What You Have to Know

- Biden administration officers mentioned the newest fiduciary plan goals to shut loopholes and require monetary advisors to offer retirement recommendation in the perfect curiosity of traders.

- The Division of Labor is also publishing proposed amendments to Prohibited Transaction Exemption 2020-02 and to a number of different current administrative exemptions.

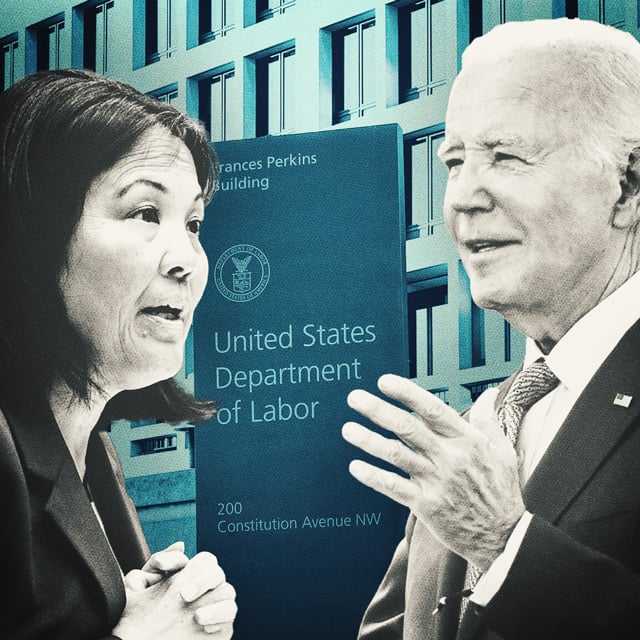

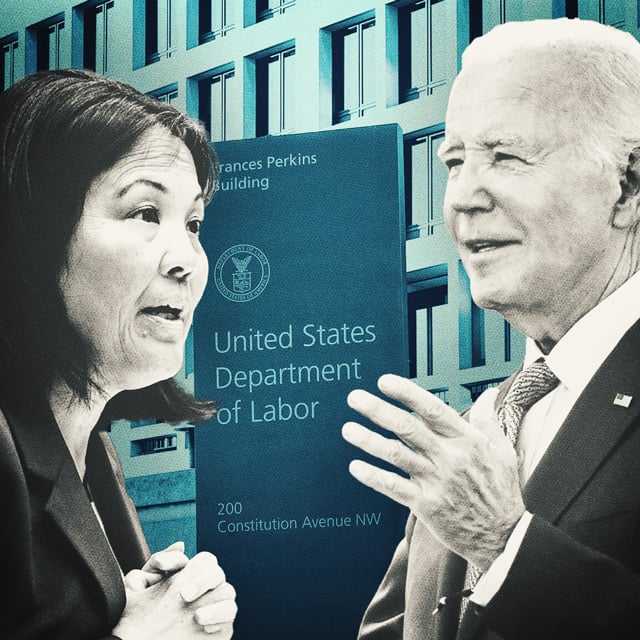

The Labor Division launched Tuesday morning its new fiduciary rule proposal, the Retirement Safety Rule: Definition of an Funding Recommendation Fiduciary.

President Joe Biden mentioned Tuesday afternoon on the White Home that with the brand new fiduciary rule, his administration “is taking over what we name junk charges.” These junk charges, Biden defined, “are hidden fees that corporations sneak into your invoice and make you pay extra, simply because they will.”

As we speak, “we’re taking further motion to remove junk charges in retirement financial savings,” the president continued.

Concentrate on Payouts

The administration’s central concern, Biden mentioned, is that whereas “most monetary advisors give their purchasers good recommendation at a good worth and are trustworthy with them, … that’s not all the time the case. Some advisors and brokers steer their purchasers towards sure investments, not as a result of they’re in the perfect curiosity of the shopper, however as a result of it means the perfect payout for the dealer.”

“I get it,” he added. “I perceive it. However I would like you to know [that] we’re watching.”

Biden administration officers defined late Wednesday throughout a name with reporters that the newest fiduciary plan goals to shut loopholes and require monetary advisors to offer retirement recommendation in the perfect curiosity of traders.

The plan seeks to amend the regulation defining when an individual renders “funding recommendation for a price or different compensation, direct or oblique” with respect to any moneys or different property of an worker profit plan, for functions of the definition of a “fiduciary” within the Worker Retirement Revenue Safety Act of 1974.

The proposal additionally would amend the parallel regulation defining for functions of Title II of ERISA, a “fiduciary” of a plan outlined in Inside Income Code part 4975, together with a person retirement account, in keeping with Labor.

PTE Updates

In Tuesday’s Federal Register, Labor is also publishing proposed amendments to Prohibited Transaction Exemption 2020-02 (Enhancing Funding Recommendation for Staff & Retirees) and to a number of different current administrative exemptions from the prohibited transaction guidelines relevant to fiduciaries beneath Title I and Title II of ERISA.

The plan amends Prohibited Transaction Exemptions 84-24, making use of to annuities, in addition to 2020-02, regarding rollover recommendation, and different PTEs.