Health Insurance

A Mother Owed Practically $102,000 for Hospital Care. Her State Legal professional Normal Mentioned to Pay Up.

Bridget Narsh’s son, Mason, wanted pressing assist in January 2020, so she was provided the possibility to ship him to Central Regional Hospital, a state-run psychological well being facility in Butner, North Carolina.

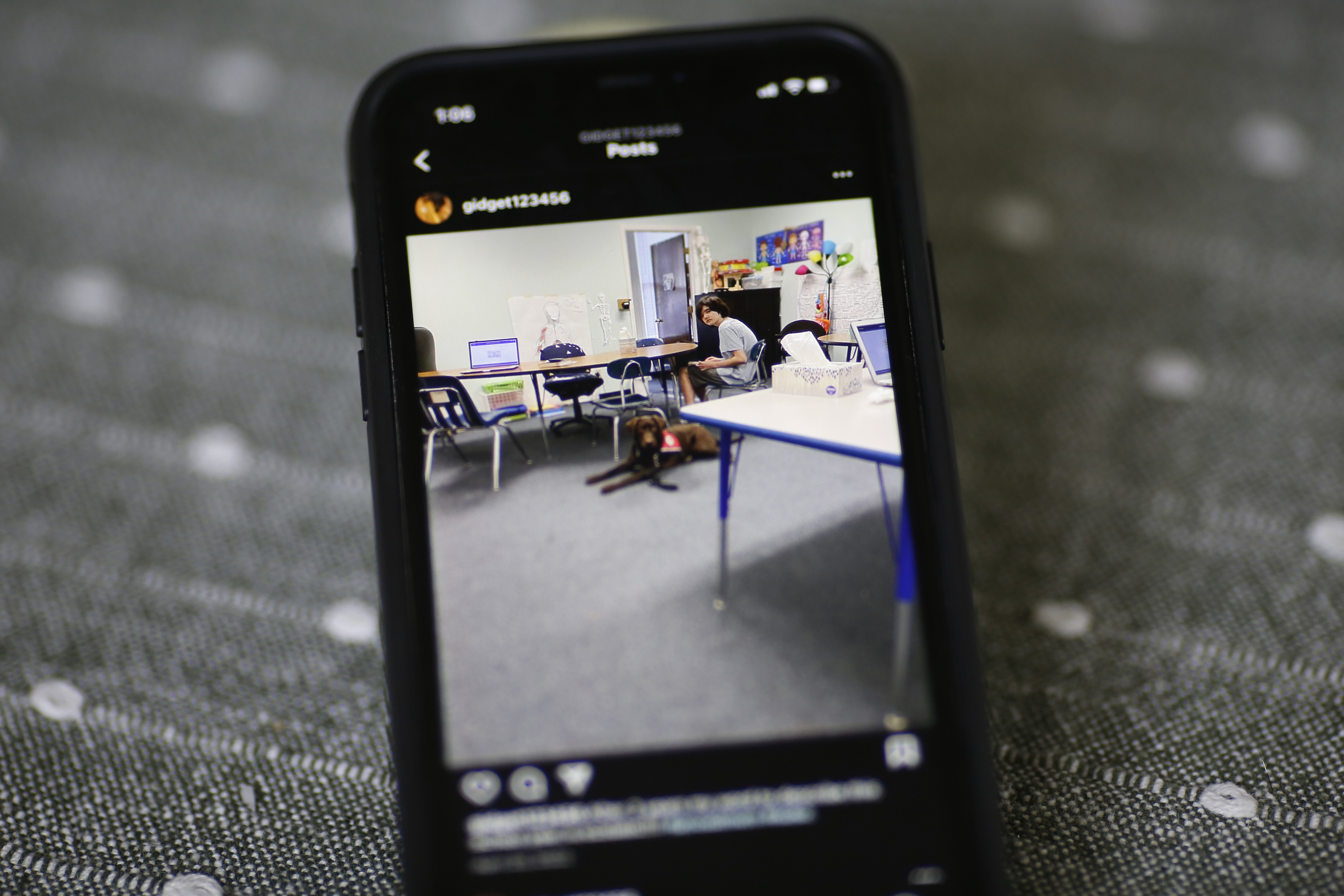

The teenager, who offers with autism and post-traumatic stress and attention-deficit/hyperactivity issues, had began destroying furnishings and operating away from house. His mom nervous for the protection of Mason and the remainder of the household.

However kids in disaster in North Carolina can wait weeks or months for a psychiatric mattress as a result of the state lacks the providers to satisfy demand. And when spots do turn into out there, they’re costly.

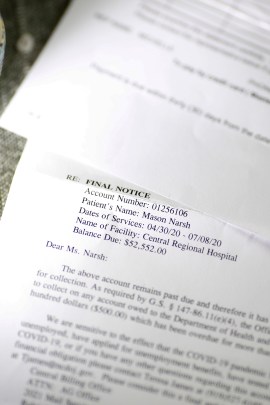

The usual fee at Central Regional was $1,338 a day, which Narsh couldn’t afford. So, when a affected person relations consultant provided a reduced fee of lower than $60 a day, her husband, Nathan, signed an settlement.

Mason, now 17, was hospitalized for greater than 100 days in Central Regional over two separate stays that 12 months, paperwork present.

However when requests for cost arrived the next 12 months, Narsh mentioned she was shocked. The letters — which have been marked “ultimate discover” and requested speedy cost — have been signed by a paralegal within the workplace of Josh Stein, North Carolina’s lawyer basic. The full invoice, $101,546.49, was considerably greater than the roughly $6,700 the Narshes anticipated to pay beneath their settlement with the hospital.

“I needed to inform myself to maintain my cool,” mentioned Bridget Narsh, 44, who lives together with her husband and three kids in Chapel Hill. “There isn’t a means I might pay for this.”

Medical payments have upended the lives of tens of millions of People, with hospitals placing liens on properties and pushing many individuals out of business. In recent times, lawmakers have railed towards privately operated hospitals, and states have handed legal guidelines meant to make medical billing extra clear and restrict aggressive debt assortment ways.

Some state attorneys basic — as their states’ prime regulation enforcement officers — have pursued efforts to defend residents from dangerous billing and debt assortment practices. However within the identify of defending taxpayer sources, their places of work are additionally typically accountable for accumulating unpaid money owed for state-run amenities, which may put them in a contradictive place.

Stein, a Democrat operating for governor in 2024, has made hospital consolidation and well being care value transparency a key challenge throughout his time in workplace.

“I’ve actual issues about this pattern,” Stein mentioned in 2021 concerning the state’s wave of hospital consolidations. “Hospital system pricing is intently associated to this challenge, as consolidations drive up already inordinate well being care prices.”

Stein refused an interview request about Mason’s payments, which arrived on the finish of 2021 as a result of the North Carolina authorities suspended debt assortment in March 2020 because the nation felt the financial fallout of the covid-19 pandemic.

Throughout the nation, states seize cash or property, file lawsuits, or take different steps to gather money owed from individuals who keep at state-run hospitals and different establishments, and their efforts can disproportionately have an effect on racial and ethnic minorities and the poor, in keeping with well being care client advocates. In North Carolina, officers seeking to acquire unpaid debt are permitted to garnish residents’ revenue tax refunds.

Attorneys basic should steadiness their conventional function of defending shoppers from dangerous debt assortment practices and the state’s obligation to serve taxpayers’ pursuits and fund providers, mentioned Vikas Saini, a heart specialist and the president of the Lown Institute, a Massachusetts-based nonpartisan assume tank that advocates for well being care reform.

The Narsh case is “the right storm of each downside in our well being care system,” mentioned Saini, who on the request of KFF Well being Information reviewed the cost demand letters the household acquired. Far too typically well being care is unaffordable, billing is just not clear, and sufferers find yourself going through monumental monetary burdens as a result of they or a cherished one is sick, Saini mentioned.

The Narsh household had Blue Cross and Blue Defend medical health insurance on the time of Mason’s hospitalizations. Bridget Narsh has information exhibiting insurance coverage paid about $7,200 for one among his stays. (Mason is now lined by Medicaid, the state-federal medical health insurance that covers some folks with disabilities and low-income folks.)

In a written assertion, Nazneen Ahmed, a spokesperson for Stein’s workplace, mentioned state regulation requires most businesses to ship their unpaid money owed to the state Division of Justice, which is charged with contacting individuals who might owe cash.

Ahmed directed KFF Well being Information to the North Carolina Division of Well being and Human Providers, which oversees Central Regional Hospital.

Bailey Pennington Allison, an company spokesperson, mentioned in a written assertion that officers researched the Narsh case and decided the state had correctly adopted procedures in billing the household.

The state bases its charges for providers on the prices of the remedy, nursing, skilled session, hospital room, meals, and laundry, Pennington Allison mentioned. Hospital staffers then work with sufferers and households to find out about their revenue and property to find out what they’ll afford and what they are going to be charged, she mentioned.

The spokesperson didn’t handle why Mason’s dad and mom have been provided, however didn’t in the end obtain, a reduced fee each occasions he was admitted in 2020.

Narsh contacted an lawyer, who negotiated the invoice with the state. In April, her household reached an settlement with North Carolina officers to pay $100 a month in change for the state decreasing the costs by roughly 96% to about $4,300. If Narsh defaults, nonetheless, the deal stipulates she should give you the unique whole.

States can take quite a lot of approaches to debt assortment. North Carolina is one among a couple of dozen that may garnish residents’ revenue tax refunds, mentioned Richard Gundling, a senior vp for the Healthcare Monetary Administration Affiliation, a membership group for finance professionals.

Gundling mentioned state officers have a duty to guard taxpayer cash and acquire what’s owed however that seizing revenue tax returns can have extra extreme penalties for folks with decrease incomes. “There’s a steadiness that must be struck to be cheap,” he mentioned.

With well being care a number one reason for private debt, unpaid medical payments have turn into a serious political challenge in North Carolina.

State lawmakers are contemplating a invoice known as the Medical Debt De-Weaponization Act, which might curb the flexibility of debt collectors to interact in “extraordinary assortment” reminiscent of foreclosing on a affected person’s house or garnishing wages. However the present model of the invoice wouldn’t apply to state-operated well being care amenities just like the one Mason Narsh went to, in keeping with Pennington Allison.

In a written assertion, Stein mentioned he helps legislative efforts to strengthen client protections.

“Each North Carolinian ought to have the ability to get the well being care they want with out being overwhelmed by debt,” Stein mentioned. He known as the invoice into account “a step in the suitable path.”

Narsh mentioned the unexpectedly excessive quantity of the invoice was irritating, no less than partially as a result of for years she struggled to get Mason extra inexpensive, preventive care in North Carolina. Narsh mentioned she had issue discovering providers for folks with behavioral points, a scarcity acknowledged in a state report launched final 12 months.

A number of occasions, she mentioned, she has been left with no choice however to take him to a hospital to be evaluated and admitted to an inpatient psychological well being facility not appropriate for folks with advanced wants.

Group-based providers that enable folks to obtain remedy at house will help them keep away from the necessity for psychiatric hospitals within the first place, Narsh mentioned. Mason’s situation improved after he acquired a service canine educated to assist folks with autism, amongst different group providers, Narsh says.

Corye Dunn is the general public coverage director at Incapacity Rights North Carolina, a Raleigh-based nonprofit mandated by the federal authorities to observe public amenities and providers to guard folks with disabilities from abuse. The irony, she mentioned, is that the identical system that’s ill-equipped to stop folks from falling into disaster can then pursue them with huge payments.

“That is dangerous public coverage. That is dangerous well being care,” Dunn mentioned.

Associated Matters

Related Posts

- Washington State Lengthy-Time period Care Insurance coverage Program to Launch Saturday

What You Have to Know Initially, WA Cares was supposed to start gathering taxes in…

- Elevating California Well being Care: New State-Enhanced Value-sharing Discount Program

In 2024 Coated California presents Californians whose incomes are not more than 250% of the…

- Full your enrollment & pay your first premium

Full your enrollment & pay your first premiumInsurance coverage corporations deal with funds otherwise. Observe…