Life Insurance

Do CPP and OAS Bridge the Monetary Hole? Can You Do Extra?

Retirement and Monetary Challenges

Regardless of hovering prices in Canada, notably in actual property, the incomes of Canadians haven’t saved tempo with the elevated price of dwelling. Each common and median incomes have grown at a slower price than the patron value index (CPI). From 1980 to 2022, the typical and median salaries elevated by solely 50% and 25% respectively, leading to minimal year-over-year progress. In stark distinction, the CPI has surged practically 400% between 1980 and 2023, indicating that salaries haven’t saved up with the price of items and companies.

This disparity is particularly pronounced in the actual property market. For instance, the common value of a property in Toronto has skyrocketed from $75,694 in 1980 to $1,126,591 in 2023. Related traits are noticed in different main cities like Vancouver.

On the similar time, life expectancy in Canada has elevated from ~75 years in 1980 to ~83 years in 2023. Remarkably, 5 out of 10 Canadians aged 20 immediately are anticipated to succeed in age 90, and 1 out of 10 could dwell to 100. Nevertheless, this elevated longevity, whereas a optimistic improvement, raises considerations concerning the affordability of retirement.

In an setting the place individuals dwell longer however face stagnant earnings progress, hovering dwelling prices, and excessive rates of interest, Canadians are more and more questioning their monetary future and their skill to afford an honest retirement.

How A lot Cash Do You Must Retire?

Figuring out the amount of cash you want to retire is advanced and will depend on a number of components. Listed here are some key concerns:

- Way of life Expectations: What sort of way of life do you envision in your retirement? What way of life are you accustomed to now?

- Mortgage Standing: Do you’ve got a mortgage that can nonetheless should be paid off throughout retirement?

- Life Expectancy: How lengthy do you count on to dwell?

- Well being Situation: What’s your present well being standing, and do you anticipate any important healthcare bills?

- Further Revenue Sources: Do you’ve got different sources of earnings or investments?

We explored these components intimately in considered one of our current articles.

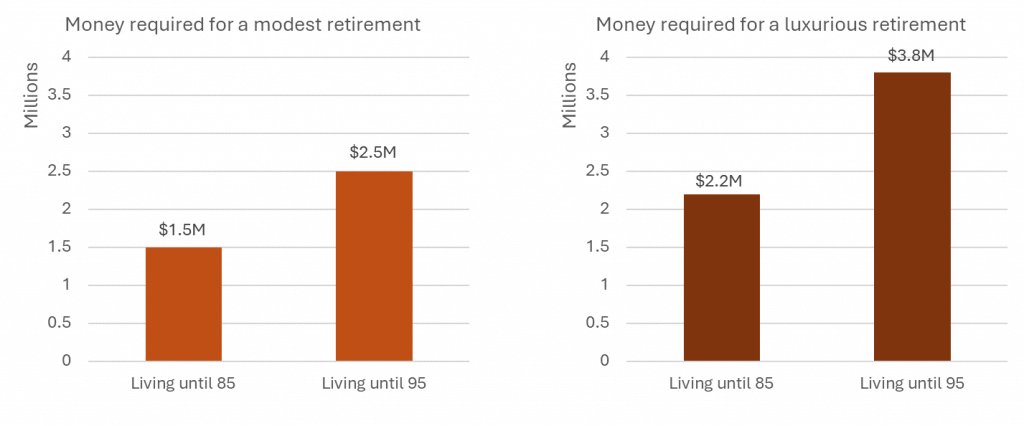

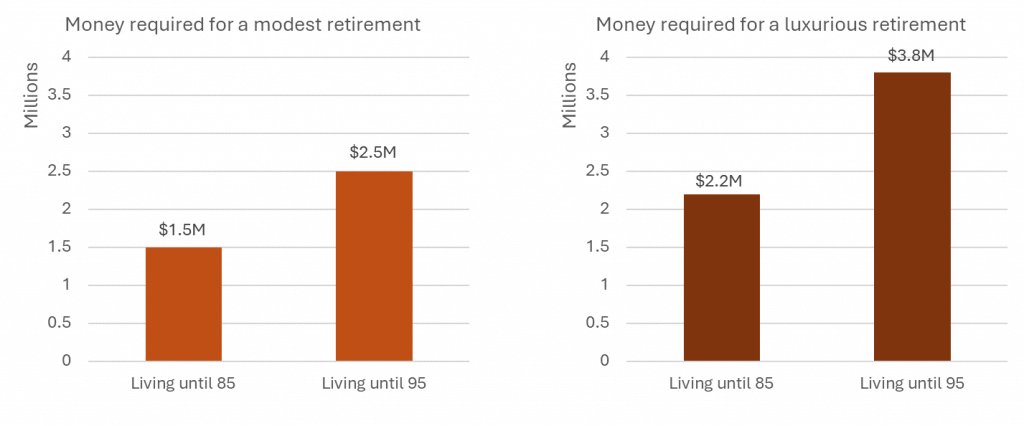

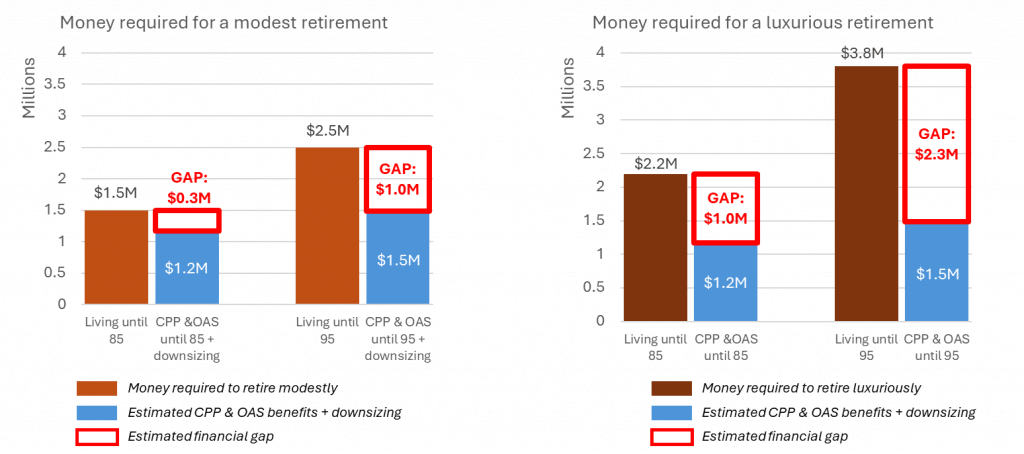

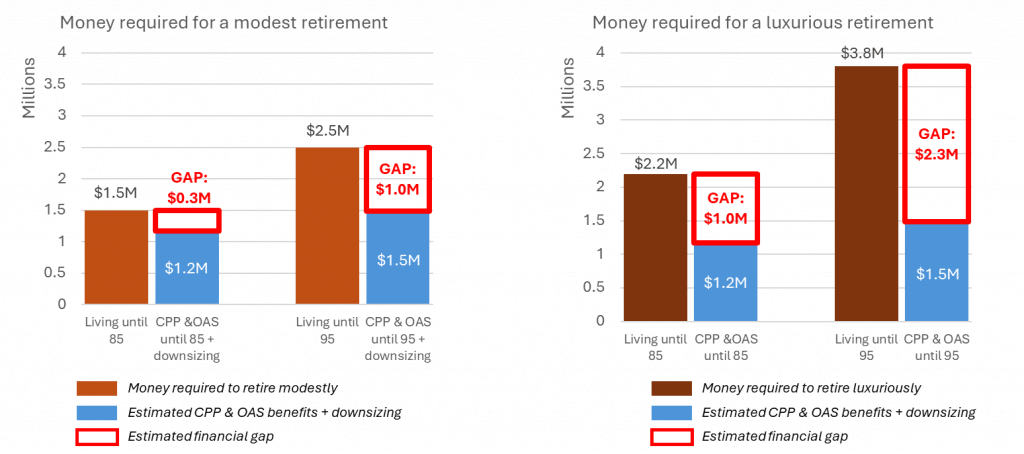

For a easy situation, contemplate a modest retirement for a comparatively wholesome, single one who has paid off their mortgage. This particular person ought to plan for roughly $1.5 million in the event that they count on to dwell till age 85 and round $2.5 million in the event that they count on to dwell till age 95.

For these planning a extra luxurious way of life, the numbers improve. Such a way of life would recommend planning for $2.2 million by age 85 and $3.8 million by age 95.

In the end, your retirement financial savings purpose will fluctuate primarily based in your distinctive circumstances and the life-style you want to preserve.

Understanding the Dimension of CPP and OAS Advantages

The Canada Pension Plan (CPP) and Previous Age Safety (OAS) advantages are essential parts of the Canadian retirement system. These are outlined profit plans that present a steady earnings stream to retirees who’ve contributed to the packages all through their working lives.

Now we have carried out an in depth evaluation, adjusting for inflation, to offer you some approximate figures:

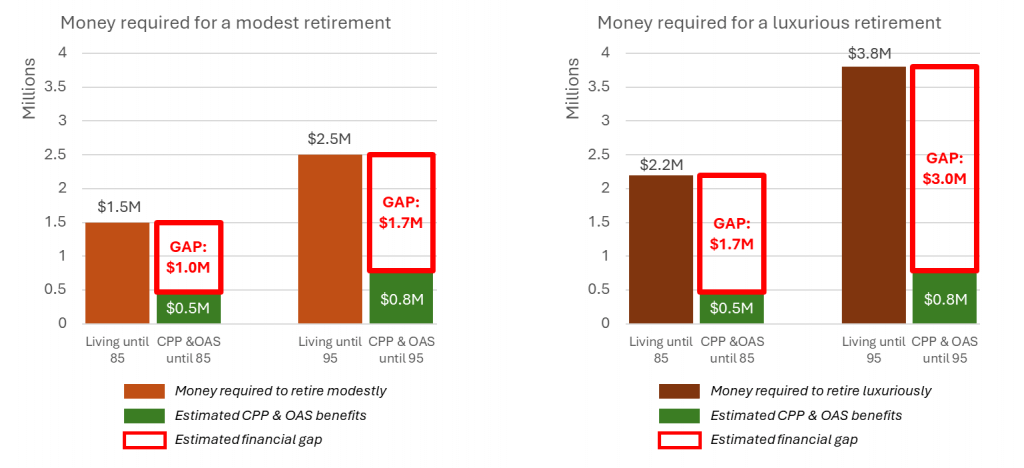

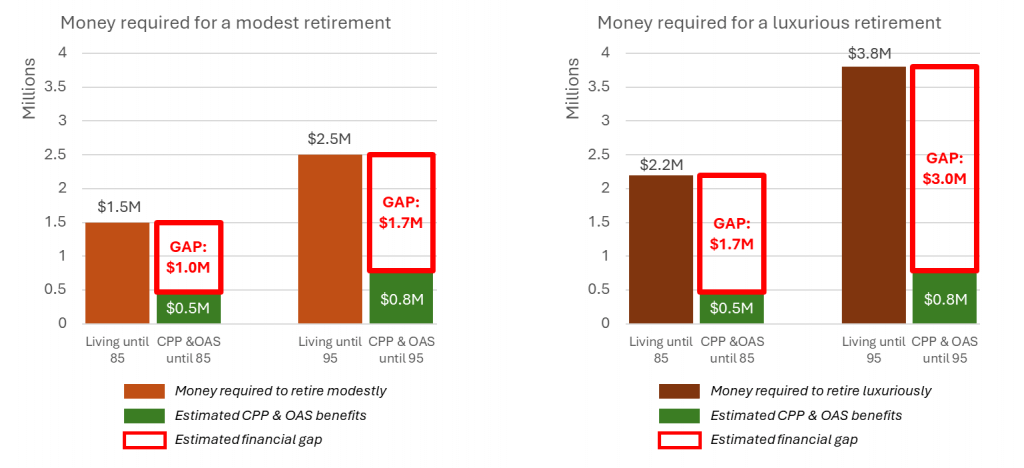

- CPP and OAS collected till the age of 85: ~$500,000

- CPP and OAS collected till the age of 95: ~$800,000

At first look, it’s evident that these quantities alone could not cowl all retirement prices.

The query then turns into, how important is the hole? Given the rising prices of dwelling, particularly in areas like housing and healthcare, the hole between the advantages offered by CPP and OAS and the precise price of a snug retirement will be substantial.

Many Canadians will discover that they want further financial savings, investments, or earnings sources to bridge this hole and guarantee monetary stability all through their retirement years.

How Huge Is the Retirement Hole?

When evaluating the scale of CPP and OAS advantages, it’s important to contemplate how these quantities stack up in opposition to the whole price of retirement. Based mostly on our earlier evaluation, the approximate hole for a modest retirement is critical: $1M for those who dwell till age 85 and $1.7 million for those who dwell till age 95. For these searching for a extra luxurious retirement, the hole turns into much more pronounced, rising to $1.7 million at age 85 and $3 million by age 95. These figures spotlight the substantial distinction between what CPP and OAS present and the precise prices required to take care of a snug lifestyle.

Bridging this hole usually requires further financial savings, investments, and cautious monetary planning to make sure a safe and fulfilling retirement.

Is the Hole Bridgeable and How?

The excellent news is that a lot of the retirement hole will be bridged with correct preparation. Listed here are just a few methods to contemplate:

Actual Property

Traditionally, actual property has been a robust supply of monetary safety and progress. For instance, for those who bought an average-priced dwelling in 2000 for $250,000, it might be price roughly $1,125,000 immediately.

When you have been to downsize from a $1.5 million home to an $800,000 condominium or transfer to a extra reasonably priced space, your monetary retirement hole may very well be diminished to $200,000 for a life expectancy of 85 years and $1 million for a life expectancy of 95 years.

For these searching for a extra luxurious way of life, these numbers could be $1 million and $2.3 million for all times expectations of 85 and 95 years, respectively.

Further Investments/Financial savings

Many Canadians have numerous forms of investments and financial savings, together with however not restricted to RRSPs, TFSAs, GICs, and shares. These investments can present a further supply of funds for retirement. Nevertheless, it’s necessary to notice that some investments carry greater dangers than others (e.g., high-risk funding portfolios). Incorporating threat concerns into your retirement monetary technique is essential to make sure a steady and safe retirement.

Proceed Working

Not everybody plans to retire absolutely. Some people could take pleasure in their work and select to increase their skilled life. Others may personal companies and handle them throughout retirement, both personally or with the assistance of further assets. Moreover, hobbies akin to gardening, baking, portray, pictures, or writing can typically be become worthwhile ventures, offering a sustainable supply of earnings.

Rental Revenue

With excessive hire ranges in Canadian cities like Toronto, Montreal, and Vancouver, proudly owning a number of rental properties—particularly these which are largely paid off—can generate further earnings. This rental earnings, mixed with actual property appreciation, might help handle retirement monetary wants. Rental properties may also be bought comparatively simply, probably leading to a big lump sum that can be utilized for retirement bills.

Dwelling with a Partner/Companion

When dwelling with a partner or accomplice, you successfully pool assets from each family members whereas needing just one property to dwell in. This shared method can scale back the general monetary burden and assist bridge the retirement hole extra effectively.

Reverse Mortgage

A reverse mortgage is a monetary association that permits owners aged 55 and older to entry the fairness of their dwelling whereas persevering with to dwell there. Not like conventional mortgages, the place the borrower makes funds to the lender, in a reverse mortgage, the lender makes funds to the house owner primarily based on the house’s fairness. The mortgage doesn’t should be repaid till the house owner sells the property, strikes out, or passes away.

Such a mortgage can present retirees with a gentle stream of earnings or a lump sum to cowl dwelling bills, healthcare prices, or different monetary wants. The quantity out there to borrow will depend on components akin to the house’s worth, the house owner’s age, and rates of interest.

Whereas the reverse mortgage might help enhance monetary liquidity, particularly for retirees, it is very important perceive that it reduces the house’s fairness and should influence inheritance.

Revenue-Producing Insurance coverage

Sure forms of life insurance coverage mix each insurance coverage and wealth accumulation parts.

Entire life insurance coverage is a flexible monetary device that not solely supplies lifelong protection but additionally incorporates a money worth element that may develop over time. Not like time period life insurance coverage, which affords safety for a particular interval with out accumulating worth, complete life insurance coverage builds money worth by means of common premium funds. This money worth grows at a assured price and will be bolstered by dividends from the insurance coverage firm. Because the coverage matures, the accrued money worth will be accessed for numerous monetary wants, akin to loans or withdrawals.

Moreover, the money worth will be invested in several methods, permitting policyholders to probably develop their wealth. This twin good thing about insurance coverage safety and wealth accumulation makes complete life insurance coverage a worthwhile element of a complete monetary technique. Over the long run, the coverage not solely supplies monetary safety but additionally serves as a rising asset that may improve total monetary stability.

Infinite Banking

Infinite banking is a private finance method that makes use of a complete life insurance coverage coverage as a “private financial institution.” This method entails taking loans in opposition to the coverage and growing money circulate by means of the coverage’s dividends. On the coronary heart of infinite banking is a collaborating complete life insurance coverage coverage. With such a coverage, you may borrow cash utilizing the coverage’s money worth as collateral, eliminating the necessity to pay curiosity to exterior lenders. This setup creates a private banking system, offering fast entry to further funds by means of the insurance coverage firm.

This method affords flexibility and entry to accrued funds, although it comes with its personal set of constraints. Now we have a separate article that delve deeper into the main points of the infinite banking technique.

Closing Phrases

As demonstrated, the funds required for a worry-free retirement are greater than ever, usually reaching into the tens of millions. Authorities packages like CPP and OAS will not be enough to shut this hole on their very own, however quite a few methods might help bridge it. Exploring these choices and incorporating them into your retirement planning can considerably enhance your monetary outlook.

When you’re thinking about discovering how some insurance coverage merchandise can improve your retirement planning, full a quote on the sidebar or go to this hyperlink.

Do CPP and OAS Bridge the Retirement Gap? Discover What More You Can Do

Related Posts

- 7 Market, Financial Predictions for 2024: Schwab

Begin Slideshow Prime market strategists from Charles Schwab not too long ago shared their ideas…

- Ought to Life Insurance coverage Be Used as a Financial savings Plan?

Understanding the Totally different Forms of Life Insurance coverage There are two principal classes of…

- How This Financial institution Rep Took the Leap to Independence

That was instrumental in serving to me with points like: Who do you utilize for…