Insurance

Group and voluntary advantages improvements for development in SMB market

Revealed on

Sheila and Marcus personal a public relations and advertising enterprise with 54 workers. They wish to foster a model that appears “hip,” even when which means hiring some nice individuals who might not stick round lengthy. From the beginning of their enterprise, they’ve created an setting the place advantages play a vital position. Periodically they ask themselves, “Does it pay to carry on new services or do these largely go unused? How can we all know that our advantages are pretty priced? Do our workers get good service from our chosen suppliers?”

Justin is a senior government within the firm. He has a variety of obligations for the enterprise, together with operations, payroll, HR, and advantages administration. Together with his a number of roles, he’s stretched skinny, however he has seen not too long ago that new workers complain about scholar loans and battle with life-work steadiness. He wonders if new sorts of advantages and companies would possibly assist them and enhance their work satisfaction. He additionally wonders if new profit choices might assist them appeal to gig employees.

Megan is a current graduate, simply employed as an affiliate account consultant. She is new to the working world, and she or he doesn’t perceive advantages but. What she does perceive, she discovered utilizing YouTube tutorials, not the corporate’s advantages information. In her first week, as she’s making an attempt to additionally be taught her job, she is drowning in a sea of insurance coverage phrases and choices. She makes some elections based mostly on a pal’s suggestion and she or he determines that she’ll attempt to be taught extra subsequent yr. Essentially the most irritating a part of the method is that enrolling doesn’t simply occur on one system. She should name some voluntary advantages suppliers, corresponding to her pet insurance coverage, and stroll via their steps individually.

To grasp at this time’s Group & Voluntary market alternatives, it’s useful to look via the eyes of all three of those enterprise varieties — homeowners, execs, and workers. In Majesco’s SMB thought management report, Resiliency in Instances of Change: Rethinking Insurance coverage to Assist SMBs Thrive, we have a look at SMB priorities, altering demographics, and insurance coverage challenges which can be impacting the business at giant. By taking a look at SMB and worker pressures and priorities, we will additionally decide the place know-how investments are finest utilized in an effort to create resiliency and profitability.

Placing the digital foot ahead.

As Millennials and Gen Z SMBs proceed to develop in proudly owning companies, they may more and more problem insurers as a result of they view and worth issues in another way than the older era. However extra importantly, they’re extremely digital in how they do enterprise. They anticipate and demand digital capabilities for his or her enterprise administration and worker advantages.

They need companies, protection, and interactions which can be obtainable to them at any time when they need them, and nonetheless they want to have interaction. Including worth to conventional merchandise and creating new ones will likely be essential to fulfill the distinctive wants of this era of SMBs.

Any firm inquisitive about recruiting high-quality expertise may even be confronted with making their setting match the lives and existence of their workers. New workers particularly will likely be envisioning how their work will help their life. Service have to be easy and personalised. Merchandise have to be clear. The worth have to be apparent.

Which group & voluntary merchandise do SMBs at the moment provide, if they provide something in any respect?

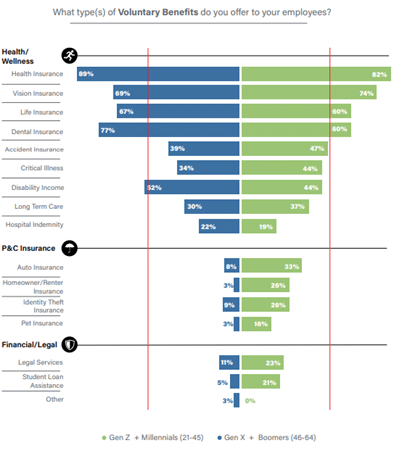

Majesco’s survey discovered that lower than half of Gen Z and Millennial (38%) and Gen X and Boomer (43%) SMB homeowners provide voluntary advantages — a low quantity given the battle for expertise. Amongst those that do, conventional advantages of well being, imaginative and prescient, life, incapacity revenue, and dental are the highest merchandise provided, starting from 52% to 89% seen in Determine 1. Accident insurance coverage, essential sickness, and long-term care create a second tier ranging between 30% and 38%.

After these two tiers, all different advantages drop off precipitously within the Gen X and Boomer section however stay comparatively sturdy within the Gen Z and Millennial section. Particularly, P&C insurance coverage choices, authorized companies, and scholar mortgage help all are comparatively new voluntary profit choices. These outcomes spotlight that Gen Z and Millennial SMB homeowners seem like extra in tune with the altering wants and expectations of at this time’s workers – particularly the youthful era – and the worth of providing newer and modern profit choices to draw and maintain workers. This highlights development alternatives for insurers who can provide advantages that meet a extra various worker base with altering wants and expectations.

Determine 1: Voluntary advantages provided

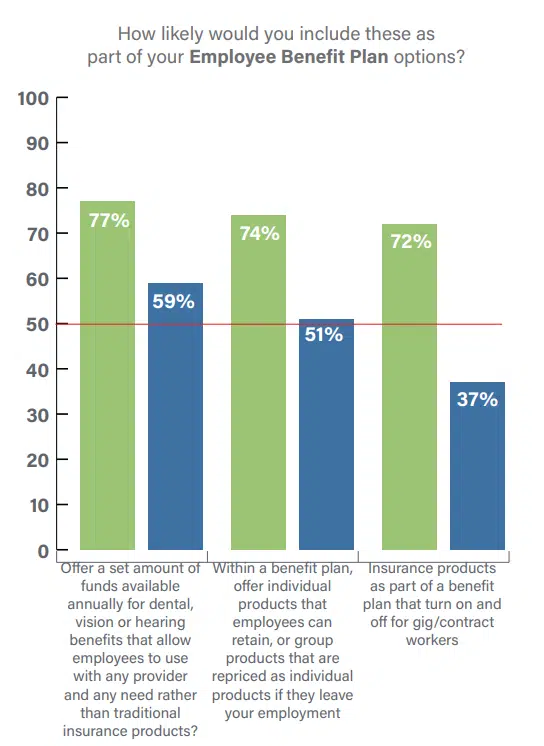

Once we requested SMB homeowners about dental, imaginative and prescient, and listening to advantages and the will for flexibility and ease, there was a powerful curiosity with each generations at 77% and 59%, as seen in Determine 2. This idea would supply workers the higher latitude to spend a set pool of funds on no matter procedures and with no matter suppliers they select, reasonably than being restricted to a selected community or restricted procedures coated.

Likewise, profit merchandise which can be provided as particular person/worksite merchandise, or as group merchandise that may be repriced and ported for workers to take with them in the event that they depart employment are of excessive curiosity from Gen Z and Millennial SMBs (74%). They acknowledge their era’s tendency to see employment as fluid. Their response is to hunt advantages that can appeal to expertise by becoming with a prospect’s imaginative and prescient of their future — as a substitute of assuming that they may stick with the corporate long-term. And whereas curiosity is decrease with Gen X and Boomer SMBs (51%), there may be nonetheless sturdy market potential. More and more, employers and brokers are in search of profit plans that supply a broader vary of merchandise that meet the altering wants of their various worker base – highlighting a possibility for insurers to suppose past conventional profit choices.

Gen Z and Millennial SMBs are additionally inquisitive about on-demand advantages that may be turned on and off with engagements as a Gig or contract employee. Given the sturdy use of this worker sort, it’s not shocking they’d search modern profit plans to draw this employee section. Whereas Gen X and Boomers usually are not as and use contract/gig employees much less, their acceleration in the usage of this worker section over the past yr might alter their views on providing on-demand advantages sooner or later.

Determine 2: Curiosity in providing new worker profit plan choices

Group and voluntary advantages are important instruments for attracting and retaining the expertise that SMBs want, significantly given the low unemployment charges, fluidity of youthful generations, and the expansion within the Gig market. By serving to to guard their monetary safety, employers are serving to workers to stay extra centered, motivated, and productive. It follows that any new or modern choices that improve that safety could be development alternatives for insurers to supply SMBs.

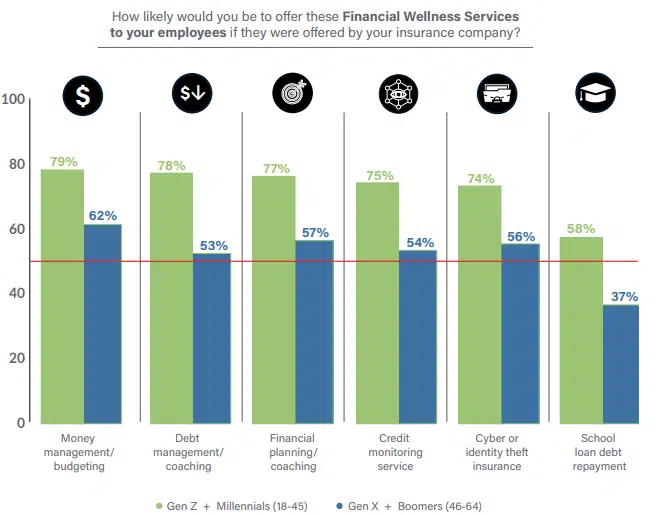

For SMB workers, monetary wellness is a rising concern.Majescofound that whereas Gen X and Boomer SMBs exceed 50% curiosity in 5 of six potential monetary wellness companies choices, Gen Z and Millennials present considerably increased curiosity, from 74% to 79%, as highlighted in Determine 3. As well as, Gen Z and Millennials present sturdy curiosity (58%) in providing scholar mortgage debt compensation help, an possibility that could be much more engaging after the June 30, 2023, Supreme Court docket determination relating to scholar mortgage forgiveness.

Private experiences and views of retirement monetary viability are probably influencing these gaps. Gen X and Boomers have accrued extra monetary administration skills and confidence over time and have reached or are approaching Social Safety eligibility. In distinction, the youthful era struggles to purchase houses and has considerations about whether or not Social Safety will likely be obtainable after they retire. Insurers who will help employers tackle these points have a possibility to construct belief and loyalty.

Determine 3: Curiosity in providing monetary wellness companies to workers

Information transformation pays off in improved pricing and elevated gross sales

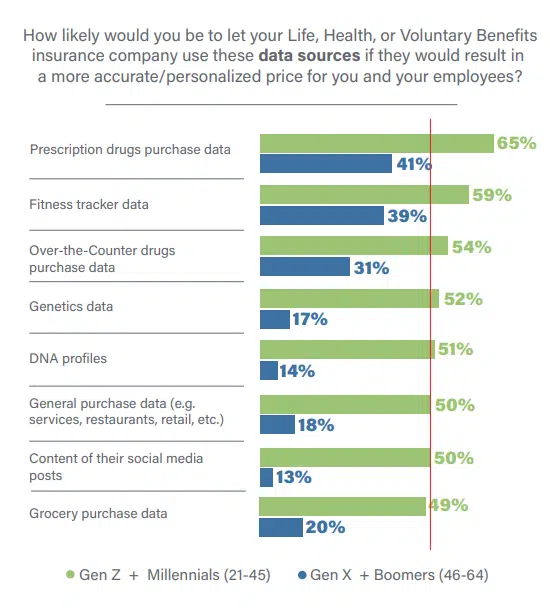

With inflation and funds/profitability the highest two considerations dealing with all SMBs, it’s important for insurers to display transparency, equity, and accuracy of their pricing. Utilizing new, modern information sources that may personalize the pricing can obtain this, offered SMBs are comfy with information sharing. When marketed correctly, insurers ought to see a rise in gross sales via clear and aggressive pricing that gives its personal justifications.

Gen X and Millennial SMBs are overwhelmingly inquisitive about the usage of new information sources for extra correct, personalised pricing as seen in Determine 4 — which given the curiosity in particular person and transportable merchandise is vital. Between 49% and 65% of Gen Z and Millennial SMBs are inquisitive about their use for all times, well being, and voluntary advantages. In distinction, Gen X and Boomers are much less comfy total, with prescription (41%) or over-the-counter (31%) drug buy information and health tracker information (39%) representing probably the most curiosity. Curiosity in all different information sources drops dramatically, with a low of 13% for content material from social media posts and 14% for DNA profiles.

Determine 4: Curiosity in new information sources for all times/medical health insurance and voluntary advantages pricing

As soon as once more, the big disparities in expectations between the generational segments require insurers to rethink their merchandise, information sources, and pricing approaches to higher meet the wants and calls for of diverging expectations. Subsequent-gen underwriting and coverage programs will likely be required to successfully tackle these calls for.

Worth-added companies present sturdy and rising attraction for SMB homeowners

A key technique for insurers to handle SMBs’ considerations about inflation, funds, and expertise acquisition is to extend the worth of the merchandise they provide. To take action, insurers ought to bundle, or provide for a worth, companies that reach the worth of the danger product/coverage, corresponding to incomes factors for wellness that can be utilized to purchase issues, annual monetary planning assessments, roadside help, and extra.

Each SMB era segments are extremely inquisitive about value-added companies as seen in Determine 5. Apparently, 61% of Gen X and Boomers could be inquisitive about providing workers health trackers that would result in reductions on life or medical health insurance.

Determine 5: Curiosity in value-added companies with life/medical health insurance and voluntary advantages

Making ready to develop into newer channels whereas giving nice service via established channels.

Conventional distribution channels for getting life, well being, and voluntary advantages – insurance coverage firm web sites and brokers/brokers – proceed to be among the many hottest choices in each generational segments, however they’re eclipsed for the primary spot by medical/healthcare networks (83%, 72%) as seen in Determine 6. The following group with sturdy curiosity is monetary planning/retirement service (76%, 62%) and dentist, eye, and listening to physician networks (72%, 58%). Given the character of SMBs being very localized, the curiosity in medical or healthcare networks throughout the neighborhood or state isn’t a surprise and opens up new partnership choices for insurers to contemplate.

After these 5 channels, Gen X and Boomer SMBs present considerably much less curiosity in any of the opposite choices. In distinction, Gen Z and Millennials are inquisitive about the entire channel choices, even two of the GAFA corporations (Apple and Fb) that are just below 50%. Some analysts are predicting Apple will enter the medical health insurance market in 2024, leveraging wealthy health and well being information gathered from tens of millions of Apple Watch customers,[i] which is able to instantly align with their need for personalised insurance coverage utilizing information from health trackers.

Determine 6: Curiosity in channel choices for all times/medical health insurance and voluntary advantages

There’s a hurdle, nonetheless, in almost all of those circumstances. Quickly, many services will likely be bought and consumed via different, non-traditional channels. How are group & voluntary insurers going to arrange to promote and associate with organizations that may carry them extra enterprise? How will they deal with not solely transaction information however the circulation of personalised information forwards and backwards from corporations, past shopping for to serving and claims, via channels and into their present programs? How will they adapt their expertise to these companions for a constant one for patrons?

Can group & voluntary insurers prioritize updates to their information frameworks, in addition to enhance their digital service via cloud-based core programs? These are questions of speedy significance as SMBs rapidly develop adept at finding and carrying modern advantages and companies.

The SMB market alternative is rising bigger every year. SMBs make use of almost 50% of all US workers. Is your group prepared for the brand new improvements in group & voluntary services? Let Majesco enable you to create an SMB-focused tech technique that features the entire options and capabilities your group must innovate.

For extra details about SMB group & voluntary developments or to search out out extra about SMB wants, you should definitely learn Resiliency in Instances of Change: Rethinking Insurance coverage to Assist SMBs Thrive after which dig into element particularly on present gaps in group & voluntary advantages with Bridging the Buyer Expectation Hole: Group & Voluntary Advantages.

[i] Collins, Barry, “Apple Will Launch Well being Insurance coverage In 2024, Says Analyst,” Forbes, October 18, 2022, https://www.forbes.com/websites/barrycollins/2022/10/18/apple-will-launch-health-insurance–in-2o24-says-analyst/amp/

Related Posts

- Group and voluntary advantages improvements for progress in SMB market

Revealed onJuly 13, 2023 Sheila and Marcus personal a public relations and advertising enterprise with…

- AI offers quite a few benefits for Group and Voluntary Advantages

Synthetic intelligence (AI) has the potential to revolutionize the group and voluntary advantages trade, significantly…

- Westland Insurance coverage joins forces with Prime Advantages Group

Prime Advantages Group is engaged in offering worker advantages and retirement options. Credit score: Alex…