Insurance

How a lot do medical health insurance brokers make per coverage?

How a lot do medical health insurance brokers make per coverage? What elements influence how a lot brokers earn? Learn on to search out out the solutions to those questions and extra

The sector of medical health insurance within the USA is powerful and all the time increasing. It may possibly seem to be a reasonably positive profession, however you might be questioning about sure monetary facets of the job, similar to how a lot do medical health insurance brokers make per coverage? Insurance coverage Enterprise will reply this query and extra on this article.

The fee charges for medical health insurance brokers differ relying on the medical health insurance supplier they’re working with. The frequent vary is between 5% and 10% of a coverage’s whole premiums for the primary 12 months, with the proportion happening after a plan is renewed.

Right here’s a pattern calculation of how a lot medical health insurance brokers make per coverage for a person medical health insurance plan, with annual premiums of $5,472, which is the nationwide benchmark, in keeping with the newest figures from Healthcare.gov.

Examples of earnings on particular person medical health insurance insurance policies

|

Annual premiums

|

Fee price

|

Fee quantity

|

|---|---|---|

|

$5,472

(Nationwide benchmark common)

|

5%

|

$273.60

|

|

10%

|

$547.20

|

Given the calculations above, a medical health insurance agent can earn between $273.60 and $547.20 in commissions per coverage within the first 12 months. If the fee price drops to 1% or 2% after renewal, the agent is ready of make about $54.72 to $109.44 within the succeeding years the coverage is lively.

For brokers specializing in group well being insurance policies, which corporations buy for his or her workers, fee charges are barely decrease at round 3% to six% of the entire premiums. However contemplating that many companies have a number of workers, this may translate to as much as four- and even five-figure earnings per firm.

The pattern calculation under is for a small enterprise with 15 workers paying $100,000 in premiums yearly for a bunch medical health insurance coverage.

Examples of earnings on group medical health insurance insurance policies

|

Annual premiums

|

Fee price

|

Fee quantity

|

|---|---|---|

|

$100,000

(Small enterprise with 15 workers)

|

3%

|

$3,000

|

|

6%

|

$6,000

|

As you possibly can see, a medical health insurance agent can earn a four-figure fee from a bunch medical health insurance coverage for a small enterprise, however those that have giant multinational corporations as purchasers, the earnings will be considerably increased.

Some insurers solely use captive brokers to distribute their insurance policies, significantly for particular person plans. This follow, nevertheless, has grow to be much less frequent with the Inexpensive Care Act’s (ACA) medical health insurance market changing into a well-liked venue for insurance coverage brokers to seek for appropriate coverages for his or her purchasers.

By way of wage, a lot of the employment web sites Insurance coverage Enterprise referred to estimate an agent’s annual common wage to be round $46,000 to $55,000. Aside from fee charges, how a lot medical health insurance brokers make is influenced by a number of elements, together with their expertise degree and the place they promote insurance policies.

The desk under reveals the percentile wage estimates for medical health insurance brokers within the nation based mostly on this web site.

How a lot do medical health insurance brokers make – lowest to highest wage vary

|

PERCENTILE WAGE ESTIMATES (HEALTH INSURANCE AGENTS)

|

||||

|---|---|---|---|---|

|

Percentile

|

Annual wage

|

Month-to-month wage

|

Weekly wage

|

Hourly wage

|

|

tenth

|

$28,750

|

$2,395

|

$553

|

$14

|

|

twenty fifth

|

$41,000

|

$3,416

|

$788

|

$20

|

|

fiftieth (Median)

|

$55,188

|

$4,599

|

$1,061

|

$27

|

|

seventy fifth

|

$60,000

|

$5,000

|

$1,153

|

$29

|

|

ninetieth (High earners)

|

$88,500

|

$7,375

|

$1,701

|

$43

|

In response to the positioning, the majority of medical health insurance brokers earn common salaries between the twenty fifth and seventy fifth percentiles, or about $41,000 to $88,500 per 12 months. Wage figures under or above this vary are thought-about outliers.

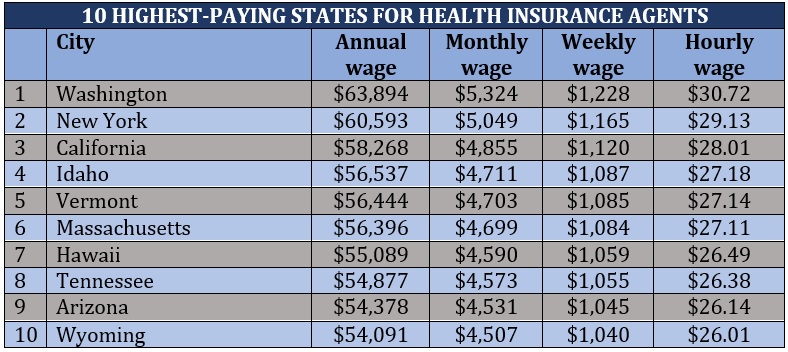

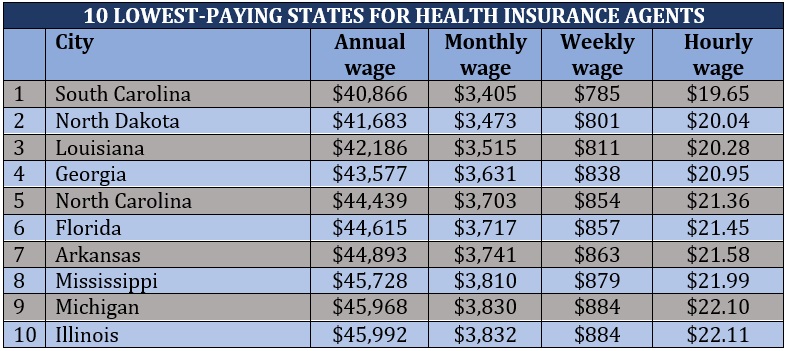

Every state implements totally different necessities for healthcare protection, which might instantly have an effect on an agent’s incomes potential. Right here’s an inventory of the highest- and lowest-paying states for medical health insurance brokers based mostly on median salaries.

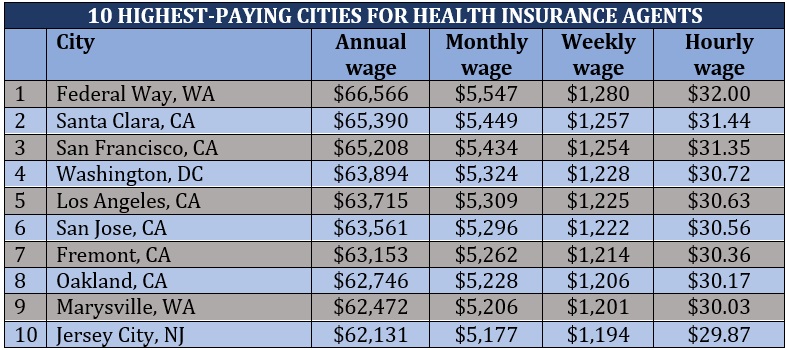

The desk under reveals how a lot medical health insurance brokers make within the highest-paying cities throughout the US.

Medical health insurance brokers act as a consultant of a number of suppliers, promoting well being insurance policies on the insurers’ behalf. These licensed professionals are tasked to elucidate the important thing options and advantages of various well being plans to potential purchasers, helping them to find insurance policies that cater to their distinctive wants.

This obligation is considerably much like that of an insurance coverage dealer. However whereas brokers work on behalf of the insurance coverage corporations, brokers are tasked to behave in one of the best pursuits of the insurance coverage consumers.

Among the different normal obligations of a medical health insurance agent embody:

- Screening and interviewing potential purchasers

- Assessing current purchasers’ insurance policies for any wanted additions or adjustments

- Calculating premiums and presenting quotes to purchasers

- Customizing medical health insurance plans to fulfill every shopper’s protection wants

- Dealing with coverage renewals

- Assist purchasers in settling claims

- Protecting buyer data up to date and arranged

Because of the excessive price of healthcare within the USA, medical health insurance has grow to be a necessary monetary device for a lot of People to afford crucial medical care. A medical health insurance agent additionally performs an necessary position in serving to residents discover inexpensive medical health insurance plans that match their wants.

The trail to changing into a medical health insurance agent has minimal entry obstacles, however as soon as there you will have to earn numerous certifications to progress in your profession. Listed below are a number of the steps you should observe if you wish to pursue a profession as a medical health insurance agent:

- End your training: To be a medical health insurance agent, you should at the least have a highschool diploma or GED certification. A school diploma might help enhance your job prospects however isn’t essentially required.

- Full a background verify: Some states require insurance coverage corporations and companies to run backgrounds on potential brokers. These embody checking prison data, credit score historical past, earlier employment, academic data, and drug take a look at outcomes.

- Get your license: Every state has totally different licensing necessities for insurance coverage brokers, so it’s best to verify along with your state’s insurance coverage division to search out out what the precise {qualifications} are. In case you’re planning on working with the ACA’s medical health insurance market, you should have the suitable certification and full the trade’s yearly coaching.

- Decide a well being insurer to work for: Most insurers, together with the most important medical health insurance suppliers within the US, use advertising and marketing organizations to search out potential brokers. The advertising and marketing organizations assist get you appointed to an insurance coverage firm. Many regional well being insurers, in the meantime, will be contacted instantly. No matter dimension, insurers could have their very own employment necessities.

- Pursue additional training: Medical health insurance brokers should full persevering with training (CE) to maintain their licenses lively. CE programs additionally differ between states.

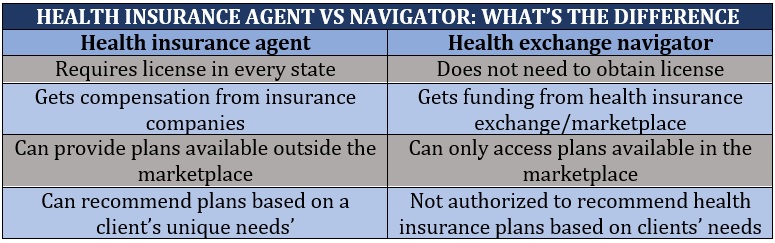

Medical health insurance navigators – additionally known as authorities trade navigators – help folks in acquiring protection via the ACA’s medical health insurance market, in addition to assist those that are already enrolled with totally different points concerning their protection, very similar to what medical health insurance brokers do.

In contrast to medical health insurance brokers, nevertheless, navigators can’t provide plans that aren’t accessible in authorities exchanges. Insurance coverage brokers, however, can present purchasers – so long as they aren’t utilizing subsidies – different ACA-compliant well being insurance policies solely accessible exterior authorities exchanges.

And whereas well being trade navigators are skilled and authorized by {the marketplace}, they aren’t licensed by the state the best way that medical health insurance brokers are. Which means navigators can’t present coverage suggestions not like brokers can and are there as a substitute to supply purchasers neutral info to assist them make selections about what plan will greatest go well with their wants.

As well as, navigators don’t obtain any compensation from medical health insurance corporations. Navigator organizations as a substitute get funding from the medical health insurance trade.

The desk under lists the primary variations between a medical health insurance agent and a well being trade navigator.

The ACA was enacted in 2010, which was designed to scale back healthcare prices to make sure that extra American households can entry medical health insurance. The regulation allows sufferers who could lack protection on account of pre-existing situations or restricted funds to get inexpensive insurance coverage via their state’s medical health insurance market.

By way of these marketplaces, sufferers can select from a variety of well being plans to go well with their totally different wants. These embody:

- Well being Upkeep Group (HMO): Limits protection to care from docs who work for or are contracted with the HMO, besides throughout an emergency. Plans might also require {that a} policyholder dwell or work in its service space to be eligible for protection.

- Unique Supplier Group (EPO): A managed care plan, which covers providers provided that the docs, specialists, or hospitals are within the plan’s community, besides in instances of emergency.

- Level of Service (POS): Policyholders pay much less in the event that they entry docs, hospitals, and different healthcare suppliers belonging to the plan’s community. It additionally requires policyholders to get a referral from their major care physician to see a specialist.

- Most well-liked Supplier Group (PPO): Policyholders to pay much less in the event that they select to get remedy from suppliers within the plan’s community, however they’ll additionally entry docs, hospitals, and suppliers exterior of the community with out a referral for an extra price.

Medical health insurance plans are additionally accessible in 4 classes based mostly on how the prices are break up between the policyholder and the insurer. Additionally referred to as the “metallic tiers,” these plans are:

- Bronze: 60% well being insurer, 40% policyholder

- Silver: 70% well being insurer, 30% policyholder

- Gold: 80% well being insurer, 20% policyholder

- Platinum: 90% well being insurer, 10% policyholder

If you wish to know what medical health insurance within the US covers, and the way healthcare protection works in different international locations, you possibly can try our world medical health insurance information.

Being a medical health insurance agent generally is a rewarding profession as a result of it offers one a possibility to assist folks in instances of want and make a optimistic influence on their lives. If you wish to pursue a profession as a medical health insurance agent, the web is an effective place to start out. Do a fast on-line search and you will discover a whole bunch, if not 1000’s, of vacancies for medical health insurance brokers.

Do you assume being a medical health insurance agent is a worthwhile profession? Have been you shocked to learn the way a lot medical health insurance brokers make per coverage? Share your ideas within the feedback part under.

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!

Related Posts

- How a lot do medical insurance brokers make on common?

How a lot do medical insurance brokers make on common? | Insurance coverage Enterprise America…

- Companions& acquires Hart Insurance coverage Brokers

Credit score: Chris Liverani on Unsplash Primarily based in Helensburgh and led by Alistair Hart,…

- SiriusPoint unveils medical insurance coverage product in China

Blue Ocean LifeTime is meant for 200 million WaterDrop customers. Credit score: SiriusPoint. SiriusPoint’s Life…