Insurance

Company networks – The brand new actuality in insurance coverage distribution | Insurance coverage Weblog

Aggressive strain, elevated capital availability (even with present charges), and the evolving enterprise panorama (thanks partially to the pandemic) have created a chance for impartial insurance coverage brokers (IAs) to get inventive to develop and stay impartial within the insurance coverage trade.

As such, many IAs have sought out company networks that present advantages traditionally more durable to return by as a standalone enterprise / company. For carriers, understanding the function of company networks and why they’re necessary might be important for the efficient use of this distribution construction. Figuring out why companies be a part of and change networks also can assist carriers make strategic selections for the long run.

We are going to now discover these matters together with the advantages of company community participation and the way carriers ought to reply to this rising distribution development.

To kick issues off, let’s focus on the aggressive strain and elevated capital availability that’s more and more inflicting companies to hunt out networks.

The “demise” of the agent has been drastically exaggerated

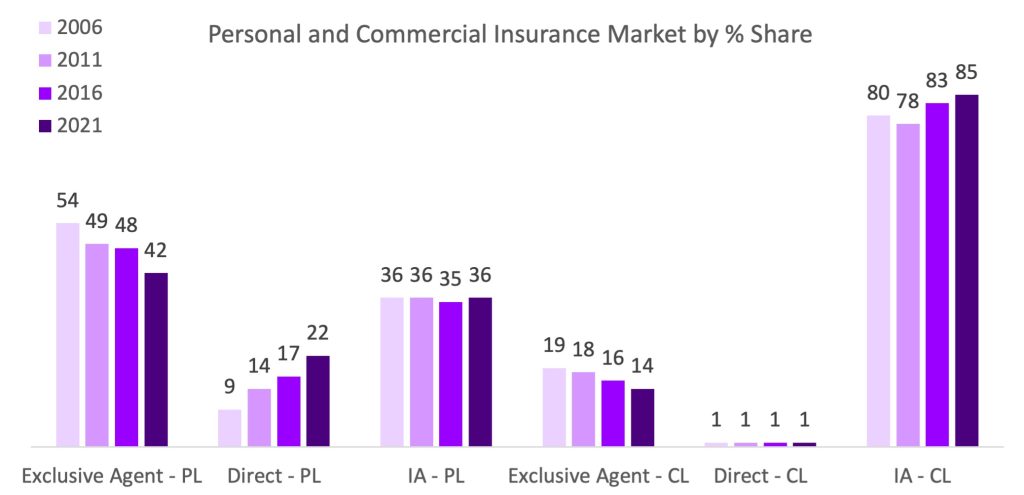

For twenty years, the trade has centered on the affect of direct and different distribution, similar to insurance coverage embedded into the acquisition strategy of a car and different point-of-sale provides. Our analysis exhibits that IAs stay the dominant channel, particularly in industrial traces.

Supply: Unbiased Insurance coverage Brokers & Brokers of America

It’s our perspective that IAs will proceed to develop their market share and increase their relevancy as exposures improve in complexity and industrial working preparations proceed to evolve. In brief, the “demise” of the agent has been drastically exaggerated.

Evolving landscapes and operational calls for add strain

Whereas IAs stay dominant, a number of forces proceed to affect this channel, together with:

- Non-public fairness funding: Company consolidation is quickly rising pushed by personal fairness funding, and regardless of the rate of interest hike slowing among the M&A market, the deal pipeline stays wealthy and capital stays out there for goal companies

- Change in work setting: The digital or hybrid work setting requires better capabilities than ever earlier than for companies to function, retain good expertise, and many others., which is each a talent and functionality hole for a lot of company house owners

- Continued competitors for expertise: Regardless of the expansion of other staffing fashions (e.g., short-term or gig employees, digital workforces), IAs are challenged to safe and retain the expertise they should run their enterprise; additional, the common age of producers and account administration employees exceeds 50, indicating youthful expertise isn’t becoming a member of the insurance coverage workforce at a enough fee for the approaching waves of retirement

- Prospecting has “gone digital”: The need for IAs to be “open for enterprise” on all channels a prospect or buyer chooses makes the necessity for a web based presence important. As such, the need for digital advertising and marketing capabilities have elevated considerably, leaving IAs in search of steerage on the best way to execute the perfect digital technique

When mixed, these elements have modified the enjoying area and shifted engagement fashions throughout the trade. The efficiency hole between small- to mid-sized impartial companies and bigger company/brokerage roll-ups has widened with bigger gamers utilizing their capital to purchase enhanced capabilities required to outperform the competitors.

Company networks stage the enjoying area for IAs

Merely put, networks assist bridge the hole created by these elements for brokers that wish to be aggressive whereas remaining impartial. Many networks supply totally different capabilities (e.g., advertising and marketing, coaching, know-how) and supply entry to elevated compensation (by pooling premiums to beat entry gates for elevated base and variable compensation) in change for a price. This construction permits small and mid-sized IAs to compete on a extra stage enjoying area with bigger standalone companies and company roll-ups. Moreover, community buildings have supplied a compelling different for EA’s to get the perfect of each worlds – they can get selection of carriers whereas additionally receiving the enterprise and operational help they want from their community. This has offered an alternate for historic EA expertise rising the pool of viable IAs reinforcing the worth networks are including.

These benefits imply networks are solely rising in reputation. There are almost 40,000 impartial companies in america as of 2022, a rise of 4,000 from 2020. It’s not stunning to us, given 2/3 of companies have <$500k in income and will reap advantages from becoming a member of up with different companies, {that a} tremendous majority of companies are in an company community. Our survey of 500 IAs throughout the U.S. exhibits that over 70% of companies take part in one of many roughly 150 networks.

And what’s the value for carriers?

That’s one of many burning questions. What does this fast growth of networks and their rising energy within the market imply for the trade? What concerning the ensuing affect on whole value of distribution?

Whereas the rise of company networks is essentially optimistic for IAs, there’s a excessive value for carriers. To interact with networks and stability the advantages vs. prices, carriers will want a deeper understanding of key IA challenges and why they’re becoming a member of networks.

What’s driving companies to affix networks?

A standard false impression is that impartial brokers (IAs) be a part of networks solely to extend income. The reality is that these networks supply further advantages past income and might be priceless to carriers too.

The drive for companies to affix networks is multi-layered. Figuring out why companies be a part of networks may help carriers make strategic selections for the long run. For a deeper understanding of the important thing motivations, we should take into account the challenges and objectives of companies.

As we speak’s key challenges and objectives for insurance coverage companies

Evergreen challenges of standalone IAs have gotten exacerbated by operational calls for described earlier on this put up. We see this throughout 4 dimensions:

- Ability: The skillsets wanted to handle the enterprise come on the expense of skillsets wanted to develop the enterprise. Additional, companies have had issue maintaining with tech abilities required to accumulate and serve clients digitally

- Scale: Smaller dimension makes it troublesome for companies to draw and retain expertise and obtain leverage with carriers

- Scope: Whereas a key worth proposition for companies is their breadth of product, many smaller companies lack capability to know a big number of merchandise and types; additional their smaller worker base means they will’t have specialised roles and should deploy generalist mannequin

- Capital: Investing in capabilities and instruments that may allow differentiated talent, scale, or scope requires capital that’s out of attain for a lot of IAs

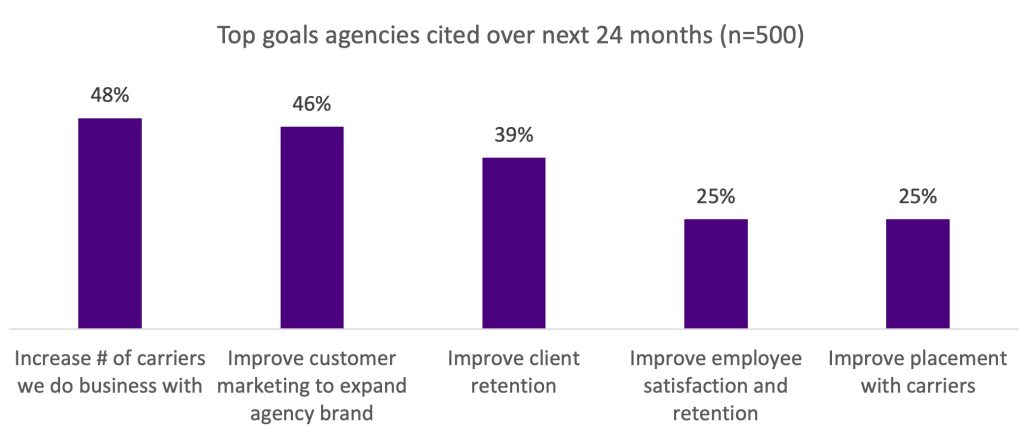

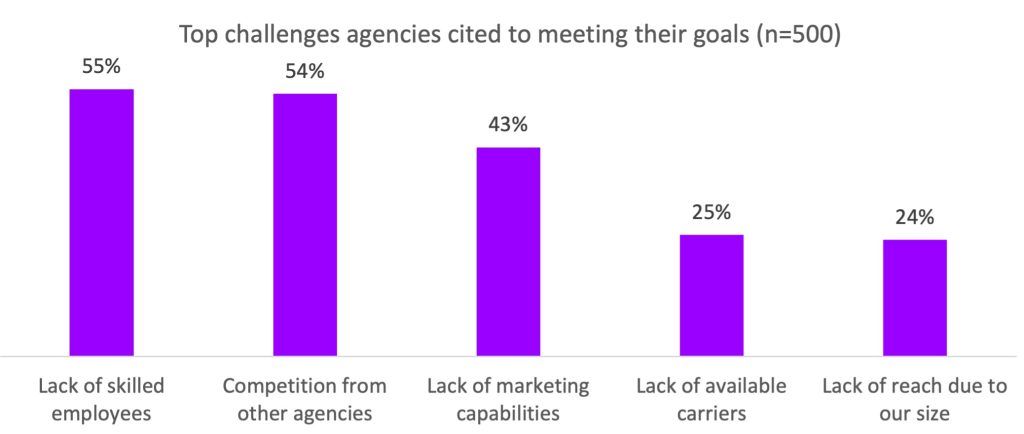

So, we weren’t stunned once we requested companies about their objectives and challenges that the dearth of expert staff (talent), competitors from different companies (scale, scope, and capital), and lack of selling capabilities (talent, capital) have been the highest three challenges stopping companies from reaching their important objectives of development and elevated retention.

Company networks have moved in as a priceless choice to handle these challenges and objectives.

Prime three causes impartial insurance coverage companies be a part of company networks

Our analysis discovered that networks delivered on three main goals: Expertise, Advertising and marketing sophistication, and Service entry and breadth.

1. Construct expertise:

IAs usually lack the size and assets for efficient recruiting, coaching, and worker growth. Greater than 55% of our respondents say discovering staff with the correct skillsets is a main problem. Companies additionally face further challenges in offering aggressive compensation and advantages, coaching, and employees growth.

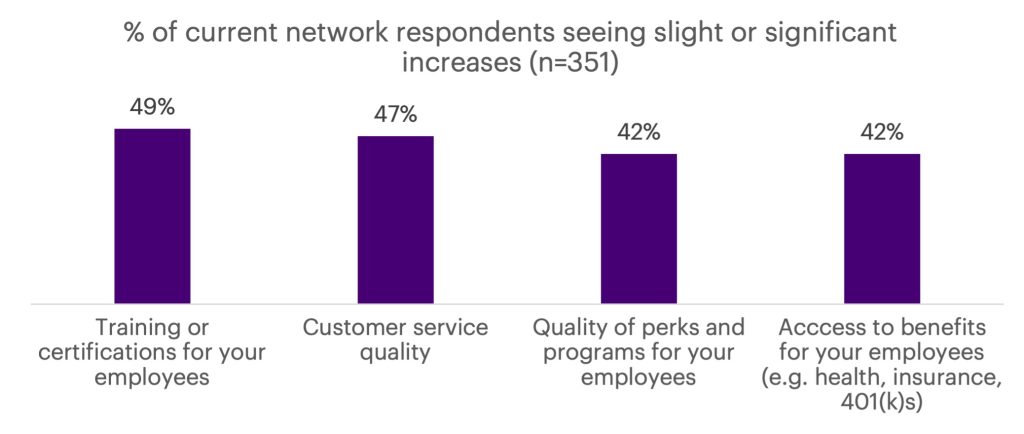

Community members from our survey noticed enhancements to their expertise issues in each the experiences they have been capable of ship to their clients (e.g., service high quality as a consequence of upskilling or entry to customer support capabilities) in addition to advantages that allowed for additional upskilling and retaining of staff.

2. Entry further advertising and marketing capabilities:

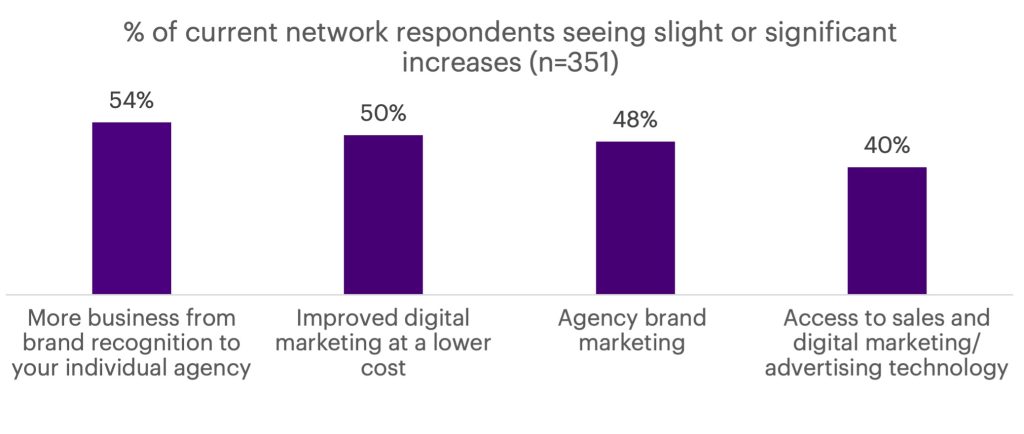

With at the moment’s “all the time on, all the time open” tradition, a web based presence is critical. The digitally pushed market has elevated advertising and marketing complexity for IAs. As with the opposite themes, brokers who belong to associations say they’ve benefited from becoming a member of, however alternative for enchancment stays. Roughly 50% of survey respondents say constructing further advertising and marketing capabilities is each a near-term precedence and a problem for his or her companies in driving further development.

A rise in IA model consciousness was highlighted by impartial brokers that have been a part of networks because of the reference to their nationwide community model. Moreover, IAs inside networks have been capable of entry less expensive digital advertising and marketing and higher know-how for advertising and marketing.

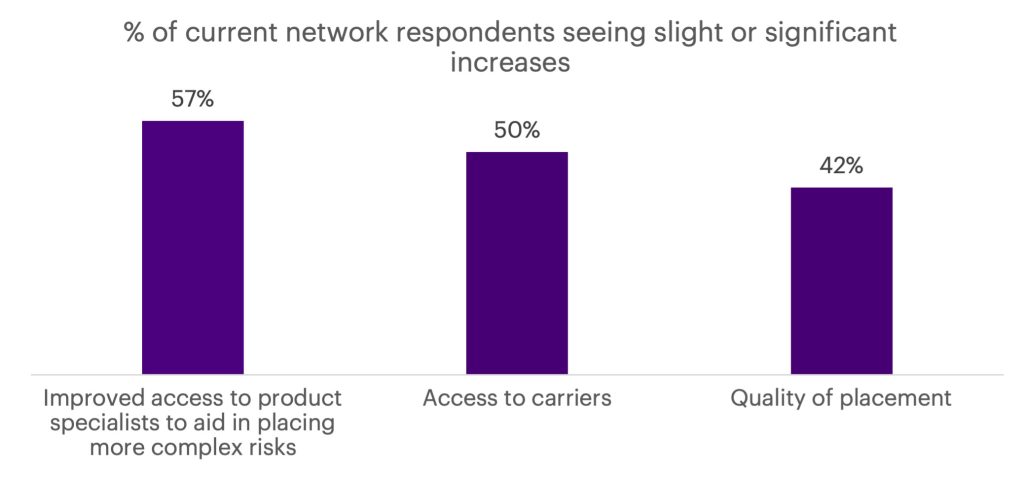

3. Improve provider entry and breadth:

We discovered that 48% of IAs wish to improve the variety of carriers they do enterprise with. One other 25% of IAs spotlight the dearth of accessible carriers, and 23% say the dearth of aggressive merchandise stay boundaries to assembly their objectives. Given the significance to the IA channel’s worth proposition of the power to position enterprise with a number of carriers throughout a spectrum of product choices and worth factors, this presents vital alternatives for networks and carriers alike.

The truth is, 91% of our respondents agree company networks enable for smaller companies to have higher placement or servicing choices. Companies say they can achieve entry to extra carriers by way of their networks and that they’ve entry to specialists for advanced dangers.

Contemplating these findings, at the moment’s participation fee of IAs in networks is no surprise. In response to the participation fee, carriers should decide the perfect methods to have interaction and leverage networks to satisfy their very own objectives.

4 methods carriers can unlock advantages by company networks

Whereas networks have been largely optimistic for IAs, they’ve brought about a rise within the whole value of distribution for carriers who’re paying extra, in some instances, for enterprise they already had on the books. To defend profitability, carriers should take a look at methods to maximise their very own advantages from company networks.

Let’s take a look at 4 methods to do that:

1. Create compensation plans that profit each companions

To maximise the size of networks and keep away from overpaying for efficiency not aligned to the provider’s objectives, carriers can create easy and clear base & variable compensation applications for companies that drive desired company conduct. For instance:

- Join will increase in community entry charges (overrides) to will increase in mutually useful outcomes for a pay-for-performance method.

- Require the community to offer the manufacturing companies inside the community with a portion of the entry price—not simply the variable compensation or revenue share fee.

2. Handle the talent and know-how gaps

Companies want help to develop abilities and know-how which are important for his or her enterprise. Whereas networks fill among the gaps, carriers ought to take into account creating partnerships through which companies can use know-how and non-carrier particular techniques to enhance effectivity. For instance:

- Digital advertising and marketing coaching for workers

- Self-service shopper capabilities that cut back operational workload

- Use of generative AI to shortly and precisely reply to an company’s request the primary time

3. Complement, don’t replicate

There are tons of of company networks vying to offer capabilities and advantages to the 40,000+ IA market. Carriers ought to take into account the capabilities offered to brokers by the community and the place the provider can fill the hole. This requires understanding the networks which are most influential within the provider’s distribution technique and what they supply to their companies. Carriers can then take a deeper take a look at the place they will step in to enrich their capabilities.

4. Decide winners and companion

As a result of networks can be utilized as a significant path for development within the context of a broader distribution technique, carriers ought to establish the set of networks that may help their enterprise goals. Moreover, growing an engagement mannequin suited to that community companion and aligning on how they are going to collectively present for company wants might be essential steps for fulfillment.

Company networks are a power inside insurance coverage distribution that’s huge and getting larger. These networks present tangible advantages to companies that assist them meet their objectives and handle challenges. Carriers are already partnering with these networks at the moment, and by acknowledging how carriers can complement and incent networks, carriers can use company networks as a significant lever to attain their goals, in service of their broader Complete Enterprise Re-invention.

Related Posts

- Inszone Insurance coverage buys Speck Insurance coverage and Monetary Companies

Earlier this month, Inszone Insurance coverage acquired a New Mexico-based insurance coverage company. Credit score:…

- ALKEME acquires Paul Kinan Insurance coverage, Wiggans Farha Insurance coverage

Paul Kinan Insurance coverage Group focuses on providing companies, households and people with property and…

- Evertree Insurance coverage Providers acquires Prosper Insurance coverage

The deal additionally permits Evertree to offer progressive insurance coverage options. Credit score: PanuShot/ shutterstock.com.…