Insurance

Billing & funds present opening to fulfill buyer calls for

Revealed on

Cell phones are part of us now. Most of our lives are spent inside inches of a cell system. We’d like them virtually like we want meals and water. They permit us to run a lot of the logistics of our life wherever we could also be. They permit us to continually talk — merging life and work right into a seamless cloth. For good or unhealthy, our lives at the moment are much less compartmentalized and extra built-in right into a unified move of data, work, wellness, communication, buying, leisure, and maintenance.

Nevertheless, telephones and cell companies are dearer than ever. This has positioned cell phone service suppliers underneath elevated buyer worth scrutiny, particularly as a result of there are so few suppliers and so many subscribers. The sheer quantity — the ratio of subscribers to suppliers — is staggering. It has stretched cell supplier billing programs and it has annoyed hundreds of thousands of shoppers. It has additionally made competitors fierce.

Take into consideration your personal cell supplier expertise, particularly about billing and repair. For the reason that massive three (AT&T, Verizon, and T-Cellular) largely carry the identical telephones, they’re now in a state of affairs the place worth, service and billing are probably the best determiners of buyer loyalty and retention. What drives you to remain or change? Are you all about price or do you prioritize utilizing a customer-friendly model that makes cell use a rewarding expertise and provides different worth?

Buyer loyalty is fragile in any business; insurance coverage is not any exception.

Nice buyer experiences, interfaces, straightforward transactions, and intuitive service can construct your model and improve buyer loyalty. Customer support points: whether or not by means of billing and cost of insurance policies or claims funds, can drive clients away. Prospects nonetheless, figuratively, vote with their ft.

Roundtable views on insurance coverage billing and funds

Deloitte and Majesco hosted a roundtable with skilled billing and funds business leaders to debate the market tendencies and subsequent methods and ways to raise billing and funds as a key a part of the shopper journey and expertise. We documented among the findings and lots of the roundtable discussions in a latest thought management report, Rethinking Billing and Funds within the Digital Age.

In a day and age the place competitors is as stiff because it has ever been, most of our contributors agree that billing and funds deserve nearer scrutiny, better consideration, and better precedence in order that it reaches its full potential as an environment friendly, efficient model builder.

Stepping As much as the brand new period of buyer billing and cost expectations

We see it throughout all industries and companies – clients are taking note of how they’re billed and paid. Their expectations, whether or not met or unmet, are one figuring out consider whether or not they select to modify to or stick with an insurer. These expectations are being pushed by an ever-growing set of choices that embody every thing from customizable billing schedules to digital cost strategies like ApplePay, Venmo, firm apps, and others to make or settle for funds. On the identical time, clients predict a seamless digital expertise.

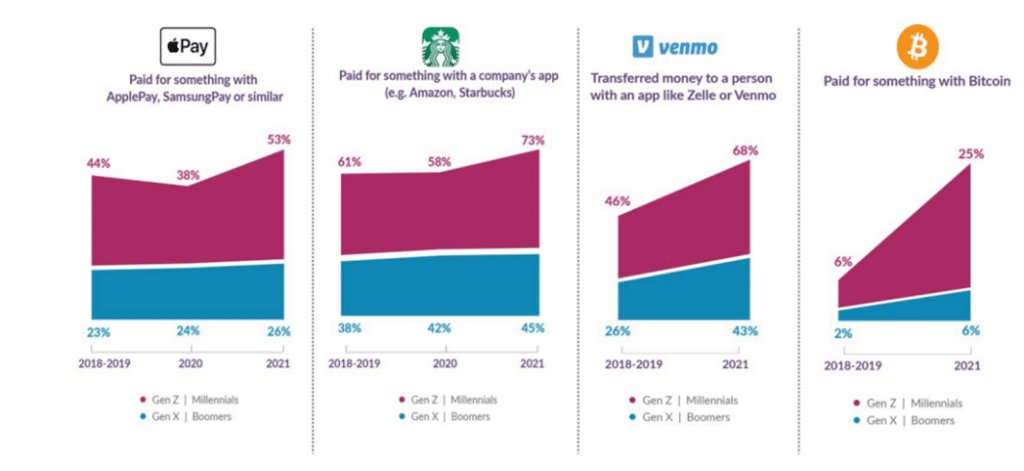

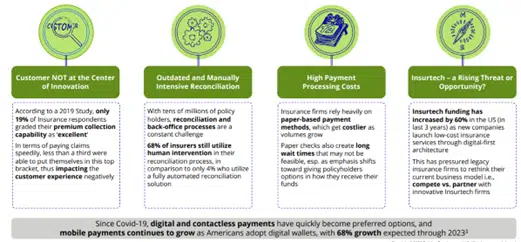

Majesco’s buyer analysis, mirrored in Determine 1, highlights the rising demand for these various cost strategies, significantly for Gen Z and Millennials.

Determine 1: New Buyer Digital Commerce Expectations

Whereas insurers should adapt their methods to be digital-centric, some clients nonetheless desire writing a test. As one roundtable participant stated, 70% of P&C funds of their line of enterprise are made through test – an astounding quantity contemplating how many individuals have tailored to digital choices. To retain belief and loyalty, and hold income unobstructed, insurers should meet all billing and cost choices.

These rising expectations speed up the shift of billing and funds from its conventional function as one of the “again workplace” processes to the “entrance workplace” as an important functionality in delivering an excellent buyer expertise. Insurers more and more understand the numerous function that billing performs. They’re waking as much as the truth that distinctive service is vital past the monetary operation. First-rate service is essential to constructing and enhancing relationships with clients, companions, and distributors. In at the moment’s more and more digital world, legacy billing programs don’t meet these rising wants and expectations.

Cultivating buyer experiences that help the model.

Superior billing and cost capabilities can now not be seen merely from a transactional perspective, however now should fill an important function in creating an inviting and holistic digital expertise. Each contact level is a chance to humanize and personalize the model relationship and strengthen model belief and loyalty.

In rethinking billing and funds, insurers are targeted on key enterprise priorities together with:

- Buyer expertise – The prevalence of digital shopping for and cost choices throughout different industries, heightens the expectation for insurance coverage to ship related capabilities to be “on par.” Insurers compete with exterior experiences.

- Transparency and adaptability – Buyer belief is influenced by transparency.

- Prospects are searching for a single invoice for a number of insurance policies, no matter product or phase.

- New merchandise reminiscent of usage-based or gig insurance coverage (which mirror actuality, not estimates) require extra frequent and customized pricing and billing.

- Prospects need to run situations. Can they preview the influence on payments if they alter plans or choices?

- Superior analytics for model administration – Insurers need perception into:

- Propensity to resume or lapse.

- Probably response charges for cross-sell or upsell provides.

- Buyer expertise satisfaction.

- And, profitability for proactive/responsive enterprise administration.

- Worth-Added Providers – More and more insurers need to improve the shopper relationship and develop income by providing value-added companies. The billing and cost choices for these companies typically require totally different approaches than conventional threat merchandise.

Communication is important.

Well timed, frequent, and customized digital communication is equally as vital.

Digital channels like voice, sensible audio system, e-mail, or textual content/SMS are more and more used to boost the connection and expertise. Communications are now not restricted to billing statements or cost statuses. Frequent communication concerning different merchandise or value-added companies is appropriate. How are insurers changing into useful, not simply transactional? Options concerning various billing choices that may higher align with a buyer’s life might present better buyer personalization and engagement. It’s more and more vital to keep away from coverage lapses or late renewals.

“Funds, from a billing perspective, is essentially the most frequent touchpoint that you’ve at any given level together with your insurers. That is the chance to have that nice buyer expertise, the place they are saying this was straightforward, this was frictionless.”

Roundtable Participant

Insurers should strategically and tactically start to convey billing and funds into buyer expertise and digital engagement plans. A various set of digital cost choices, superior applied sciences, and a coordinated mixture of digital communication strategies will lay a stable basis and meet the rising expectations of shoppers, brokers, and companions.

“We’ve created an organizational change administration workforce beneath our chief expertise officer. They’re constructing out a complete portfolio of messaging. We need to perceive the obstacles that individuals see. If we will get that info and converse again in phrases they’re utilizing, we will affect them to the atmosphere we would like.”

Roundtable Participant

Digital billing and funds: the place do insurers start?

Digital billing and funds can re-energize an insurer’s skill to fulfill retail tendencies head-on.

To get to the following degree and rethink billing, they wanted to beat hurdles like crippling legacy debt that hinders their effectiveness and buyer expertise because it pertains to billing and funds and rethink their future state. What alternatives would come up if insurers may change into extremely digital, with a brand new working mannequin and a stable, but versatile know-how basis?

Cope with the hurdle of legacy debt.

One of many important hurdles for digital transformation is legacy debt – each the working mannequin and know-how – stifling an insurer’s skill to fulfill buyer digital expectations, develop billing and cost choices and drive down operational prices. An insurer’s legacy debt removes the flexibility to launch new, revolutionary merchandise reminiscent of embedded, on-demand, UBI, and value-added companies as a result of limitations of the know-how. Billing know-how like Majesco Billing for P&C, Majesco Billing for L&AH, Majesco Digital Digital Bill360 for P&C and our ecosystem of companions allows, not inhibits.

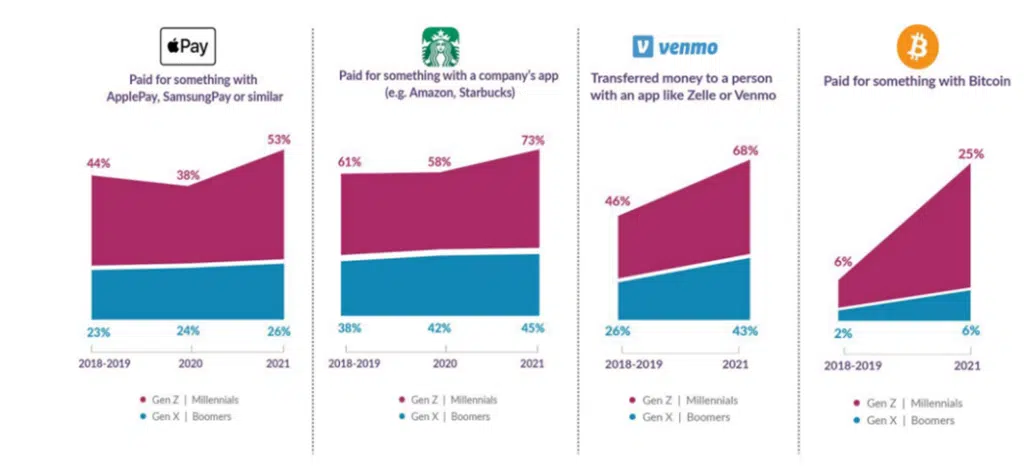

Every of the areas mirrored in Determine 2, highlights the market development challenges and operational realities of legacy debt.

Determine 2: Present state of funds within the insurance coverage sector

Addressing the present state requires a technique and plan that tackles the operational mannequin, together with all processes, know-how, and tradition. At the moment’s clients count on their most popular manufacturers to instinctively replace their processes and transaction capabilities to maintain up with what their gadgets and existence have made potential.

They need a threat product, value-added companies, and an expertise that gives them with what they should handle their lives. Insurers should humanize the method and expertise. However conventional product-oriented methods handicap insurers. Insurers must “suppose exterior their very own packing containers” and hold buyer lifecycles and desires in focus.

Insurers that take note of these shifts ought to take the following step and make fast strikes to take away their crippling legacy debt.

Unify the know-how technique and customer-focused ways.

The long run state calls for an operational mannequin and know-how that gives a basis to adapt, innovate and ship at velocity to execute technique and market shifts. The rising significance and adoption of platform applied sciences, APIs, microservices, digital capabilities, new/non-traditional knowledge sources, and superior analytics capabilities at the moment are essential to market management.

From the entrance workplace to the again workplace, SaaS next-generation platforms are reshaping the enterprise focus from coverage to buyer, from course of to expertise, from static to dynamic pricing, from point-in-time underwriting to steady underwriting, from the historic view of knowledge to predictive and prescriptive knowledge, from conventional merchandise to new, revolutionary merchandise, and a lot extra. Insurers’ skill to ship elevated worth to the shopper relationship will deepen and differentiate buyer loyalty.

Central to the elevated worth is enhancing buyer selections, but with selection comes complexity. This complexity will be simplified, managed, and optimized with a next-gen billing and cost unified technique.

A unified billing and cost technique offers a holistic, enterprise method to enterprise capabilities, processes, and buyer engagement. It strikes billing and funds from the again workplace and a defensive place to the entrance workplace and an offensive place for buyer engagement, resulting in increased satisfaction, loyalty, and retention.

Conventional instance: Direct and Company Invoice

Direct and Company invoice are two of essentially the most used billing varieties. Direct invoice is when an insurer sends the invoice to the policyholder for cost on to the insurer. In distinction, company invoice the company payments the insured and collects the premium then pays the insurer. Particular processing is required to help each of those. There are different forms of billing together with checklist or group invoice, third social gathering invoice (reminiscent of mortgagees), and cut up or multipayer billing.

Whereas these proceed to be dominantly used, as merchandise change and the way premium is calculated – extra often or in real-time – revolutionary billing choices are rising. Insurers should have the ability to help these new choices to fulfill product calls for of shoppers.

Revolutionary instance: Computable contracts

One tactic of an offensive technique that’s being thought-about by some corporations is together with the flexibility to have computable contracts (placing the coverage settlement into code) for every coverage. For instance, a rock hits your windshield. You’re taking an image and submit a declare. As a result of the info about your automotive and coverage are identified by means of this computable contract, the cost can move instantly and digitally. The method is quick, and it naturally reduces operational prices.

Innovation targeted on the shopper can drive extra offensive performs whereas accelerating transformation. Making a holistic buyer expertise not solely offers digital billing and cost choices, but additionally allows broader communication and engagement together with cross-sell or up-sell of insurance policies with extra merchandise, amendments, or value-added companies primarily based on their distinctive demographics.

Revolutionary instance: Purchase now, pay later.

Inflation is inflicting clients to guage all their bills. Consequently, some are contemplating various financing choices reminiscent of Purchase Now, Pay Later (BNPL). BNPL is a comparatively low-cost, versatile credit score possibility that gives sooner entry to credit score in comparison with different unsecured mortgage merchandise, thereby lowering uncertainty and easing buy selections for patrons.

This selection is primarily pushed by Fintechs who’re providing entry to credit score for patrons with low credit score scores. It offers them the merchandise they want with a decrease up-front accountability. They obtain:

- On the spot gratification (in contrast to layaways).

- Higher money move administration by means of versatile reimbursement plans & rates of interest (0-30%).

- A considerably extra personal and secure transaction that is less expensive and extra accessible than bank cards.

It’s estimated that 40% of shoppers count on installment loans as a cost possibility, however in main downturns, Deloitte estimates that installment loans can act as an vital bridge for over 90% of shoppers.

This cost possibility could possibly be a consideration in serving to folks pay massive premiums. For some insurers, this sort of tactic might not appear essential. Nevertheless, should you think about that a part of model constructing is making transactions straightforward and painless, it suits squarely inside the insurance coverage model technique.

In our subsequent weblog, we’ll take a look at how insurers can arrive on the future state. How can insurers select and use the best mixture of billing and cost applied sciences that may match customer-focused methods and construct the model by means of the absolute best experiences? Deloitte and Majesco collectively are working ahead considering, main insurers within the business, to rethink their billing and funds operation and know-how to raise their model and buyer loyalty in a world of quickly altering expectations.

For a deeper look, remember to obtain the Majesco/Deloitte report, Rethinking Billing and Funds within the Digital Age.

At the moment’s weblog is co-authored by Denise Garth, Chief Technique Officer at Majesco, and Ajay Radhakrishnan, Principal, Deloitte Consulting

Related Posts

- Billing & funds present opening to fulfill buyer calls for

Revealed onJune 15, 2023 Cell phones are part of us now. Most of our lives…

- Billing and Funds pathway to enterprise progress booster

Printed onOctober 26, 2023 Earlier than everybody began calling their merchandise “bespoke” options (a phrase…

- 15 Greatest Core Inventory Funds: Morningstar

Begin Slideshow Constructing an funding portfolio is a private expertise, but most traders would in…