Insurance

Group & Voluntary merchandise assist preserve staff completely happy

In 2022, quiet quitting was a brand new time period that cropped up within the realm of Human Sources. In line with Gallup, quiet quitting is a type of worker disengagement the place staff may expertise an absence of “readability of expectations, alternatives to be taught and develop, feeling cared about and a connection to the group’s mission or goal.”[i] This causes them to cease working arduous and so they stop to see the necessity or want to go the additional mile. Gallup’s analysis from Q2 2022 discovered that fifty% of staff fell into this class and that solely 38% of staff have been actually “engaged.”

Why is that this development taking place now? One idea is that quiet quitting is, alongside larger job resignations, one of many unintended outcomes of the COVID-19 office and work-from-home atmosphere. Quiet quitters grew to become disengaged from their jobs and employers whereas they weren’t socially current on the workplace. Their lack of connection eliminated their pure want to go the additional mile — a possible menace to the enterprise. If they’re managers, they could do extra harm by ignoring those that report back to them.

Companies should do every part that may to assist staff re-engage and improve loyalty. Group and Voluntary insurers are in a novel place to assist employers enhance engagement and recapture the quiet quitters IF they’re prepared to reinforce and broaden their choices. Majesco has stepped in to assist insurers contemplate all choices.

Majesco’s annual SMB buyer survey report captures the high-level view of the Group and Voluntary trade together with the place it’s headed by taking a look at priorities. Which merchandise are being prioritized? Which providers are being thought of for launch? Are there specific applied sciences that insurers are leaning towards? In Majesco’s Thought Management stories, Sport-Altering Strategic Priorities Redefining Market Leaders, and the upcoming report, Bridging the Buyer Expectation Hole: Group & Voluntary Advantages, we give a complete image of the place insurers are focusing transformations and the place this aligns with buyer want and sentiment. In at present’s weblog, we’ll look particularly at priorities. What are group and voluntary insurers getting ready and launching to fulfill SMB buyer wants – and the wants of their staff?

Present profit choices

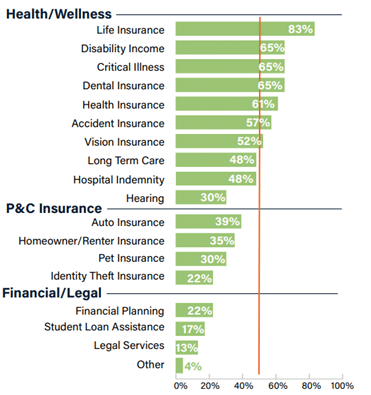

For insurers promoting voluntary advantages, conventional Well being/Wellness merchandise dominate their choices as seen in Determine 1. That is no shock. Life insurance coverage stands out at 83%, adopted by the following merchandise starting from 61% (well being) to 65% (incapacity, vital sickness, and dental) — all conventional choices in profit plans. The second tier, Accident, Imaginative and prescient, Lengthy Time period Care, and Hospital Indemnity vary from 57% to 48%, reflecting extra specialised choices relying on household and way of life wants. Listening to sees a major drop to 30% within the third tier.

Apparently, Auto, Home-owner/Renter, and Pet insurance coverage replicate new merchandise in that “tier 3” vary of advantages. Whereas the opposite merchandise are provided by insurers between 13% and 22%, they do replicate a rising space of focus and want within the market the place staff need to meet all their danger wants simply on the identical time. These are very important advantages employers want to draw and retain expertise, and the low variety of insurers in these areas represents a chance for firms that may enter these markets shortly, forward of different entrants.

Determine 1: Sorts of voluntary advantages provided

Multi-line vs. Single line priorities

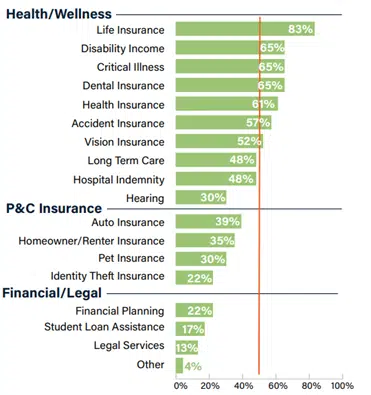

When taking a look at it from a line of enterprise view, multi-line firms make the most of their place with a considerable lead within the newer classes, to not point out in practically each different sort of voluntary profit as seen in Determine 2. Multi-line insurers considerably lead by 75% and 67% in providing auto and house owner/renter insurance coverage, respectively, and by 64% in medical health insurance.

These, in addition to leads of 16% to 25% in Monetary/Authorized choices, give multi-line firms a considerable aggressive edge in assembly the wants and expectations of at present’s insurance coverage clients. As our newest client and SMB analysis highlights, at present’s clients will give choice to firms that may assist them meet their holistic wants for monetary and well being wellness. The broader the choices, the higher.

The holistic view of the worker

For workers to remain loyal and engaged, they need to really feel that their firm cares about them and their lives. Meaning serving to them to simplify their duties outdoors of the workplace. Supporting an worker’s life and way of life goes past the thought of job perks and into the thought of a real-life partnership. Carrying pet insurance coverage, id theft, and authorized providers in a profit plan, exhibits staff that you just don’t wish to see their lives disrupted. It additionally simplifies fee, since most voluntary profit premiums are paid robotically by way of paycheck deductions.

Group & Voluntary advantages suppliers can additional help firms with holistic protection by unifying and using worker knowledge throughout advantages. It will require a personalised strategy to knowledge that may profit the insurer in some ways. For instance, the power to offer better granular element to insurance coverage brokers and SMBs will help in focused and personalised advertising and marketing. A fringe profit, nevertheless, shall be that trendy knowledge platforms may help Group & Voluntary insurers obtain actual portability in advantages, bettering general retention.

Determine 2: Sorts of voluntary advantages provided by firm sort

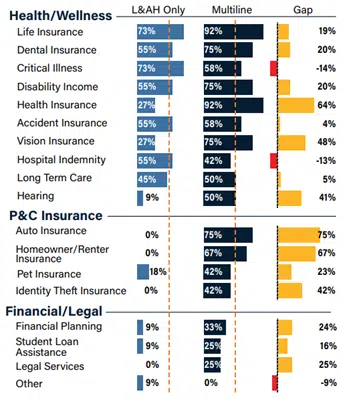

With the fluid state of employment that’s notably frequent for Gen Z and Millennials, portability and suppleness of advantages are more and more essential for SMB clients as they compete for expertise. Majesco’s newest insurance coverage buyer analysis discovered that SMBs and shoppers alike, particularly Gen Z and Millennials, are all for a number of new, revolutionary sorts of advantages. However, as highlighted in Determine 3, most insurers are nonetheless in consideration or approaching the planning/piloting section on these choices – that means they may very well be 1-3 years out, placing them at a aggressive drawback.

New methods to hold and use advantages

Majesco’s analysis additionally checked out transportable and “gig-friendly” profit choices from the standpoint of Leaders, Followers, and Laggards. Considerably surprisingly, Followers are displaying probably the most management throughout all 4 choices inside a profit plan proven in Determine 3. In distinction, Leaders are defying their label and performing as Laggards in three of the 4 choices. Leaders’ largest gaps to Followers (37%) and Laggards (21%) is for providing particular person merchandise that staff can take with them once they depart their employer.

This spectacular distinction between Laggards and Followers to Leaders demonstrates how insurers can probably leapfrog Leaders to distinguish themselves out there whereas bringing new merchandise, providers, and capabilities that clients really need and want.

Determine 3: Profit plan choices being thought of by Leaders, Followers, and Laggards

Insurers’ gaps with their clients, particularly SMBs, are notably evident within the final two choices. The third possibility, addressing the Gig employee/impartial contractor development is obvious of their low exercise in insurance coverage merchandise that may be turned on and off as contracts begin and finish. The ultimate possibility, giving staff the latitude to spend a set pool of funds on no matter procedures and with any suppliers they select, was among the many hottest with SMBs and shoppers in our analysis. Nonetheless, insurers’ low exercise highlights a promising new market alternative for firms that may create a enterprise mannequin to ship on this. That sort of flexibility is the type that staff are on the lookout for from their firm and their voluntary advantages.

Knowledge sources for personalised pricing

Inflation and funds are prime considerations for each shoppers and SMBs. Family and enterprise prices are beneath the microscope. With this elevated sensitivity, insurers should display transparency, equity, and accuracy of their pricing to take care of belief, a way of worth, and, in the end retention amongst their clients. Utilizing new, revolutionary knowledge sources that present extra personalised pricing may help in a major means.

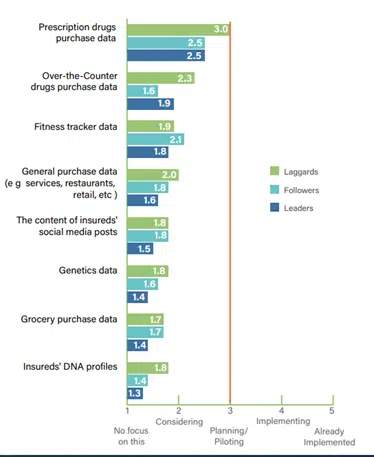

Sadly, Group and Voluntary advantages insurers are simply hovering round consideration reasonably than motion for all however one of many new knowledge sources, mirrored in Determine 4. As soon as once more Laggards are displaying management in most of those knowledge sources, notably in prescription drug and over-the-counter drug buy knowledge as in comparison with Leaders or Followers. Whereas not a heavy focus for many, this can be very encouraging to see the experimentation in the usage of new sources of information to fulfill buyer wants and expectations.

Health tracker knowledge is one other alternative space for insurers, given the gaps they’ve with Gen Z & Millennial clients in utilizing this expertise. Some employers already present profit incentives to staff by way of their wellness packages. Any Group or Voluntary supplier that may simply combine health tracker knowledge into their merchandise might discover that they’re a very good match for employer plans that incentivize wellness.

Determine 4: Use of recent knowledge sources for group/voluntary advantages by Leaders, Followers, and Laggards

Including worth to the total package deal by way of value-added providers

As staff reside their lives, they discover the gaps created when work and life don’t “have all of it coated.” For instance, simply because an organization has well being advantages and a household depart coverage, doesn’t imply they’ve made it straightforward for an worker so as to add a brand new youngster to the household and have a worry-free expertise. Put up-leave child-care advantages might make staying at an organization way more priceless to the worker.

Take into consideration any of life’s gaps and a Group and Voluntary insurer might discover a chance. Elder care advantages, pet sitting, cellular mechanics, and residential restore concierge providers might all be a part of the brand new wave of voluntary services and products.

Sensible applied sciences might also play a task in offering these providers by informing staff that one thing must be executed and even by serving to them set objectives for well being or life enhancements.

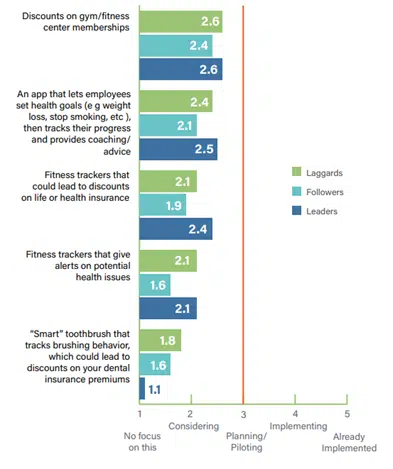

Majesco requested firms about their priorities concerning good well being units. Reductions on fitness center/health middle memberships and an app for setting and monitoring well being objectives are at present getting probably the most consideration by Leaders, Followers, and Laggards. Leaders are 33% extra energetic in contemplating providing health trackers that might result in reductions than they’re in contemplating health tracker knowledge for pricing (2.4 vs. 1.8).

These choices outlined in Determine 5 are simply examples of what insurers might supply. Rethinking the worth proposition with value-added providers shall be more and more essential to draw and retain clients based mostly on their sturdy curiosity indicated in our client and SMB analysis.

Determine 5: Improvement of value-added providers for group/voluntary advantages by Leaders, Followers, and Laggards

Increasing channel choices

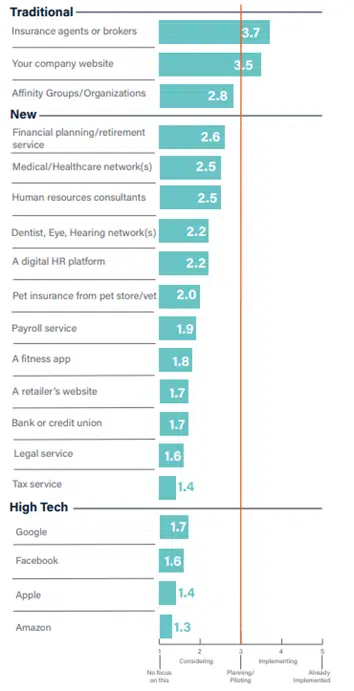

Conventional channels for distributing Group/Voluntary advantages – insurance coverage firm web sites and brokers/brokers – proceed to be probably the most used choices, which aligns with SMB channel preferences famous in our SMB analysis, with one exception. Medical/Healthcare networks edged each for SMBs’ primary choice, reflecting the sturdy relationship and belief with their healthcare suppliers.

Whereas in a barely completely different order, the highest 7 channels utilized by insurers in Determine 6 match the highest 7 preferences of SMB Group/Voluntary advantages clients. Curiosity within the remaining channels drops quickly for Gen X & Boomer SMBs however declines solely barely for Gen Z & Millennial SMBs. Even the Excessive Tech choices Google and Amazon have been on par with affinity teams, authorized providers, and digital HR platforms with Gen Z & Millennial SMBs.

Determine 6: Group/voluntary advantages distribution channels used

Multi-channel service is vital to on-the-go staff, who’re asking, “What could be achieved whereas I’m on break at work or whereas I’m ready by way of soccer follow?” Every level of potential service creates an atmosphere the place an worker sees the employer as a companion in life and work. Advantages are then seen as an important instrument to maintain life operating easily.

Group and Voluntary insurers want a buyer engagement plan that features serving to firms to retain their staff by successfully selling their advantages and all that they’ll do for them.

To perform this, nevertheless, Group and Voluntary suppliers want methods and processes that may deal with merchandise, knowledge, and providers in fully new methods. The inspiration for a brand new Group and Voluntary technique shall be a core platform within the cloud, supplemented by a Knowledge & Analytics system that’s prepared for the numerous new structured and unstructured streams of information provided by way of wearables and telematics.

Is your organization prepared to help at present’s SMB gamers with worker engagement and the very best in profit services and products? Discover out extra about Majesco’s market-leading options together with L&AH Clever Core Suite, ClaimVantage IDAM, and Majesco World IQX Gross sales and Underwriting options which are serving to Group and Voluntary insurers enhance enrollment digital experiences, innovate with new merchandise, and meet the rising calls for of employers and their staff with 8 of the highest 15 insurers at present! And you should definitely obtain Majesco’s newest report, Bridging the Buyer Expectation Hole: Group & Voluntary Profit.

[i] Harter, Jim, Is Fairly Quitting Actual?, Gallup, September 6, 2022, up to date Could 17, 2023.

Related Posts

- Group & Voluntary merchandise assist preserve staff glad

In 2022, quiet quitting was a brand new time period that cropped up within the…

- Bettering Knowledge to Assist the House- and Group-Based mostly Workforce

This November, as we honor Nationwide Household Caregivers Month, the U.S. Division of Well being…

- Ascot Group appoints new group CFO

Marck Wilcox will report back to group CEO and president Jonathan Zaffino. Credit score: Shutterstock.com.…