Insurance

How a lot does small enterprise insurance coverage price?

Does cheaper actually imply higher in the case of small enterprise insurance coverage price? What components have an effect on premiums? Learn on and discover out

Having the proper sort of protection is essential for any enterprise, particularly when you personal a start-up or small enterprise that’s nonetheless weaving its strategy to profitability. However how a lot will small enterprise insurance coverage price you? Will it present the safety that you just want? And does cheaper actually imply higher in the case of this type of protection?

Should you’re a small enterprise proprietor looking for solutions to those questions, then you definately’ve come to the proper place. On this information, Insurance coverage Enterprise will provide you with an in depth breakdown of how a lot the various kinds of small enterprise insurance coverage price. We will even clarify how every coverage works and what components have an effect on pricing. We encourage insurance coverage professionals to share this text with their small enterprise shoppers to assist them work out how a lot they’ll spend on the completely different coverages that they want.

The price of small enterprise insurance coverage begins at round $20 and might exceed $125 monthly or $240 to $1,500 yearly primarily based on the varied worth comparability and insurer web sites we checked out. The precise price of protection, nevertheless, will depend on the form of safety that your small business wants.

The most typical sort of insurance coverage that small companies take out known as enterprise proprietor’s coverage or BOP. This will price between $40 and $100 month-to-month on common.

BOP bundles collectively normal legal responsibility and business property insurance coverage. If bought as a standalone cowl, the month-to-month premiums for these insurance policies vary from about $40 to $55 and $60 to $70, respectively.

Some BOPs additionally embrace enterprise interruption insurance coverage, which might price about $40 monthly for low-risk enterprises and $130 for companies which can be uncovered to extra dangers.

The desk beneath gives a breakdown of the various kinds of insurance policies small companies usually buy and the way a lot they price.

Small enterprise insurance coverage price – breakdown by coverage sort

|

HOW MUCH DOES SMALL BUSINESS INSURANCE COST?

|

||

|---|---|---|

|

Sort of coverage

|

Common month-to-month premiums

|

Common annual premiums

|

|

Enterprise proprietor’s coverage

|

$40 to $100

|

$480 to $1,200

|

|

Normal legal responsibility insurance coverage

|

$40 to $55

|

$480 to $660

|

|

Business property insurance coverage

|

$60 to $70

|

$720 to $840

|

|

Enterprise interruption insurance coverage

|

$40 to $130

|

$480 to $1,560

|

|

Staff’ compensation insurance coverage

|

$45 to $70

|

$540 to $840

|

|

Business auto insurance coverage

|

About $150

|

About $1,800

|

|

Skilled legal responsibility insurance coverage

|

$50 to $60

|

$600 to $720

|

|

Product legal responsibility insurance coverage

|

$30 to $60

|

$360 to $720

|

|

Cyber insurance coverage

|

$140 to $150

|

$1,680 to $1,800

|

Please observe that these figures are estimates. Your precise charges could be considerably greater or decrease relying on your small business’ distinctive set of wants and circumstances.

Within the succeeding part, we’ll talk about how insurance coverage firms decide the premiums for every sort of protection listed above.

The price of small enterprise insurance coverage insurance policies is impacted by a spread of things. Let’s undergo every of them.

1. Normal legal responsibility insurance coverage price

Small companies usually pay round $40 to $55 month-to-month or $480 to $660 yearly for normal legal responsibility insurance coverage protection. However since your small business faces a distinct set of dangers in comparison with different enterprises, your premiums might likewise range. Listed below are the principle components that dictate the price of normal legal responsibility insurance coverage.

- Sort of business: Workplace-based companies that don’t expertise plenty of foot site visitors comparable to monetary consultancies pay decrease charges than retailers, which clients frequent and face a better probability of accidents.

- Enterprise dimension: The extra workers a enterprise has, the upper the price of insurance coverage as every workers member carries a sure degree of danger.

- Claims historical past: Every declare you make can push up your premiums come renewal time. Insurers view companies with a historical past of lawsuits and previous claims to cowl losses as high-risk.

- Location: Companies primarily based in areas with greater crime and accident charges usually tend to have greater premiums than these in safer areas.

You’ll be able to take a look at our complete information to normal legal responsibility insurance coverage price for extra particulars on how insurance coverage firms calculate premiums for such a coverage.

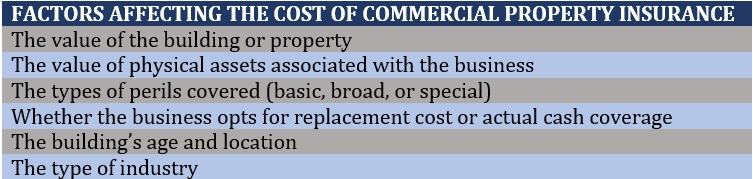

2. Business property insurance coverage price

Though not necessary, business property insurance coverage is commonly required in business leasing preparations. The desk beneath lists the various factors that affect small enterprise insurance coverage price for this type of protection.

3. Enterprise interruption insurance coverage price

Enterprise interruption insurance coverage, additionally referred to as BI protection, gives monetary safety for the losses your small business sustains because of a disruption to your operations brought on by an insured occasion. It covers your working prices whereas your small business briefly shuts down.

Identical to in different varieties of insurance policies, the business, enterprise location, and previous claims have a significant affect on the price of protection. The opposite components that have an effect on BI premiums embrace:

- Income: As a result of such a protection compensates a enterprise for misplaced revenue throughout a short lived shutdown, these with greater income are inclined to pay greater charges.

- Property worth: Enterprise interruption insurance coverage covers the prices if you have to transfer to a short lived location. Should you personal or hire a high-value business property, your premiums will even be greater.

- Protection limits: As with different small enterprise insurance coverage insurance policies, the upper the protection limits, the upper the prices.

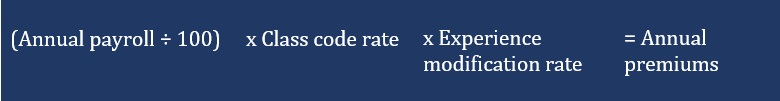

4. Staff’ compensation insurance coverage price

Staff’ compensation is a kind of enterprise insurance coverage coverage that covers the price of medical care and part of misplaced revenue of workers who turn into injured or unwell whereas doing their jobs. Nearly all states require companies to take out employees’ compensation insurance coverage.

Staff’ compensation premiums are calculated utilizing this system:

As you will have seen, there are three primary components that have an effect on how charges are calculated. These are your small business’:

- Annual payroll: This consists of the salaries and advantages of all of your workers, together with those that work full-time, part-time, seasonal, and short-term. Typically, the bigger your payroll, the upper the premiums you pay for protection.

- Job classification code: This a is a four-digit quantity that signifies the kind of work a job entails and the dangers related to it.

- Expertise modification price (EMR): Insurers use EMRs to match a enterprise’ claims historical past towards the business common to foretell its probability of submitting claims sooner or later. An EMR above the business common of 1.0 means your losses are better than the common, which pushes your premiums up.

To grasp the maths, right here’s a information on how employees comp is calculated.

5. Business auto insurance coverage price

Business auto insurance coverage is one other necessary protection for small companies working a automobile. It really works identical to commonplace personal automobile insurance coverage however covers business autos.

The desk beneath lists among the primary components that dictate small enterprise insurance coverage price for business autos.

6. Skilled legal responsibility insurance coverage

Companies in sure industries are required, both by regulation or business requirements, to buy skilled legal responsibility insurance coverage. The sort of coverage protects them towards claims of economic losses ensuing from alleged or precise negligence. Some shoppers can also require your small business to hold such a protection earlier than agreeing to do enterprise with you.

The primary components that affect the price of skilled legal responsibility insurance coverage embrace:

- The business your small business is in, and the dangers related to it

- The place the enterprise is positioned

- Years of operation

- Variety of workers

- Earlier claims

- Protection limits and deductibles

If you wish to study extra about how such a protection can defend your small business, you may take a look at our complete information to skilled legal responsibility insurance coverage.

7. Product legal responsibility insurance coverage

Product legal responsibility insurance coverage protects your small business towards lawsuits from clients claiming losses or damage due to a product you manufacture, design, or promote. Some normal legal responsibility insurance coverage insurance policies additionally present such a protection.

Premiums for product legal responsibility insurance policies are influenced by the identical components that dictate the price of skilled legal responsibility and normal legal responsibility insurance coverage.

8. Cyber insurance coverage price

Cyber insurance coverage is a kind of insurance coverage coverage designed to cowl monetary losses if your small business falls sufferer to a cyberattack. Insurers typically decide the price of protection utilizing these components:

- Firm dimension: The better the variety of customers, units, and methods your small business has, the bigger its menace floor. This implies a better probability of falling prey to cybercriminals, pushing up the premiums you have to pay.

- The kind of business: Some industries are extra liable to cyberattacks than others. Companies that deal with delicate info comparable to these below monetary companies and healthcare are enticing targets for cybercriminals, elevating the price of protection.

- Income: If your small business earns greater income, insurers are inclined to view it to be at a better danger of being focused by cybercriminals, growing the value you have to pay.

- Degree of protection: The upper your coverage limits, the upper your premiums.

- Cybersecurity measures in place: Insurers will typically reward your small business with cheaper charges when you allocate important sources for stopping cyber incidents from occurring.

Cyber insurance coverage is more and more changing into an important type of protection, particularly with digital transformation happening at a fast price. You’ll be able to take a look at what sort of safety the highest insurers within the nation present in our newest rankings of the high cyber insurance coverage firms within the US.

Small enterprise insurance coverage price – does cheaper actually imply higher?

Price is a crucial consideration in the case of selecting the best protection, particularly for a lot of small companies with restricted monetary sources. However as a small enterprise proprietor, you must also take note of the standard of protection inexpensive plans present. Whereas a less expensive coverage might suit your finances, it could not provide the extent of protection that your small business requires.

Should you’re looking for the proper insurance policies that fit your wants and monetary scenario, the very best transfer is to strike a stability between small enterprise insurance coverage price and the kind of safety these insurance policies present. It’s also advisable to seek the advice of an skilled insurance coverage agent or dealer who can assist you make an knowledgeable determination as to what sorts of protection to take out.

Enterprise insurance coverage performs an important position in serving to firms maintain operations when surprising accidents and disasters happen. If you wish to study extra about how such a protection can assist you navigate difficult occasions, you may take a look at our complete information to enterprise insurance coverage.

Is small enterprise insurance coverage value the fee? Do you suppose start-ups and small enterprises can survive with out it? Be at liberty to share your ideas beneath.

Associated Tales

Sustain with the most recent information and occasions

Be a part of our mailing checklist, it’s free!

Related Posts

- Insurance coverage Enterprise secures quite a few business awards

Insurance coverage Enterprise secures quite a few business awards | Insurance coverage Enterprise America Insurance…

- Assessment your enterprise life insurance coverage coverage yearly

Life insurance coverage could be a precious a part of your enterprise plans. We…

- First Insurance coverage & Danger Administration commences enterprise in US

A tailor-made danger administration dashboard based on business or classification is made accessible for insureds,…