What You Must Know

- Nearly all of advisors select a structured annuity technique with the first goal of avoiding a damaging return.

- Maximizing progress is a secondary aim as soon as the specified degree of safety is chosen.

- One-year listed phrases with annual resets can present extra safety over the complete give up cost interval.

In response to a 2021 LIMRA research on structured annuities, nearly half of all structured annuity gross sales utilized a method time period of 5 or 6 years. The opposite half was damaged down between one- and two-year listed phrases.

So why are so many advisors selecting to make their purchasers wait 5 or 6 years earlier than curiosity will get credited to the coverage? It’s my opinion that almost all of advisors select a method with the first goal of avoiding a damaging return. Maximizing progress is a secondary aim as soon as the specified degree of safety is chosen.

If my assumption is true, then long run methods make good sense. In spite of everything, if I am going out six years and mix this with a ten% buffer, there’s a slim likelihood {that a} shopper will expertise a loss six years later. However how slim? Fortuitously, SIMON from iCapital’s annuities platform might help reply that query.

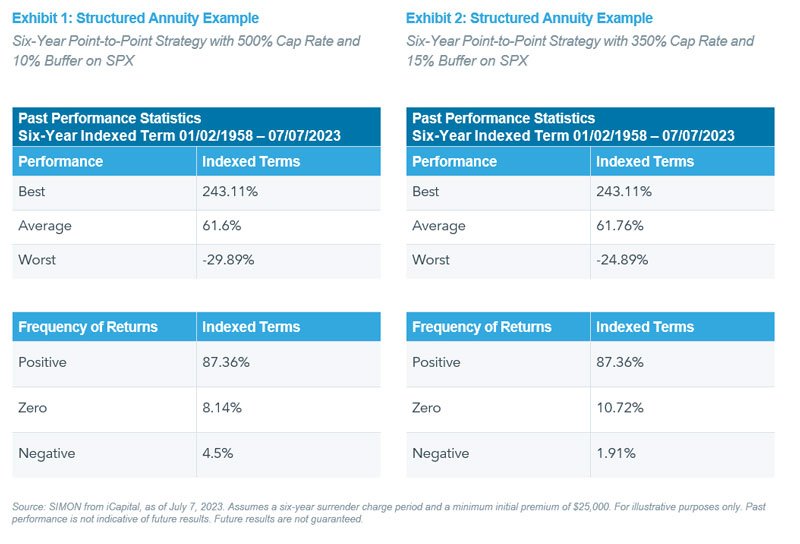

Let’s check out an instance of a structured annuity with a six-year point-to-point technique with a 500% cap charge and 10% buffer on the S&P 500. Utilizing SIMON, we are able to view the hypothetical efficiency metrics throughout six-year listed phrases between Jan. 2, 1958, and July 7, 2023. We discover that in this era, the index dropped in value greater than 10%, solely 4.5% of the time over any rolling six-year interval, and the common six-year return primarily based on a 500% cap charge would have been 61.6%, or 8.33% per 12 months.

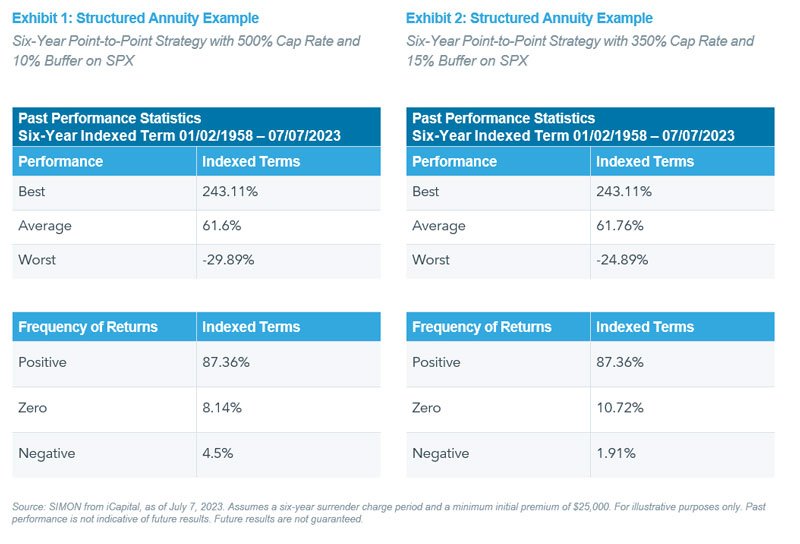

Take one other instance of a structured annuity with the identical six-year point-to-point technique, however with a 350% cap charge and 15% buffer on SPX. Throughout this similar interval, the hypothetical efficiency metrics present the share of damaging returns falls to only 1.91%. And the way a lot upside can we quit? None. The truth is, we truly acquire upside by selecting the upper buffer with the decrease cap charge. Why? As a result of the SPX has by no means elevated in value greater than 243.11% over any rolling six-year interval.

Subsequently, except we expertise a historic bull market, each the 350% and 500% cap charges are successfully uncapped choices. By eliminating among the damaging returns with the upper buffer and decrease cap charge, we truly barely enhance historic common returns to 61.76%, or 8.35% per 12 months.

From these examples, we are able to observe with six-year listed phrases, a buffer of not less than 10% does certainly present quite a lot of safety.

Evaluating Listed Phrases

The subsequent query we should ask is, how does a six-year listed time period examine to a one-year listed time period?

Let’s first check out an instance of a structured annuity with a one-year point-to-point technique with a 19.5% cap charge and 10% buffer on SPX. Once more, we’ll go to SIMON to investigate the hypothetical efficiency.

Utilizing SIMON, we discover that throughout one-year listed phrases between Jan. 7, 1958, and July 7, 2023, the absolute best one-year return is clearly equal to the 19.5% cap charge, and the common one-year return could be 8.36%, barely higher than the 8.33% per 12 months generated by the six-year point-to-point technique with a 500% cap charge and 10% buffer on SPX.

However then we see the worst attainable one-year return of -38.82%. Meaning there was a one-year interval the place SPX fell 48.82%, leaving a damaging return of 38.82% after the ten% buffer. Not a superb final result for the shopper.

As well as, the ten% buffer would have failed to totally defend the shopper in 13.61% of the time interval. In different phrases, in a single out of each eight years an advisor must inform the shopper that, whereas it might have been worse, the worth of their structured annuity dropped throughout the 12 months.