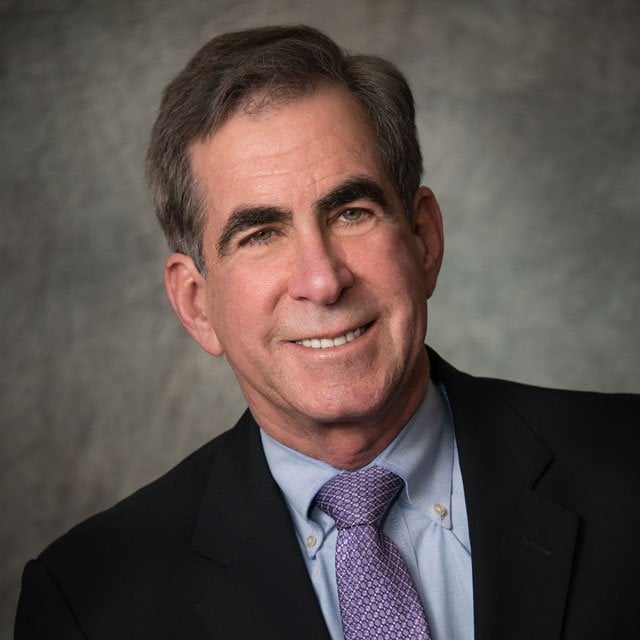

In terms of portfolio investments, the Israel-Hamas battle is “enterprise as standard. By way of life, completely not. However I don’t need my feelings to impression investing,” Allan Roth, founding father of Wealth Logic, tells ThinkAdvisor in an interview.

The fee-only advisor is making no adjustments to purchasers’ asset allocations as a result of the horrifying assaults by Hamas are already priced into the market.

“If you happen to’re going to vary your asset allocation, you’ve bought to know one thing the remainder of the market doesn’t know,” Roth says.

As a substitute, he argues that advisors and their purchasers ought to “keep the course.” A longtime John Bogle aficionado, Roth was gearing as much as attend the Bogleheads Convention close to Washington, D.C., the day after this interview.

His purchasers are ultra-high-net-worth people refined of their investing. But when they don’t stick with their funding coverage statements, he lays a guilt journey on them for “breaking their contract with their very own cash.”

Earlier than opening his personal RIA in 2003, the 25-year veteran of the monetary enviornment held high-level positions at giant firms, together with Kaiser Permanente and Exxon.

ThinkAdvisor interviewed Roth on Oct. 11. He was talking from his workplace in Colorado Springs, Colorado.

Throughout the context of the battle dialogue, he talks about what he calls “true diversification.”

“That’s not selecting something to obese or underweight,” he stresses.

Listed here are highlights of our interview:

THINKADVISOR: What are your preliminary ideas concerning the Israel-Hamas battle in relation to your purchasers’ funding portfolios?

ALLAN ROTH: It’s so stunning. What a failure in intelligence. I’m simply heartbroken and indignant. However I don’t need to let my feelings impression investing.

What ought to monetary advisors be telling their purchasers?

Keep the course. The one cause to make a change to outsmart the market is that they know one thing the remainder of the market doesn’t already know.

In any other case, you’re following the herd, and that normally doesn’t finish properly.

If I decide now, due to what’s happening in Israel or the battle in Ukraine, to get out of all worldwide shares, I’ve offered shares which have underperformed. That’s efficiency chasing.

Are you altering any investments in any respect due to the Israel-Hamas battle?

I’m altering completely nothing in my portfolio and my purchasers’ portfolios as a result of I don’t know something that the market doesn’t already know that’s unlikely priced into the market.

The Tel Aviv Inventory Trade [index] hasn’t budged a lot.

Have your purchasers been asking you about their portfolios in view of what’s taking place in Israel?

Completely not. My common consumer is aware of extra about investing than, I’d say, not less than 90% of funding advisors.

[Further], we don’t put money into any specific nation aside from the U.S. however in a [Total International Stock Index Fund], which clearly goes to have some Israeli shares; it used to have Russian shares however doesn‘t any longer.

Do you assume many buyers have been panicking and promoting primarily based on emotion?

I’m certain they’ve. However when the market didn’t go down, they in all probability stopped panicking.

The Monday after the [Saturday Hamas attack on Israel], it began down after which ended constructive.

The headlines that morning mentioned: “Shares down because of Israeli battle.” Later that day when shares have been up, the headline was: “Shares rebound.”

We are able to’t clarify why investments do what they did prior to now — and definitely not sooner or later.

Do you assume folks have been dashing to purchase protection and vitality shares and commodities?