-saving, sustainable mannequin for future progress. That is the place Majesco is targeted throughout all our platforms and is mirrored within the vital R&D to advance these options with our Spring 23 launch to fulfill our buyer and trade calls for in a quickly altering market.

The outcomes of this yr’s report, Sport-Altering Strategic Priorities Redefining Market Leaders, are thrilling, enlightening, and thought-provoking. For firms which can be involved in assembly clients the place they purchase, it gives you and your groups a wonderful base in your strategic conversations all year long.

In insurance coverage, we’ve completed our function once we meet new dangers with a capability to assist clients handle them. It’s now not an exterior vs. inside focus. It really works once we design enterprise fashions and capabilities that may serve each.

Related Posts

- Threat Methods purchases Bisnett Insurance coverage in Oregon

Threat Methods offers threat administration recommendation, insurance coverage/reinsurance placement for property & casualty, worker advantages…

- Inszone Insurance coverage buys Speck Insurance coverage and Monetary Companies

Earlier this month, Inszone Insurance coverage acquired a New Mexico-based insurance coverage company. Credit score:…

- 5 methods to simplify and reinvent your insurance coverage enterprise | Insurance coverage Weblog

In a context of ongoing disruption, insurers are being known as to reinvent themselves. With…