Insurance

12 varieties of enterprise insurance coverage insurance policies you need to take into account

There are a lot of varieties of enterprise insurance coverage you should buy. However which of them fit your wants? Learn on and learn how every protection works

One of many greatest advantages of getting enterprise insurance coverage is the monetary safety it gives when unexpected accidents and calamities threaten to derail your operations. Having the precise coverage performs a key function in serving to what you are promoting recuperate sooner. However with the myriad varieties of enterprise insurance coverage insurance policies on the market, how are you aware which one offers the proper protection?

That is what Insurance coverage Enterprise will show you how to with on this article. For those who’re a enterprise proprietor attempting to work out which insurance policies match your distinctive wants, this information can show helpful. We offers you a rundown of the completely different types of protection you possibly can entry and the form of safety every one offers. Learn on and discover out what varieties of enterprise insurance coverage insurance policies swimsuit you.

Your online business faces a novel set of dangers and challenges which are completely different from these of different companies. That’s why there’s no single coverage that may cater to each want.

Enterprise insurance coverage carriers present a variety of insurance policies that may assist shield your organization. The choice is numerous and the form of protection you require is dependent upon a number of components together with dimension, scope, and placement. Listed here are a number of the most important varieties of enterprise insurance coverage insurance policies you might want to hold your operations going when accidents and calamities strike.

1. Normal legal responsibility insurance coverage

Though not legally required, basic legal responsibility insurance coverage is likely one of the most vital coverages to have due to the form of safety it gives. Additionally referred to as enterprise legal responsibility or public legal responsibility insurance coverage, it covers what you are promoting financially in opposition to claims of bodily harm and property harm ensuing out of your day-to-day operations.

Normal legal responsibility insurance policies might present protection for copyright infringement and incidents that trigger reputational hurt together with libel, slander, and invasion of privateness.

Most insurance policies additionally supply product legal responsibility protection, which protects what you are promoting from lawsuits claiming harm or losses due to a product you promote or make.

Normal legal responsibility insurance coverage pays for the authorized and settlement prices if your organization has been accused of inflicting the abovementioned hurt. Some insurance policies additionally cowl medical bills for accidents that occur inside what you are promoting premises, whether or not you might be at fault, or a lawsuit has been filed.

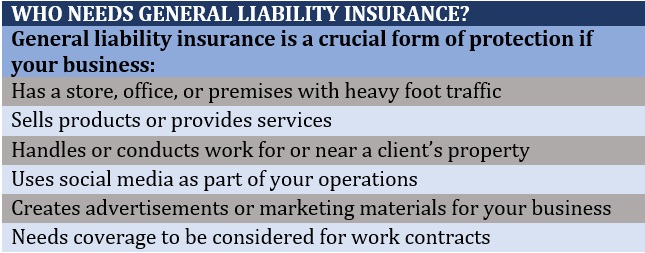

The desk beneath lists the varieties of companies that want basic legal responsibility insurance coverage.

2. Business property insurance coverage

Business property insurance coverage helps reduce the monetary affect of the harm pure and man-made disasters trigger to what you are promoting’ on-site bodily belongings. These embrace:

- Property or constructing what you are promoting operates in

- Gear and expertise what you are promoting makes use of

- Stock of merchandise and supplies your organization shops and sells

Business property protection lessens the disruption of sudden incidents to your every day operations by offering compensation for the damages and losses. Some insurance policies additionally pay out part of misplaced revenue if the harm retains what you are promoting from conducting its ordinary operations. Though not obligatory, such a enterprise insurance coverage is commonly a requirement in business leasing preparations.

Business property insurance coverage is often bundled with basic legal responsibility insurance coverage in a enterprise proprietor’s coverage (BOP), which is a type of small enterprise insurance coverage. Some BOPs additionally embrace enterprise interruption protection.

3. Staff’ compensation insurance coverage

Staff’ compensation insurance coverage protects what you are promoting from the monetary legal responsibility of getting to pay for prices ensuing from job-related accidents and sicknesses. Nearly all states within the US require companies with a sure variety of staff to take out such a protection.

As a enterprise proprietor, you might be liable for shouldering the whole value of protection. You can’t require your staff to contribute to the premiums. You may click on on the hyperlink to search out out how employees comp is calculated.

Staff’ compensation insurance coverage additionally follows a no-fault system. This implies the profit an worker receives is just not impacted by their or what you are promoting’ negligence, though there are particular conditions that may result in employees comp claims being denied.

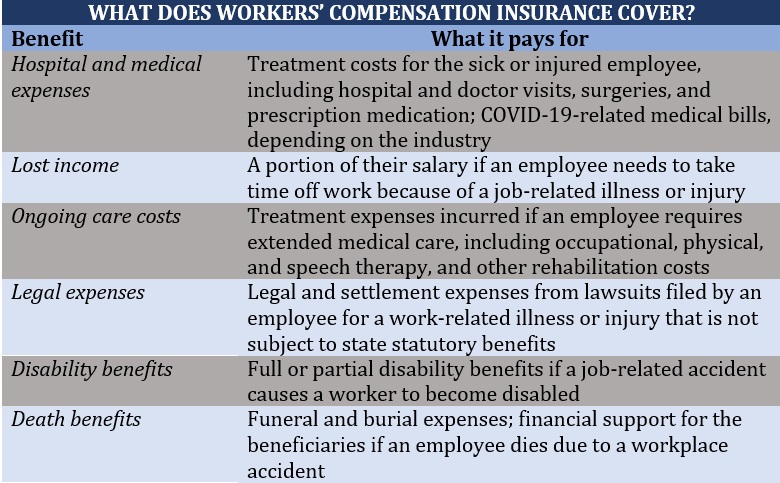

The desk beneath particulars what employees’ compensation insurance coverage sometimes covers.

4. Business automobile insurance coverage

Business automobile insurance coverage is one in every of a number of varieties of enterprise insurance coverage insurance policies which are legally required. This type of protection works equally to personal auto insurance coverage, however with one main distinction: it covers primarily firm automobiles and business vehicles and vans.

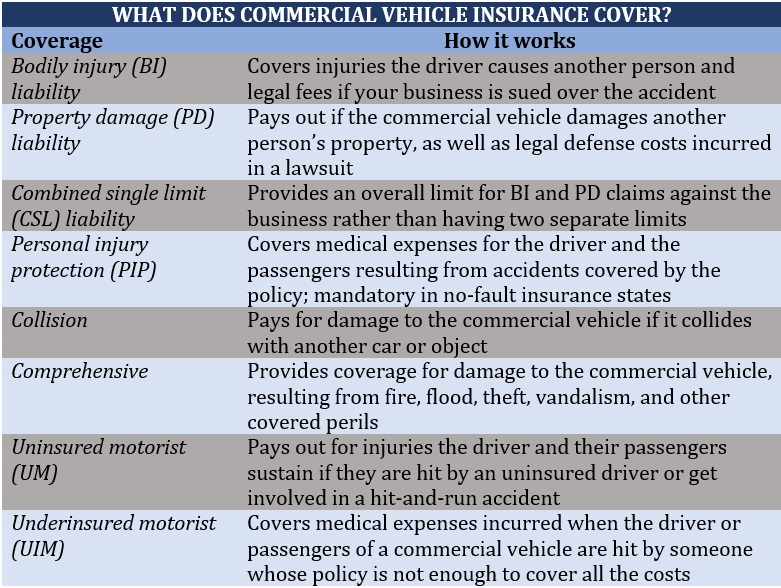

The desk beneath sums up what business automobile insurance coverage sometimes covers.

Some states permit companies to buy UM and UIM protection individually. There are additionally business-specific coverages accessible, together with these for misplaced enterprise revenue.

5. Medical health insurance

If what you are promoting employs greater than 50 full-time workers, you might be required to take out medical insurance on your employees below the Reasonably priced Care Act (ACA). In case you have lower than 50 employees, you possibly can entry Small Enterprise Well being Choices Program (SHOP) as a substitute.

Medical health insurance is designed to assist offset the prices of medical remedy by overlaying a portion of the skilled and hospital charges incurred. In line with the most recent worker well being advantages survey by well being coverage centered non-profit KFF, US firms pay about 83% of their staff’ complete medical insurance value for single protection and 72% for household protection. These are estimated at $7,911 and $22,463 per yr, respectively.

You may take a look at how well being insurance policies work within the US, in addition to in different nations that Insurance coverage Enterprise covers in our international medical insurance primer.

6. Skilled legal responsibility insurance coverage

Though not at all times legally required, skilled legal responsibility insurance coverage is likely one of the a number of varieties of enterprise insurance coverage insurance policies which are important for firms providing skilled or advisory companies.

Knowledgeable legal responsibility coverage protects what you are promoting in opposition to claims of economic losses ensuing from alleged or precise negligence throughout the success of an expert service. It covers authorized and settlement prices arising from the next:

- Service-related errors and oversights

- Inaccurate recommendation

- Misrepresentation

- Breach of contract

- Unfinished work

- Price range overruns

- Private harm, together with libel and slander

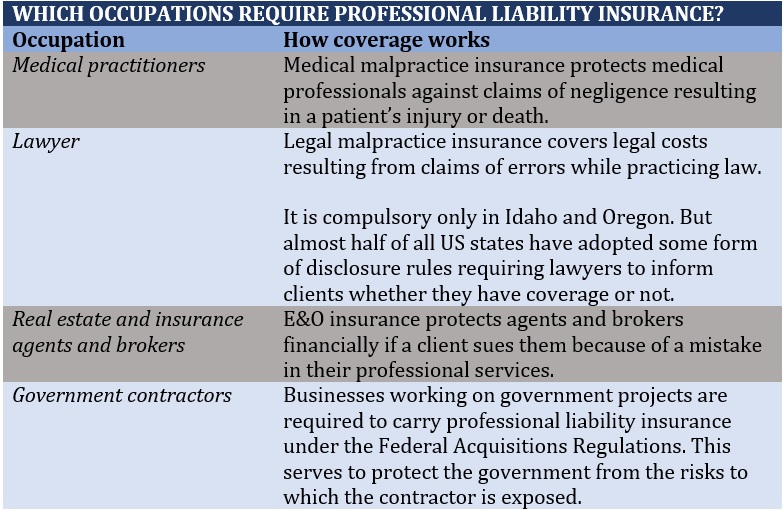

Skilled legal responsibility insurance coverage is obligatory for some occupations. Relying on the trade, it might even be known as errors and omissions (E&O) or malpractice insurance coverage. The desk beneath lists a number of the professions the place this type of protection is required:

Though not obligatory, the next professions can profit from having skilled legal responsibility insurance coverage:

- Accountants

- Architects

- Consultants

- Engineers

- Monetary advisors

- Graphic designers

- Data expertise (IT) specialists

- Insurance coverage professionals

- Authorized professionals

- Medical practitioners

- Actual property professionals

- Software program builders

- Stylists

- Tradespeople

- Marriage ceremony planners

Skilled legal responsibility insurance coverage can be a necessary type of protection for restricted legal responsibility firms (LLC). Discover out what different varieties of enterprise insurance coverage entities like these want in our complete information to legal responsibility insurance coverage for LLC.

7. Administrators’ and officers’ (D&O) insurance coverage

D&O insurance coverage is designed to guard the administrators and senior administration of your organization in opposition to monetary losses ensuing from business-related lawsuits. Additionally referred to as D&O legal responsibility protection, it pays out for financial losses from these authorized actions. These embrace protection and settlement prices, and fines.

There are three primary varieties of D&O protection. These are additionally known as insuring agreements or sides, with every providing a special stage of safety.

- Facet A: Covers “non-indemnifiable loss” or conditions the place your organization can not indemnify your administrators or officers. This may be as a result of chapter or as a result of what you are promoting is just not legally allowed to take action.

- Facet B: Reimburses what you are promoting after it has compensated a director or different senior administration for a loss. That is probably the most accessed insuring settlement.

- Facet C: Supplies direct protection for a enterprise when each your organization and its administrators and senior administration are named in a lawsuit. This coverage can be referred to as entity protection.

8. Cyber insurance coverage

Cyber insurance coverage is designed to cowl monetary losses ensuing from cyber incidents. This type of protection has turn out to be a well-liked danger administration instrument amongst companies, particularly with the speedy shift to digital transformation giving rise to consistently evolving cyber threats.

Usually, cyber insurance coverage gives two varieties of safety:

1. First-party protection

This kind of coverage pays out for the monetary losses what you are promoting incurs due to a cyber incident, together with:

- The price of responding to an information breach

- Restoring and recovering misplaced or broken information

- Ransomware assault funds

- Misplaced revenue ensuing from enterprise interruption

- Threat evaluation of future cyberattacks

- The price of notifying shoppers concerning the cyber incident

- The price of offering buyer with anti-fraud companies

2. Third-party protection

This kind of coverage offers monetary safety in opposition to lawsuits filed by third events for damages brought on by a cyberattack on their companies. These can embrace your prospects, distributors, and even your personal staff.

Third-party insurance policies are additionally known as cyber legal responsibility protection. It sometimes covers court docket and settlement charges, in addition to regulatory bills and fines.

9. Enterprise interruption insurance coverage

Enterprise interruption insurance coverage is designed to supply monetary safety for the losses what you are promoting suffers because of the disruption of your operations if this was brought on by an insured occasion. Additionally referred to as BI protection, it pays out the working prices whereas what you are promoting quickly shuts down. These prices embrace:

- Potential income

- Worker salaries

- Enterprise mortgage repayments

- Mortgage or hire on business house

- Taxes

Some BI insurance policies additionally present protection for extra bills associated to the closure. These embrace the prices of establishing a short lived location or coaching workers to make use of new gear. BI protection is usually included in a enterprise proprietor’s coverage.

Enterprise interruption insurance coverage entails a 48- to 72-hour ready interval to kick in. That is indicated in your coverage’s restoration interval, which initially lasts for 30 days however will be prolonged for as much as a yr.

10. Instruments and gear insurance coverage

Instruments and gear insurance coverage is a sort of coverage that pays out the prices to restore and substitute what you are promoting’ instruments and gear if these are stolen, broken, or vandalized. If what you are promoting depends closely in your instruments and gear to get the job performed, then such a protection is price contemplating.

This coverage offers protection for a variety of instruments and gear that you simply use for what you are promoting if the gadgets meet these three standards:

- They’re movable.

- They’re lower than 5 years outdated.

- They’re price lower than $10,000.

Instruments and gear insurance coverage is commonly written on an all-risks foundation. This implies it might cowl occasions not particularly listed in your coverage. Some insurance policies present protection for the instruments and gear that you simply lease or hire. There are additionally insurance policies that pay out for misplaced revenue and extra provides or companies wanted to maintain the undertaking on schedule.

11. Product legal responsibility insurance coverage

If what you are promoting designs, manufactures, or sells merchandise, product legal responsibility protection could also be price contemplating. This kind of enterprise insurance coverage protects your organization in opposition to lawsuits from prospects claiming losses or harm due to your product. It additionally covers authorized protection prices and compensation if the enterprise is discovered to be at fault.

12. Extra legal responsibility insurance coverage

Extra legal responsibility insurance coverage protects what you are promoting from catastrophic claims and losses that exceed your protection limits. For those who’re a small enterprise proprietor, such a coverage might help reduce the danger {that a} lawsuit or catastrophe will trigger your organization to go bankrupt. Some companies additionally set this type of protection as a situation for a lease or shopper contract. Extra legal responsibility insurance coverage can be typically known as business umbrella legal responsibility insurance coverage.

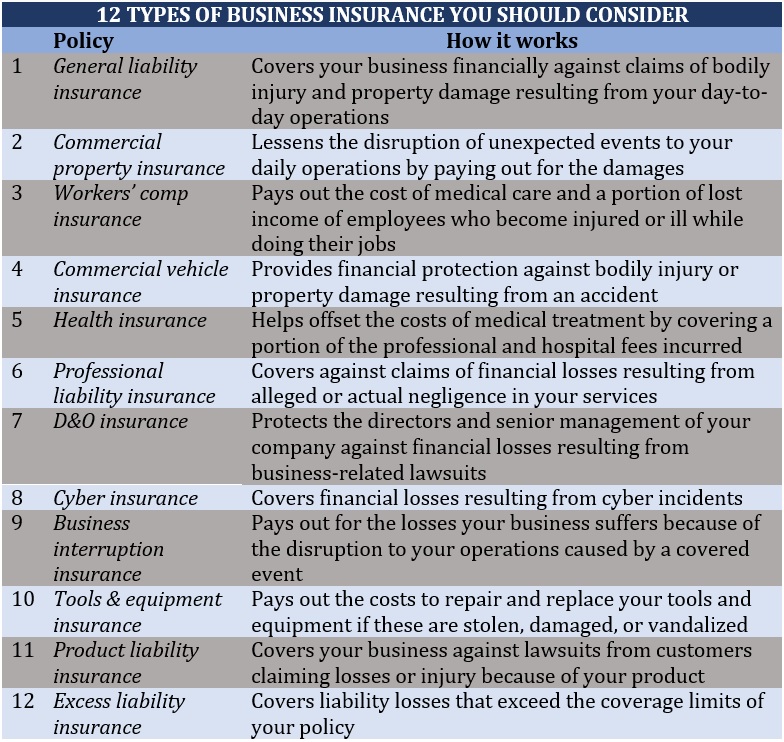

Right here’s a abstract of the 12 varieties of enterprise insurance coverage insurance policies each enterprise ought to take into account:

In your day-to-day operations, what you are promoting might face conditions that may adversely have an effect on your profitability. Errors can result in pricey lawsuits, whereas accidents and calamities can take an enormous chunk out of your income. Having the precise varieties of enterprise insurance coverage insurance policies might help present the monetary safety you want when sudden disasters strike.

One other good thing about carrying the precise varieties of enterprise insurance coverage is that it boosts your organization’s credibility. The reason being that many stakeholders and shoppers desire working with companies that they know are financially protected.

Taking out protection, nonetheless, is only one side of how one can reduce what you are promoting’ losses. Pairing the proper insurance coverage insurance policies with sound danger administration practices is commonly the easiest way you possibly can shield what you are promoting’ belongings and funds.

What varieties of enterprise insurance coverage insurance policies do you assume are important? Share your ideas within the feedback part beneath.

Associated Tales

Sustain with the most recent information and occasions

Be part of our mailing record, it’s free!

Related Posts

- Assessment your enterprise life insurance coverage coverage yearly

Life insurance coverage could be a precious a part of your enterprise plans. We…

- Inszone Insurance coverage buys Speck Insurance coverage and Monetary Companies

Earlier this month, Inszone Insurance coverage acquired a New Mexico-based insurance coverage company. Credit score:…

- First Insurance coverage & Danger Administration commences enterprise in US

A tailor-made danger administration dashboard based on business or classification is made accessible for insureds,…