Insurance

Distribution Administration ways maintain insurers forward of modifications

Revealed on

In 2018, revenues for the net gross sales website, Craigslist, peaked at $1.03 billion after which started a speedy descent. It’s nonetheless a viable firm (2022 revenues have been $694m) but it surely suffers from a case of channel calcification. Craigslist hasn’t modified a lot of its performance because it began, and customers discover that different choices provide a a lot better expertise.

On October 4, 2016 (be aware the timing), Fb Market hit the scene. Despite the fact that Fb itself is in decline, its offshoots similar to Market and Instagram are thriving. Market is maybe Craigslist’s most related competitor because it permits customers to look and purchase domestically with ease. eBay, one other competitor, does much less native enterprise, however eBay sellers profit from built-in transport choices that make it simpler for consumers and sellers. And most just lately is Etsy, the place sellers can provide high-quality, artisanal merchandise and developed an incredible loyal buyer base with an estimated 40% are gross sales from repeat consumers. I do know I’ve purchased from all of those relying on what I’m in search of – I’m a multi-channel purchaser.

Fb Market has some clear benefits over Craigslist, most having to do with the client expertise. First, there’s safety. Patrons and sellers can see one another and work together way more simply, eradicating a number of the buy’s uncertainty. They’ll touch upon one another on the platform, which makes each events liable for finishing a great and honest transaction. The vendor dashboard is straightforward to make use of. Fee could be made by way of the platform if each events conform to it with a number of totally different cost choices. Sellers may also pay a premium to get “pushed” to the highest of the listings.

So, the Craigslist downturn has two elements to it: Lack of buyer expertise enhancements and lack of vendor choice. If sellers discover that they’re promoting extra by way of a greater channel, they’ll transfer. Patrons will then transfer with them as a result of the choice improves by way of the brand new channel.

There are a dozen classes on this state of affairs for insurers, however let’s look intently at 5.

Lesson 1: Channels aren’t fastened. They’re fluid.

Most insurers grasp that they should create an ecosystem of interconnected channels, utilizing a variety of capabilities that may join with clients when and the way they need to purchase. Channel improvement and use is a balancing act. Channel effectiveness is all the time in movement. Insurers must ask themselves, “Are we treating our channels as if they’re fastened in time or are we making ready to make use of right this moment’s trending channels right this moment and tomorrow’s trending channels tomorrow.” Not solely are channels not fastened in place, however an insurer’s channel technique must be constructed to move with channel tendencies. The best way to maintain up with buyer demand is to grow to be adept at broad distribution strategies and nice experiences. That is the place tech is available in. Lots of Majesco clients are re-creating their digital distribution surroundings utilizing our distribution administration options and ecosystem of companions.

In a press launch saying our expanded capabilities, Karlyn Carnahan, head of Celent’s North American Insurance coverage apply acknowledged, “If a provider needs to completely exploit the potential of its numerous channels, they need to suppose very in another way about distribution administration, compensation, and segmentation. Distribution administration platforms should proceed to evolve to allow insurers to handle their distribution pressure with rising sophistication.”

Lesson 2: It’s essential for insurers to know trending channel preferences.

In Majesco’s current thought-leadership report, Bridging the Buyer Expectation Hole: Property Insurance coverage, we glance intently at buyer buy channel preferences weighed in opposition to insurance coverage for channel improvement. Do they match up? Once we visualize the info, the gaps are straightforward to see.

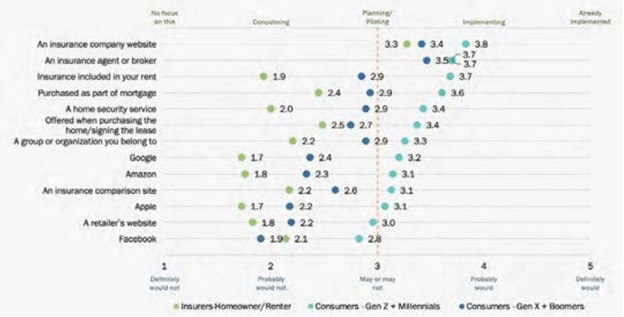

Conventional channels stay the popular technique for buying house owner/renter insurance coverage, together with brokers/brokers and firm web sites, as mirrored in Determine 1. Nevertheless, for all the opposite channels, clients’ curiosity is almost twice that of insurers’ actions, significantly for the Gen Z and Millennial section.

Determine 1: Buyer-Insurer gaps in distribution channels for private property insurance coverage.

The youthful era displays the need for entry by way of and all channels. Members of this era are heavy renters, and they’re starting their transition to homeownership. Insurers who’re providing ease of entry to renters’ insurance coverage have the chance to construct sturdy buyer relationships that may generate higher income. The digital expectations and ease of entry are prime priorities for this era.

Insurers that need to seize extra enterprise by way of a broad-channel strategy will take note of the bigger gaps and tendencies as they search for alternatives. Nevertheless, they may also need to take note of these areas the place insurers appear to be getting nearer, however maybe their firm remains to be within the consideration part. It is a signal that rivals could also be beating them to profitable partnerships. For instance, there’s a lessening hole for the channels, buying property insurance coverage on the level of a house buy or bought as part of a mortgage. These partnerships could also be rising in frequency.

Lesson 3: Life and enterprise occur on the level of buy and vice versa.

Fb Market had one distinct benefit over Craigslist proper from the outset — it was positioned the place individuals have been interacting, even after they weren’t purchasing for something. When taking a look at Majesco survey information, it’s clear that SMB business property insurance coverage purchases may also occur almost wherever there may be interplay or engagement. Insurers must be asking themselves, “The place can’t we promote?”

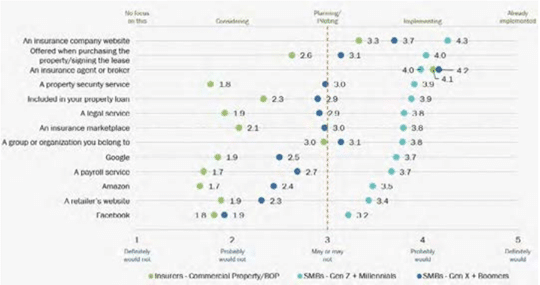

Each generational SMB segments are thinking about all channels as proven in Determine 2. Nevertheless, insurers aren’t assembly these expectations, aside from brokers/brokers, and to some extent, firm web sites. The gaps are important – as much as 2 occasions what insurers do – significantly for the youthful era of Gen Z and Millennials, in step with their expectations for a multi-channel world.

These gaps restrict insurers’ attain and development whereas placing them in a aggressive gap as in comparison with others which can be utilizing a multi-channel technique. Whereas brokers will proceed to be vital, quick access to insurance coverage through different channels, significantly for embedded insurance coverage, can be more and more vital for future viability.

Determine 2: Buyer-insurer gaps in distribution channels for business property insurance coverage.

For instance, in Determine 2, take a look at the hole between Gen Z/Millennial SMB’s curiosity inpurchasing property insurance coverage by way of their payroll service and insurers’ curiosity in offering property insurance coverage by way of the payroll channel.

For an SMB proprietor, there may be nearly no enterprise accomplice that’s consulted extra persistently than the payroll firm. Payroll contact occurs weekly or bi-weekly. Business property insurers would do nicely to accomplice with payroll firms. It’s a win/win. It makes a wonderful instance of the factors insurers ought to think about when they’re eager to broaden their distribution. Search for locations the place life and enterprise occur and people are the factors the place publicity could be fruitful. Payroll is some extent of buy.

Insurers can search for spots the place life and enterprise are happening, even when there might not be a selected buy concerned. Examples of those could be commerce associations, neighborhood enterprise associations, authorized companies, upkeep suppliers, or safety companies. Actually, one of many best relationship synergies must be between property insurers and property safety firms, but this distribution channel additionally has one of many largest gaps.

Lesson #4: Don’t suppose you’ll be able to wait till tomorrow for channel growth.

The time is now for speedy multi-channel growth, enabled by applied sciences that may deal with the rising tempo of change. Some channels could not pan out. Some channels will pull their weight. Some can be profitable. Like investing in mutual funds as an alternative of particular person shares, insurance coverage expertise investments want to permit for a broad strategy to distribution.

Change is quicker, deeper, wider, and extra highly effective than we’ve ever been used to earlier than. The consequence? Rising buyer expectation gaps, significantly for the youthful era who are actually the dominant consumers put insurers susceptible to dropping loyalty and stifling development.

Ahead-thinking leaders are making daring, warp-speed strikes to shut buyer expectation gaps and place themselves for market management and development. They’re specializing in prolonged market and buyer attain for individuals and companies by way of new distribution channel choices, together with embedded insurance coverage. These choices meet individuals the place they’re right this moment, not the place they are going to be subsequent yr.

For insurers, adopting a brand new distribution channel philosophy will give them a stronger, extra aggressive market place by way of a rising channel ecosystem that performs to their strengths and closes gaps or weaknesses.

Lesson #5: It isn’t sufficient to supply a brand new channel. It’s best to lend one thing new and improved to the expertise.

Partnerships and trendy distribution expertise are two items of the identical puzzle. In right this moment’s insurance coverage, you’ll be able to’t have one with out the opposite. Fashionable distribution administration isn’t nearly connections — it’s about utilizing information, channel expertise, and channel efficiency to tweak, flex, and generate gross sales. Good digital experiences occur when the proper applied sciences are used creatively.

Majesco’s Distribution Administration and Digital360[DG1] options assist insurers fast-forward their channel growth plans, whereas immediately giving them the cutting-edge AI and machine studying instruments to adapt and develop. Insurers ought to ask themselves questions like, “Can we use our information to anticipate subsequent steps or anticipate further wants? Is our distribution administration feeding us insights that may assist us shift in a well timed method?”

Staying on the entrance of the aggressive pack takes an open angle and a willingness to repeatedly adapt. “The place can’t we promote?” The reply is, “Solely the place we aren’t ready to.”

It might be laborious to imagine, however Craigslist was as soon as “cutting-edge” and disruptive. It definitely shares a number of the credit score for hastening the demise of some day by day print newspapers. But, evidently it was by no means Craigslist’s purpose to grow to be way more than it already was.

Insurers should be totally different. Leaders that want to stay on prime of the competitors will maintain distribution expertise on the forefront of their priorities. They may also return incessantly to their distribution technique and assess its alignment with particular person and enterprise buyer channel tendencies.

For a better take a look at how some insurers are aligning themselves to P&C clients, make sure you learn Majesco’s thought-leadership report, Bridging the Buyer Expectation Hole: Property Insurance coverage. For extra info on how right this moment’s tech can assist to broaden your organization’s distribution channels, contact Majesco right this moment.

[DG1]hyperlink

Related Posts

- Distribution Administration techniques maintain insurers forward of modifications

Printed onAugust 10, 2023 In 2018, revenues for the web gross sales web site, Craigslist,…

- The Way forward for Variable Traces Dealer Administration

This put up is a part of a sequence sponsored by AgentSync. Key takeaways: What…

- Life insurers look to various investments

Life insurers look to various investments | Insurance coverage Enterprise America Insurance coverage Information Life…