Insurance

Industrial & Specialty Insurance coverage Gives Development Potentialities

Revealed on

Your advertising workforce has simply handed you SMB purchaser personas that they’ve created to your evaluate and enter. You assume again to an analogous train that the manager workforce did six or seven years in the past and also you dig it up simply to check. Right here they’re…facet by facet. How has the SMB purchaser modified? How has the danger modified? How has the market modified? How have your business product choices modified? The place does the brand new purchaser slot in your planning? The place do you match into theirs? These are the vital questions that have to be requested.

Proper worth.

First, you discover some similarities. SMB decision-makers are nonetheless value-driven. One in all their priorities is buying their enterprise round. They’re nonetheless involved about getting a good worth. Then and now, SMB decision-makers take their time when researching choices. They’re no-nonsense. They don’t purchase into advertising fluff. They need what is important. They consider based mostly on actual info. In the event that they make an emotional choice, it’s as a result of their evaluation has triggered an emotion based mostly on a present ache level or threat want.

Comfort and searching for suggestions had been additionally key indicators of buy patterns. Had been the merchandise simple to purchase, simple to make use of, and was the claims course of easy when it was wanted? These traits are nonetheless in impact as effectively, however one thing has modified. SMB consumers need much more comfort and they should really feel that their insurer really understands them — not simply their trade — together with the small print behind their enterprise dangers. SMB decision-makers are rising increasingly more snug with sharing company/telematic/non-public knowledge if it contributes to raised costs, improved companies, or larger safety. SMB consumers admire transparency within the relationship.

Proper place.

If you have a look at the 2023 and the 2016 personas facet by facet, the obvious distinction pertains to enterprise pressures. SMB decision-makers could have felt stress in 2016, nevertheless it’s nothing like as we speak’s considerations. SMBs are going through dozens of latest challenges, together with inflation, provide chain points, rising rates of interest, rising threat, and low unemployment. At this time’s insurers can win the market by serving to SMBs survive and thrive addressing these challenges, some the identical and a few new. However the actual key to capturing a larger degree of market share is ensuring the choices are positioned the place the SMB purchaser is wanting.

To assist insurers the place and the right way to meet the brand new SMB consumers as they navigate as we speak’s compounding points, Majesco revealed an SMB survey report entitled, Resiliency in Occasions of Change: Rethinking Insurance coverage to Assist SMBs Thrive. It covers SMB buyer sentiment and SMB decision-maker demographics that determine choices the place to put new services, and the right way to place these services to optimize their affect. In as we speak’s weblog, we glance particularly at Industrial Property and Enterprise House owners Insurance policies, in addition to Staff Compensation insurance coverage and Cyber insurance coverage.

Industrial Property and BOP for SMBs

At this time, we’re seeing rising environmental, societal, and technological dangers which have the potential to intersect and considerably disrupt individuals’s lives. Elevated excessive climate occasions and pure disasters have a rising unprecedented and more and more vital affect. Because of this, the price of insurance coverage is rising, placing monetary stress on SMBs.

Some areas and properties are seeing vital will increase as a result of claims from catastrophic occasions comparable to wildfires, hail, and flooding. Danger Administration journal experiences that wind and flood losses had been excessive previous to Hurricane Ian, and that occasion alone is anticipated to value the trade greater than $50 billion with some specialists estimating it as excessive as $100 billion. Flood premiums may rise by 25% or extra. On the identical time, the substitute worth of most properties has elevated considerably as a result of inflation, which is able to drive greater substitute value values and insurance coverage prices.[i]

What may also help to decrease Industrial Property and BOP premiums?

Personalised Pricing with Knowledge

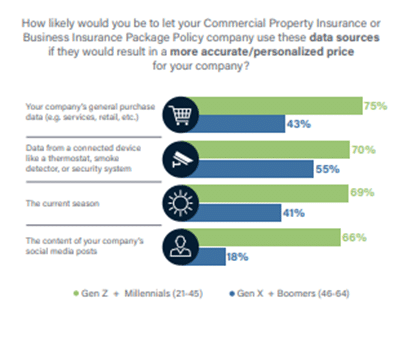

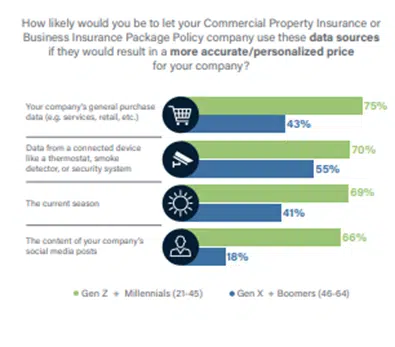

Gen Z and Millennial SMBs are extremely (66% to 75%) in utilizing knowledge from a number of new, non-traditional sources if it ends in extra correct, personalised costs for business property or BOP insurance coverage (see Determine 1). In distinction, Gen X and Boomer SMBs’ curiosity is way decrease with gaps of twenty-two% to 48% as in comparison with the youthful era.

For each generations, the usage of linked units in a property is robust and presents a possibility for insurers to develop new merchandise that leverage such units to not solely assist worth but in addition monitor and scale back the danger for properties. Insurers providing merchandise that present monitoring and personalised pricing may assist SMBs scale back threat and, doubtlessly, insurance coverage premiums, which addresses the monetary top-of-mind problem.

Determine 1: Curiosity in new knowledge sources for business property/BOP insurance coverage pricing

Demand for Worth-Added Companies

There’s a a lot nearer alignment between the generations concerning value-added companies for business property or BOP, with a median hole of solely 14% (see Determine 2).

There’s very excessive curiosity by each generational SMB respondents in selling security, threat resilience, and peace of thoughts by safety monitoring with good units. These companies could be packaged together with present business or enterprise insurance coverage insurance policies, or they are often introduced as value-added service choices. Both manner, monitoring companies can use sensors and alerts for smoke/CO2, water leaks, tools failure, and extreme climate. These companies have among the many highest ranges of curiosity for each segments. Gen Z and Millennials’ demand for companies to assist make their lives simpler is as soon as once more mirrored of their very excessive curiosity in digital property self-assessment instruments (87%) automated claims FNOLs based mostly on extreme climate and site knowledge (75%), on-demand single-item insurance coverage (73%), and concierge service for repairs and preventative upkeep (68%).

For SMBs, this turns into an actual worth with all of the pressures they face day by day — together with the time it takes to easily handle and function the enterprise. Protecting measures, identical to insurance coverage, ought to function within the background and take little or no time to arrange or preserve, however present threat resilience that ensures their enterprise is protected and safe.

Value-conscious SMB decision-makers are additionally fascinated by defending their property, equipment, and capital investments. The concept of threat resilience with preventive companies ought to be top-of-mind for insurers as a manner to offer extra worth for SMB premiums. Preventive companies could, after all, function coverage add-ons that might generate income on their very own, relying on how they’re constructed.

Insurers must look to new merchandise that leverage IoT units and digital loss management choices to provide “energy” to SMBs to evaluate and handle their property and related dangers. Majesco’s Loss Management, Property Intelligence[DG1] , and Clever Core for P&C[DG2] are tightly built-in and may also help insurers incorporate loss management, property, and different knowledge to make use of for threat evaluation, underwriting and new companies inside or alongside current or new merchandise.

Determine 2: Curiosity in value-added companies with business property/BOP insurance coverage

Enhancing Product Placement By way of Expanded, Related Channel Choices

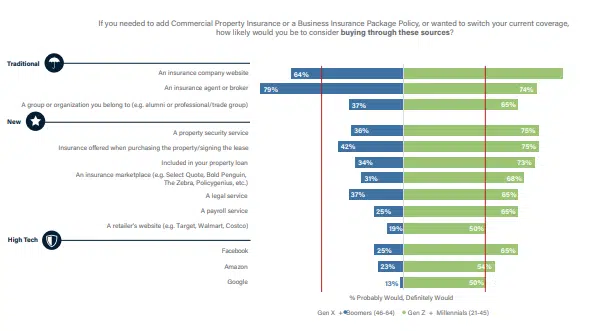

The Majesco SMB survey additionally uncovered actual alternatives for improved product placement. Regardless that Brokers/brokers and insurance coverage firm web sites stay the popular strategies for buying business property or BOP insurance coverage (as seen in Determine 3), the generational segments flip of their preferences for these two conventional channels, with Gen X and Boomers preferring brokers/brokers by 15% and Gen Z and Millennials preferring insurance coverage firm web sites by 12%.

Gen X and Boomers SMBs have much less curiosity in all different channel choices apart from the smooth embedded possibility of buying insurance coverage when shopping for the property or signing the lease (42%). In distinction, Gen Z and Millennial SMBs are fascinated by all of the channels – in keeping with their expectations of a multi-channel world. Particularly, their curiosity is exceptionally robust for the embedded choices of shopping for the property/signing the lease (75%), together with the property mortgage (73%) and from a property safety service (75%). And as soon as once more, the Excessive-Tech channels do very effectively with Gen Z and Millennials, reaching 50% curiosity or greater. Because of this discovering the fitting placement for insurance coverage merchandise is now an crucial problem AND an actual alternative.

Determine 3: Curiosity in channel choices for business property/BOP insurance coverage

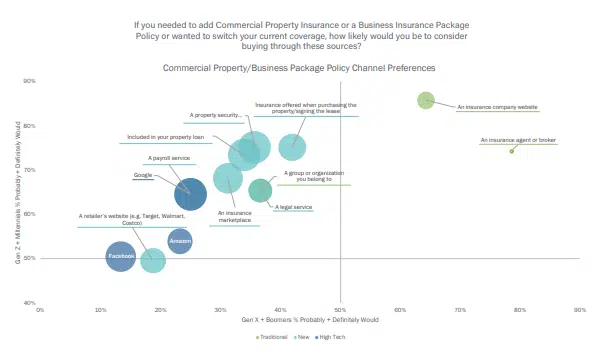

In one other view of this knowledge, Determine 4 emphasizes the dominance of the 2 conventional channels (brokers/brokers and insurance coverage firm web sites) within the higher right-hand quadrant by way of curiosity. The bigger bubble for insurance coverage firm web sites signifies Gen Z and Millennial SMBs’ larger desire for this channel as in comparison with the older era.

Due to the decrease curiosity by the older era and enormous gaps between the 2 generational teams, the opposite channels are represented by bigger bubble sizes – highlighting market alternatives for the youthful era for insurers.

Determine 4: Generational alignment on curiosity in channel choices for business property/BOP insurance coverage

The brand new and rising spectrum of channel choices, particularly the thrilling alternatives for embedded insurance coverage, will give modern insurers and their companions super alternatives for progress, with new markets, new choices, glad and constant prospects. Majesco’s Digital Customer360 for P&C and Digital Agent360 for P&C[DG3] , with new and rising AI instruments, will place Industrial and BOP insurers able to capitalize on their Proper Place, Proper Value method.

Staff Compensation and Cyber Insurance coverage

As companies proceed to adapt to the impacts of the pandemic, low unemployment, new work choices, and inflation, they’re adjusting their operational fashions to satisfy worker wants and expectations, which, in flip, has implications for staff compensation. As firms look to rising traits and dangers comparable to marijuana legalization, distant working, psychological well being and wellness, and elevated use of Gig staff, the affect on SMBs and staff compensation insurance coverage will drive insurers to rethink their method.

As well as, cyber will proceed to rise to the highest as SMBs speed up the digitalization of their enterprise. In keeping with a report by Gallagher, “After three years of hardening circumstances, the cyber insurance coverage market has lastly begun to indicate indicators of stabilization and from a premium perspective, cyber insurance coverage consumers are seeing smaller charge will increase and, in some circumstances, even flat renewals.”[ii]

Managing and minimizing these dangers will turn out to be ever extra essential to SMBs, mirrored within the curiosity in value-added companies.

Demand for Worth-Added Companies

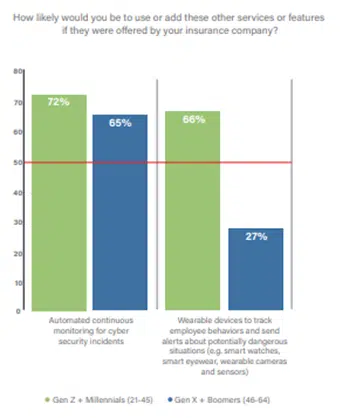

Cyberattacks are on the rise for SMBs, a lot of whom are ill-equipped to deal with or get well from an assault. Consequently, cyber threat/knowledge safety is the fifth most vital top-of-mind problem for each Gen Z and Millennials (66%) and Gen X and Boomers (63%) as beforehand famous. As such, it isn’t stunning there’s very excessive curiosity by each generational segments within the value-added service of automated, steady monitoring for cyber safety incidents (72%, 65%), as seen in Determine 5. With their rising digital capabilities, minimizing this threat turns into more and more vital to their ongoing enterprise operations in addition to for holding their prospects’ belief. Main insurers providing cyber insurance coverage are working with their prospects to offer these companies, differentiating them available in the market in addition to serving to to reduce any losses.

Curiosity in employee’s compensation value-added companies diverge between the 2 generational teams. Gen Z and Millennials’ robust curiosity in utilizing wearable units to watch worker behaviors for doubtlessly unsafe conditions (66%) is in stark distinction to that of Gen X and Boomers, with a spot of 39%.

With the rising curiosity in wearables by people by Fitbit, Apple Watch, and different units, these units have the potential to forestall accidents or accidents, streamline the restoration course of, scale back claims, and finally, enhance well being and monetary outcomes for workers and employers by a speedy restoration. Insurers ought to benefit from the curiosity of the youthful era of SMBs with new, modern merchandise and value-added companies connected to them.

Determine 5: Curiosity in value-added companies with knowledge breach/cyber and staff compensation insurance coverage

Increasing Channel Choices

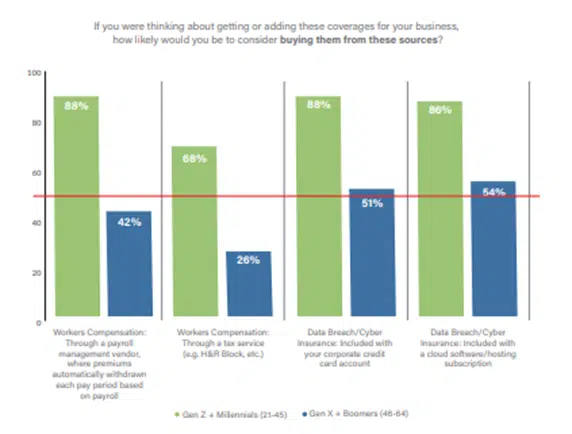

As mirrored in Determine 6, Gen Z and Millennials proceed their excessive curiosity in new channels for each staff comp and knowledge breach/cyber safety, starting from 68% to 88%.

Nonetheless, a disparity emerges for Gen X and Boomers between these two strains of enterprise. Their curiosity in two embedded choices for cyber insurance coverage exceeds the 50% midpoint, however their curiosity in new staff comp channels is decrease, reaching simply 42% for acquiring it by a payroll administration vendor and 25% for acquiring it by a tax service. We may speculate that Gen X and Boomers’ views on these two varieties of protection could possibly be influenced by their longer expertise with staff comp, and the truth that it’s usually a required protection.

Each areas are seeing elevated or rising threat for SMBs, leaving many unprepared for the possibly critical penalties. Insurers providing these merchandise ought to look to different channels to assist educate and provide these merchandise, serving to SMBs whereas additionally rising their enterprise.

Determine 6: Curiosity in channel choices for knowledge breach/cyber and staff compensation insurance coverage

Understanding these ache factors for SMBs is the equal of understanding the alternatives as an insurer. Each new menace represents a brand new risk for insurance coverage to play a task. And every new product and repair has the potential to be bought at some extent of sale or use — that means that digital service and multi-channel methods are essential to serving the brand new SMB cohort.

As an insurer, irrespective of the place you’re within the strategy of product and channel growth for Industrial and BOP P&C, Employee’s Comp, and Cyber, your group can benefit from Majesco’s new, revolutionary Clever Core options for insurers. Majesco P&C Clever Core Suite, Loss Management, Property Intelligence and Digital 360 Options are[DG4] designed to be essentially the most versatile and sturdy system resolution obtainable — able to dealing with a far wider vary of enterprise merchandise and channels than ever earlier than. Majesco’s clever core platforms harness the ability of microservices, APIs, cloud, AI/ML, generative AI, pre-configured content material and finest practices, entry to new knowledge sources, and an ecosystem of modern capabilities.

For a clearer image of how your organization can benefit from all that Majesco presents, you should definitely tune into the Majesco webinar, The Daybreak of Clever Core Insurance coverage Software program as we speak.

[i] Cavignac, Jeff, “What to Count on for the Industrial Insurance coverage Market in 2023,” Danger Administration, November 21, 2022, https://www.rmmagazine.com/articles/article/2022/11/21/what-to-expect-for-the-commercial-insurance-market-in-2023

[ii] Farley, John, “2023 U.S. Cyber Market Circumstances Outlook Report,” Gallagher, January 2023, https://www.ajg.com/us/news-and-insights/2023/jan/2023-us-cyber-market-conditions-outlook-

Related Posts

- Specialty insurance coverage firm Ryan Specialty to purchase AccuRisk

AccuRisk is an MGU centered on providing medical stop-loss options. Credit score: Zhen H/Unsplash. US-based…

- Driving development with higher service for insurance coverage clients | Insurance coverage Weblog

Customer support is the ultimate vital piece of reimagining your entire buyer expertise that insurers…

- HDI International Specialty insurance coverage capability partnership Coalition

HDI International Specialty will assume a quota share on all of Coalition’s cyber insurance coverage…