Insurance

Group & Voluntary profit innovation wanted to alleviate stress

Printed on

In case you suppose your insurance coverage know-how job has been altering dramatically within the final three years, strive working in Human Assets!

Working in at the moment’s HR is form of like making an attempt to maintain water in a colander. You try and preserve precious workers from quitting or retiring whereas on the similar time hiring sufficient folks to maintain the colander full. You do that whereas making an attempt to maintain your worker inhabitants bodily and mentally wholesome, along with monitoring their efficiency and advantages. You additionally cope with HR disaster conditions, and you’re chargeable for upgrading HR know-how to satisfy the rising calls for of HR administration.

HR is so complicated! Good HR execs want interpersonal expertise, analytical experience, and a beneficiant dose of knowledge. In addition they want methods to extend their resilience as a result of HR groups are affected by burnout.

For sure, HR is stressed.

It’s simple to see how we arrived right here. From making an attempt to arrange distant operations throughout Covid, overseeing hybrid work conditions now, combating for expertise, shifting worker demographics, and coping with their very own understaffed HR departments and an improve of their very own applied sciences — there may be an excessive amount of to do and too little time through which to do it.[i]

Insurers now have a chance to alleviate a few of their buyer stressors. How? Serving to them with one of the vital vital points associated to worker retention and enhancing advantages packages. New varieties of staff are persevering with to emerge, driving adjustments to product wants, eligibility, and choices.

However because of this Group and Voluntary insurers should deal with one among their most impactful stressors … their operational mannequin and know-how basis. It requires a concentrate on enterprise transformation.

Transformation begins with listening.

Assembly at the moment’s altering market want for advantages isn’t only a matter of easy conjecture and even market knowledge. It requires an understanding round at the moment’s actual product, service, and know-how points. The place are the stress factors? How can insurers rework to take away their very own stress and buyer stress?

At a current roundtable dialogue, Majesco and Capgemini listened to insurance coverage executives as they mentioned the challenges of recent market dynamics in serving their Group & Voluntary insurance coverage clients. They lined each inner and exterior points. You may learn the complete report by downloading, Don’t Pull Again…Put the Pedal to the Steel for L&AH Transformation. In at the moment’s weblog, we are going to share insights from our conversations relating to points corresponding to:

- Market drivers

- Buyer expectation gaps in a posh buyer atmosphere

- Product shifts (and worker expectations) that can require tech innovation

Every of those conversations resulted in lists of actual, on a regular basis points that insurers and their clients face. These lists turn into the start line for understanding how firm stresses and buyer stresses may very well be solved with options that meet the wants of each.

Layers of stress relieved by next-gen tech options

In 2023, we see cost-of-living challenges, rising medical bills, decrease disposable incomes, inflation, rising expertise loss with projected retirements inside the business, the battle to accumulate and preserve new expertise, and the problem of legacy know-how.

On the within of the insurance coverage enterprise…

…insurers compete in a post-COVID market, the place they’re challenged with new worker expectations relating to work flexibility and the know-how wanted for his or her jobs. On the similar time, long-tenured workers are retiring and taking essential enterprise data with them, together with about their operational processes, merchandise, and legacy techniques. The influence is new workers suppose in another way and need digital know-how to do their work.

On the surface of the enterprise…

Brokers are in dire want of recent applied sciences, looking for options from insurers that make it simple to do enterprise with them and applied sciences that present a customer-centric view. Clients led by their HR groups are desirous to embrace new applied sciences, merchandise, and strategies that can save them time and meet the rising worker range of wants and expectations.

Can insurers…

- enhance their very own enterprise person expertise,

- whereas their groups enhance the dealer expertise,

- whereas the dealer improves the employer expertise,

- whereas the employer improves the worker expertise?

“The youthful expertise, coming in by recruiters, ask for a digital profile of the corporate they’re making use of for as a result of they need to know what sort of know-how they use. That’s a key level. The know-how facet of the place we’ve been as an business versus the expectations of recent workers and associates coming in — there’s a giant hole there.” – Roundtable Participant

One key and a rising layer of stress is the shifting demographics of insurer clients – each the enterprise proprietor and their workers. The “conventional” Group & Voluntary Advantages SMB clients – Gen X and Boomers – which were loyal for years, at the moment are turning into extra digitally savvy and demanding larger worth from their insurance coverage suppliers due to their altering worker demographics.

On the similar time, there may be an rising dominance of SMB clients within the Gen Z and Millennial technology who’re extra in tune with at the moment’s altering worker wants and expectations as a result of they’re one. With the fluid state of employment that’s more and more widespread for the youthful technology and the rising retirement of the older technology — portability, personalization, new merchandise, and adaptability of advantages has turn into crucial within the competitors for expertise to satisfy worker expectations.

However legacy know-how, legacy gross sales, and enrollment strategies can’t meet the shifting worker, dealer, and buyer calls for.

Insurers can enhance their means to develop, make capital extra environment friendly, and scale back prices whereas assembly rising buyer expectations together with new threat and product calls for. It should require insurers to rethink their enterprise technique, together with their operational mannequin and know-how platform, however that’s the form of rethinking that can maximize outcomes.

Stressors require a shift from product to buyer focus.

Till extra lately, the Group and Voluntary enterprise have been product- and broker-centric, relying on the dealer to satisfy the wants of the client with the precise merchandise and plans. However that doesn’t work for all clients – notably smaller ones who could not have entry to a dealer. If insurers shift from a product to a buyer focus, they obtain a fringe profit — a greater understanding of buyer wants and expectations that may be invaluable.

In at the moment’s L&AH market, each group and particular person, clients need to do enterprise when, the place, and the way they need. A customer-first focus is much tougher to attain due to the breadth of buyer sorts and demographics insurers try to serve.

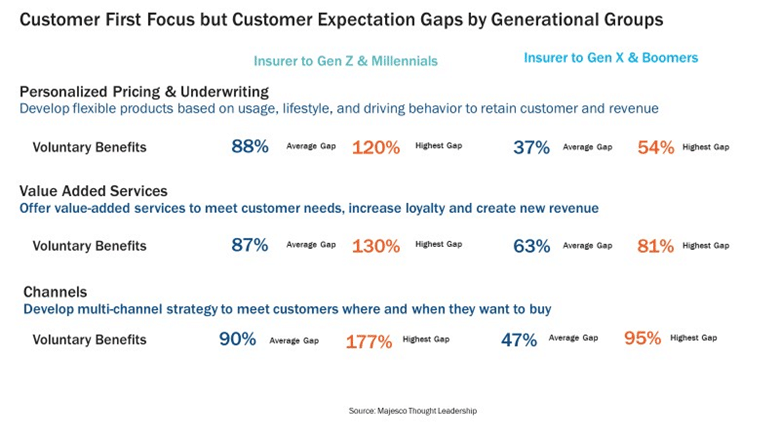

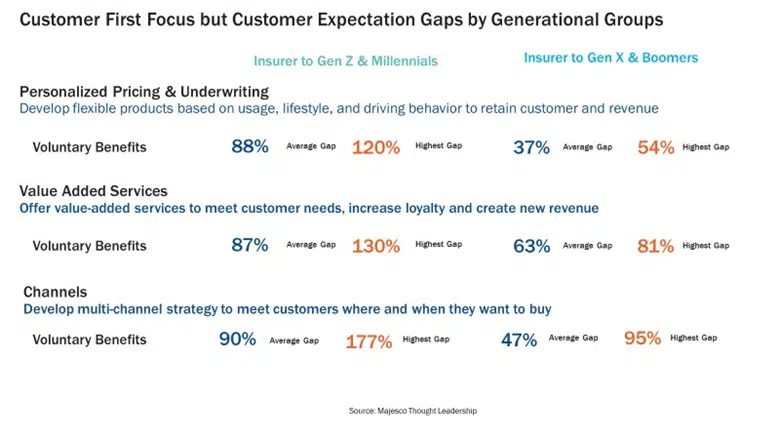

Employers want to have the ability to attraction to 4 vastly totally different generations within the office, which requires the correct mix of merchandise inside profit plans. Protection gaps for customized merchandise and value-added providers inside a profit plan (see Determine 1) can’t be closed with out the event of and supply of recent merchandise that meet the wants of the youthful generations. Employers want the precise advantages bundle to draw and retain expertise throughout a number of generational and demographic teams. It’s complicated and getting extra so.

Determine 1

This similar situation, from the provider perspective, is analogous, however extra technology-based. As Child Boomers and a few Millennials are retiring in rising numbers, recruiting has turn into a serious difficulty. Youthful generations anticipate to make use of next-gen know-how of their jobs – whether or not as an IT or enterprise individual. If not, many don’t come or actually depart inside a number of weeks of becoming a member of. The youthful technology has no need, nor incentive to work on antiquated know-how.

“It proved to be actually difficult to get these Gen Z’s and the millennials up to the mark on our tech and our course of.” – Roundtable Participant

Fixing these generational issues inside insurers will finally assist remedy the challenges they’ve in filling the product, expertise, and channel gaps for his or her clients – each the employer and their workers. It is going to be an enormous step in turning into really customer-centric and assembly the wants of product and digital experiences.

How does your product decrease EVERYONE’s stress?

It’s attention-grabbing. If an insurer redefines “product,” to be all-inclusive of the chance product, value-added providers, and the client expertise, then they immediately turn into a customer-focused and never a product-focused firm. Out of the blue, merchandise turn into the instruments that can improve experiences and add worth to life and work.

The voluntary advantages market should present these sorts of value-driven merchandise with the rising shift in price accountability from employer to worker for many nonmedical, health-related insurance coverage merchandise and the demand for newer merchandise that align with totally different wants. Nonetheless, most of at the moment’s merchandise stay largely conventional — targeted on life, accident, incapacity, medical, dental, and A&H, missing innovation and solutions for brand spanking new wants and expectations, notably for Millennials and Gen Z.

Clients predict extra area of interest, customized merchandise, providers, and experiences that align with their particular wants, dangers, existence, and behaviors. From an elevated curiosity in life, important sickness, and incapacity insurance coverage, to portability, scholar mortgage compensation, pet insurance coverage, or gig worker on-demand insurance coverage, at the moment’s clients anticipate a greater variety of insurance coverage merchandise supplied in profit plans.

“… you may’t compete on wage alone. Profit packages have now turn into increasingly more sturdy, and we’re including in issues like pet insurance coverage or journey and wellness, and mortgage insurance coverage. We’re scholar mortgage compensation and caregiver assist. And it’s not even simply in regards to the product anymore. It’s additionally about providers. The teaching, wellness, and help, — monetary help and the way to retire, [teaching] workers how to consider retirement and funding.” – Roundtable Participant

Insurers who supply new choices along with conventional merchandise have a chance to satisfy the broadening range of consumers with elevated gross sales and the power to develop the connection as they evolve alongside their employment and life journey. This consists of going past the normal L&AH merchandise to broaden into P&C merchandise like auto and owners’ insurance coverage, and pet or journey insurance coverage. Creating or partnering with different insurers to supply the merchandise demanded by altering worker demographics is extra vital than ever for each the insurer and their buyer the employer.

Savvy, revolutionary corporations are redefining insurance coverage from an outside-in perspective to adapt to what clients – of any technology — need and anticipate, as a substitute of following the generations-long apply of an inside-out perspective that requires clients to adapt to the way in which insurance coverage works.

A part of the innovation includes enhancing experiences with out including dramatically to employer and worker advantages prices. In some circumstances, which means increasing buy channels or guiding workers to pick out the merchandise utilizing AI-driven capabilities which might be most related to them, their demographics, and their existence. It means utilizing know-how to drive efficiencies and effectiveness and really innovating with new merchandise.

“HR budgets will not be rising; they’re shrinking in lots of circumstances. We’re seeing a lot of pricing pressures on the dental plans, imaginative and prescient, listening to, and scholar mortgage compensation plans. A number of employers are saying, “Pay attention, I’m going to place a primary healthcare price in among the first preliminary ancillary advantages after which I’m going to chop the worker a examine. I simply want a platform that claims, ‘Decide from one among these 10-12 issues which might be significant to you and related to you.” That is forcing us to consider totally different advantages, totally different partnerships we’d like. Do you go in with one other provider who’s obtained a unique providing and method?” – Roundtable Participant

The transformation that can relieve the pressures upon all stakeholders relies upon next-gen clever core options and digital applied sciences as a brand new basis for a brand new period of group and voluntary advantages. These options have a unique structure, one primarily based on the native cloud. APIs, Microservices & containerization, headless, and most significantly embedded analytics with BI, AI/ML, and Generative AI. These options allow insurers to suppose huge, act quick, create shortly, and innovate when concepts and partnerships come up.

“We now have to be keen to vary in order that we are able to take full benefit of the know-how with out customizing it in order that we don’t proceed to bear these prices of customization and we are able to deploy our folks to our clients and let our merchandise stand on their very own. What’s most vital are the those that we serve and the way we serve them.” – Roundtable Participant

After all, there may be extra to transformation than simply know-how change. It requires forward-thinking management and a tradition that’s keen to vary. Majesco and Capgemini have been collectively main these sorts of transformation efforts, with nice outcomes, positioning Group & Voluntary Advantages insurers for a profitable future.

“I used to be conscious of the partnership earlier than I obtained right here (to Capgemini), mentioned Samantha Chow, Capgemini, Life and Annuity Sector Chief. “It’s a fairly sturdy relationship on the market within the business, that Majesco and Capgemini have had. And never simply on the techniques, integration, and alliances aspect, however on that strategic partnership, supporting the life and advantages business, with a concentrate on legacy modernization and claims, and the way they’ll higher match the wants of our evolving clients.” – Samantha Chow, Capgemini, Life and Annuity Sector Chief

The time is correct for Group & Voluntary leaders to make these selections and step into this new period of advantages with the instruments to make alternatives into earnings. Majesco’s L&AH Clever Core, Majesco International IQX Gross sales & Underwriting Workbench, Digital Enroll360 for L&AH, and ClaimVantage Connect360 for L&AH present insurers with the next-gen cloud platforms they should make the right selections on positioning their group for achievement.

For a deeper take a look at govt opinions and extra concepts about capturing the Group & Voluntary market, remember to learn the Majesco/Capgemini thought-leadership report, Don’t Pull Again…Put the Pedal to the Steel for L&AH Transformation at the moment.

As we speak’s weblog is co-authored by Denise Garth, Chief Technique Officer at Majesco, and Kelly Reisling, Senior Director, Capgemini

[i] Ladika, Susan, Burnout Is a Drawback for HR Professionals, HR Journal, March 14, 2022

Related Posts

- Ascot Group appoints new group CFO

Marck Wilcox will report back to group CEO and president Jonathan Zaffino. Credit score: Shutterstock.com.…

- AI offers quite a few benefits for Group and Voluntary Advantages

Synthetic intelligence (AI) has the potential to revolutionize the group and voluntary advantages trade, significantly…

- Group & Voluntary merchandise assist preserve staff glad

In 2022, quiet quitting was a brand new time period that cropped up within the…