Health Insurance

Biden Plan To Save Medicare Sufferers Cash on Medication Dangers Empty Cabinets, Pharmacists Say

Months into a brand new Biden administration coverage meant to decrease drug prices for Medicare sufferers, impartial pharmacists say they’re struggling to afford to maintain some prescribed drugs in inventory.

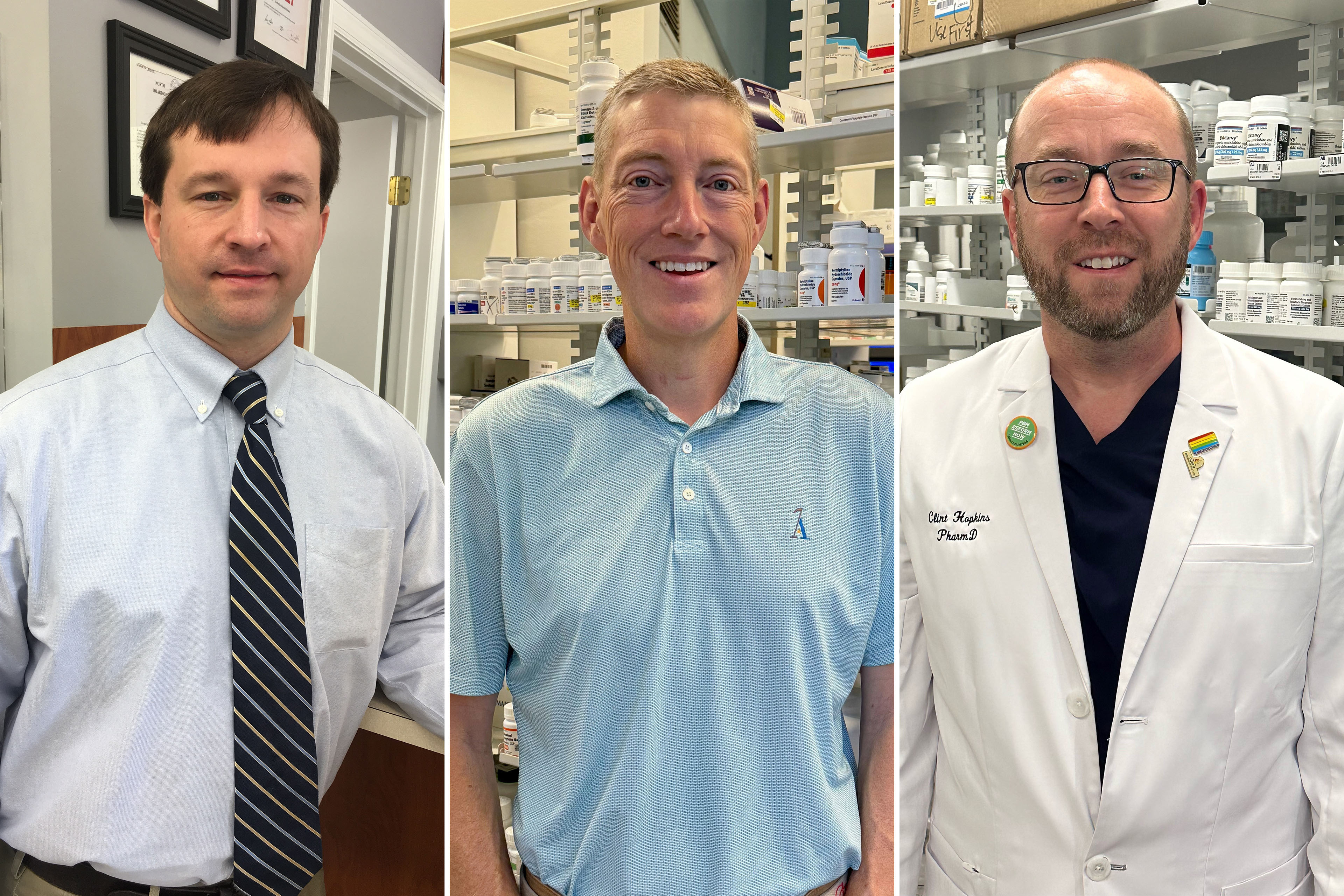

“It could not matter if the governor himself walked in and mentioned, ‘I have to get this prescription crammed,’” mentioned Clint Hopkins, a pharmacist and co-owner of Pucci’s Pharmacy in Sacramento, California. “If I’m dropping cash on it, it’s a no.”

A regulation that took impact in January modifications prescription costs for Medicare beneficiaries. For years, costs included pharmacy efficiency incentives, doable rebates, and different changes made after the prescription was crammed. Now the changes are made first, on the pharmacy counter, decreasing the general value for sufferers and the federal government. However the brand new system means much less cash for pharmacies that purchase and inventory medicines, pharmacists say.

Pharmacies are already fighting workers shortages, drug shortages, fallout from opioid lawsuits, and rising working prices. Whereas impartial pharmacies are most weak, some large chain pharmacies are additionally feeling a money crunch — notably these whose guardian corporations don’t personal a pharmacy profit supervisor, firms that negotiate drug costs between insurers, drug producers, and pharmacies.

A prime official on the Facilities for Medicare & Medicaid Companies mentioned it’s a matter for pharmacies, Medicare insurance coverage, and PBMs to resolve.

“We can’t intrude within the negotiations that happen between the plans and pharmacy advantages managers,” Meena Seshamani, director of the Heart for Medicare, mentioned at a convention on June 7. “We can’t inform a plan how a lot to pay a pharmacy or a PBM.”

However, CMS has reminded insurers and PBMs in a number of letters that they’re required to supply the medication and different advantages promised to beneficiaries.

A number of impartial pharmacists advised KFF Well being Information they’ll quickly reduce on the variety of medicines they carry on cabinets, notably brand-name medication. Some have even determined to cease accepting sure Medicare drug plans, they mentioned.

E-mail Signal-Up

Subscribe to KFF Well being Information’ free Morning Briefing.

As he campaigns for reelection, President Joe Biden has touted his administration’s strikes to make prescribed drugs extra reasonably priced for Medicare sufferers, hoping to attraction to voters troubled by rising well being care prices. His achievements embrace a legislation, the Inflation Discount Act, that caps the worth of insulin at $35 a month for Medicare sufferers; caps Medicare sufferers’ drug spending at $2,000 a 12 months, starting subsequent 12 months; and permits this system to discount down drug costs with producers.

Greater than 51 million folks have Medicare drug protection. CMS officers estimated the brand new rule decreasing pharmacy prices would save beneficiaries $26.5 billion from 2024 by means of 2032.

Medicare sufferers’ prescriptions can account for no less than 40% of pharmacy enterprise, based on a February survey by the Nationwide Neighborhood Pharmacists Affiliation.

Impartial pharmacists say the brand new rule is inflicting them monetary bother and hardship for some Medicare sufferers. Hopkins, in Sacramento, mentioned that a few of his newer clients used to depend on a neighborhood grocery pharmacy however got here to his retailer after they might not get their medicines there.

The crux of the issue is money circulate, the pharmacists say. Underneath the previous system, pharmacies and PBMs reconciled rebates and different behind-the-scenes transactions just a few occasions a 12 months, leading to pharmacies refunding any overpayments.

Now, PBM clawbacks occur instantly, with each crammed prescription, decreasing pharmacies’ money available. That has made it notably tough, pharmacists say, to inventory brand-name medication that may value a whole lot or hundreds of {dollars} for a month’s provide.

Some sufferers have been compelled to decide on between their pharmacy and their drug plan. Kavanaugh Pharmacy in Little Rock, Arkansas, not accepts Cigna and Wellcare Medicare drug plans, mentioned co-owner and pharmacist Scott Tempo. He mentioned the pharmacy made the change as a result of the businesses use Categorical Scripts, a PBM that has reduce its reimbursements to pharmacies.

“We had loads of Wellcare sufferers in 2023 that both needed to swap plans to stay with us, or they needed to discover a new supplier,” Tempo mentioned.

Tempo mentioned one affected person’s drug plan just lately reimbursed him for a fentanyl patch $40 lower than his value to amass the drug. “As a result of we’ve had a long-standing relationship with this explicit affected person, they usually’re dying, we took a $40 loss to handle the affected person,” he mentioned.

Conceding that some pharmacies face cash-flow issues, Categorical Scripts just lately determined to speed up cost of bonuses for assembly the corporate’s efficiency measures, mentioned spokesperson Justine Periods. She declined to reply questions on cuts in pharmacy funds.

Categorical Scripts, which is owned by The Cigna Group, managed 23% of prescription claims final 12 months, second to CVS Well being, which had 34% of the market.

In North Carolina, pharmacist Brent Talley mentioned he just lately misplaced $31 filling a prescription for a month’s provide of a weight management and diabetes drug.

To attempt to cushion such losses, Talley’s Hayes Barton Pharmacy sells CBD merchandise and specialty gadgets like studying glasses, tub merchandise, and books about native historical past. “However that’s not going to return shut to creating up the loss generated by the prescription sale,” Talley mentioned.

His pharmacy additionally delivers medicines packaged by the dose to Medicare sufferers at assisted dwelling services and nursing houses. Reimbursement preparations with PBMs for that enterprise are extra favorable than for filling prescriptions in particular person, he mentioned.

When Congress added drug protection to Medicare in 2003, lawmakers privatized the profit by requiring the federal government to contract with business insurance coverage firms to handle this system.

Insurers supply two choices: Medicare Benefit plans, which normally cowl medicines, along with hospital care, physician visits, and different companies; in addition to stand-alone drug plans for folks with conventional Medicare. The insurers then contract with PBMs to barter drug costs and pharmacy prices with drug producers and pharmacies.

The phrases of PBM contracts are typically secret and limit what pharmacists can inform sufferers — for instance, in the event that they’re requested why a drug is out of inventory. (It took an act of Congress in 2018 to get rid of restrictions on disclosing a drug’s money value, which may generally be lower than an insurance coverage plan’s copayment.)

The Pharmaceutical Care Administration Affiliation, a commerce group representing PBMs, warned CMS repeatedly “that pharmacies would probably obtain decrease funds beneath the brand new Medicare Half D rule,” spokesperson Greg Lopes mentioned. His group opposes the change.

Recognizing the brand new coverage may trigger cash-flow issues for pharmacies, Medicare officers had delayed implementation for a 12 months earlier than the rule took impact, giving them extra time to regulate.

“Now we have heard pharmacies saying that they’ve considerations with their reimbursement,” Seshamani mentioned.

However the company isn’t doing sufficient to assist now, mentioned Ronna Hauser, senior vp of coverage and pharmacy affairs on the Nationwide Neighborhood Pharmacists Affiliation. “They haven’t taken any motion even after we introduced potential violations to their consideration,” she mentioned.

Associated Subjects

https://kffhealthnews.org/information/article/biden-medicare-dir-fees-reform-pharmacy-cash-flow/

Related Posts

- Anxious About Medicare Scams: A Medicare Query

What You Must Know Efforts to bilk Medicare beneficiaries are widespread. You may assist by…

- Reimburse Worker Medicare Premiums | Medicare & HRAs

Can I reimburse my worker's medicare premiums? Nice query! Figuring out what's reimbursable inside QSEHRA…

- Medicare Fundamentals in a Nutshell: A Medicare Query

What You Must Know Some shoppers may have to purchase protection for the primary time.…