What You Must Know

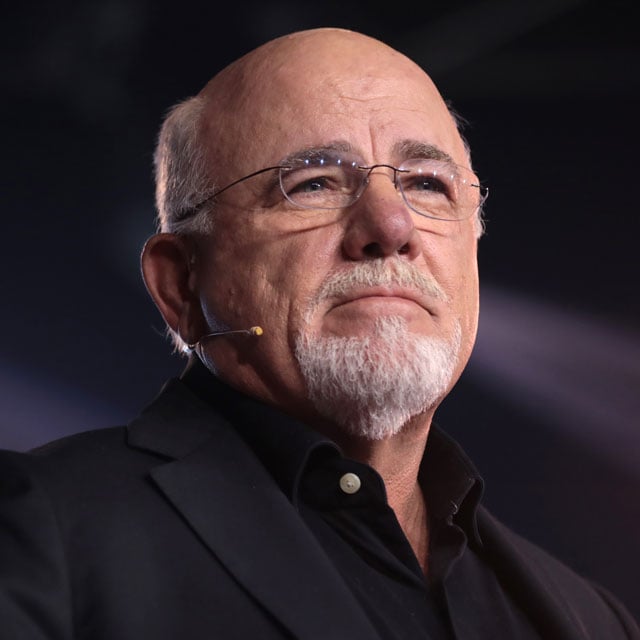

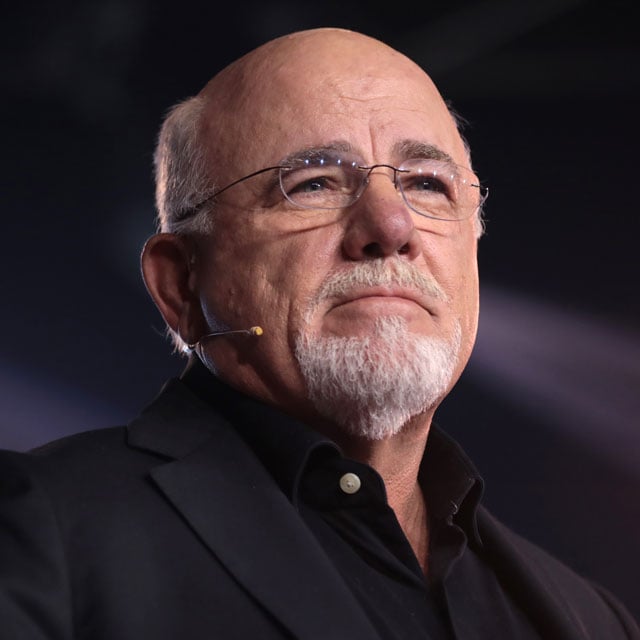

- Dave Ramsey sparked a giant debate by arguing that retirees ought to make investments and spend far more aggressively than researchers recommend.

- Some well-known monetary planners criticized the nationwide persona’s argument for 8% withdrawals and a 100% inventory allocation.

- Revenue consultants hope that the continuing debate will focus consideration on the advanced and evolving points tied to retirement spending.

Dave Ramsey has executed monetary advisors a favor by bashing the conclusions of a number of retirement consultants about “secure” withdrawal charges in his latest podcast, two veteran monetary planners say — by drawing consideration to the necessity for tailor-made approaches for purchasers.

Throughout a latest podcast, Ramsey — a well-liked and at-times provocative nationwide monetary planning persona — blasted retirement spending researchers for being “supernerds” and “goobers” who “stay of their mom’s basement with a calculator.”

Ramsey went on to argue that the business’s conventional 4% withdrawal rule (and more moderen revenue planning methods that make the most of dynamic guardrails to manage spending) is overly conservative, and it fails to completely leverage the ability of the inventory market.

Relatively than relying on rigorously calculated spending methods which can be revisited and adjusted over time, he suggests a 100% inventory portfolio and eight% annual withdrawals.

The assertion could fly within the face of the standard fiduciary monetary skilled’s perspective, but it surely additionally offers monetary advisors with an entry level for deeper planning conversations with their purchasers and prospects.

That’s, advisors can show precisely what Ramsey fails to debate about sequence of returns danger, the rising challenges of longevity and the hazards which can be offered by counting on overly bullish market predictions.

This was the consensus of numerous revered monetary planning consultants who had been all requested this week to weigh in on the Ramsey vs. “Supernerds” debate, together with Bryn Mawr Belief’s Jamie Hopkins and Morningstar’s John Rekenthaler.

Whereas he understands his business colleagues’ skepticism about Ramsey’s 8% spending argument, Hopkins tells ThinkAdvisor he’s truly a lot much less skeptical than others could also be, and he cites his deep engagement with the newest planning analysis because the trigger.

As Hopkins explains, the actual cause there might be a lot debate about retirement spending methods is that there’s “truly no single proper reply on this matter, and the spending query is extra of a real debate versus a query of what’s proper or flawed.”

Ramsey’s Views & Trio’s Response

Ramsey, for his half, argued that the secure spending determine is definitely round 7% or 8%, a viewpoint based mostly largely on his simultaneous assertion that many retirees could be higher off with a 100% inventory allocation versus a standard 60-40 and even 50-50 mixture of shares and bonds.

Each the normal 4% withdrawal rule and more moderen spending guardrails frameworks use these “safer” asset allocations, and Ramsey additional argued that such a “pessimistic” investing and spending method could lead on many individuals to imagine that they’ll by no means afford to retire.

Taking to LinkedIn, Wade Pfau, a widely known retirement researcher, steered that Ramsey’s perspective could sound rational to the standard novice investor, however the actuality is that he’s talking from the place of a “complete returns extremist.”

“If that’s your factor, then extra energy to you,” Pfau wrote. “However he’s suggesting a really dangerous method to retirement revenue, and never all his listeners will perceive the dangers they’re taking with an 8% withdrawal on a 100% shares portfolio.”

Past his feedback on social media, Pfau was considered one of a trio of self-professed supernerds who responded to Ramsey’s call-out in a broadly circulated ThinkAdvisor commentary piece. In it, Pfau argues alongside Michael Finke and David Blanchett that Ramsey’s place dangerously overlooks that the sequence of returns danger is actual — and it’s a giant a part of what makes retirement revenue totally different from pre-retirement wealth accumulation.

What Planners Are Saying

Among the many dozens who responded to the “supernerds” kerfuffle on social media this week was Roger Whitney, an authorized monetary planner and founding father of the Rock Retirement Membership.

“I’ve met [the supernerds] and assume they’re clever, fantastic individuals,” Whitney wrote. “The talk is, what’s a secure withdrawal price? 8% over 4%? That is an educational query.”

As Whitney and plenty of others emphasize, sound retirement planning isn’t based mostly on any single metric, whether or not that may be a secure withdrawal price or another determine.

“Nobody creates a plan and sticks to it all through retirement,” Whitney argues. “Objectives and markets are messy. Heck, life is all the time messy. The one fixed I’ve seen in strolling with retirees is CHANGE. Some are predictable, however most will not be!”

Whitney provides that the “supernerds” are appropriate in advocating for flexibility and a few measure of warning within the revenue planning course of, given simply how excessive the stakes are for any given particular person or couple. Failure, on this planning context, can imply that ageing Individuals run out of cash to fund their way of life at a really weak time in life, when returning to work or decreasing spending might be tough or not possible.

“Modifications in objectives, circumstances, markets, rates of interest, and so forth., all occur randomly,” Whitney warns. “In the end, it doesn’t matter whether or not a retiree begins with an 8% or 4% withdrawal price. What issues most is having a sound course of faithfully adopted to make little changes as life unfolds. The uncomfortable reality is there isn’t a reply.”

Extra Skeptical View

The same perspective was shared by Morningstar’s John Rekenthaler, director of analysis, in an in-depth response posted to the agency’s web site and in supplementary feedback shared with ThinkAdvisor.

“This isn’t a lot of a ‘debate,’” Rekenthaler suggests. “As my article states, Ramsey’s argument is predicated on the doubly false assumptions that shares reliably return 11% to 12%, and that solely common returns matter for portfolios which can be funding withdrawals. In reality, as everyone knows, shares have extended stretches the place they make a lot lower than that, and volatility strongly damages the flexibility of portfolios to outlive below such circumstances.”