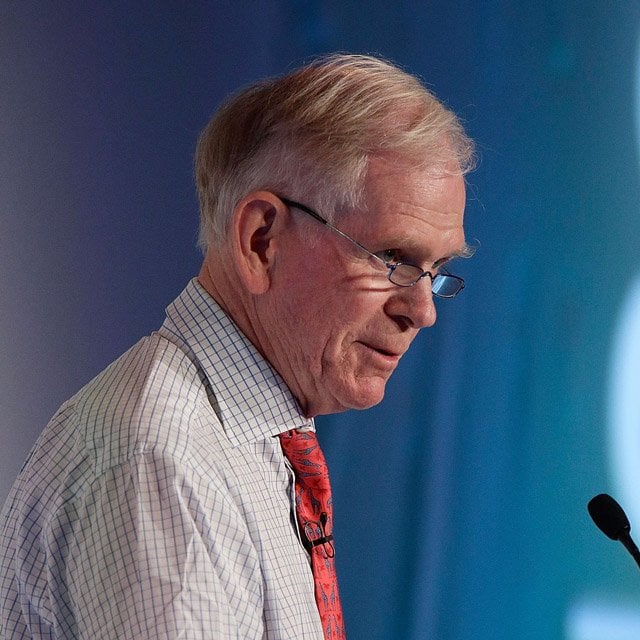

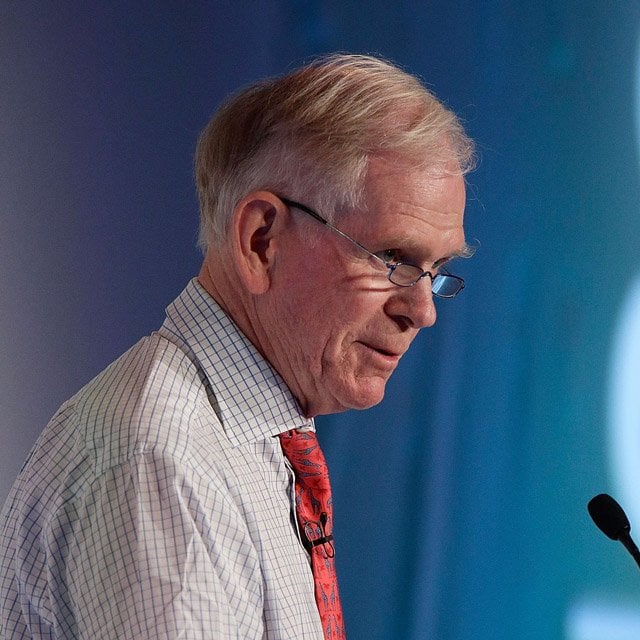

What You Must Know

- The world outdoors the U.S. is investable, Grantham says.

- The Russell 2000 is particularly weak, he notes.

- Nice bubbles take years to rise and years to fall, the strategist says.

The S&P 500 index may drop by 50%, Jeremy Grantham, GMO co-founder and funding strategist, mentioned this week, recommending that buyers keep away from shopping for U.S. shares.

He mentioned he doesn’t count on the index to slip that far however considers it a risk and does anticipate a significant pullback.

Grantham warned in early 2021 that the market was experiencing “one of many nice bubbles of monetary historical past” and final yr mentioned that the “superbubble“ was coming into its closing act.

“With a view to get the market right down to a stage the place it might sometimes out-yield the lengthy bond by 5% … the market must drop by greater than 50%. This isn’t my forecast. I’ve a really genteel forecast that something under 3,000 would make me assume that it was affordable,” Grantham mentioned on Bloomberg’s Merryn Talks Cash podcast.

“And if every part works out badly, which it generally does, I’d not be amazed if it went to 2,000 on the S&P, however that may require a few wheels to fall off,” he added. “And wheels are likely to fall off within the nice bubbles unraveling, but it surely doesn’t imply they’ve to.”

The S&P 500 sat at 4,300 noon Friday, so a slide to three,000 would characterize a roughly 30% drop.

“The good bubbles take their time, fairly a number of years going up, fairly a number of years coming down and the market suffers from consideration deficit dysfunction so it at all times thinks each rally is the start of the subsequent nice bull market,” Grantham mentioned.

Russell 2000 shares are significantly weak, given the businesses’ report debt, with about 40% missing earnings, he advised.

“The Russell 2000 nearly has no collective earnings in any respect,” has report debt and consists of zombie corporations that may make curiosity funds solely by issuing extra debt, Grantham mentioned.

The S&P 500 is about 18% under its excessiveest shut, in January 2022, and with 7% to eight% inflation, the market is down about 10%, the strategist mentioned. “The markets should not doing in addition to individuals assume” as a result of buyers don’t account for inflation, he added.

A recession is coming and “it can most likely go deep into subsequent yr,” Grantham projected, though he doesn’t know if will probably be delicate or critical. “Each bubble has been greeted with a refrain of sentimental touchdown, and there’s by no means been one.”

The market is unlikely to get greater than a 3% return when the Shiller P/E ratio, or cyclically adjusted price-earnings ratio, reaches roughly 30, though the market expects twice that, Grantham mentioned.

“Ultimately, the easy arithmetic suggests you’ll both have a dismal return otherwise you’ll have a pleasant bear market after which a traditional return,” Grantham mentioned. “And the great bear market might be hopefully lower than a 50% decline, but it surely received’t be an enormous quantity much less from the height than 50% in actual phrases.”