Health

The layoffs that hammered the tech trade

That is an version of The Atlantic Day by day, a e-newsletter that guides you thru the largest tales of the day, helps you uncover new concepts, and recommends the very best in tradition. Join it right here.

This yr was certainly one of periodic bloodshed in tech, and the continued reverberations of early-pandemic hiring sprees are a part of the issue.

First, listed here are three new tales from The Atlantic:

“Again to the Nicely”

Earlier this month, simply days after Spotify Wrapped gave customers a whimsical breakdown of their listening habits this yr, the corporate launched a heavier bit of reports: It was shedding about 17 p.c of its workforce, in its third spherical of cuts this yr. After tech layoffs slowed to a yr low in September, they’ve crept again up as corporations sit up for the brand new yr.

The previous 18 months have been crammed with setbacks for a sector that had till not too long ago been coasting on a decade-plus of frenzied development. In line with Layoffs.fyi, a website that tracks job losses in tech, practically 260,000 employees have been laid off thus far this yr, in contrast with 165,000 final yr. These numbers are notably notable in a yr that has seen a mostly-hot labor market. The excellent news is that, though tech layoffs are elevated far above the place they had been in early 2022, these numbers are nonetheless means decrease than they had been originally of the yr. In January, some 90,000 employees had been laid off throughout 276 corporations, Layoffs.fyi discovered. Final month, the whole was nearer to eight,000. However the broader tech surroundings, particularly for start-ups, is brutal: Erin Griffith reported in The New York Instances final week that about 3,200 venture-backed corporations had been worn out in 2023 (she famous that that is possible an undercount).

The lengthy tail of over-hiring in the course of the flush early days of the pandemic is the principle issue driving present layoffs in tech, Roger Lee, the creator of Layoffs.fyi, informed me. As my colleague Derek Thompson wrote in January, “When rates of interest had been low, buyers valued development narratives, and tech corporations (or corporations that known as themselves tech corporations) had a monopoly on these narratives … When inflation and rates of interest elevated, the businesses that had been making long-term guarantees had been most in danger, and so they bought clobbered.” Tech corporations are nonetheless correcting for the reams of employees they employed when it appeared just like the get together would by no means finish. And now AI is including to some tech corporations’ issues, threatening their core operations. Many corporations’ projections bought hammered by rates of interest remaining increased this yr than executives had hoped, so some which have already laid off workers “are going again to the properly and making additional cuts,” Lee defined.

A few of this timing is cyclical. The tip of the yr is traditionally a well-liked time for layoffs (and, in fact, an particularly powerful time to lose a job). It marks the ultimate stretch of the fiscal yr for a lot of organizations; corporations are taking inventory of that yr’s efficiency, and planning forward for the following one. Within the quick time period, we might proceed to see tendencies corresponding to cuts proceed, Lee stated (although he stays a stalwart optimist concerning the sector general). Inflation has moderated, and a few economists are cautiously predicting that the Federal Reserve might decrease charges in 2024; that will make investing in corporations cheaper and will spur development within the tech sector subsequent yr, Nick Bunker, the economic-research director at Certainly Hiring Lab, informed me. However he doesn’t predict speedy beneficial properties in tech hiring, partly as a result of corporations might have discovered a factor or two from the over-hiring spree of 2021.

Tech executives have been chastened by the blows of the previous few years. Many are being extra disciplined of their method to hiring, Lee stated, and “they’re focusing extra on effectivity, slightly than development in any respect prices.” However there may be one notable exception: AI corporations. Regardless of the difficult funding surroundings, Lee informed me, buyers are keen to pour cash into AI due to what they see as large potential. AI corporations are nonetheless hiring and battling for expertise; they’re partying prefer it’s 2021, at the very least whereas they will.

Associated:

Dispatches

Discover all of our newsletters right here.

Night Learn

The Pleasure of Underperforming

By Olga Khazan

For many people—the vitamin-D-deprived, the sugar-addled, maybe the out of the blue jobless or these dreading household gatherings—’tis the season not a lot to be jolly, however simply to be “in a season.” The phrase has change into a typical means of speaking your self by a sudden upheaval, or of explaining that you simply’ll be doing issues slightly in a different way for some time …

Though it might appear tacky or evasive on its face, the expression is a wholesome option to interpret the occasions when doing all of it or pleasing everybody merely isn’t doable. In reality, considering of life when it comes to seasons may simply be one of the simplest ways to remain sane throughout occasions of change.

Extra From The Atlantic

Tradition Break

Learn. These seven books will make you rethink your relationship to nature.

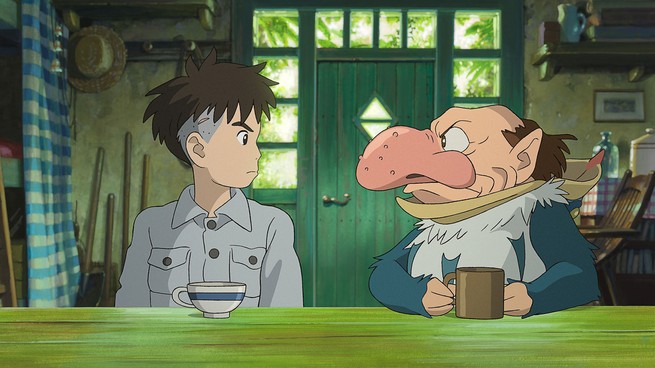

Watch. The Boy and the Heron (in theaters), which may very well be the Studio Ghibli co-founder Hayao Miyazaki’s closing movie, is extra of a daring reinvention than a somber farewell.

Play our day by day crossword.

P.S.

My colleague Rogé Karma wrote an article this week that helped me take into consideration rates of interest in a brand new means. It’s really an excellent factor that the period of low cost borrowing is over, he argues. Although it will likely be painful within the quick time period, nonzero rates of interest will in the end imply that “corporations trying to enhance their inventory value should win new clients or develop higher merchandise as an alternative of counting on monetary engineering,” he writes. He breaks down how ZIRP, or “zero interest-rate coverage,” helped gasoline inequality within the years following the 2008 monetary disaster, and he argues that increased charges will result in a fairer, extra sustainable financial system. I like to recommend testing his piece, and I additionally suggest saying ZIRP aloud. It is vitally enjoyable.

— Lora

Katherine Hu contributed to this article.

Once you purchase a ebook utilizing a hyperlink on this e-newsletter, we obtain a fee. Thanks for supporting The Atlantic.

Related Posts

- Can Insurance coverage Carriers Stem the Bleeding from Tech Layoffs?

This put up is a part of a sequence sponsored by AgentSync. In January 2023…

- Schwab Layoffs of two,000 Have Begun

What You Have to Know The agency says it’s reducing 5%-6% of its workforce, which…

- Futuristic Underwriters commences operations tech-driven MGA

Futuristic’s options will embrace next-generation expertise together with synthetic intelligence (AI). Credit score: Nattanan Kanchanaprat…